So you’ve just made the big move to America – congratulations! This is an exciting time in your life, and there are plenty of new opportunities ahead. One of the most important things you’ll need to do as a new immigrant is secure a mortgage loan. Don’t worry; this process can be relatively easy with the right information.

As of 2023, there is an option called a new immigrant mortgage, which is designed to help those new to the country secure a mortgage loan. These programs provide access to competitive rates and flexible terms that can make it easier for immigrants to get the financing they need.

In this guide, we’ll discuss everything you need to know about the mortgage process. From mortgage lenders to the best programs for a foreign national, permanent resident, or non-permanent resident, and much more. Let’s get started!

Table of Contents

Is It Possible To Get a Mortgage as a Foreign National?

Yes, it is possible for a foreign national to get a mortgage in the USA. However, the requirements and eligibility criteria for foreign nationals may vary from those of US citizens.

You’ll need to meet certain requirements, depending on the home loan or mortgage program you opt for. There are a variety of programs you can choose from, and all have varied qualifications and requirements. So it’s best to do thorough research before applying.

Why Do New Immigrants Need a Mortgage Loan?

Mortgages are important for new immigrants because they provide them with the opportunity to purchase a home and become homeowners. Without a mortgage, many immigrants would not be able to afford homes in the United States, making it difficult to establish themselves financially.

Also, many foreign nationals living in the United States view owning a home as a vital aspect of the American dream. According to the National Association of Realtors (NAR), resident foreign buyers are more likely to purchase a home with a mortgage. NAR’s 2022 report showed that 57% of recent immigrants or resident foreign buyers obtained mortgage financing from US sources.

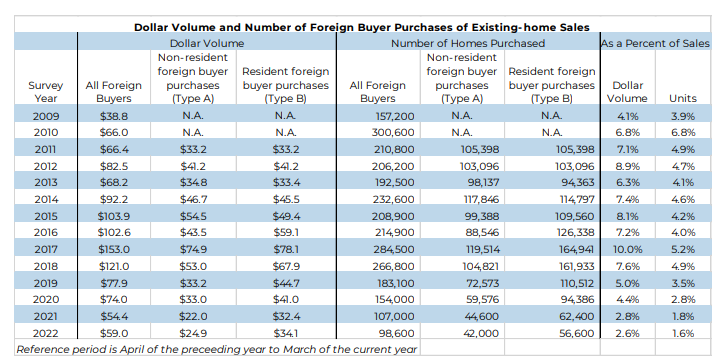

Foreign residential buyers in the US heavily invest in real estate and choose to become homeowners. Between April 2021 – March 2022, foreign nationals bought $59 billion worth of a real estate. They bought over 98,600 units of real estate to put down their roots and dive into the American real estate industry.

With the use of the right resources, information, and experienced money lenders, new immigrants can overcome the challenges of buying a home in the USA.

New Immigrants Fall Into Two Categories: Permanent Resident Aliens And Non-Permanent Resident Aliens

New immigrants, otherwise categorized as non-citizens, in the US generally fall into two categories: Permanent Residents and Non-Permanent residents. It is important to understand which category you fall into before applying for a mortgage. Your process of application and your chance of qualification depend on the same.

Permanent residents have both a green card authorised by the United States Citizenship and Immigration Services (USCIS) and a social security number which equates to permanent residency. 72% of all immigrants fall into this category.

Non-permanent resident aliens, such as those in the U.S. who are work visa holders, hold just a social security number and no green card. They make up 5% of the immigrant population in the US.

Qualification Criteria For New Immigrant Mortgage

To apply for a home loan, mortgage lenders typically require several forms of documentation. The first step for the mortgage lender in the process is always to verify that the prospective homeowner has the means to make the monthly mortgage payments.

What is the process for permanent residents?

Permanent resident aliens (green card holders and lawful permanent residents or LPRs) can get a mortgage in the United States relatively easily because they only need to present their social security number and a valid green card, along with other standard documents.

The qualification process is pretty similar to that of a US citizen. They may be able to secure a home with as minimal as a 3% down payment.

When applying, they can expect to be asked to submit some or all of the following documents:

- Green card

- Passport

- Social Security card

- Proof of income

What is the Process for Non-Permanent Resident Aliens?

Non-permanent resident aliens must demonstrate that they intend to live in and utilize the home they are purchasing as their primary residence.

For this, they can expect to request the following documents:

- Social Security Number

- Employment Authorization Document (EAD)

- Proof of income

- Visa status

If the borrower does not have an EAD, then they can apply using the following Visa options:

- He/she can present a special valid visa sponsored by his employer as proof of lawful status.

- The Canadian and Mexican NAFTA series

- E series

- H series

- G series

- L series

- NATO series

- O series

Are there any other documents that the lenders might ask for?

In addition to these documents, lenders may also ask for the following:

- W-2 forms from the past two years

- Information about past employers

- Pay stubs from the most recent month

- Bank statements for the past two months

- Tax returns from the past two years

- A current year profit and loss statement (if self-employed)

- Proof of additional income sources

- Investment account statements to verify the ability to repay the loan

- Provide a down payment

- A credit score or proof of steady bill payment (e.g., utility bills, rent)

Note: The requirements may vary depending on the lender and the program.

Have a look at your homeowning and finance options if you are on an H1-B visa!

The type of mortgage you are eligible for depends on your residency status

Permanent resident aliens who have a good credit report and a steady income are considered ideal candidates for a mortgage and are eligible for most government benefits, including social security and Medicare. They can even apply for a Conventional Mortgage, which is a type of loan that is not backed by the government.

Non-permanent resident aliens, who are in the US on a temporary basis or haven’t lived long enough to apply for permanent residency, may not be eligible for some government benefits and may not have a good credit score, making it more difficult to qualify for a mortgage.

They are typically only eligible for a government-backed loan, such as an FHA loan or VA loan, which are insured by the Federal Housing Administration and the US Department of Veterans Affairs, respectively.

HomeAbroad provides foreign national mortgage programs with no US credit history, and you can contact us for a quick quote and preapproval.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

What Is the Difference Between Interest Rates On Both Types Of Mortgage?

Permanent residents enjoy access to more favorable mortgage rates compared to non-permanent residents. Securing a favorable mortgage requires a strong credit score, alongside other factors like job stability and down payment size.

Non-permanent residents may not fulfill such criteria since they’ve recently moved to the country. But they’ll still be able to secure a mortgage; however, they may face higher interest rates and be required to make a larger down payment of 20%.

When shopping for a mortgage, it is important for both permanent and non-permanent residents to compare offers from multiple lenders and find competitive interest rates.

Also, check out our thorough guide on the mortgage options for permanent resident aliens and non-permanent resident aliens!

Other Immigrant Status Who Can Buy Home in USA

Apart from permanent resident and non-permanent resident alien, there are a few other kinds of residency statuses as well, which allow for buying homes in the US:

Refugees and asylum grantees

Individuals who have been granted refugee status or asylum can take advantage of the same government-backed loan options available to U.S. citizens. They can apply for a mortgage after a year, once they have obtained a green card. In order to qualify for a mortgage, they will need to provide proof of a form I-94 or official employment authorization document, as well as residency verification.

DACA recipients

Individuals who hold DACA status can purchase a house in the United States as long as they intend to use it as their primary residence and have a minimum credit score of 620 or higher. As of January 19, 2021, DACA recipients are now eligible for an FHA loan.

Other buyers who live outside of the U.S.

Foreign nationals can buy a home in the U.S., but lenders typically require borrowers to have a social security number and an established credit score and have resided in the U.S. for at least two years in order to qualify for a mortgage.

Due to these requirements, many foreign buyers opt to pay for their homes in full at the time of purchase. According to the NAR’s 2022 report, 44% of buyers chose to pay all cash.

What Are the Different Types Of Programs Available For New Immigrants Seeking Mortgages?

This is a comprehensive list of the various programs available in the US for new immigrants seeking mortgages, including:

- Foreign national loans: Foreign national loans are mortgage loans extended to non-citizens or non-permanent residents with zero US credit for property purchase or refinancing in their country of residency.

- DSCR loans: These are loans determined by the Debt Service Coverage Ratio, a metric used to evaluate a borrower’s ability to repay a loan based on their property’s cash flow instead of the borrower’s credit history or income proofs.

- Cash-Flow Mortgage: A Cash-Flow Mortgage is a type of loan that is based on the borrower’s ability to generate enough income to cover the mortgage payments, rather than the value of the property used as collateral.

- FHA loans: These loans are backed by the Federal Housing Administration and have a more lenient credit score and down payment requirements than conventional loans.

- VA loans: VA loans are backed by the Department of Veterans Affairs and are available to eligible veterans, active-duty military members, and certain categories of surviving spouses.

- USDA loans: USDA loans are backed by the United States Department of Agriculture and are available to low- and moderate-income borrowers in rural areas.

- Conventional loans: A conventional loan is not backed by the government and typically has stricter credit and down payment requirements.

- Community Development Financial Institutions (CDFI): These are private financial institutions that are certified by the government to provide loans to low- and moderate-income communities.

- Jumbo loans: A jumbo loan is a mortgage loan that surpasses the conforming loan limit set by Fannie Mae and Freddie Mac and typically requires a higher credit score and down payment.

- State and local programs: Some state and local governments offer their own programs to help immigrants and other first-time homebuyers with down payments, closing costs, and other expenses.

Note 1) Some of the programs listed above do not require a credit history. However, borrowers may still need to demonstrate that they have a steady income and the ability to repay the loan. Also, having a co-signer with a good credit score or history may help in the mortgage application process.

2) Programs like DSCR loans and Cash-Flow Mortgage loans are best suited for real estate investors interested in investing in different properties, especially rentals.

3) It’s also important to note that new immigrants may face additional requirements for getting approved for a mortgage due to their lack of credit history or income in the US, so it’s essential to seek guidance from a mortgage professional to determine which program is best for them. HomeAbroad specializes in providing US mortgages for foreign nationals, including expats, newcomers, and non-resident investors buying primary residences, second homes, or investment property. Get a quote today!

What Is the Process Of Applying For a Mortgage As a New Immigrant?

The step-by-step process for new immigrants is as follows:

Step 1: Research

Research different mortgage lending programs available to new immigrants and decide which one best fits your needs. The programs listed above will be a good start.

HomeAbroad can come to your aid by connecting you with an ideal CIPS agent who can help you along every step of the journey.

Compared to local agents, they have deep knowledge of international commerce, cross-cultural expertise, and the global real estate market, allowing them to make informed investment decisions. CIPS agents can also facilitate cross-border transactions and provide global assistance, ensuring a more seamless transaction.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

Step 2: Prepare for paperwork

When applying for a mortgage in the U.S., you will need to provide various documents. Most programs generally ask for paperwork regarding:

- Your identity

- Income

- Employment

- Assets

It’s advisable to have a real estate attorney review contracts and a tax specialist for potential tax liabilities.

Step 3: Connect with a mortgage lender

Find a lender that offers streamlined and hassle-free mortgages specifically for new immigrants and fill out the loan application with all the necessary information.

You will need to research thoroughly, compare interest rates, measure your finances, and take note of the important paperwork required. It is best to find an expert mortgage lender to not only find the best rates but also get help in the entire process.

Step 4: Apply and get a mortgage prequalification

A prequalification streamlines the process of financing a property in the U.S. Here, the lender assesses your financial background to determine how much you can borrow and the estimated interest rate.

They are several advantages to this. You get a 90-day commitment in writing. It gives you improved bargaining leverage with the seller. It helps you fix a budget within which you can shortlist homes to buy. Moreover, you can rest assured of a competitive interest rate.

Step 5: Submit and wait for approval

Submit the loan application and wait for the lender to review your documents and make a decision. If approved, sign all of the paperwork and pay any associated fees or closing costs.

Closing costs can comprise recording taxes, attorney fees, sales commissions, title insurance, bank fees, and other miscellaneous fees.

You will also be informed of the terms and conditions and be given a closing date for when you can complete the purchase process.

Step 6: Close the application!

The final step of your home purchase is the closing, where you’ll sign legal documents and pay the costs to transfer ownership. Attendees typically include the buyers, sellers, attorneys, the bank, and the insurance official.

Once all the paperwork is finalized, you will be ready to find a new home! After closing on the loan and moving in, you’ll begin making a monthly mortgage payment until it is fully repaid.

Following these steps will help new immigrants secure the best mortgage loan for their needs, putting them on their way to becoming homeowners in the United States.

Tips On How To Improve Your Chances Of Being Approved For a Mortgage

Getting a mortgage loan approved is a crucial step to buying a home and establishing yourself in a new country. You can use the following tips to increase your chances of achieving your dream of buying a home.

1. Ensure basic documentation

Make sure to have proof of residence, proof of income, and a valid social security number before applying; these are some of the most basic prerequisites required for almost all loan programs.

2. If required, build up a credit score

If the program requires, build up your credit score as much as possible. However, there are mortgage programs that you can get without a credit history too.

3. Keep cash handy for the down payment

Save money for a down payment (FHA loans require only 3.5%, while conventional loans typically require 20%).

4. Collect paperwork

Gather paperwork that fulfills all the documentation requirements. Also, if the original documents are in a foreign language, don’t forget to get them translated into US English for approval.

5. Research the best lenders and programs

Make sure to shop around to compare different lenders and loan programs. This is how you’ll get an idea of the market and can choose the program most suitable for you.

6. Get pre-approved for a loan before you start house hunting

This way, you can be more secure and assured about your financial status while looking for a house and also plan better financially.

7. Find an experienced agent to help out in the process

Additionally, working with an experienced real estate agent or loan officer who understands the unique needs of immigrants can make the process much easier. With their help, you can be well on your way to becoming a homeowner in no time.

Getting a mortgage can be a complicated process for some, which is why 74% of buyers choose to work with an expert real estate agent.

What Are the Challenges That New Immigrants Face When Trying To Obtain a Mortgage?

New immigrants face several unique challenges when trying to obtain a mortgage. Some of these are:

1) Lenders’ hesitancy

Many lenders are reluctant to issue mortgages to new immigrants (mainly non-permanent residents) because of uncertainty about long-term residency status and the potential risks associated with financing a home in a foreign country.

2) Documentation issues

Additionally, some new immigrants may struggle to provide adequate documentation due to language barriers or lack of familiarity with the lending process.

3) Lack of credit history

Other challenges may include a lack of credit history in the United States, difficulty verifying income and employment, or an inability to meet down payment requirements.

This is why we recommend opting for programs that require minimal or zero credit history, like Foreign National loans, Cash-Flow Mortgage, DSCR, FHA, VA, USDA, or CDFI loans. This way, you can easily become a homeowner with minimal hassles.

Otherwise, these obstacles can create significant hurdles when applying for a mortgage as a new immigrant, making it important to seek assistance from experienced loan officers and real estate agents who understand the unique needs of new immigrants.

To get the best help, have a look at HomeAbroad’s guide to finding the best real estate agent as a foreigner!

What Are the Benefits Of Obtaining a Mortgage As a New Immigrant?

Obtaining a mortgage as a new immigrant can bring numerous benefits, both financially and beyond.

- For starters, owning your own home is an excellent way to build equity and establish financial security.

- Additionally, having access to fixed-rate mortgages allows you to plan ahead by knowing how much will be owed each month, allowing for better budgeting.

- Mortgages also offer tax benefits as the interest and other loan-related expenses may qualify for deductions on your federal income tax return.

- In addition to financial security, owning a home can help connect immigrants with their new community and provide stability for family members or dependents.

- Ultimately, mortgages are a great way for new immigrants to become homeowners and begin their journey toward financial security in the United States.

With the right guidance and support, immigrants can find the mortgage loan that best fits their needs and take advantage of all the benefits that come with home ownership.

HomeAbroad: One-Stop Platform For Foreigners To Get US Mortgages

If you’re a new immigrant seeking mortgage loans, we are here to help you navigate the mortgage process. Our team will analyze your situation and connect you with a lender that meets your specific needs and goals.

Even if you lack US credit, which is common for newcomers, we can still assist you in obtaining a mortgage. We have connections with lenders who evaluate creditworthiness through alternative methods, allowing you to qualify for a mortgage with no US credit.

FAQs

Q1. Are there special mortgage programs for new immigrants?

A. Yes, there are special mortgage programs available to new immigrants. Some of these include DSCR loans, Cash-Flow Mortgage loans, Foreign national loans, FHA loans, conventional mortgages, and jumbo loans. It’s important to research the different loan options available in order to find the one that best fits your needs.

Q2. How can I improve my chances of being approved for a mortgage as a new immigrant?

A. The best way to improve your chances of approval is to secure proper documentation, save up for a down payment, and get pre-approved before you start house hunting. Additionally, working with an experienced real estate agent or loan officer who understands the needs of new immigrants can make the process much easier.

Q3. How does my residency status impact my mortgage application?

A. For immigrants residing in the US, qualifying for a mortgage as a permanent resident with a green card or a non-permanent resident with a work permit or valid work visa is similar to the process for U.S. citizens, as per the standards set by Fannie Mae and Freddie Mac.

However, these standards can make it difficult for foreign nationals who do not reside in the U.S. to qualify for a mortgage. A lender may still approve a mortgage loan for a foreign national whose primary residence is outside the U.S., but the loan will not be sold to a government-sponsored enterprise. In such cases, lenders may require a higher down payment of 20-25% to offset their risk.

Q4. Do I need to have a credit history in the United States to obtain a mortgage?

A. Not necessarily. Many lenders offer special programs that don’t require a credit history in the United States, making it possible for new immigrants to secure a mortgage with little or no credit history. It’s important to discuss your options with an experienced loan officer to determine what might be best for you.

Q5. Can a non-US citizen get a US mortgage?

A. Non-U.S. citizens can qualify for a mortgage, but the process is different. Lenders may require additional documentation such as proof of income, a valid U.S. visa, and a significant down payment of 20%. To be eligible, the non-U.S. citizen must have a valid Social Security Number or an Individual Tax Identification Number and demonstrate their ability to repay the loan.

Q6. Can immigrants get bank loans?

A. Yes, immigrants can get bank loans. However, banks may require additional documentation and evidence that the immigrant can repay the loan. This could include proof of employment, income, and assets. Additionally, some banks may have specific requirements for foreign nationals seeking a loan such as a valid U.S. visa or permanent residency status in the United States.

Q7. Do lenders check immigration status?

A. It depends on the lender. Some lenders will check immigration status when reviewing an application, while others may not. It’s important to discuss your situation with a loan officer who understands the process for obtaining a mortgage as an immigrant in the United States.

Q8. How long do you have to live in US to get a mortgage?

A. The length of time you need to have lived in the US can vary depending on the lender and type of mortgage you are applying for. Some lenders may require you to have lived in the US for at least two years, while others may have no minimum residency requirement. It’s best to check with individual lenders for their specific requirements.

Q9. How long does it take to get approved for a mortgage loan?

A. The timeline for mortgage loan approval can vary depending on the type of loan, your credit score and financial history, and other factors. Typically, it takes anywhere from a few days to several months to get approved for a mortgage loan. However, working with an experienced lender may help you speed up the process.

Q10. Can I get a mortgage while waiting for a green card?

A. Yes, it is possible to get a mortgage while waiting for a green card. However, the process can be more complicated as lenders may require additional documentation such as proof of income, a valid U.S. visa and/or work permit, and a larger down payment.

Q11. Can undocumented immigrants get a mortgage?

A. Unfortunately, there are very few options for undocumented immigrants to obtain a mortgage, as most lenders will not approve loans for borrowers without a valid Social Security Number or Individual Tax Identification Number.

However, some community-based organizations have begun offering alternative loan programs and lending solutions for undocumented immigrants. It’s important to research the market thoroughly before making a decision.

Q12. Can you buy a house with TPS status?

A. It’s possible for TPS (Temporary Protected Status) holders to buy a house in the US, but it may be more difficult compared to legal permanent residents or citizens. Lenders may require additional documentation, proof of income, valid TPS status, credit history, and a larger down payment.

TPS status is also temporary and subject to government discretion, so it’s important to be aware of the expiration date and plan accordingly. It’s best to check with individual lenders for their specific requirements for TPS holders.

Q13. Who is not eligible for a mortgage?

A. Eligibility factors vary from lender to lender and program to program. However, some factors might make it difficult for you to get a mortgage:

1. A lack of a steady source of income and/or without proof of employment or financial assets.

2. You’re a minor or an individual under the age of 18.

3. Undocumented immigrants without a valid Social Security Number or Individual Tax Identification Number.

4. Individuals who have filed for bankruptcy in the last seven years.

5. Individuals currently facing foreclosure or other legal issues related to their mortgage.

Q14. Which mortgage is best for first-time buyers?

A. The best mortgage for first-time buyers will vary depending on your individual situation. There is no one “best” mortgage program for first-time homebuyers, as the ideal program will vary based on the individual’s specific financial situation, credit history, and property type. The Foreign National loan program is one of the simplest and most hassle-free programs to avail.

Government-backed programs like FHA, USDA, and VA loans may offer more favorable terms, while conventional mortgages typically require a higher down payment but may have lower interest rates in the long run.

You should consider your financial situation and goals, research the different loan options, and work with a lender to determine which program best suits your needs.

Q15. What is the lowest income to qualify for a mortgage?

A. The lowest income for a mortgage varies & depends on the loan program, size, credit, DTI & financial factors. Lenders generally prefer a stable income enough to cover down payments and monthly payments. It’s best to speak with a lender for min income requirements & eligibility assessment.

Q16. Can I get a mortgage without permanent residency?

A. It is possible to obtain a mortgage without permanent residency, though it may depend on the lender and loan program you choose. Many lenders offer foreign national loans that are specifically meant for non-permanent residents. It is important to research different loan options and speak with a lender to determine which program best fits your needs.