Are you a foreigner hoping to own a house in America someday? Do you wish to find out what the average house prices are across America? Is the lack of knowledge of mortgage options holding you back? Then relax, for you have landed on the right page. Today we intend to walk you through the average price range of houses in some most popular states, mortgage options that you may avail, and loan procedures to help you make a good choice and catalyze your dream of owning a house in America!

Before we leap ahead, let’s first understand the average house prices across America. This will help you gauge the extent of finances that you will need to arrange to buy a house here.

Table of Contents

Average Home Price in the USA

According to the Federal Reserve Bank of St. Louis, the national average home sales price in the USA is $428,700. This number has increased from last year by $58,900.

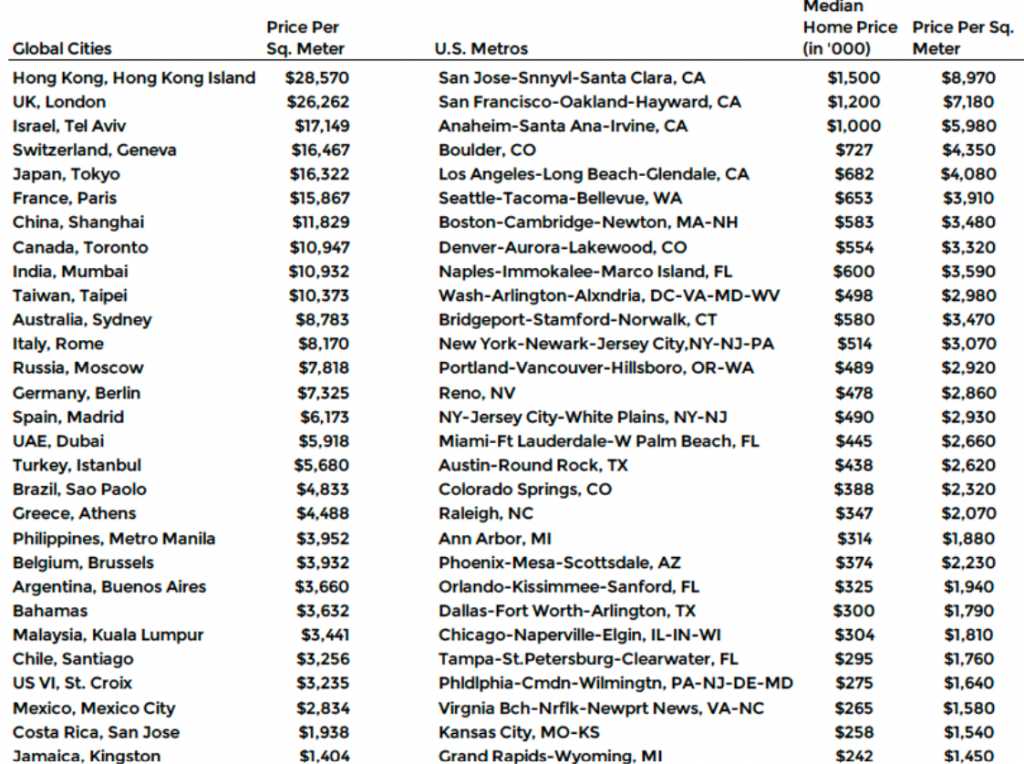

The most expensive state to buy a house is Hawaii, where the median home value is $524,000. And the cheapest place is West Virginia, with a median home value of $92,000. While these numbers may look daunting, one must know that as per the NAR report, the average median home price in the USA remains lower than in big metro cities of many countries, inevitably making the USA one of the most favorable countries for buying homes in.

Average Home Price in Popular USA States

As we mentioned before, prices can vary greatly depending on the state. Here is the median house price in some of the most popular states pan America:

California

The median home price in California reached $769,405 this year. An increase of 8.7% from the last year has been noticed. California provides great opportunities for people who want to live near the beach or in a big city.

Texas

According to popular real estate websites, the median home value in Texas is currently $315,815. Median home prices in Texas have escalated by 17.7% from those recorded last year.

New York

The average home price in New York is $781,622, spiked by 7.1% from the last year. The real estate market in New York is quite expensive. Nevertheless, New York is a great place to live if you want to be in a big city with lots of things to do.

Florida

The median home value in Florida is currently $406,988, an increase of 27.8% from the last year has been observed. Florida is great for people who want to retire or live near the beach.

Illinois

The average house price in Illinois is $267,383. The prices have increased by a whopping 10.9% from the last year. Illinois is a great state for people who want to live in the city or in the suburbs.

Michigan

The median home value in Michigan is $237,236. It spiked by 10.5% over the past year. Michigan is a great state for people who want to live in the country or in a small town.

San Francisco

The median home value of a house in San Francisco is $1,487,728 and has increased only by 0.1% over last year. Additionally, San Francisco is a great place to live if you want to be in a big city with lots of things to do.

South Carolina

The median home value in South Carolina is currently around $299,173. Home prices have increased by about 23.0% over the past year. If you have got beach vibes, South Carolina is great for you.

New Mexico

The median home value of a house in New Mexico is $299,814. New Mexico’s home prices have increased by 15.5% from the last year. New Mexico is a great state for people who want to live in the country or in a small town.

New Hampshire

The median home value of a house in New Hampshire is $438,366, indicating an increase of 15.1% from last year. New Hampshire is a great place to live if you want to be in the city or in the suburbs.

Refer to the table for more information on the Median Home Value of States in the US as on July 2022

| States | Median Home Prices |

| Wyoming | $320,939 |

| Alabama | $204,965 |

| Alaska | $337,373 |

| Arizona | $458,907 |

| Arkansas | $177,710 |

| Colorado | $604,911 |

| Connecticut | $383,222 |

| Delaware | $355,181 |

| District Columbia | $826,124 |

| Georgia | $318,273 |

| Idaho | $476,198 |

| Idaho | $476,198 |

| Indiana | $221,437 |

| Iowa | $192,568 |

| Kansas | $206,176 |

| Kentucky | $197,644 |

| Louisiana | $214,522 |

| Maine | $360,836 |

| Maryland | $415,797 |

| Massachusetts | $611,819 |

| Minnesota | $340,122 |

| Mississippi | $164,132 |

| Missouri | $231,062 |

| Montana | $449,723 |

| Nebraska | $239,814 |

| Nevada | $484,530 |

| New Jersey | $480,275 |

| North Carolina | $322,055 |

| North Dakota | $282,461 |

| Ohio | $213,360 |

| Oklahoma | $181,574 |

| Oregon | $534,956 |

| Pennsylvania | $267,549 |

| Rhode Island | $443,482 |

| South Dakota | $292,488 |

| Tennessee | $297,943 |

| Utah | $588,862 |

| Vermont | $358,862 |

| Virginia | $379,206 |

| Washington | $640,494 |

| West Virginia | $137,286 |

| Wisconsin | $266,750 |

As you can see, there is a huge range in prices. So, if you want to buy a house in America, you will need to research the most affordable places in the specific state you are interested in. But, how to decide about the affordability of the house? The answer to this is quite simple. All you need to do is calculate the home affordability index.

How to calculate Home Affordability Index?

A home affordability index is a tool that measures whether or not a median-priced home is affordable for a typical American family. Foreigners can draw a parallel by converting their income into dollars for calculation purposes and better understanding. The calculation is based on the percentage of median family income that is needed to make mortgage payments on a median-priced home, including taxes and insurance.

A value of 100 indicates that a family with a median income has just enough income to qualify for a mortgage on a median-priced home. An index above 100 implies that a family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home. For example, a composite index of 120.0 means a family earning the median family income has 120% of the income required to qualify for a conventional loan. An increase in the HAI suggests that this family earns more than enough to afford the median-priced home.

HAI calculation assumes a down payment of 20 percent of the purchase price and a qualifying ratio of 25 percent. That means the monthly principal and interest payment cannot exceed 25 percent of the median family’s monthly income.

Formula: (MEDINC/QINC)*100

Key:

MEDINC = Median Family Income

QINC = Qualifying Income

The higher the home affordability index, the more expensive homes are relative to income. For example, an index of 50% means that median-priced homes are half as expensive as the median family income. An index of 200% means that median-priced homes are twice as expensive as the median family income.

Home Affordability Index can also be used for calculating, Monthly Affordable Mortgage Payments. Here is the step-by-step process,

1)Look for a recent article that reports the Home Affordability Index. As on June 2022, the home affordability index is 98.5%.

2) Divide this number by 100 to convert it to a decimal. For example, divide 98.5 by 100 to get 0.985.

3) Multiply this decimal by the median household income of your area. Freddie Mac publishes state-level data on its website. Suppose the median household income in your state is $60,000 per year. Multiplying 0.985 by $60,000, you will get a figure of $59,100.

4) Divide this number by 12 to calculate the monthly amount you can afford to spend on your mortgage payment, property taxes, and insurance. For example, $59,100 divided by 12 gives a monthly affordable mortgage payment of $4,925.

A home affordability index is a helpful tool for both buyers and sellers. It can help determine whether or not the borrower can afford a particular home.

Once you have an idea about the area and affordability. You may progress toward the next step, which is finding the best-suited mortgage

Mortgage Options for Financing the Home Purchase

1. DSCR Loans

A DSCR loan is a mortgage available to people with a high debt-to-income ratio. It is based on the cash flow of the investment/rental property in consideration. It is one of the best-suited options for foreign buyers who do not have a U.S credit history and wish to surpass long loan approval procedures and tedious paperwork.

To get a fine deal on DSCR loans, it is important to reach out to only reputable and experienced lenders. HomeAbroad has an excellent network of DSCR lenders who are backed by immense experience working with foreign investors, helping them realize their American dream.

2. Foreign National Mortgages

A Foreign National Mortgage loan is designed specifically for foreign nationals who want to buy property in the United States. While foreign nationals are eligible for traditional mortgage loans, they frequently struggle to qualify for them due to a lack of U.S. credit history and income in the United States. Foreign National Mortgage loans are an excellent option for those without a U.S. credit history. Its requirements are similar to a traditional loan except that the borrower’s credit report from his/her home country can be considered proof of their creditworthiness, and you need to put down 20%. You just need the right lender who offers foreign national mortgages.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

3. Jumbo Loans

Jumbo loans are home loans that exceed the conventional loan limit. Jumbo loans usually have slightly higher interest rates than conventional loans. They are an excellent option if you are buying an expensive property. However, to qualify for the loan, the borrower must have lived in the US for about 5 years and is required to stay employed in the USA for the next three years post-approval of the loan.

4. Private Mortgage

A private mortgage is a non-QM loan. It does not require proofs related to income, tax returns, bank statements, employment authorization documents, etc. A private mortgage is granted by a private lender, for whom the positive cash flow of the property and your ability to make timely monthly repayments is of utmost importance. This loan option allows you to negotiate the terms and conditions of the loan with your lender. However, as a borrower, you are expected to purchase private mortgage insurance (PMI) if your down payment is less than 20% of the purchase price.

5. FHA Loans

An FHA loan, or Federal reserve bank loan, is a mortgage granted by federal banks. It’s a government-backed loan available to borrowers with a credit score of at least 580 and a down payment of 3.5%, it is primarily for the native first-time home buyer. A foreign buyer who may not have a U.S credit history cannot avail of this loan type.

The Procedure for Buying a Home in America

Step 1: Go through the Listings

The first step is to go through the listings of available homes in your area. You can do this online or in person or contact CIPS Agent. CIPS agents are real estate agents who have completed the Certified International Property Specialist (CIPS) designation. This designation is granted by the National Association of REALTORS® and signifies that an agent has the knowledge and experience to help buyers purchase properties outside of their home country.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

Step 2: Narrow down your options

Once you have reviewed all the listings, it is time to narrow down your options. Consider things like price, location, and size when making your decision.

Step 3: Find the right lenders

Once you have found the perfect house, it is time to find the right lender. You will want to compare interest rates, fees, and terms before you choose a lender. HomeAbroad specializes in foreign national mortgages, and you can get a mortgage at most competitive terms with us.

Step 4: Get pre-approved

After you have found the right lender, you will need to get pre-approved for a loan. This means that you will need to provide the lender with your financial plan and property information so they can determine how much you can borrow.

Step 5: Make an offer

Once you have found the perfect house and the right lender, it is time to make an offer. The offer will include the price you are willing to pay for the house and any other terms of the sale.

Step 6: Home inspection

Once your offer has been accepted, you need a home inspection. This ensures that the house is in good condition and has no hidden problems.

Step 7: Underwriting

The next step is underwriting. This is when the lender will review your financial information to ensure you are a good candidate for the loan.

Step 8: Closing

The final step is to close on the offer. This means that you will sign all of the paperwork and pay any remaining fees. You will then officially own the house!

Now that you know all of this information, you are ready to start looking for a house in America! Use these tips to help you find the perfect house for you and your family.

Factors to Keep in Mind Before Buying a House in America

There are a few things that you should keep in mind before buying a house in America.

Location

The location of the house is very important. You will want to ensure that you are buying a house in a safe neighborhood with which you feel comfortable.

Green Space

It is also important to make sure that there is enough green space around the house. This can include a backyard, a park, or even just some trees on the property.

Size

The size of the house is also important. You will want to make sure that it is big enough for your needs but not too big that it is too expensive to maintain. It inadvisable to have an idea of the square foot you would want your house to be.

Walk-in Closets and Granite Countertops

These are two features that are often included in American houses. Walk-in closets are large ones that you can walk into and have plenty of space for all your clothes and belongings. Granite countertops are a type of countertop that is made from natural stone. They are very popular in America because they are durable and easy to clean.

Access to Amenities

When looking for a house, you will also want to ensure that you have access to the amenities you need. This can include things like schools, supermarkets, and hospitals.

The Cost of Living

The cost of living in the area where you buy your house is also important to consider. You will want to make sure that you can afford the mortgage payments as well as the cost of living in the area.

Life Style

Your lifestyle is an important factor to keep in mind when you are buying a house. You will want to make sure that the house you buy is conducive to the lifestyle you want to live.

Rental Value

If you are buying a house as an investment, you will also want to keep in mind the rental value of the property. You will want to make sure that you buy a house in an area with high rental values so that you can make a good return on your investment.

Climate

The climate is also important to consider when you are buying a house in America. You will want to make sure that you buy a house in an area that has a climate that you are comfortable with.

Home Prices

Make sure that you are not overpaying for the house. Research the prices of similar houses in the area to ensure you are getting a good deal. You can use the Affordability Index to help you determine how much you can afford to spend on a house.

Housing Inventory

The number of houses on the market can also affect prices. If there are a lot of houses for sale, you may be able to negotiate a lower price.

Mortgage Rates

Mortgage rates can vary greatly depending on the current market conditions. You will want to ensure that you get the best possible interest rate on your mortgage.

Monthly Payments

Your monthly mortgage payment will be determined by the mortgage rate, the loan term, and the amount of the down payment. You will want to make sure that you can afford the monthly payments before you commit to buying a house.

Down Payment

The down payment is the biggest upfront cost of buying a house. You will want to ensure that you have saved up enough money for a down payment before looking for houses.

Closing Costs

Closing costs are the fees associated with buying a house. These can include things like appraisal fees, title fees, and loan origination fees. You will want to ensure that you have an estimate of the closing costs before making an offer on the house.

Homeowners Insurance

Homeowners’ insurance is required in most states. You will want to ensure that you get the best possible rate on your homeowner’s insurance.

Property Taxes

Property taxes are based on the value of your house. You will need to budget for property taxes when you are buying a house.

Home Maintenance

Owning a home comes with a lot of responsibility. You will need to budget for painting, repairs, and landscaping.

Now that you know all of this information, you are ready to start looking for a house in America! Use these tips to help you find the perfect house for you and your family.

Conclusion

Buying a house in America as a foreigner is as simple as it is for a US citizen! You just need the right real estate (CIPS )agent and lender to navigate and facilitate your purchase. HomeAbroad can help you get in touch with the best CIPS agents and the right lender who can help you close the loop and own a house in America, which you have been dreaming of for so long. So, what are you waiting for? Reach out to us and let your home-buying journey in America begin!

Frequently Asked Questions

How much money do I need to buy a house in America?

The amount of money you need to buy a house in America will depend on the price of the house, the type of loan you get, and your down payment. Generally speaking, you will need at least 20% of the purchase price for a down payment and closing costs. You may also need to save money for a reserve, an emergency fund that can cover 3-6 months of mortgage payments.

How to calculate the average home price of a state?

You can calculate the average home price of a state by taking the median sales price of homes in that state and dividing it by the number of homes sold. You can find this information on your state’s real estate commission website.

How to calculate the home affordability index?

The home affordability index is a measure of how affordable housing is in a given area. It is calculated by taking the median house price in an area and dividing it by the median household income. The resulting number is then multiplied by 100 to get the index number.

For example, if the average home price in an area is $200,000 and the median household income is $50,000, the home affordability index would be 400. This means that housing in this area is very unaffordable for most people.

What is the national average house price in the USA?

According to the Federal Reserve Bank of St. Louis, the national average house price in the USA is $428,700.

How much is a cheap house in America?

There is no definitive answer to this question as it depends on your definition of “cheap.” However, according to Zillow, the median home value in the United States is $226,700. So, you could consider any house that is priced below this amount to be a “cheap” house.

How much is a rich house in America?

There is no definitive answer to this question as it depends on your definition of “rich.” However, according to Realtor.com, the median list price for houses in the United States is $269,000. So, you could consider any house that is priced above this amount to be a “rich” house.