Are you a citizen of China, and you’re interested in buying a home or investment property in the USA? If yes, you might be interested to know that the real estate market there is becoming more and more attractive.

The country’s economy is stable, and it is feasible to make long-term investments to generate growth over time.

Can Chinese or Hong Kong citizens buy property in the USA?

Yes, you can buy a home in the United States as a Chinese or Hong Kong citizen with no restrictions imposed by the US government.

Furthermore, there are no limits on foreign nationals purchasing real estate in the United States. If you need one, you can even apply for a mortgage as a non-citizen in America with no US credit history.

Many Chinese and Hong Kong nationals may find this an intriguing option because of the relatively cheaper housing prices in the United States (compared to metro areas of other Western countries) and the availability of coastal area properties in many country locations. However, the property market in the United States differs significantly from one place to the next.

Therefore, you’ll want to look into the property prices and market trends in the state and city you’re considering purchasing a property. In addition, housing accounts for a significant amount of most Americans’ household spending, so you’ll want to be sure you’re getting the most value for your buck.

Table of Contents

In recent years, various foreigners, notably from Asian nations such as China and Hong Kong, have made significant investments in the US real estate market. However, before entering the US real estate market, you must first get your feet wet by learning about local buying rules, taxes, and purchasing procedures.

For someone unfamiliar with the US real estate process, the process of purchasing property might be overwhelming. Likewise, buying property in the United States from China or Hong Kong may appear daunting.

As a result, many Chinese and Hong Kong investors are wary of overseas markets because of their insecurity and the start of an unknown process. However, buying US real estate is an excellent investment. This article will examine Chinese and Hong Ko’s primary considerations when conducting cross-border real estate transactions in the United States.

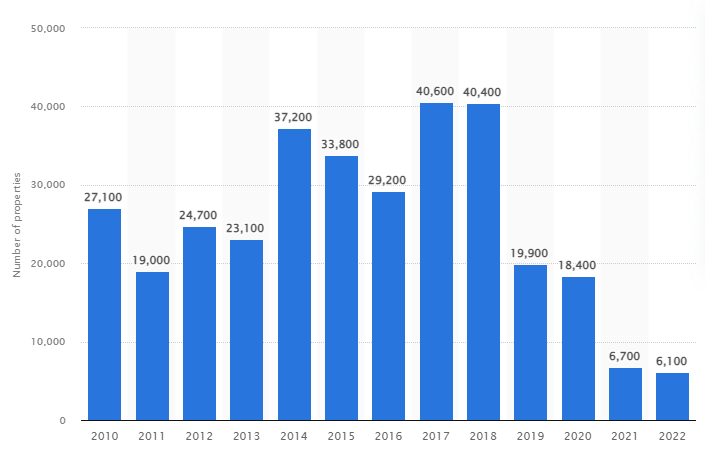

How much US real estate is purchased by the Chinese (including Hong Kong) every year?

According to the National Association of Realtors (NAR), China (including Hong Kong) emerged as the top country of origin among foreign buyers in 2021, accounting for 8% of all foreign buyer purchases in terms of the dollar volume of existing home purchases in the United States.

- In 2021, Chinese buyers purchased 6,300 existing housing units worth $4.5 billion, a decrease of 66 percent in terms of the number of units (18,300 units last year) and 61 percent in terms of dollar volume ($11.5 billion the year before).

- The majority of this decrease can be attributed to Covid-19-related travel restrictions.

- Between 2010 and 2021, Chinese buyers of US real estate purchased an average of $18 billion per year of US property, with 27,000 units purchased each year.

This makes the Chinese (including buyers from the People’s Republic of China and Hong Kong) the most prominent foreign real estate investors in the United States.

As of 2022, China remained the most significant foreign buyer in terms of the dollar amount of residences purchased. However, due to the increase in the average purchase price to $1.0 million (from $710,400 in the prior period), Chinese purchased existing residences worth $6.1 billion, which went up 30% from the prior period.

The following table shows the historical dollar volume and quantity of existing home purchases by Chinese nationals in the United States:

Table of Historical Trend for US Existing Home Purchase by Chinese (includes Hong Kong)

| Year | # Units | $ (in Billions) |

| 2010 | 27,100 | $11.20 |

| 2011 | 19,000 | $7.00 |

| 2012 | 24,700 | $12.00 |

| 2013 | 23,100 | $12.80 |

| 2014 | 38,400 | $22.70 |

| 2015 | 34,300 | $28.50 |

| 2016 | 29,200 | $27.30 |

| 2017 | 40,600 | $31.70 |

| 2018 | 40,400 | $30.40 |

| 2019 | 19,900 | $13.40 |

| 2020 | 18,400 | $11.50 |

| 2021 | 6,300 | $4.50 |

| 2022 | 6,100 | $6.1 |

Pro Tip: When you are ready to buy a house in the US, you should ideally work with a real estate agent with expertise in working with foreign national clients, such as a real estate agent with CIPS designation.

A CIPS (Certified International Property Specialist) real estate agent has undergone specialized training to handle real estate transactions smoothly for foreign-born individuals residing in the US.

5 Reasons Why Chinese and Hong Kong citizens buy Property in the USA

China remains one of the largest investors in US real estate due to the following reasons:

1. Opportunity to Send their Children to the Best Universities in the World

Three-quarters of the world’s leading universities are located in the United States. For this reason, many wealthy Chinese parents strive to give their children a leg up in life by purchasing a second home in the United States, where their children can obtain residence and attend college.

More than 80% of China’s wealthiest people are included in this group. The expanding scope of Chinese real estate investments is evidence of this. For example, between 2020 -21, Chinese real estate investment accounted for 13% of student use of all home purchases in the United States.

2. Stable and Secure Real Estate Investment

China is experiencing property bubble concerns, which were further heightened by the Evergrande issue. In contrast, US real estate investment is relatively stable and secure, coupled with USD capital appreciation.

In addition, the EB-5 Visa program in the United States rewards larger and more prominent real estate investments for Chinese investors eager to create jobs. Chinese nationals currently account for nearly three-quarters of all EB-5 visa holders in the United States.

The legal framework and no restrictions for foreign real estate investors in the United States makes the real estate investment so appealing. As a result, the United States ranks first in the world for real estate investors. Chinese investors have already invested more than $200 billion in real estate ventures in the United States in the last 10 years.

3. A Path to Citizenship

The EB-5 visa can be utilized for investors to obtain a green card. Many Chinese investors prefer American real estate (for commercial purposes) because it provides a viable path to citizenship, particularly for high-net-worth individuals.

4. Favorable Debt Terms & Mortgage Financing

US lenders specializing in foreign national mortgages offer long-term fixed-rate mortgages at low and competitive rates for non-residents (with no US credit) and US Newcomers on visas from China and Hong Kong.

This makes the investment in US real estate even more attractive.

5. High-Quality Real Estate with Relatively Lower Prices

You can generate positive cash flows (after paying for your mortgage) in the US real estate market, making it a highly desirable investment. In addition, the property prices in the US are comparatively cheaper than in central areas of other global cities, icing on the top!

Exploring the Growing Trend of Chinese Investment in US Real Estate

Chinese investment in US real estate has significantly increased in the past few years. The rise is due to the growth of China’s economy and the increasing popularity of real estate as a viable investment option in the US.

Chinese citizens favor popular US zip codes such as Los Angeles, San Francisco, Seattle, Boston, and New York City for real estate investment. These cities offer diverse property options, including luxury condos and commercial properties. The recent trends in Chinese investment in US real estate in these locations indicate significant growth.

- Chinese Buyers bought US properties worth $190 billionForeign investors, especially those from China, are driving up the demand for US homes. They have bought US properties worth $190 billion in the last two decades. Chinese investments in US commercial property increased to US$700 million in 2021.

Residential properties bought by Chinese Home Buyers 2010-2022

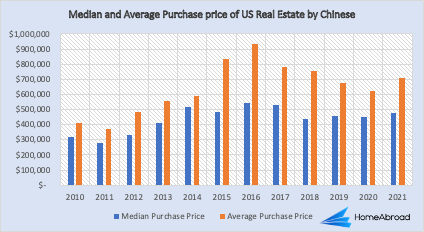

Flight of CapitalChinese Home buyers also tend to purchase homes with a higher median price. Wall Street Journal attributed this growing trend amongst the Chinese to capital flight. For instance, their median purchase price was $439,100 in 2018, considerably higher than the median housing prices of all foreign buyers ($292,700) and domestic buyers ($259,600).

Housing prices rose by 8%A study by Wharton showed that areas with a significant number of Chinese immigrants rose by 8% in house prices between 2012 and 2018. Similarly, last year, Chinese buyers paid a median price of $470,600 for American properties. Additionally, in the same year, they purchased over 6,100 homes worth $6.1 billion.

Chinese nationals are attracted to US real estate due to its stability, higher returns, and portfolio diversification opportunities. Chinese buying US real estate is a growing trend that provides opportunities for investors looking to capitalize on this trend.

With the proper research and preparation, investors can make informed decisions to maximize their return on investment.

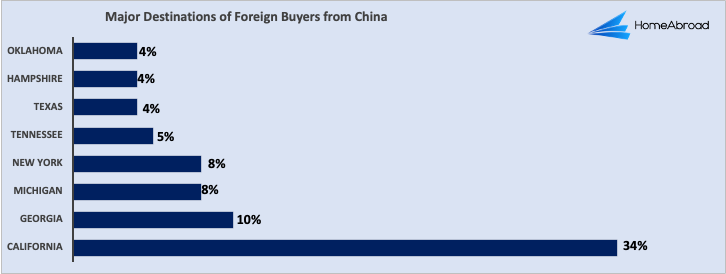

Where do Chinese and Hong Kong nationals buy real estate property in the United States (US)?

California remained the top destination for the Chinese, with 34% of all Chinese purchases last year (April 20- March 21) taking place in the state. That said, other popular destination includes Georgia (10%), New York (8%), Michigan (8%), Tennessee (5%), Oklahoma (4%), New Hampshire (4%), and Texas (4%).

Major US Destinations for Foreign Buyers from China and Hong Kong

| US Destination | Percentage of Chinese Buyers |

| California | 34% |

| Georgia | 10% |

| Michigan | 8% |

| New York | 8% |

| Tennessee | 5% |

| Texas | 4% |

| Hampshire | 4% |

| Oklahoma | 4% |

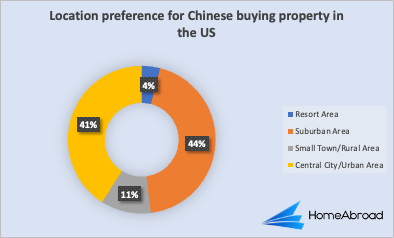

85% of Chinese buy their US property in an Urban/central city or suburban area, while the remaining 15% purchase in rural or resort areas.

How do the Chinese and Hong Kong nationals intend to use their US property?

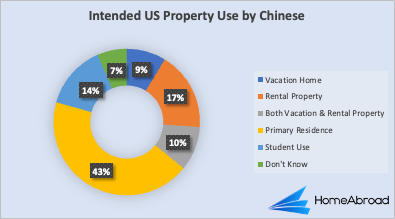

The Chinese buyers were the most likely to buy a home for a primary residence (40%), vacation& rental (9%), residential rental (16%), vacation home (8%), and student use (13% ), accounting for of all their home purchases in the United States.

US Property Use by foreign buyers from China and Hong Kong

| Intended Property Use | Percentage (%) |

| Vacation Home | 8% |

| Vacation and Rental | 9% |

| Student Use | 13% |

| Rental residence | 16% |

| Primary residence | 40% |

| Don’t Know | 6% |

How does home prices in the US compare to China and Hong Kong?

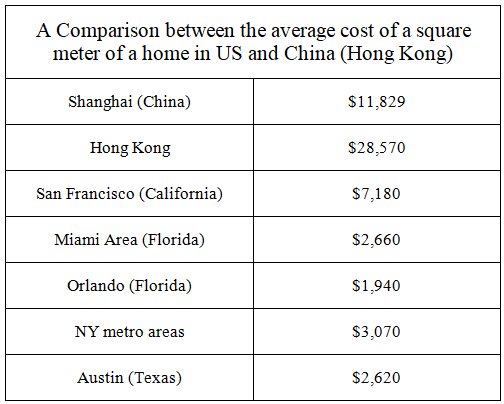

Home prices in many US metro areas are pretty modest compared to significant regions of worldwide cities.

For example, you will pay on average USD 11,829 per sq. meter for a home in Shanghai (China) and an average of USD 28,570 for a home in Hong Kong, compared to per sq. meter price of $7,180 in San Francisco (California), $2,660 in the Miami Area (Florida), $1,940 in Orlando (Florida), $3,070 in NY metro areas, $2,620 in Austin (Texas), etc.

The following is a list of significant US metro cities’ median home prices and per-square-meter pricing:

Due to the limited land availability and rapid population growth and urbanization in China, property prices are significantly higher than those in the US. However, some major metropolitan areas in the US offer affordable housing prices similar to other cities worldwide.

Moreover, many housing options are available in the US at different price points. Although some expensive areas like San Francisco exist, many other areas in the US offer more economical housing options.

Factors such as local market trends, economic conditions, amenities, infrastructure growth, and government policies impact home prices in both countries. Nonetheless, the US offers more reasonably priced options and broader choices for homebuyers.

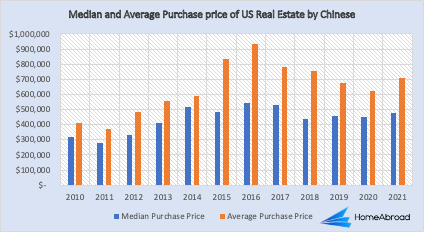

What is the median and average price of house purchases in the United States by Chinese and Hong Kong nationals?

Between April 2020 and March 2022, the median price of US real estate purchased by the Chinese (including Hong Kong) was $476,600, with an average purchase price of $1,005,700.

The median purchase price was up 6%, while the average price was up by 14% compared to the same period last year.

Table of historical trend for Median and Average Purchase Price of US Real Estate by China and Hong Kong

| Year | Median Purchase Price | Average Purchase Price |

| 2010 | $ 320,800 | $ 412,200 |

| 2011 | $ 282,100 | $ 370,900 |

| 2012 | $ 333,300 | $ 484,000 |

| 2013 | $ 412,500 | $ 555,900 |

| 2014 | $ 516,400 | $ 590,800 |

| 2015 | $ 486,100 | $ 831,800 |

| 2016 | $ 542,100 | $ 936,600 |

| 2017 | $ 529,900 | $ 781,800 |

| 2018 | $ 439,100 | $ 752,600 |

| 2019 | $ 454,900 | $ 674,900 |

| 2020 | $ 449,500 | $ 622,300 |

| 2021 | $ 476,500 | $ 710,400 |

| 2022 | $ 470,600 | $ 1,005,700 |

US Mortgages for a Chinese Citizen Buying US Real Estate

If you’re a Chinese national looking to buy a home in the United States, working with a lender who understands your financial situation can be helpful. US Mortgages for Foreign Nationals are specifically designed to meet the needs of non-US citizens. They can make securing financing for a home purchase in the US easier.

Mortgages with established US Credit History

Acquiring a mortgage in the United States can be complicated. However, having a solid credit profile in the US can make obtaining a mortgage more accessible and beneficial.

An established US credit history shows responsible financial behavior and improves the likelihood of getting favorable loan terms and interest rates.

FHA Loans

The Federal Housing Administration insures FHA loans, which can be a good option for Chinese buyers who purchase a primary residence, have a US credit history, and are willing to provide proof of employment, W2s, and pay stubs.

Qualification for FHA:

- Credit Score: The FHA does not have a strict minimum credit score requirement, but most lenders typically require a credit score of at least 580 to qualify for the low down payment option (3.5%). Borrowers with a credit score between 500 and 579 may still qualify but must make a larger down payment (10%).

- Down Payment: The FHA loan program allows borrowers to make a down payment as low as 3.5% of the purchase price or appraised home value, whichever is lower. However, borrowers with a credit score below 580 must make a minimum down payment of 10%.

- Employment and Income: Borrowers are required to have a steady employment history or source of income. Lenders typically prefer seeing at least two years of consistent employment or income from the same source.

- Property Eligibility: FHA loans are intended for owner-occupied properties, meaning the borrower must live in the property as their primary residence. The property must also meet certain standards set by the FHA, including minimum property requirements and appraisal guidelines.

Conventional Mortgage

To qualify for it, borrowers generally need a stable income, a good credit score, and make a down payment of around 20% of the property’s value. The mortgage features competitive interest rates and flexible terms, making it a popular choice among Chinese buyers.

Qualification for Conventional loan

- Credit Score: Most lenders prefer a credit score of at least 620, although some may require a higher score for better interest rates and terms. However, the specific credit score requirements can vary among lenders and loan programs.

- Down Payment: Conventional loans typically require a higher down payment compared to FHA loans. The minimum down payment required is often 5% of the purchase price, but it can vary depending on the loan program and the borrower’s creditworthiness. Some programs, such as Fannie Mae’s HomeReady and Freddie Mac’s Home Possible loans, offer down payment options as low as 3%.

- Employment and Income: Lenders will review your employment history and income stability. They typically prefer to see a steady employment history, usually for at least two years, and consistent income. Self-employed individuals may need to provide additional documentation, such as tax returns and financial statements, to demonstrate their income.

- Property Appraisal: The property you intend to purchase must be appraised to determine its market value and ensure it meets the lender’s requirements. The property should be in good condition, free from significant issues affecting its value or habitability.

Mortgages with No/Thin US Credit History

It can be challenging to obtain a mortgage for people in the US with little to no credit history, such as recent immigrants, international students, and those who haven’t built up a strong credit profile.

However, even if you have a limited US credit history, you can still possibly obtain a mortgage. By exploring alternative options and requirements, you can increase your chances of successfully becoming a homeowner in the US.

Foreign National Mortgage

A Foreign National Mortgage is a type of loan intended for non-U.S. citizens looking to invest in U.S. real estate. This mortgage is tailored to the unique situation of international buyers and may involve a more significant down payment and marginally higher interest rates than conventional mortgages.

A significant benefit of a foreign national mortgage is that it is accessible to Chinese immigrants and property investors as it does not demand a social security number or permanent residency.

Qualification

- Valid Passport and Visa: Foreign nationals must produce a valid passport and visa to prove their legal residency. The lender’s criteria may determine the type of visa necessary.

- Established Credit History: Foreign nationals are usually required by lenders to have a credit history established either in their home country or an international credit report to assess their ability to repay the borrowed amount and their creditworthiness.

- Adequate Down Payment: Lenders may ask foreign nationals to provide a larger down payment than U.S. citizens or residents. This is because there is a higher risk involved. Usually, the down payment amount is 20% or more.

- Proof of Income and Assets: To get a loan, borrowers must submit proof of their income and assets, such as bank statements, employment verification, income tax returns, and asset statements.

- International References: To demonstrate financial stability and establish credibility, specific lenders may ask foreign nationals to provide references from their home country, such as those relating to banking or their profession.

DSCR loan

A DSCR (Debt Service Coverage Ratio) loan is commonly used in purchasing investment real estate. It assesses the property’s ability to generate sufficient income to cover the loan payments.

While DSCR loans may require a larger down payment and slightly higher interest rates, they allow Chinese buyers to finance their property acquisitions and expand their real estate investment portfolio in the US market.

Also Read, DSCR Loans Guide [2023]: How to Qualify for DSCR Loan?

Qualification:

- 1 or Higher: Lenders typically require a minimum DSCR of 1 or higher for DSCR loans. The DSCR measures the property’s ability to generate sufficient income to cover mortgage payments and other operating expenses. A DSCR of 1 indicates that the property’s net operating income equals the debt payment, providing a comfortable cushion for the lender.

- Credit Score of 620 or Higher: Lenders may require a minimum credit score of 620 or higher for DSCR loans. A good credit score demonstrates a borrower’s creditworthiness and ability to manage debt responsibly.

- Down Payment of 20-25%: DSCR loans often require a down payment ranging from 20% to 25% of the property’s purchase price. A higher down payment reduces the lender’s risk and strengthens the borrower’s commitment to the investment.

- Appraisal: The property being financed with a DSCR loan will typically require an appraisal to determine its market value. The appraisal objectively assesses the property’s worth and helps ensure that it aligns with the requested loan amount.

- 1007 Rent Schedule: A 1007 Rent Schedule is a document that shows the rental income and expenses related to a property. If you want to borrow money to buy a property, the bank might ask for the rent schedule to check how much money is coming in and going out of the property. This helps the bank determine if the rental income is enough to pay the mortgage and other costs.

You should also consider hiring a CIPS (Certified International Property Specialist) real estate agent as they have received specialized training in assisting non-native individuals residing in the US with real estate transactions.

HomeAbroad has a vast network of CIPS agents and can help you connect with the best agents for free!

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

A step-by-step process for Chinese and Hong Kong citizens to buy property in the US

If you are unfamiliar with the real estate purchase process in a new country, buying a house in a foreign country can be challenging. However, if you take the time and effort to educate yourself, it can also be a fascinating experience.

The home-buying process in the United States involves the steps below (for details of each stage listed below, please see our blog post on how to buy a house in the U.S. as a foreign national.

- Choose where you wish to buy a house in the United States.

- Find a real estate agent who has handled international transactions before, especially with a specialist accreditation like CIPS (Certified International Property Specialist). CIPS-designated real estate agents are trained to work with foreign clientele, including both Chinese and Hong Kong residents living in the United States and non-resident Chinese looking to acquire real estate in the United States.

- Understand how to work with a Real Estate Agent in the United States.

- Understand your cross-border tax situation

- Begin your house search with the help of a real estate agent.

- Make an offer on a house you like and finalize your American dream home.

- Inspect the Property

- Make a purchase agreement with the seller.

- Complete Title Report

- Obtain Home financing through a U.S. Mortgage for foreign nationals (if needed)

- Take possession of your new home in the United States.

Keep the following simple recommendations in mind if you’re considering buying a rental property in the United States to produce rental income (or to utilize it as a rental property and vacation home).

5 tips for Chinese purchasing rental property in the United States

- Study the rental market in the area where you want to buy. Knowing how much rental income your home can bring in will help you decide which type of investment is right for you.

- If you intend to utilize your investment property as a vacation home, be aware of peak season and rental demand during certain months so you can fit in your ideal holiday in the United States.

- Hire a reputable property management company to look after your investment while you are away.

- Work with a CIPS (Certified International Property Specialist) designated real estate agent with experience with international transactions.

- Don’t forget about taxes and insurance: If you’re looking for a return on your investment in a U.S. property, be sure you understand the tax implications of capital gains (when you sell the investment property) as well as taxes owing on rental income in the U.S. You must additionally pay the property tax on your property in the United States.

Can Chinese and Hong Kong citizen obtain a mortgage home loan in the USA?

Between April 20 and March 21, 40% of Chinese buyers in the United States paid in cash. However, did you know that Chinese people can receive a mortgage in the United States at competitive rates even if they have no US credit history!

You can take advantage of low mortgage rates in the United States and put your cash to work for other assets. So, whether you’re buying a home in the United States to live in, invest in, or use as a holiday home, mortgage solutions without a US credit history are available at competitive rates to match your needs.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

These US mortgage lenders specialize in foreign national mortgage products and analyze your credit risk using non-traditional data points, such as your credit history outside the US. These lenders may also consider your rental income in the United States when determining your eligibility for a mortgage in the United States.

Most foreign national mortgage product options in the United States will require a minimum down payment of 20-25 percent of the purchase price if you don’t have an established US credit history. Getting a mortgage in the United States eliminates the risk of foreign exchange rate fluctuations in your mortgage payments and gives you peace of mind.

The mortgage home loan procedure in the United States involves the steps listed below (For a complete explanation of each step listed below, please see our comprehensive guide for foreign nationals to secure US mortgage loans without US credit history):

- Calculate your budget and the amount of money you’ll need to finance to purchase a house.

- Obtain a Loan Pre-approval from your lender for your foreign national mortgage

- Prepare your documentation for a house loan from a foreign country.

- Make an offer on your home.

- Complete your application for a foreign national mortgage loan.

- As mortgage rates in the United States change daily, it’s a good idea to lock in your interest rate.

- Process and underwrite your mortgage loan in the United States.

- Conduct property appraisal.

- Get ready to close your mortgage home loan.

Tax Implications for Chinese investors purchasing real estate in the United States

A foreign person (non-resident buyer) is subject to US tax on US source income, including income from the property, according to the IRS (Internal Revenue Service).

When a foreign buyer purchases real estate in the United States, there are several tax implications to consider. Here are some key points to keep in mind:

- Property Taxes: If you own property in the United States, you must pay property taxes. The tax rates depend on the state and locality, so be sure to research and understand the specific tax requirements in the area where you plan to invest.

- Income Taxes: If you earn money by renting out a property, you’ll be subject to U.S. income taxes. Even if you’re not a U.S. resident, you may have to file a U.S. tax return and report your rental income. There are tax treaties between the U.S. and several other countries, like China, that can provide advantages and prevent double taxation. To ensure compliance, it’s advisable to consult with a tax specialist who is knowledgeable in global tax laws.

- Capital Gains Taxes: If you sell your property at a profit, you might have to pay capital gains taxes. The exact rate of tax you pay will depend on many factors, like how long you owned the property and your overall tax status. It’s also worth remembering that tax treaties between the U.S. and China could affect your tax obligations.

- Estate Taxes: If you pass away, your U.S. real estate properties may be subject to estate taxes. Estate tax laws can be intricate, and the exemption threshold is subject to change, making it essential to seek advice from an international estate planning expert.

According to the Internal Revenue Code, a foreign person’s income earned in the United States is taxed at 30 percent. However, if a provision of the Internal Revenue Code offers a reduced rate or if the foreign person’s country of residency and the United States has a tax treaty, a lower rate, including an exemption, may apply.

Non-residents of the United States can also choose to have their rental income taxed as if it were actively connected to a trade or business in the United States.

In such situations, taxpayers may deduct any expenses incurred while renting the property from their rental income. They are taxed on their net rental income, including cost deductions, rather than a 30% flat rate on gross rent. To avoid being taxed 30%, a taxpayer must fill out form W-8ECI and submit it to the person paying the rent.

Tax compliance for Chinese selling US property

If a non-resident of the United States sells real estate in the United States, FIRPTA (Foreign Investment in Real Property Tax Act) imposes a 10% or 15% withholding tax on the gross selling price.

If the property is sold for more than $300,000 but less than $1,000,000 and the buyer plans to live there, the buyer will only have to pay a 10% withholding rather than 15%. If the sale results in a capital gain, you will owe US taxes, which FIRPTA tax withholdings will offset.

What kind of properties are excluded from the FIRPTA regulations?

You will be excluded from FIRPTA withholdings if the non-US resident’s property is sold for less than $300,000 to a buyer who plans to use it for use as a residence.

According to the IRS, the buyer or a family member must intend to live in the property for at least half of the number of days any person uses it over the first two 12-month periods after the date of transfer.

Furthermore, any capital gain on the sale of a US property is taxable, and the non-resident foreigner must file a tax return (1040NR).

In Conclusion

Buying a home is an overwhelming undertaking no matter where you live, but as an overseas buyer in the United States, the process can be confusing if you don’t have the proper guidance and work with the right experts.

Therefore, we’ve included some crucial information and items to remember in this article to assist you in buying your American property more smoothly.

Frequently Asked Questions (FAQs)

1. Can Chinese or Hong Kong Citizens buy a house in the US?

Yes, Chinese citizens can buy a house in the US. There are no restrictions on foreigners buying property in the US, and there is a large and vibrant market for people looking to invest in US real estate.

In addition, buying a house in the US is relatively straightforward, and many resources are available to help foreign buyers navigate the process.

2. Why do Chinese invest in US Real estate?

Chinese investors have been increasingly active in the US real estate market recently. There are several reasons for this trend. First, US real estate is considered a safe investment, as it is relatively stable and has a long history of appreciation.

In addition, US real estate offers good returns, particularly in comparison to other investment options in China. And finally, Chinese investors perceive the US legal system as being more reliable than the Chinese system, which gives them greater peace of mind when investing in US real estate.

3. Can Chinese or Hong Kong citizens obtain US mortgage?

Yes, Chinese or Hong Kong citizens can obtain a US mortgage. There are many reasons why someone might want to purchase a property in the United States, whether it’s for investment purposes or to live in.

The process of obtaining a mortgage is similar for foreign citizens to US citizens.

4. Can investors from China affect property prices in the USA?

Investors from China can greatly influence real estate prices in the United States, especially in popular urban areas.

They are willing to pay higher prices than market value, resulting in intensified competition and escalated prices for domestic homebuyers and overseas investors.

5. Are the Chinese buying houses in America?

China is the third most prominent group of foreign buyers in America and has bought between 20,000 to 40,000 residential properties. In 2022, 6% of foreign buyers who bought property worth $6.1 B were from China.

6. How do Chinese (Hong Kong) investors buy houses with cash?

Chinese (Hong Kong) investors transfer money abroad from their bank accounts in China or Hong Kong to a US-based bank account to buy a property in cash.

However, in this case, FIRPTA requires a 15% withholding tax, and they must comply with anti-money laundering laws.

7. Are the Chinese buying California Real Estate?

California appeals to foreign buyers because of its excellent public schools and universities, good quality of life, and friendly community.

On average, in 2022, buyers from China bought California properties for US$1 million, with 31% choosing to buy in the state where 58% of buyers made an all-cash purchase, 52% intended to use the homes as their primary residences, while 8% bought properties for student use.

8. How much real estate does China own in the USA?

China bought real estate worth $6.1B in 2022, making it the third largest foreign buyer in the USA.

9. Is China the top foreign buyer of US housing?

Chinese buyers remain the biggest group of foreign purchasers of residential properties in the United States.

They tend to buy more expensive properties than Canadian investors or Mexican buyers, and historically, they have bought between 20,000 to 40,000 residential properties. In 2022 Chinese buyers accounted for six percent of all foreign property sales.

10. Where are the Chinese investing in the housing market in the US?

Chinese buyers tend to focus their residential real estate investments on the Pacific Coast, with almost 40% buying properties in California. In contrast, foreign buyers from other countries tend to spread out their investments across the United States.

![Can Foreigners Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)