Key Takeaways:

➡️ Foreign nationals can legally buy property in California with no restrictions.

➡️ California’s top cities, including tech-centric areas like Silicon Valley, offer excellent long-term investment and rental income potential.

➡️ HomeAbroad provides tailored mortgage solutions for foreign buyers without the need for a US credit score, making it easier for expats working in the tech industry to invest.

Table of Contents

“California: bordering always on the Pacific and sometimes on the ridiculous. So, why do I live here? Because the sun goes down a block from my house.” — George Carlin’s words capture the essence of California’s charm—a place where the extraordinary meets the everyday.

In 2024, California became the third most popular choice for foreign buyers, with 11% of all international property investments made here. From its stunning coastlines to iconic cities like Los Angeles and San Francisco, California isn’t just a location—it’s a lifestyle.

At HomeAbroad, we specialize in helping foreign nationals tap into California’s lucrative real estate market, making your dream of owning a piece of the Golden State a reality.

Can Foreigners Buy Property in California?

Absolutely. Foreign nationals can purchase property in California without any restrictions. Whether you’re looking to buy a primary residence or an investment property, the process is straightforward and open to all international buyers.

With California’s thriving real estate market, foreign investors can take full advantage of the opportunities here, and HomeAbroad is here to simplify every step of the way, offering guidance and tailored mortgage solutions to help you secure your dream property.

Now that you know it’s possible for foreign nationals to buy property in California, let’s explore why this investment is particularly appealing. Beyond legality, California offers compelling reasons to consider it your next real estate destination.

Why Should Foreign Nationals Buy Property in California?

It’s not for nothing that California is one of the most sought-after choices for foreign nationals looking to buy property. But why? Let’s dive into the key reasons that make California the perfect place to invest in real estate.

1. The World’s Fifth-Largest Economy

One of the strongest reasons foreign investors are drawn to California is its economic strength. With a $3.9 trillion GDP (larger than most countries), California’s booming economy is a major draw for foreign investors.

Real estate markets in cities like San Francisco and Los Angeles are supported by this robust economy, offering stable, long-term investment opportunities. Whether you’re buying a luxury condo or rental property, California’s economic power makes it an ideal location for foreign investors.

2. Lucrative and Profitable Cities

California’s real estate market continues to attract foreign investors, especially in its top-tier cities. Here’s a look at three key markets:

- Los Angeles: As one of the most sought-after cities globally, Los Angeles offers a thriving real estate market with median home prices reaching $956,844. Rental yields are equally impressive, with the average rent at $4,438 per month.

- San Francisco: Known for its tech-driven economy, San Francisco boasts median home prices around $1,290,350. The rental market here remains lucrative, with the average rent at $4,025 per month.

- San Diego: With its coastal charm and robust real estate market, San Diego presents median home prices comparable to the state average, and rental rates at $4,156 per month.

These cities offer high-value real estate opportunities with strong appreciation and rental income potential.

The table below summarizes key metrics for California’s top three cities as of 2024:

| City | Home Price (2024) | Monthly Rent (2024) |

| Los Angeles, CA | $956,844 | $4,438 |

| San Francisco, CA | $1,290,350 | $4,025 |

| San Diego, CA | $1,028,191 | $4,156 |

[Data Source: Zillow]

Property Types Preferred by Foreign Nationals

Foreign buyers in California tend to gravitate towards:

- Condos: Popular in urban areas like Los Angeles and San Francisco for their convenience and lower maintenance.

- Single-Family Homes: Particularly appealing for those looking for long-term investment or personal use, especially in suburban areas of cities like San Diego.

- Rental Properties: Investors often seek properties with strong rental yields in areas with high demand for housing, such as Silicon Valley and Southern California’s coastal cities.

3. High-Value Real Estate Markets with Excellent ROI (Return on Investment)

California’s real estate market is known for its high-value properties. For example, the median home price in San Francisco sits at $1,290,350, while Los Angeles follows close behind with a median of $956,844.

These cities offer excellent returns for both short-term rental income and long-term property value growth.

Even smaller cities like San Diego have seen property values rise significantly, with the average home costing a whopping $1,028,191. The state offers not just luxury properties but also high rental yields, making it a lucrative option for international investors.

4. Exceptional Investment Potential

Foreign investors are attracted to California’s impressive property appreciation rates. According to Zillow, homes in California have appreciated by 6% over the past year, with areas like San Francisco and Los Angeles leading the charge.

While financial gains are certainly a driving force, California offers more than just ROI. It also offers a lifestyle that few places can match. Let’s explore the unparalleled lifestyle that comes with investing in California.

The Global Lifestyle Offered by California to Foreign Nationals

California’s allure is undeniable. It’s where world-class innovation, breathtaking landscapes, and a booming economy converge to create one of the most desirable places for foreign nationals to invest in real estate.

1. Year-Round Sunshine and Iconic Lifestyle

California’s Mediterranean climate offers over 300 days of sunshine annually, making it one of the most desirable places to live globally.

From the glamorous beaches of Malibu to the stunning cliffs of Big Sur, the state presents a lifestyle that’s hard to resist.

Foreign buyers are drawn to California’s laid-back vibe, world-class entertainment, and cultural diversity, offering a taste of the Hollywood lifestyle in cities like Los Angeles.

2. Top-Tier Education and Innovation

For foreign nationals prioritizing education, California boasts some of the best universities in the world, including Stanford University, UC Berkeley, and the California Institute of Technology. Homes near these prestigious institutions are in high demand, making them excellent choices for both personal use and rental investments.

Additionally, with Silicon Valley at the heart of the tech revolution, California offers proximity to world-leading innovation, appealing to investors interested in staying close to groundbreaking developments.

Convinced that California is the place to be? Now, let’s break down how foreign nationals can begin the journey of buying property in California.

Steps to Buying Property in California for Foreigners

The process of buying property in California as a foreign national involves key steps, from researching the market to closing the deal. At HomeAbroad, we simplify this journey for you. For a detailed breakdown of the entire process, check out our guide on Can Foreigners Buy Property in the US.

To better understand the buying process, watch our YouTube video that walks you through every step visually:

[Watch Now: How Foreigners Can Buy Property in the US]

Now that you know the steps, the next crucial step is figuring out how to finance your California dream. Let’s dive into your financing options.

Financing Options for Foreign Nationals

At HomeAbroad Loans, we offer tailored mortgage solutions tailored for foreign nationals, with no US credit score required. Our competitive interest rates and simple documentation process make it easier than ever for international buyers to invest in California’s booming real estate market.

With a minimum down payment of 25% for foreign nationals, HomeAbroad Loans ensures you can secure the financing you need to purchase your ideal property.

For a detailed look at our mortgage options, visit our comprehensive guide on Foreign National Mortgages.

Taxation and Reporting Requirements

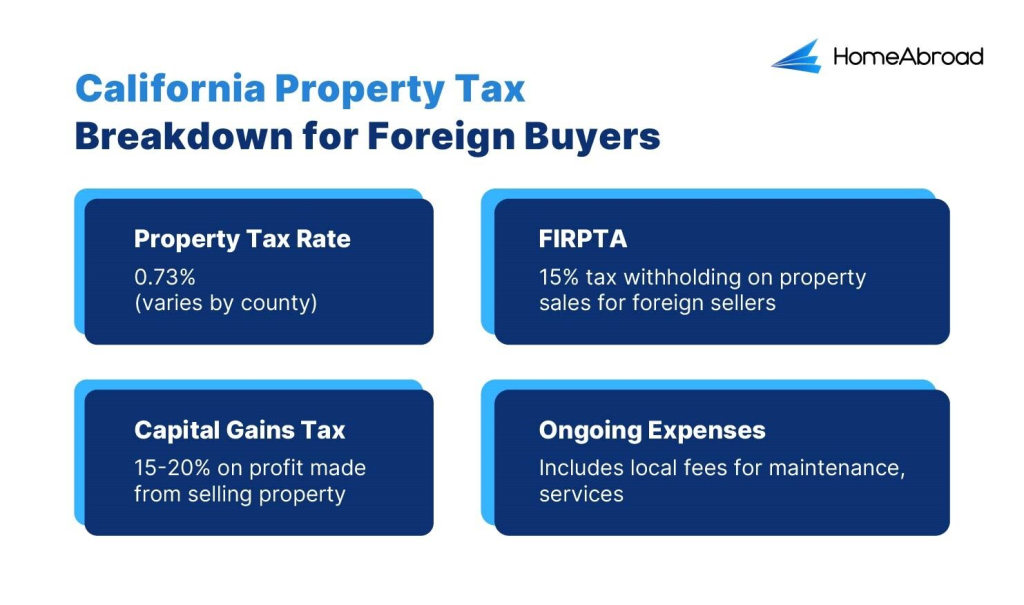

1. FIRPTA

Foreign buyers should be aware of the Foreign Investment in Real Property Tax Act (FIRPTA), which requires foreign sellers of US real estate to withhold 15% of the gross sales price for tax purposes. However, please note that this is not additional tax, but withholding which will be refunded when you file the tax return.

2. Capital Gains Taxes

When a foreign national sells property in California, they are subject to capital gains taxes. The federal capital gains tax rate depends on the investor’s income and the length of property ownership:

California also imposes a state capital gains tax, which is calculated at the investor’s ordinary income tax rate, ranging from 1% to 13.3%. This is in addition to the federal tax, making it crucial for foreign nationals to plan ahead for capital gains taxes when selling their property.

However, foreign nationals may be able to defer paying capital gains taxes through a 1031 Exchange.

A 1031 exchange allows investors to sell an investment property and reinvest the proceeds into another “like-kind” property. By doing so, they can defer paying capital gains taxes until the new property is sold. This strategy is beneficial for those looking to continue investing in real estate and grow their portfolio without immediate tax obligations.

Take the First Step Toward Owning Property in California

Buying property in California offers foreign nationals a unique opportunity to tap into one of the world’s most lucrative real estate markets. With the help of HomeAbroad, the process is straightforward and tailored to meet your needs.

From financing to closing, we ensure you have the support needed to secure your investment. Contact us today to get started with your California real estate purchase.

FAQs

1. Can foreign nationals buy commercial property in California?

Yes, foreign nationals can purchase property in California without restrictions.

2. Does buying property in California help with visa or residency status?

No, purchasing property in California does not automatically grant residency or visa status. Property ownership is independent of immigration status, but it can help establish ties to the US, which might support certain visa applications in the future.

3. Can foreign nationals qualify for a DSCR loan in California?

Yes, foreign nationals can qualify for a Debt Service Coverage Ratio (DSCR) loan to invest in rental properties without needing to verify personal income. For more details, visit our DSCR Loan guide.

4. What documents do foreign buyers need to purchase property in California?

Foreign buyers will typically need identification (such as a passport), proof of funds for the down payment, and any necessary financing documentation. Working with HomeAbroad’s real estate agent and mortgage officer who specializes in foreign nationals is crucial for getting through the process smoothly.

5. How does HomeAbroad make the process easier for foreign nationals?

At HomeAbroad, we specialize in providing foreign nationals with tailored mortgage solutions that don’t require a US credit score. Our experienced real estate agents and mortgage officers guide you through every step, ensuring a smooth and stress-free buying process.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

Governor Gavin Newsom – https://www.gov.ca.gov/2024/07/15/californias-economy-leads-the-nation/

Zillow – https://www.zillow.com/research/data/

FIRPTA – https://www.irs.gov/individuals/international-taxpayers/firpta-withholding

Investopedia – https://www.investopedia.com/financial-edge/0110/10-things-to-know-about-1031-exchanges.aspx

How Does HomeAbroad Help?

"Unlocking US real estate for the world with our tailored offerings."