Colorado’s real estate market is thriving, but securing financing through traditional lenders can be a challenge. Many investors face hurdles like high debt-to-income ratios or the need for extensive personal income documentation, causing delays and missed opportunities.

I’ve worked with several clients who struggled with these issues, but by leveraging DSCR loans, they were able to qualify based on the rental income of their properties, not their personal earnings. Whether they were eyeing Denver’s growing short-term rental scene or the stable long-term market in Colorado Springs, DSCR loans helped them secure financing and expand their portfolios faster.

If you’re ready to take the next step in your investment journey, now is the perfect time to start. Apply for a DSCR loan in Colorado today and take the first step toward expanding your real estate portfolio!

Table of Contents

Key Takeaways

1. DSCR loans are ideal for expanding rental portfolios, acquiring multiple properties, or leveraging cash-out refinancing, suitable for self-employed individuals in Colorado.

2. No W2s, pay stubs, or tax returns required, skip extensive documentation and get approved quickly by focusing on the property's cash flow.

3. DSCR loans focus on property rental income, not personal income, making them ideal for investors with non-traditional income sources.

What is a DSCR Loan?

A DSCR (Debt Service Coverage Ratio) loan is an excellent option for real estate investors who want to qualify based on rental income rather than personal income. I recently worked with an investor struggling to get approved for a traditional loan. Instead of using things like W-2s or tax returns, we looked into a DSCR loan, which focuses solely on the property’s rental income.

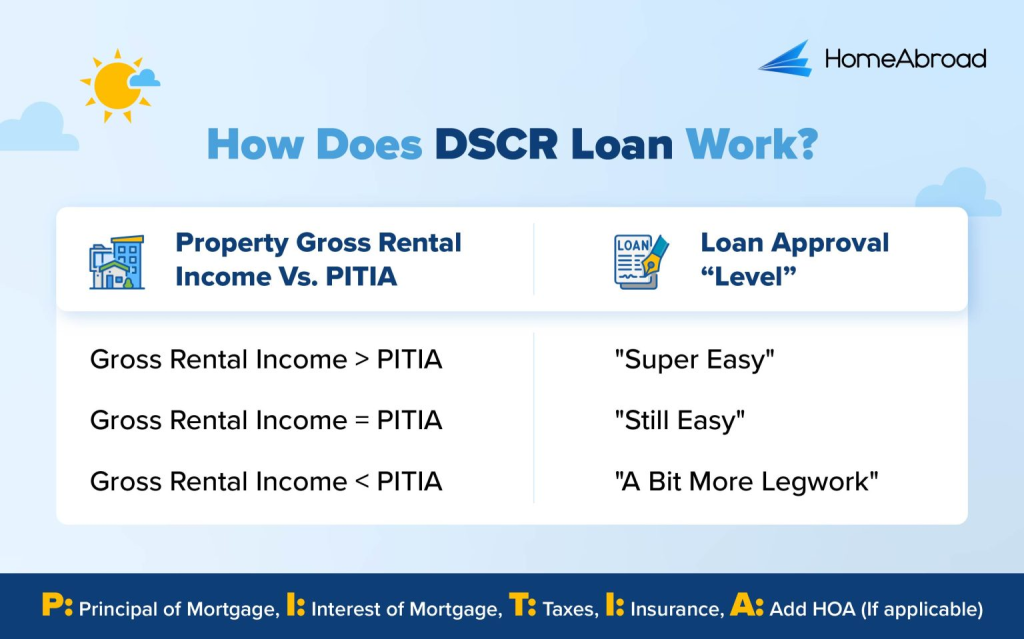

A DSCR loan compares the property’s rent to the mortgage payment. You have positive cash flow if the rent covers the mortgage and more. For example, I helped an investor in Denver where the rental income was higher than the mortgage, which made it a substantial investment.

It’s a flexible and easy way for investors to finance properties, especially in markets like Colorado, where rental yields are strong. With HomeAbroad, you can explore these options and take your investment to the next level.

How to Calculate Your DSCR Ratio

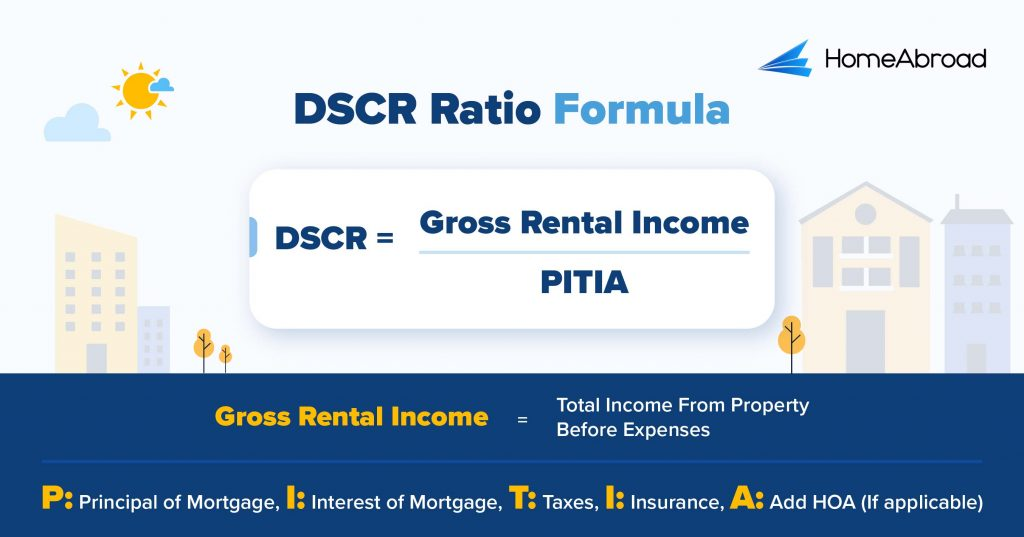

The Debt Service Coverage Ratio (DSCR) is a key metric that lenders use to determine whether a rental property generates enough income to cover its mortgage payments.

If you’re a real estate investor in Colorado, understanding and calculating your DSCR ratio can help you quickly secure the best loan terms and expand your investment portfolio.

The formula for calculating DSCR is:

I recently worked with a client looking to invest in a rental property in Denver, Colorado. He wanted to secure financing but wasn’t sure if the property’s cash flow would meet lender requirements. I helped him analyze the numbers, calculate the Debt Service Coverage Ratio (DSCR), and navigate the loan process.

Example

Calculating the DSCR Ratio for a Colorado Property:

With a DSCR of 1.16, the property generated more income than its loan obligations, making it a solid investment. This number helped my client secure financing, knowing the property had a positive monthly cash flow of $350.

HomeAbroad requires a minimum Debt Service Coverage Ratio (DSCR) of 1.0 to ensure the property at least breaks even. However, we also offer flexibility by providing DSCR loans with a DSCR ratio of 0.75, giving investors more options, but with higher down payments and interest rates to mitigate the additional risk.

After working through the numbers together, my client successfully closed on the property and is now generating steady rental income.

DSCR Loan Interest Rates

Understanding these rates is crucial for investors, as they significantly impact the profitability of investment properties. Before investing, follow our DSCR loan interest rate guide to learn about current DSCR loan interest rates and their influencing factors.

Due to the unique nature of DSCR loans and the associated increased risk for lenders, these rates are typically 1% to 1.5% higher than those of conventional mortgages. For more details on DSCR loans and how they work, visit HomeAbroad’s DSCR loan hub.

How to Qualify for a DSCR Loan in Colorado

At HomeAbroad, we make qualifying for a DSCR loan flexible and straightforward, whether you’re a domestic investor or a foreign national. Now, let’s learn about our tailored DSCR loan requirements to provide domestic and foreign investors with flexible financing solutions.

| Features | Domestic Investors | Foreign Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | 620 or higher | No US credit history required |

| Down Payment | 20% | 25% |

| Loan-to-Value (LTV) | Up to 80% for purchase/refinance Up to 75% for cash-out refinance | Up to 75% for purchase/refinance Up to 70% for cash-out refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

HomeAbroad’s No-Ratio DSCR Loans are available for properties with a DSCR of less than 1, requiring a higher down payment but allowing financing for underperforming or transitional properties.

Areas We Lend in Colorado

- Denver

- Colorado Springs

- Aurora

- Fort Collins

- Boulder

- Thornton

- Arvada

- Westminster

- Woodland Park

- Jefferson

- Hartsel

- Guffey

- Florissant

- Lake George

Let’s examine a case study of one of our past clients to understand how profitable investing in the Colorado real estate market can be.

Case Study: David Expands His Rental Portfolio in Colorado

Property Details:

Location: Denver, Colorado

Property Price: $500,000

Monthly Rent: $4,200

Loan Details:

Loan Amount: $400,000

Down Payment: 25%

Monthly PITIA: $3,375

DSCR Calculation:

DSCR Ratio = Gross Rental Income ÷ PITIA

DSCR = $4,200 / $3,375

DSCR = 1.24

Client: David Thompson

Advisor: Steven Glick, Director of Mortgage Sales, HomeAbroad (NMLS# 1231769)

David Thompson, an experienced real estate investor from California, wanted to expand his rental portfolio by purchasing a single-family property in Denver. He aimed to acquire a high-performing investment while keeping his income and real estate finances separate.

David worked with Steven Glick, an expert in debt service coverage ratio (DSCR) loans, to achieve this. Steven structured a financing solution that relied solely on the property’s income potential, eliminating the need for traditional income verification.

The HomeAbroad Solution

A DSCR of 1.24 means that the property’s rental income exceeds its debt obligations by 24%, ensuring positive cash flow of $825 and a substantial investment.

This strategy allowed David to expand his rental portfolio successfully, leveraging the property’s income potential without using his income for qualification.

Why This Matters?

Steven Glick highlights the importance of this financing approach:

David’s case is a perfect example of how DSCR loans empower investors to scale their portfolios without traditional income verification hurdles. By structuring the financing around the property’s rental income, we ensured he could secure a high-performing asset in Denver while keeping his personal finances separate. This strategy gave him both flexibility and strong cash flow, making his investment a success.

Steven Glick, Director of Mortgage Sales, HomeAbroad

This case highlights the power of DSCR loans in helping real estate investors efficiently scale their portfolios. With expert guidance and tailored financing, David successfully entered one of the nation’s most dynamic rental markets without the usual income verification roadblocks.

DSCR loans offer a practical, results-driven solution for investors seeking to grow their holdings with minimal financial entanglements.

Top Places to Invest in Colorado with a DSCR Loan

Colorado offers a strong real estate market with attractive rental yields, making it a prime investment opportunity. With an average home price of around $500,000, higher than the national average of $355,328, investors benefit from steady property appreciation and strong rental demand.

Thanks to top universities and booming industries, cities like Denver, Boulder, and Fort Collins attract long-term demand from students and professionals. Meanwhile, Colorado Springs, Breckenridge, and Aspen thrive on tourism, creating excellent short-term rental potential.

With Colorado’s solid rental yields and access to DSCR loans, investors can secure properties that cover their mortgage and generate positive cash flow.

Here are some top investment cities in Colorado:

City | Rental Type | Rental Yield |

|---|---|---|

Lake George | Short-Term | 11.5% |

Florissant | Long-Term | 10.9% |

Guffey | Short-Term | 9.8% |

Hartsel | Short-Term | 10.2% |

Jefferson | Short-Term | 10.7% |

Woodland Park | Long-Term | 9.8% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in Colorado or anywhere in the US!

Get a HomeAbroad DSCR loan in Colorado

HomeAbroad simplifies US real estate investment for both US and international buyers with tailored DSCR loans. Whether you’re targeting short-term rentals in Denver, multifamily properties in Colorado Springs, or single-family homes in Aurora, our flexible financing helps you expand quickly.

As a one-stop PropTech and FinTech platform, we offer:

- Foreign National Mortgages for international investors

- AI-Powered Property Search to find high-yield rentals

- 500+ Expert Agents providing personalized guidance

- Concierge Services covering LLC formation, US bank accounts, insurance, and property management

Start building your real estate portfolio in Colorado. Find and finance a rental property that pays for itself while generating steady cash flow. Apply now and secure your DSCR loan in Colorado with HomeAbroad!

FAQs

Can foreign nationals apply for DSCR loans in Colorado?

Foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international investors.

Is cash-out refinancing available for DSCR loans?

HomeAbroad Loans offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

How long does it take to get a DSCR loan in Colorado?

At HomeAbroad Loans, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices

![DSCR Loan Florida [2025]: Qualify with Your Property’s Income](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCR-Loan-Florida.png)

![DSCR Loan in Texas: Qualify with Rental Income [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-Loans-Texas.jpeg)