The United States offers Canadians a variety of options when it comes to purchasing a vacation property. Depending on the needs and wants, there is sure to be an ideal location for Canadian buyers. For those looking for warmer climates, the states along the Gulf Coast, such as Florida, Alabama, and Mississippi, are great choices. For those looking for cooler temperatures, the states along the Great Lakes, such as Michigan, Wisconsin, and Illinois, are great options. Ski resorts in Colorado and New Hampshire can also offer Canadians an enjoyable winter destination.

In this article, you will discover the exotic list of the 10 best places for Canadians to buy a vacation property in the USA.

Table of Contents

10 Best Places for Canadians to Buy Vacation Property in the USA

Canadians often buy vacation homes in America either to escape from the cold, to have new experiences, or to encash on investment opportunities. Here are some of the most popular places to buy a vacation property in the USA.

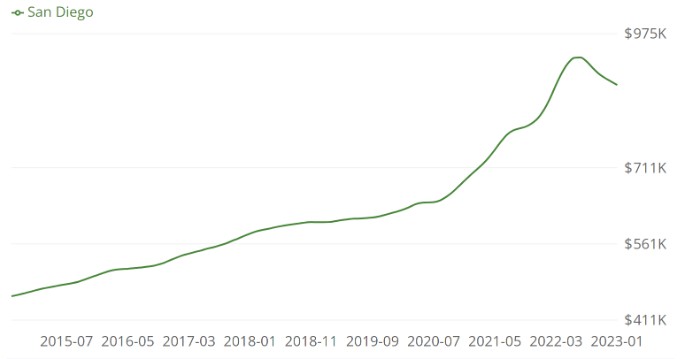

1. San Diego, California

With its beautiful beaches, majestic mountains, and vibrant cities, California offers Canadians an ideal choice for purchasing a vacation property in the United States. San Diego has become one of the most popular vacation spots for Canadians to buy property in the US. It’s home to beautiful beaches and vibrant culture, with plenty of options for all budgets. San Diego also offers excellent educational opportunities, which makes it a great place to invest in real estate.

Highlights:

- Its idyllic warm climate attracts thousands of Canadians yearly into the tropical environment.

- About 70- miles of pristine beaches make for a perfect laid-back holiday or a beach walk and run.

- Immense Balboa Park hosts the renowned San Diego Zoo and several art galleries, studios, and museums.

Median Home Price:$ 873, 825

Property Appreciation Rate: 6.0%, 1-yr

Average Rental Income: $2,989

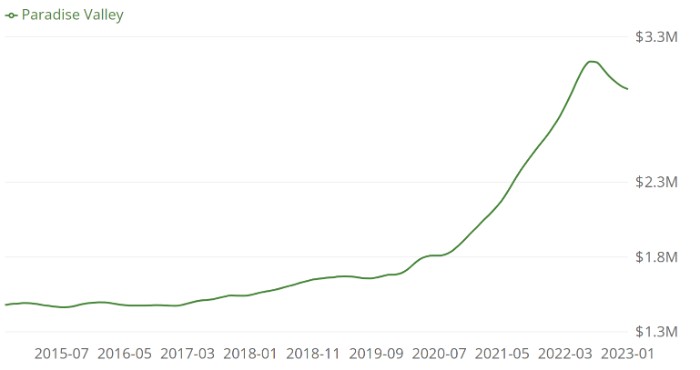

2. Paradise Valley, Arizona

From the stunning deserts of Phoenix to the majestic canyons of Sedona, Arizona offers Canadian tourists plenty of options for finding a vacation home. Paradise Valley is one of the most exclusive and desirable locations in Arizona, offering visitors a luxurious lifestyle that includes some of the country’s best golf courses and year-round warm weather. Paradise Valley is perfect for Canadians looking to invest in vacation property close to popular cities like Scottsdale and Phoenix while enjoying an exclusive resort experience.

Highlights:

- It is a Golfing paradise, with PGA tour events getting conducted regularly.

- Mummy Mountain makes for a great wilderness. The views are impressive from the peak of the mountain at just over 2,200 feet.

Median Home Price: $2,96,843

Property Appreciation Rate: 9.5%, 1-yr

Average Rental Income: $ 1,907

3. Palm Coast, Florida

Located on the Atlantic Coast of Florida, Palm Coast is one of the best places for Canadians to buy vacation property in Florida. With its warm ocean waters, nature reserves, and plenty of recreational activities, this area is perfect for a vacation getaway or an investment opportunity to purchase a vacation property. From beachfront condos to vacation homes in gated communities, there is something for everyone in this Florida property.

Highlights:

- Plenty of Beautiful parks

- Connecting trails of more than 125 miles for walking and cycling

- Several running series for sports enthusiasts

- World-class golf course and Tennis court

Median Home Prices: $357,164

Property Appreciation Rate: 9%, 1-yr

Average rent: $1,801

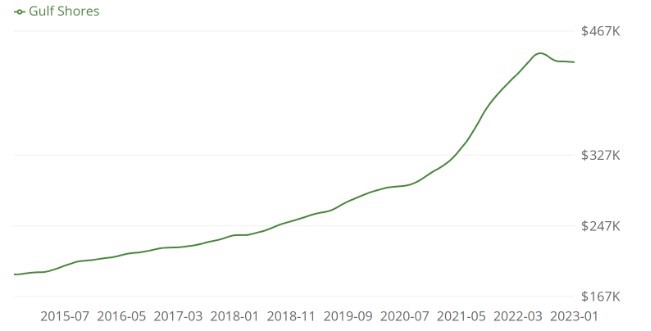

4. Gulf Shores, Alabama

Gulf Shores is an ideal place for Canadians looking to invest in a vacation property. Gulf Shores offers many activities, from fishing and swimming to golfing and sightseeing. It also has stunning beaches, and warm weather year-round. Canadians will feel right at home in Gulf Shores with its friendly locals, quaint downtown area, and proximity to many major US cities such as Pensacola, Mobile, and New Orleans. With so much to offer, Gulf Shores is the perfect place for Canadians looking for an affordable vacation property in the US.

Highlights:

- 32 miles of Sugar white Beaches are truly breathtaking.

- Gulf State Park’s Hugh S. Backcountry trail runs about 28 miles, covering nine different ecosystems

- Bon Secour National Wildlife Refuge is a sight with thriving sea turtles and migratory birds.

- National Shrimp Festival and Music shows are one of the main attractions here.

Median Home Prices: $432,570

Property Appreciation Rate: 6.2%, 1-yr

Average Rental Income: $1,382

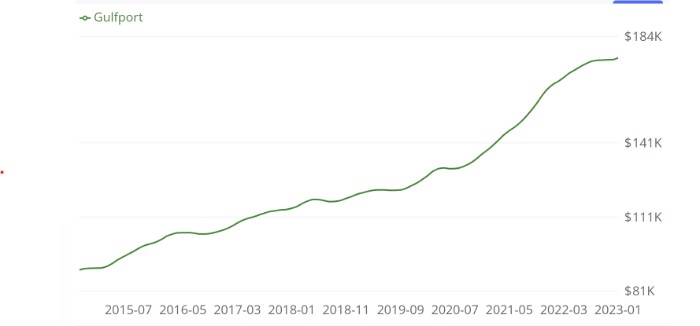

5. Gulfport, Mississippi

Gulfport, Mississippi, is a charming coastal town located on Mississippi’s Gulf Coast, and it’s also one of the best places for Canadians to buy a vacation property in the US. Gulfport has a rich selection of attractions, including award-winning beaches, world-class casinos, and plenty of shopping and dining options. The town also boasts excellent medical facilities and an affordable housing market, making it an ideal spot for Canadians to buy a vacation property in the USA. In addition, Gulfport offers all the amenities that come with beachside living, including excellent fishing and watersports opportunities.

Highlights:

- It is famous for the World’s Largest Fishing Rodeo

- Mississippi Aquarium and Gulf Islands National Seashore attract many tourists each year.

- It also has many cool beach bar, for a laid-back vacation experience.

Median Home Prices:$176,049

Property Appreciation Rate: 6.6%, 1-Yr

Average Rental Income: $1,125

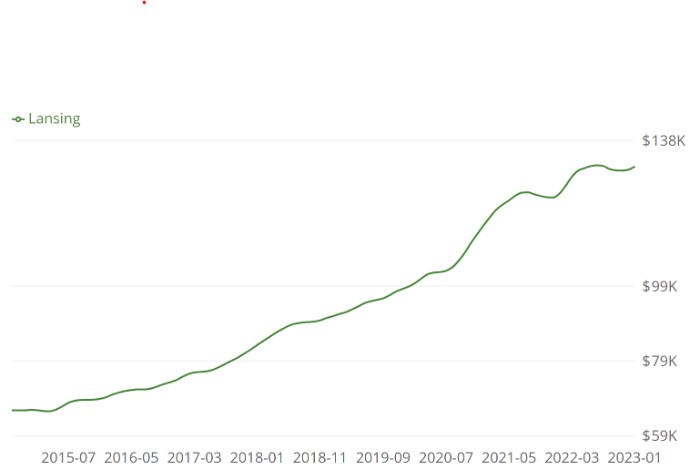

6. Lancing, Michigan

The city’s proximity to Lake Huron and Saginaw Bay makes it a popular destination for vacation home buyers looking for outdoor recreation, such as fishing and boating. The city has several shops, restaurants, and a world-class golf course. Lancing offers a unique combination of rural and urban amenities, making it an ideal destination for those looking to get away from everyday life. The city boasts many outdoor recreation options, such as nature trails and lakeside activities.

Highlights:

- Young visitors find The State Capitol Building and Impression 5 Science Center interesting.

- For artists and historians, Lansing offers an array of art galleries, theaters, museums, and historical sites.

- Nature lovers and sports enthusiasts can benefit from the Lansing River Trail. It winds past 19 city parks, three museums, a creek, two rivers, and a zoo. The 13-mile trail is a melting point for many walkers, joggers, and rollerbladers.

Median Home Prices:$131,659

Property Appreciation Rate: 5.9%, 1-yr

Average Rental Income: $1,061

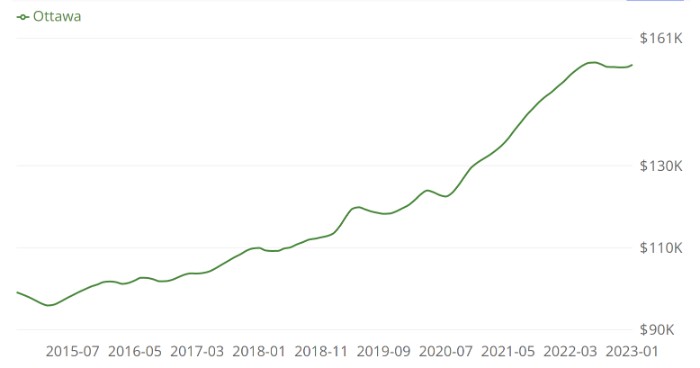

7. Ottawa, Illinois

Ottawa is situated in the west-central part of Illinois and has some of the most affordable property prices in the state. Ottawa offers its residents a peaceful lifestyle with plenty of outdoor activities such as fishing, biking, camping, hunting, and golfing. It is close to major cities like Chicago and Milwaukee. The city is a great spot for fishing, boating, and biking.

Highlight:

- Illinois River Road is the National Scenic Byway that follows the water 150 miles southwest to Havana.

- Ottawa Rail Bridge is a spectacular lift-style railroad bridge across the river in Ottawa.

- Starved Rock State Park draws visitors willing to explore sandstone canyons, gorges, creeks, and a seasonal waterfall.

Median Home Price: $155,395

Property Appreciation Rate: 3.5%, 1-yr

Average Rental Income: $1,295

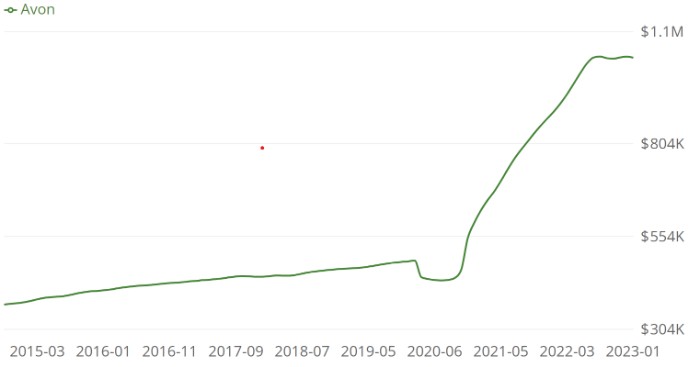

8. Avon, Colorado

Avon is located in the heart of the Rocky Mountains and provides beautiful views of this iconic mountain range. It is ideal for outdoor enthusiasts, as it boasts of world-class skiing and snowboarding, making it a perfect winter vacation spot.

Highlights:

- Benchmark Lake Reservoir and dam are just a few minutes from downtown Avon and are big draws for swimmers, kayakers, and sunbathers during the summer months.

- The reservoir is also home to various gamefish like bass, trout, and perch, making it a big attraction for anglers.

- EagleVail Golf Course was established in the ’70s and now features both a traditional 18-hole course and a 9-hole par three one.

- Mountains Science Center exhibits programs that are appropriate for toddlers and senior citizens too; in addition to being entertaining and engaging, they’re also educational.

Median Home Price: $1,035,191

Property Appreciation Rate: 16.1%, 1-yr

Average Rental Income: $1,450

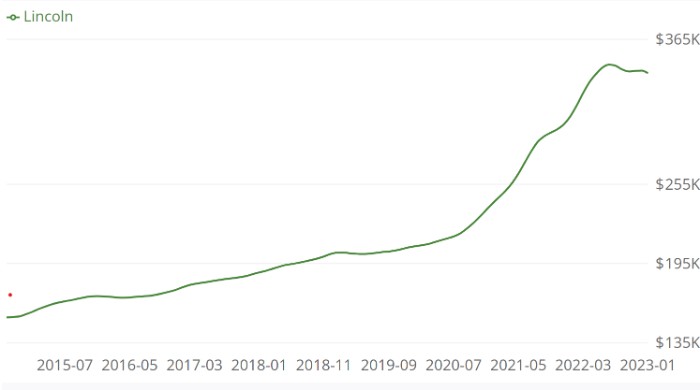

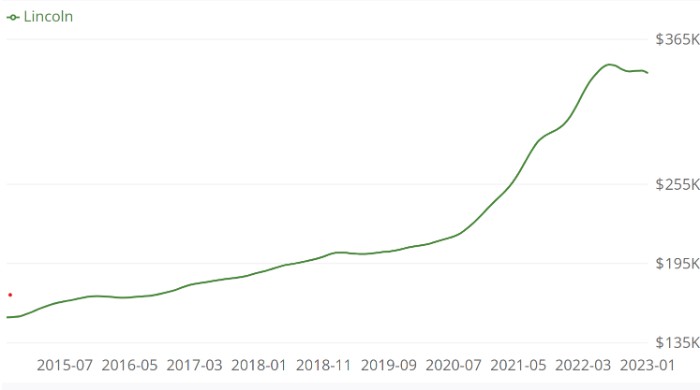

9. Lincoln, New Hampshire

With its majestic White Mountains, charming towns, and picturesque lakes, New Hampshire is the perfect spot for Canadians looking for an outdoor getaway. It is located in the heart of the White Mountain National Forest and offers plenty of outdoor activities for those who love skiing, hiking, mountain biking, and more. With plenty of beautiful scenery, Lincoln also has some great shopping and dining options. Vacation properties here are known to give great returns.

Highlights:

- Franconia Notch State Park is Lincoln’s heart and hosts some of the best hikes of the White mountains.

- Flume Gorges is one of the most exotic sights on the White Mountain hike.

- Drive the Kancamagus Highway. The splendor of colors, rivers, waterfalls, gorges and historic sites often leaves travelers spellbound.

Median Home Price: $339,577

Property Appreciation Rate: 10.7%, 1-yr

Average Rental Income: $1,169

10. Ozaukee County, Wisconsin

Ozaukee County, Wisconsin, is an excellent destination for Canadians looking to buy a vacation property in the United States. Ozaukee County is conveniently located just north of Milwaukee and Chicago, giving visitors easy access to both cities. In addition, it boasts some of the most beautiful scenery in the Midwest, with plenty of lakeside fun and outdoor activities.

Highlights:

- Lion’s Den Gorge Nature Preserve is home to many animals, migratory birds, and countless mesmerizing views of Lake Michigan.

- Cedarburg Cultural Center hosts performing arts, like open mic nights, live music concerts, comedy shows, and plays.

- It is also famous for visual creations, local crafts, and history tours.

Median Home Prices: $366,611

Property Appreciation Rate: 3.6%, 1-yr

Average Rental Income: $1,516

These were the 10 vacation property in the USA; Canadians should do their research and consider all of these locations carefully. Each location has unique features that could make it a great choice for vacation home ownership.

When purchasing a vacation property in the US, having all of your paperwork and documents in order is important. Let’s look at some mandatory papers that you must have at all times.

What Do I Need When Buying Property in the US as a Canadian?

When Canadian buying property in the US, you’ll typically need to submit the following paperwork and documents:

- Proof of identity: Provide a copy of your passport, driver’s license, or other government-issued ID to verify your identity.

- Proof of ownership: You must submit evidence that you own the assets based on which you are applying for the mortgage for purchasing property in the US. This can be a deed, title, or other document showing that you are the legal owner of the assets.

- Proof of funds: You will have to submit evidence that you have the funds to pay for a down payment, closing costs, and maintenance costs.

- Tax paperwork: You’ll need to provide tax forms and other documents showing up-to-date with any taxes owed on the property in question.

Tax Implications of Buying a Vacation Property in the USA as a Canadian

While buying property in the US can be as a Canadian it is important to be aware of the potential property taxes. Generally, if you’re buying real estate in the US, then you’ll need to

- FIRPTA: According to FIRPTA (Foreign Investment in Real Property Tax Act), international buyers must pay property taxes on real estate appreciation.

- Internal Revenue Service: Rental income earned on the property for up to two weeks each year need not be reported to IRS (Internal Revenue Service). However, if the property has been rented out for more than 14 days and it has been used for personal use for lesser than 14 days or 10% of the total days when it was rented, IRS will compare the commercial and personal usage of the property and take into account whichever is greater.

- Tax Rates: Real estate property located in the US and not connected with a US trade is taxed at a 30% rate.

- Section 871 (d) Election: If a Canadian buyer owns a property in the US, which is used to generate income, then they can include all income earned from that property as effectively connected with a US trade by using Section 871(d) election.

- If a Canadian buyer opts for this election, deductions attributable to the property income can be claimed.

- It is important to gather information about purchase price legal fees, local real estate market conditions, legal requirements, financing options, and more.

How to Buy Vacation Property in the USA as a Canadian?

When buying a vacation or investment property in the US, Canadians should take steps such as:

1. Find the Right Real Estate Agent with International Expertise

Find a reputable CIPS agent who understands the market’s pulse like a local real estate agent, and can help international buyers find the right property and assist with paperwork. We can help you with that. Reach out to HomeAbroad and get in touch with the best CIPS agents.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

2. Find a Lender

It is important to shop for the lender who suits your requirement the best and subsequently apply for a pre-approval. HomeAbroad provides specialized mortgages loans for foreign nationals and US investors. Reach out to get started with HomeAbroad.

3. Arrange Funds by Getting Pre-Approval

Pre-approval from a lender will help to speed up the process and give you more confidence when making an offer. It also shows sellers you are committed and serious about buying the property.

4. Home Inspection

A home inspection is one of the most important steps in buying a vacation property. A professional inspector can detect any potential problems with the property, such as structural damage or plumbing issues, that could cost you money down the line.

5. Underwriting

The lender will review the property and all documents provided by you to apply for the mortgage. This is known as ‘underwriting’. It helps assess whether you are eligible for a loan on that particular property.

6. Closing

Once everything has been checked and approved, the closing process can begin. This involves signing all of the legal documents and transferring ownership of the property from the seller to you.

Buying a vacation property in the US can be a great investment for Canadians. With careful research, due diligence, and the right paperwork, you, too, can have your own piece of paradise.

Now that you have the list of the 10 best places for buying a vacation property and also the list of the required documents, it’s time to gather some information about financing your purchase.

Mortgage Options for Canadians Buying Vacations Home in the USA

There are many mortgage options to pick from, depending on your US credit history, budget, timeline, and repayment capacity. Many borrowers consider US credit history and estimated time involved for loan approval as the prime factors while applying for a mortgage. Therefore, here are the options for those with good US credit history and for those with no or thin US credit scores.

Mortgage Options with US Credit History

1. FHA Loans

FHA loans are government-backed loans and have several benefits for borrowers, including lower down payment (as low as 3.5%), relaxed credit score requirements, and more flexible qualification criteria. However, FHA loans also come with certain limitations, such as limits on the size of the loan and restrictions on the types of properties that can be purchased with FHA loans.

2. Conventional Loans

These are not guaranteed or insured by the federal government. Instead, conventional loans are typically offered by private lenders such as banks, credit unions, and mortgage companies. The terms and requirements of conventional loans vary depending on the lender, but they generally require borrowers to have good credit scores, stable income, and a down payment of at least 3-20% of the home’s purchase price.

3. Freddie Mac and Fannie Mae

It aims to provide liquidity to the mortgage market by buying qualified mortgages from lenders and repackaging them into securities that can be sold in the secondary market. Homeowners who use Freddie Mac loan programs may have access to limited down payment, fixed-rate mortgages, and adjustable-rate mortgages.

Note: Conventional mortgages are for buying a primary residence, and if you are planning to use your vacation property for rental income, then you need to look for some other mortgage program.

Mortgage Options with No US Credit History

1. Foreign National Mortgage

To qualify for a foreign national mortgage, borrowers must provide documentation demonstrating their ability to repay the loan. They may also need to provide a larger down payment of about 20% of the property’s purchase price. It’s important to note that foreign national mortgages are available for vacation homes or investment properties only.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

Must Read: Ultimate Guide for Canadian Citizens to Get US Mortgages

2. DSCR Loan

DSCR loan is an excellent alternative for Canadians buying a vacation home in the US with no or thin US credit score. DSCR stands for Debt Service Coverage Ratio and is used by lenders to assess a borrower’s ability to repay the loan.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

To know all about DSCR, read DSCR Loans Guide: How to Qualify for DSCR Loan?

Buying a vacation property in the US can be an exciting and rewarding experience for Canadians, but it is important to do your research first. You should know the documents required, the best places to buy, and how you plan to finance your purchase.

Conclusion

As a Canadian, buying a vacation property in the US is a great way to diversify your portfolio and increase your total wealth. With the right research and preparation, you can secure a great piece of real estate that will provide rewards for many years. HomeAbroad can help you connect with the best real estate agents and mortgage lenders so you can own your very own slice of paradise!

Frequently Asked Questions

Q. What documents are required to buy a vacation property in the US?

A. You will need to provide proof of identity, such as a passport or driver’s license, tax forms, and other documents showing your ability to make the purchase. You may also be asked to provide additional documents related to the purchase price, legal fees, local real estate market conditions, legal requirements, financing options, and more.

Q. What taxes do I have to pay when buying a vacation property in the US?

A. Generally, if you’re buying real estate in the US, you’ll need to pay income tax on any profits made from rentals or sales of the property. Additionally, other taxes and charges may be associated with the purchase, such as state property tax, local transfer taxes, homeowner association fees, etc. Therefore, it is important to understand these taxes and fees before making any commitments.

Q. Is it more expensive to buy a vacation property in the US?

A. It can depend on market conditions, location, and other factors. Generally speaking, the cost of residential real estate in the US is higher than in Canada, and so are the returns.

Q. What are some tips for buying a vacation property in the US?

A. Make sure you do your research and understand the local market conditions. Get pre-approved for a loan so you can make an offer quickly if you find the right property. Make sure to get a home inspection before signing any contracts, as this will help ensure that no major problems exist with the property. Also, it is advisable to hire a property management company to maintain the property. Finally, understand all the tax implications associated with owning a vacation property in the US.

Q. What should I look for in a real estate agent?

A. Look for an experienced agent who understands local customs, laws, and market conditions. It’s also important to find someone who is reliable and trustworthy. Ask for referrals from friends or family, or search online for qualified agents who specialize in the area you’re interested in. HomeAbroad can assist with this process to make sure you find a real estate agent that best suits your needs.

Q. Where do Canadians buy a second homes?

A. Canadians are increasingly purchasing second homes in US states such as Florida, Arizona, and California due to their favorable climates, low taxes, and great investment opportunities. However, each location has its own unique features, so it is important to do research before making any decisions.

Q. Do Canadians pay higher property taxes in Florida?

A. Canadians generally do not pay higher property taxes in Florida than US citizens.

![Can Canadians Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/08/CanCanadiansBuyPropertyInTheUSA-scaled.jpg)