If you’re a Mexican national looking to purchase a home in the United States, there are a few things you’ll need to know. In this guide, we’ll cover all of the basics when it comes to US mortgages for Mexicans, including:

– The different types of mortgages available

– The application process

– What you’ll need to qualify

– And more!

So, if you’re ready to learn more about US mortgages for Hispanic homebuyers, let’s get started!

Table of Contents

Can Mexicans Obtain a Mortgage in the US?

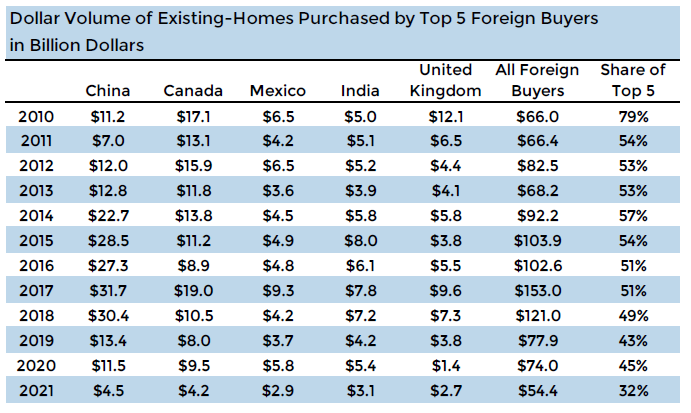

Yes, like US citizens, foreign nationals, including Mexican nationals, have the same rights to acquire and own real estate in the United States. Mexico is the second largest country of origin for foreign buyers in the USA.

Mexicans can obtain a mortgage home loan to purchase property in the United States if specific criteria are met. However, it’s important to remember that you may be approved for a mortgage even if you don’t have a credit history.

Last year, 33 percent of Mexico’s property purchasers offered cash. However, this is due to a lack of knowledge and understanding about mortgage financing alternatives accessible to Mexican purchasers. You may take advantage of mortgage home loan financing from US lenders (which don’t require a credit history in the United States), whether you’re buying a house as a primary residence or a real estate investor looking to buy investment property in the US.

Please refer to our comprehensive blog on How to Obtain a US Mortgage for Foreign Nationals with No or thin US Credit History for a detailed step-by-step process.

How Do Mortgage Loans Work in the US?

One of the first things you’ll need to know is that there are two main types of residential loans available in the United States: fixed-rate and adjustable-rate. As the name suggests, a fixed-rate mortgage has a set interest rate that will not change over the life of the loan. On the other hand, an adjustable-rate mortgage has an interest rate that can change.

There are a few things to consider when choosing between a fixed-rate and adjustable-rate mortgage. For example, with a fixed-rate mortgage, you’ll have a predictable monthly mortgage payment for the life of the loan. However, these payments will be higher than if you had an adjustable-rate.

On the other hand, adjustable-rate mortgages offer lower interest rates and monthly payments at first. But after a certain period (usually five years), the interest rate can change, and your monthly payments could go up or down depending on the market.

Another thing to remember is that with an adjustable-rate mortgage, your interest rate and monthly payment could go up even if the prime interest rate doesn’t change. That’s because most adjustable-rate mortgages have a “margin.” The margin is a set percentage above the prime interest rate that the lender can add to your interest rate. So, if the prime interest rate is 3 percent and your mortgage has a 2 percent margin, your interest rate would be 5 percent.

If you want to know more about the US home buying process or work with a real estate agent experienced in international real estate transactions, check out this definitive guide on The ultimate guide for a Mexican buying house in the USA.

How Mortgage Differs in the US from Mexico.

The mortgage process in Mexico is quite different from the US.

Payment

In Mexico, it’s common to pay cash for a property outright or make a down payment of 50 percent and finance the rest with a bank loan. However, people in the United States prefer taking out a complete mortgage and paying it back over time to taking out a partial mortgage and paying it all at once.

Loan period

In Mexico, the loan period is generally shorter than in the United States. The average mortgage in Mexico lasts about 10 years, while in the United States, it’s closer to 30 years.

Amortization

In Mexico, mortgages are “fully amortizing.” This means that every payment you make goes toward both the principal (the amount you borrowed) and the interest. In the United States, mortgages are “interest-only” for the first few years. This means that your payments only go toward the interest and not for a certain period of time. This means that your monthly payments only go towards the interest and not the principal for a set number of years. After that, you’ll start making fully amortized payments.

Credit Score

However, to qualify for a Mexican bank loan, you’ll need to have a good credit history and earn a salary at least triple the monthly loan payment amount.

On the other hand, in the U.S., to qualify for most types of loans, you’ll need a qualifying FICO® Score of at least 620 points. So if your credit score is below 620, you should consider an FHA or V.A. loan.

Ownership

It’s also important to note that the bank owns the property in Mexico until the loan is paid off in full.

In the US, on the other hand, you’ll own the property as soon as the closing documents are signed and the closing costs are covered. The bank will then have a lien on the property until the loan is paid off.

If you’re looking to purchase property in the US, it’s essential to be aware of the differences in the mortgage process. By working with a real estate agent experienced in international transactions and understanding the process, you can be sure that you’re getting the best deal possible on your new home.

When you’re ready to start searching for your dream home in the United States, don’t forget that working with an experienced real estate agent is one of the best ways to ensure you get the best out of your investment.

Qualifying For Mortgage based on Citizenship Status

To get a mortgage in the U.S., you don’t need to be a citizen of the country.

- If you’re a Permanent Resident Alien, you’ll need your green card and social security number. The process of applying for a mortgage will be similar to that of U.S. nationals.

- Suppose you’re a Non-Permanent Resident Alien who doesn’t have a green card but a social security number. In that case, you can use a work visa or a special employer-sponsored visa to finance a home. It’s also helpful if you can guarantee that you’ll be able to stay in the country for at least three years.

- Immigrants who are not citizens or residents but are refugees or have been given asylum can work and seek funding in the same way lawful resident aliens can. However, to be qualified, people must show that they are refugees or asylees.

- Home loans from Fannie Mae, Freddie Mac, or the Federal Housing Administration are unavailable to non-US residents who reside illegally in the United States.

What Type Of Mortgage Can Mexicans Get in the U.S.?

Most standard government and non-government backed mortgage programs are available to lawful permanent residents and many nonpermanent residents. Because they don’t meet legal residency requirements or can’t document income in the United States, illegal immigrants and foreign nationals typically don’t qualify for regular mortgages. A summary of the programs offered for each immigrant status is provided below.

- FHA loans are government-backed loans. The Federal Housing Administration (FHA) covers loans with down payments as little as 3.5 percent and credit scores as low as 580 produced by FHA-approved lenders. For an FHA loan to be approved, permanent and nonpermanent resident immigrant borrowers must have a valid green card, visa, Social Security number, and two years of verifiable income.

- Veterans Administration (VA) Loans. Nonpermanent resident immigrants are not eligible for loans guaranteed by the US Department of Veterans Affairs because they are unable to join the military (VA). Permanent residents with green cards, on the other hand, can enlist and serve, as well as receive VA home loan advantages to buy a home with no down payment and flexible qualifying conditions.

- Conventional Loans. Fannie Mae and Freddie Mac are government-sponsored corporations that buy residential mortgages and set standards for homebuyer programs with a 3% down payment. Conventional loans are available to permanent and nonpermanent residents with a credit score of at least 620.

- Non-QM loans are a type of loan that does not require a credit check. Alternative lenders may offer non-qualified mortgage (QM) programs to foreign nationals and immigrants who do not have legal permission to live in the United States. Non-QM loans are for borrowers who do not meet the regulators’ stringent requirements for determining a borrower’s ability to repay a home loan. Borrowers who don’t have a Social Security number or can’t prove their income in the United States may be eligible for these specialized programs. However, you should expect greater down payments, higher interest rates, and potentially prepayment penalties, which are fees charged if you pay off a loan early.

What are the Documents Required for a Mortgage Approval?

The United States government requires a variety of papers from mortgage applicants depending on their immigration status. The following documents will be needed based on citizenship status.

Non-Resident Living Outside the U.S.

As a Non-Resident living outside the US, you will be required to provide your home country’s documents, such as:

Tax Documents: Income Tax, Benefit Return, and Notice of Assessment and Bank Statements

Investment Income: Last two years of investment slips and Income Documentation

Salaried Employees: Last two years of income slips. Paystubs for the past 30 days of income

Self-employed individuals: Last two years of business returns for any entity where ownership is 25% or more, with all pages and schedules

Retired individuals: Most recent retirement awards letters

Proof of citizenship: Copy of passport, Green Card, or a U.S. visa

Proof of identity: Tax Identification Number (RFC)

Permanent or Temporary Residents

Suppose you’re a permanent or temporary resident working and living in the U.S. In that case, you will be required to procure U.S. Documents such as:

Tax Documents: 1040 U.S. Individual Income Tax Return

Investment Income: 1040 Schedule B Interest and Ordinary Dividends, and Schedule D Capital Gains and Losses

Salaried Employees: W2 Wage and Tax Statement of Income

Self Employed individuals: 1040 Schedule C Net Profit or Loss from Business, and 1065 K-1 Partner’s Share of Income, Deductions, Credits, etc.

Retired Individuals: Social Security or Awards Pension letter

Proof of Citizenship: Copy of passport, Green Card, or a U.S. visa

Proof of Identity: Social Security Number

The following documents will be required by both residents and non-residents of the United States:

Proof of assets: For each account you hold, the most recent two months of statements are provided.

Insurance documents: Copies of the property tax notice and home insurance premiums for each residential property are required for prior property owners.

Steps To Get a Mortgage in the U.S. as a Foreign National

Purchasing a property in another nation might be difficult. After all, there are numerous phases and rules to go through, and you don’t want to make a costly mistake.

Here’s a quick summary of everything you need to consider before purchasing so you can make informed buying decisions and get the most out of your purchase.

Step 1: Choose where you wish to buy a house in the United States.

Step 2: Look for a real estate professional who has worked with foreign clients before, particularly one that specializes in CIPS (Certified International Property Specialist). CIPS-certified real estate professionals are educated to serve foreign customers such as Indian residents who live in the United States and non-resident Indians wanting to buy property in the United States.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

Step 3: Learn how to work with a Real Estate Agent in the United States.

Step 4: Recognize your tax condition on the other side of the border.

Step 5: Start your house hunt by hiring a real estate agent.

Step 6: Make an offer on the property you like and close on your American dream home.

Step 7: Conduct a thorough inspection of the property.

Step 8: Make a purchase agreement with the seller.

Step 9: Fill out a Title report.

Step 10: You can also get home financing through a U.S. mortgage lending system.

Congratulations! You are now ready to take possession of your new home in the United States!

Please see this page for a step-by-step guide on how foreigners can buy a home in the United States.

Where Can You Get an International Mortgage From?

Most traditional U.S. banks do not offer foreign mortgages, although certain international business banks do. The most common choice for most people is to use a mortgage broker to identify a suitable lender. Let’s go over some key points about each option and some possibilities to think about.

HomeAbroad

We are a one-stop-shop for all your finance and real estate needs if you are a new immigrant to the United States or a non-resident investor in U.S. real estate.

We can help you with:

- Buying real estate in the United States with as little interruption as possible,

- Regardless of your credit history, we can help you get loans with no US credit history,

- Connect you with the best lender and real estate agent to make your home-buying process super easy

HomeAbroad specializes in providing US mortgages for foreign nationals, including expats, newcomers, and non-resident investors buying primary residences, second homes, or investment property. Get a quote today!

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

From a Bank

While checking to determine if your present bank, i.e., Mexican banks, lends money to people in other countries is important, you should expect the answer to be no. This does not, however, rule out the prospect of acquiring an international mortgage from a bank.

Many international banking brands cater to ex-pats and international investors with foreign services. These are usually the best sites to look for a bank-to-bank foreign mortgage. Here are a few to consider:

- Standard Chartered International Mortgages

- HSBC International

From a Mortgage Broker

Mortgage brokers are skilled at connecting customers with lenders. Of course, you’ll have to pay a fee for the service, but you’ll receive better rates and a broader range of vendors.

Many international mortgage lenders specialize in particular areas, such as connecting customers with lenders in Mexico or Europe. A quick Google search with your location will bring up a long range of options.

What Mexican Buyers of U.S. Real Estate Need to Know

Mexican citizens and legal residents who buy property in the United States have different rules and regulations to follow than U.S. buyers. Here are some key things you need to be aware of:

- You will need to show that the purchase price is being paid in Mexican pesos, not U.S. dollars, by providing a certified copy of a wire transfer or check.

- You must have a Mexican passport to enter the United States. If you are not a legal resident of the United States, you will need to apply for a visa.

- You may not be able to get a mortgage from a U.S. lender if you do not have a Social Security number or an Individual Taxpayer Identification Number (ITIN).

- You may be able to get a mortgage from Mexican banks and Mexican lenders if you are buying property in the United States.

- If you are not a legal resident of the United States, you will need to file an annual tax return reporting any rental income earned from the property.

- Foreign real estate buyers can’t use Fannie Mae or Freddie Mac loans and are often forced to utilize non-conforming loans with higher interest rates. However, foreigners on work visas or green cards can qualify for Fannie Mae or FHA loans.

- Lenders will require a larger down payment from foreign buyers and have stricter lending requirements.

- The mortgage process for non-U.S. citizens also takes longer, while selling a property means higher taxes.

Tax Implications for Mexicans Buying Property in the U.S.

If you’re buying a primary house in the United States, you’ll only have to pay your property tax, just like any other domestic buyer in the country.

However, there are a few factors to keep in mind if you are purchasing US real estate as an investment property with the intention of generating rental income.

Tax duties in Mexico of US Investment Property

An individual resident of Mexico may receive income from another nation that is liable to taxation in that country. As a result, the individual can deduct the foreign income tax paid from his or her Mexican tax due. The credit is limited to the smaller of

- the foreign tax paid on foreign-source income taxable in Mexico

- the Mexican tax corresponding to that income in the US

- no credit is given for foreign taxes paid on income that is not subject to Mexican taxation.

US Tax Obligations for US Investment Property

Mexican real estate investors in the United States must pay taxes on any income produced in the United States, including rental revenue (rental income, if any).

A non-US resident who rents out their US residence is generally liable to a 30% withholding tax on the gross amount of each rental payment. The foreign owner, on the other hand, must only pay tax on the net rental income on his or her US tax return, which means the non-US owner can deduct a lot of expenses (standard deductions in renting a property include interest deductions for mortgages, advertising costs, cleaning costs, property manager costs, etc.). As a result, the foreign owner may easily pay no (or very little) tax.

To take advantage of any tax treaty benefits, foreign nationals must have either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN), according to the IRS. In addition, if one has not already been obtained, the non-US owner must get a US Individual Taxpayer ID Number (an “ITIN”).

Finally, the IRS Form W-8ECI must be completed by the non-US owner. Unless the foreign owner obtains an ITIN, the IRS Form W-8ECI is not completed. It is feasible (and usual) for a foreign owner to owe no tax after taking all permissible deductions (such as mortgage interest, homeowner’s association fees, and repairs and maintenance).

The overseas national must also file a 1040NR tax return on time.

Frequently Asked Questions

Which Visas Are Eligible for Loans in the U.S.?

Anyone can get a loan in the U.S., including non-resident investors without a visa.