Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. A DSCR loan qualifies you primarily based on rental income coverage, not W2s, paystubs, or US tax returns.

2. DSCR is typically calculated as gross monthly rent divided by PITIA, where PITIA reflects the full monthly housing payment.

3. HomeAbroad DSCR guidelines for foreign nationals include 25% down, purchase LTV up to 75%, and DSCR eligibility down to 0.75 in eligible scenarios.

4. HomeAbroad is a one-stop shop that makes the entire process simple for international real estate investors, helping you find properties using our AI-driven investment property search platform, get mortgages, set up a US-based LLC, open a local bank account, and handle paperwork required for closing.

Over the years, I’ve helped countless real estate investors secure financing tailored to their goals. One question consistently arises:

How can I grow my portfolio without relying on my personal income or tax returns?

The answer is DSCR loans, a financing tool designed explicitly for international real estate investors. These loans prioritize the property’s rental income over the borrower’s income, simplifying the approval process and enabling faster portfolio growth.

Whether you’re a seasoned property owner or just starting your journey, this guide will provide you with everything you need to know about DSCR loans: how they work, who can benefit, and why they might be the perfect fit for your investment strategy.

By the end of this article, you’ll not only understand the power of DSCR loans but also gain actionable insights to leverage them for your real estate goals.

Table of Contents

What is a DSCR Loan?

A DSCR loan, short for Debt Service Coverage Ratio loan, is an investment property mortgage where qualification is driven primarily by the property’s rental income and cash flow potential rather than your personal income documentation.

For foreign national investors, this is one of the most practical paths to financing because it reduces reliance on US-specific documentation like domestic credit history and tax filing continuity. HomeAbroad’s DSCR loan is tailored specifically for international real estate investors who may not have a US income or a US credit profile.

This innovative approach simplifies the process and makes DSCR loans an ideal choice for:

While DSCR loans are gaining popularity, many people, including industry professionals, are unfamiliar with how they work and how to calculate the DSCR.

Let’s break it down step by step.

How DSCR Loans Work

Understanding how DSCR (Debt Service Coverage Ratio) loans operate is crucial for real estate investors seeking financing options that prioritize a property’s rental income over personal income verification.

DSCR underwriting can be summarized in three steps:

1. The property is underwritten like an investment

Instead of starting with your personal income and debt-to-income ratio, DSCR underwriting starts with the rental property’s rental income ability to carry its own payment through rent.

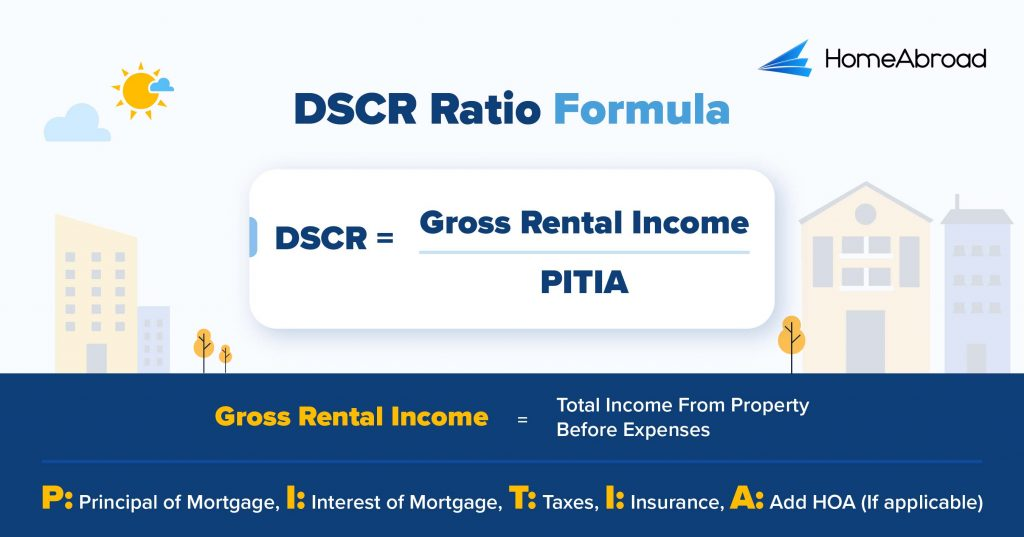

2. DSCR is calculated

DSCR is the ratio that compares rental income to the monthly housing payment, typically using a PITIA-style payment figure. At HomeAbroad, we reference PITIA as the baseline coverage benchmark.

A DSCR of 1.25 indicates that the property generates 25% more income than the mortgage payment, signaling strong cash flow.

3. Terms are shaped by leverages and risk controls

In DSCR lending, the ratio matters, but so do the other risk levers: down payment, reserves, the property profile, and documentation quality. HomeAbroad’s published DSCR program requirements make those levers explicit.

Let’s hear from Jay Thomas, a seasoned real estate agent, on the suitability of DSCR loans for investors.

Jay Thomas – Real Estate Agent (Source: BiggerPockets Forum)

You can check current DSCR loan interest rates to secure financing that aligns with your investment strategy.

DSCR Calculation, What PITIA Means, and What Counts As Rent

DSCR Formula used in rental properties:

What PITI means

PITI stands for principal, interest, taxes, and insurance, which are the four basic parts of a monthly mortgage payment.

Why HomeAbroad DSCR uses PITIA?

DSCR underwrites aim to reflect the full carry cost. That is why you will see PITIA used in DSCR explanations, because association dues can materially change the payment profile on condos and HOA-governed rentals.

What counts as rental income for DSCR

Most DSCR files support rent in one of two ways:

This matters for foreign investors buying a vacant property, a newly renovated rental, or a property that will be leased after closing.

Let us understand DSCR ratio with the example of an Indian investor who bought an investment property in Memphis with HomeAbroad DSCR Loan:

HomeAbroad DSCR Loan Requirements for Foreign Nationals

At HomeAbroad, we’ve tailored our DSCR loan requirements to provide flexible financing solutions for foreign investors.

Whether you’re purchasing your first property or expanding your portfolio, our tailored criteria ensure that qualifying is straightforward and efficient.

Features | Requirements |

|---|---|

DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. |

Credit Score | No US Credit History Required |

Down Payment | 25% |

LTV Ratio | Purchase: Up to 75% |

Cash Reserves | 6 Months |

Property Use | Investment properties (residential and commercial) |

Loan Amount | >= $100k |

DSCR Loan Options: Purchase, Rate and Term Refinance, Cash-out Refinance

DSCR is not a single use loan. It is a qualification method that can apply across common investor transactions.

DSCR purchase

Used when you are buying an income-producing rental and want underwriting tied to rent coverage rather than personal income.

DSCR rate and term refinance

Used when you want to replace an existing mortgage with new terms, typically without pulling out significant equity. HomeAbroad’s DSCR LTV guidelines show rate and term refinance up to 75% in eligible scenarios.

DSCR cash-out refinance

Used when you want to tap equity and redeploy capital into another investment. HomeAbroad’s DSCR loan allows cash-out refinance up to 70% LTV in eligible scenarios.

Property Use: What Types of Rentals Work Best with DSCR

From an investor standpoint, DSCR works best when the rent story is clean and supportable.

Strong DSCR candidates often include:

HomeAbroad’s DSCR program is positioned for investment properties across residential and commercial categories, so the key is not the label, it is the rent support and execution path.

DSCR Loans for Short-Term Rentals

DSCR loans for short-term rentals, like Airbnb, can work, but the critical question becomes: what income basis is the lender willing to underwrite.

A Quick 7-Step Guide to Applying for a DSCR Loan

1. Get Started with HomeAbroad

Choosing the right DSCR loan lender is crucial. HomeAbroad specializes in DSCR loans, offering tailored loan terms to maximize your investment returns.

With our proven track record of working with international real estate investors and our expertise in DSCR loans, we are committed to helping you achieve your real estate investment goals. Begin your DSCR loan journey with us.

Not sure about us? Liam and Emma can vouch for us:

Despite having no US credit history, they guided us to the perfect DSCR loan, allowing us to invest in a stunning property in Lahaina. The process was smooth, and the rental income is covering our mortgage. We couldn’t be happier with their expert support and highly recommend them to any foreign national looking to invest in the US.

Liam and Emma – Canadian Investor – Purchased a rental property in Hawaii.

You can read about Liam and Emma’s homebuying journey here.

2. Meet with Our Mortgage Officers

After you submit your details, our dedicated mortgage officer will promptly contact you and guide you through every step of the process.

At HomeAbroad, we prioritize your investment success and are dedicated to providing personalized support tailored to your needs.

3. Get Preapproval

Submit basic financial information to get preapproved for a DSCR loan, giving you an idea of how much you can borrow based on your available assets for a down payment, reserves, and expected closing costs.

4. Gather Your Documents and Fill Out an Application

Collect necessary documents, including rental agreements, financial statements, and property details, and complete the loan application.

Required Documents for DSCR Loans:

- Property’s purchase contract

- 2 Months’ Bank Statements

- 1007 Rent Schedule

- Homeowners Insurance

- Entity Documentation (If buying under LLC)

5. Underwriting

To make a final decision, the underwriter will thoroughly evaluate your application and supporting documents in accordance with the lending guidelines.

6. Approval

The underwriter will either approve, decline, or accept your loan application with conditions.

7. Closing

After approval, our loan officer will provide a closing disclosure that includes your final loan terms, your monthly mortgage payment schedule, and the closing costs you are required to pay on closing day. Accept it and complete the necessary paperwork to receive the funds and take ownership of the property.

By following these steps and meeting the outlined criteria, you can qualify for a DSCR loan and leverage its benefits to grow your real estate investment portfolio.

Here’s what our Mortgage Officer, Steven Glick, has to say about DSCR Loans:

Steven Glick,

Director of Mortgage Sales, HomeAbroad Loans

Pros and Cons of DSCR Loans

DSCR loans offer a unique financing option specifically tailored for real estate investors. Based on my experience working with a diverse range of clients, I have identified the advantages and potential drawbacks of DSCR loans to help you make an informed decision.

PROS | CONS |

|---|---|

No Personal Income Verification; loan underwritten based on the property’s rental income | Higher Interest Rates |

Get Multiple DSCR Loans Simultaneously | Larger Down Payments |

Fast and Streamlined Process; loan approval within 30 days | Additional Closing Costs |

Flexible Loan Options; DSCR ratio as low as 0.75 accepted | Risk with Low Cash Flow |

Cash-Out and Refinance Options | |

Versatility in Property Use |

DSCR Loan Success Story: How a UK Investor Achieved Their US Real Estate Goals

Over the years, I have worked with international real estate investors, and I’ve seen firsthand the unique challenges they face when entering the US real estate market. However, at HomeAbroad, we specialize in turning these challenges into opportunities.

One such success story is that of a UK investor who secured a DSCR loan to purchase a rental property in Florida.

This case perfectly highlights how tailored solutions, expert guidance, and a deep understanding of DSCR loan flexibility can make all the difference for foreign investors.

Overview:

Client Profile

Name: Sam Smith (name changed for privacy)

Background: A UK citizen on an L1 visa with less than six months in the US and no US credit history.

Objective: Purchase a $500,000 rental property in Sarasota, Florida, to generate steady cash flow and build a US real estate portfolio.

Challenges

No US Credit History: Sam faced multiple rejections from traditional lenders due to their lack of a US credit score, a common obstacle for foreign nationals.

Low DSCR: The rental property had a DSCR below 1, which typically disqualifies it for traditional DSCR loan programs.

Understanding US Financing Requirements: As a foreign national, Sam was unfamiliar with the US loan application process and documentation requirements.

The HomeAbroad Solution

HomeAbroad’s expert mortgage officer, Steven Glick, tailored the DSCR loan program to craft a perfect solution ideally suited to Sam’s needs:

- Identifying the Right Loan Program: Recognizing the limitations of traditional lenders, our mortgage officer, Steven Glick, recommended a no-ratio DSCR loan, which does not require a specific DSCR for approval.

- Customizing the Process: Steven simplified the application process for Sam by guiding them through every step, including understanding property performance metrics and submitting essential documents.

- Efficient Underwriting: Despite the property’s low DSCR and Sam’s lack of credit history, our tailored approach ensured a smooth underwriting process, culminating in loan approval within 29 days.

The Outcome

With HomeAbroad’s support, Sam successfully purchased the $500,000 rental property under an LLC and secured the following loan terms:

- Loan Amount: $341,000

- Loan Type: No-ratio DSCR loan

- Time to Close: 29 days

Sam is now generating rental income from the property and has laid the foundation for an expanding US real estate portfolio.

Why This Case Matters

This success story underscores the flexibility and power of DSCR loans, particularly for foreign nationals. At HomeAbroad, our expertise in working with global investors ensures that challenges like a lack of US credit history or low DSCR don’t stand in the way of your investment goals.

Get Started and Apply for a DSCR Loan Today

Debt Service Coverage Ratio (DSCR) loans have revolutionized real estate financing by eliminating the traditional hurdles of income verification and credit history. Instead, they focus on the property’s rental income potential, making them the ultimate tools for scalable, flexible investments.

With over 10 years of experience in helping global investors leverage DSCR loans, I can confidently say this financing strategy is a game-changer for building a strong US real estate portfolio. At HomeAbroad, we take pride in being at the forefront of DSCR lending, offering tailored loan solutions designed to meet the unique needs of international buyers and US newcomers.

But our support goes far beyond financing. As a one-stop PropTech and FinTech platform, HomeAbroad simplifies every aspect of purchasing and managing US real estate. Alongside DSCR loans, we provide:

- Now, you can use HomeAbroad’s AI-powered investment property search platform to find investment-ready homes.

- Access to 500+ expert US real estate agents for personalized guidance.

- Concierge services including LLC formation, US bank account setup, and homeowner’s insurance.

- Property management coordination to ensure your investments are stress-free and profitable.

Whether you’re a seasoned investor or just entering the US real estate market, HomeAbroad equips you with the tools, expertise, and ongoing support to succeed.

Ready to take your investments to the next level? Contact us today and let our experts guide you every step of the way.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Questions HomeAbroad Team Gets Asked By Investors Regarding DSCR Loan – FAQs

Can I use future rental income to qualify for a DSCR loan?

Yes, if the property is not currently rented, we can use the appraised market rent value to calculate the DSCR. This is particularly useful for newly acquired properties or those undergoing transition. However, documentation such as a rental market analysis or appraisal report will be required.

Can you qualify for a DSCR loan with a DSCR less than 1?

HomeAbroad offers a DSCR Loan even if your DSCR ratio is less than 1. However, you would need to make a larger down payment.

Are there any restrictions on the types of properties I can finance with a DSCR loan?

DSCR loans are highly versatile and can be used to finance a variety of properties, including:

Single-family homes

Multi-family units

Short-term rentals such as Airbnb and Vrbo

However, properties must be intended for investment purposes, not primary residences or second homes.Do I need a good credit score for DSCR loans?

DSCR loans focus on the property’s rental income, rather than personal income verification. Foreign investors can qualify for a DSCR loan without a US credit history.

Can I use DSCR loans for property flipping?

DSCR loans are not designed for short-term flipping because they focus on rental income rather than the property’s resale value. However, if you plan to hold the property as a rental after renovations, a DSCR loan can be a viable option. For property flipping, you can check out HomeAbroad’s Fix and Flip loans.

Is cash-out refinancing available for DSCR loans?

Yes, HomeAbroad offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

What are the interest rates for DSCR loans?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

- Investopedia: Debt Service Coverage Ratio: How to Use and Calculate It

- What Is a Homeowners Association (HOA), and How Does It Work?

- Consumer Financial Protection Bureau: What is a debt-to-income ratio?

- Fannie Mae: 1007 Rent Schedule

![DSCR Loans Guide for Foreign Nationals: What It Is & How to Apply in [2026]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN-500x325.png)

![How to Get DSCR Loans for Airbnb? [A 2026 GUIDE]](https://homeabroadinc.com/wp-content/uploads/2022/10/GettingDSCRForAirBnB.jpg)