Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

➡️ Home prices are projected to increase steadily, allowing homeowners to build significant wealth over five years.

➡️ Renters lose money without returns, while buyers gain equity—creating a financial difference.

➡️ "Time in the market" is more valuable than trying to time it, making homeownership a reliable path to wealth creation.

➡️ Buying a home now locks in today’s prices and sets the foundation for long-term financial stability.

What if you could be $235,000 wealthier in just five years?

While hypothetical, this number paints a compelling picture of the financial gap between renting and owning a home.

According to Fannie Mae’s Home Price Expectations Survey, homeownership is more than just a lifestyle choice—it’s a strategy for building long-term wealth. By investing in a home, you’re not just securing a place to live; you’re positioning yourself to benefit from equity growth and rising property values.

With home prices projected to climb steadily over the next five years, now is the time to explore the financial rewards of owning a home.

Let’s break down the numbers and uncover why buying a home in 2024 could be your smartest financial move yet.

Table of Contents

Why Homeownership is A Smart Wealth-Building Strategy

“Rent is a payment for today; a mortgage is an investment in tomorrow.”

Renting might feel convenient, but it often comes with a significant financial downside: you’re spending thousands of dollars each year without any return on investment.

On the other hand, homeownership allows you to:

✅ Build equity as property values appreciate over time.

✅ Benefit from stable housing costs rather than fluctuating rent prices.

✅ Create a long-term financial asset that contributes to your net worth.

Fannie Mae’s projections suggest that home prices will see consistent growth through 2029, making now a great time to consider stepping into the market.

By locking in today’s prices, you not only secure a home but also position yourself for wealth accumulation.

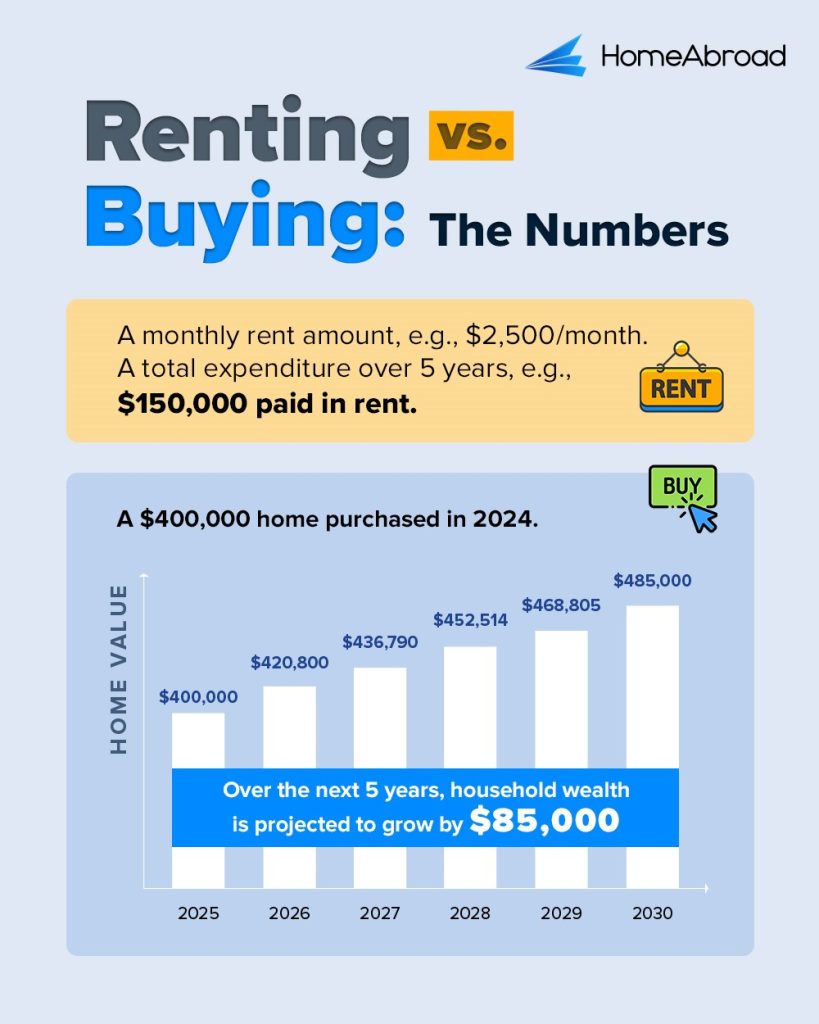

Renting vs. Buying: The Numbers

To understand the impact of this decision, let’s break it down:

🛅 Renting: If you’re paying $2,500 per month in rent, you’ll spend $150,000 over five years. That’s money you’ll never get back.

💲 Buying: Purchasing a $400,000 home in 2024 could see the property’s value grow to $485,000 by 2029. This creates an estimated $85,000 in equity growth, which adds directly to your net worth.

These numbers highlight the stark financial contrast between renting and buying—showing how homeownership helps you grow wealth while avoiding the sunk costs of rent.

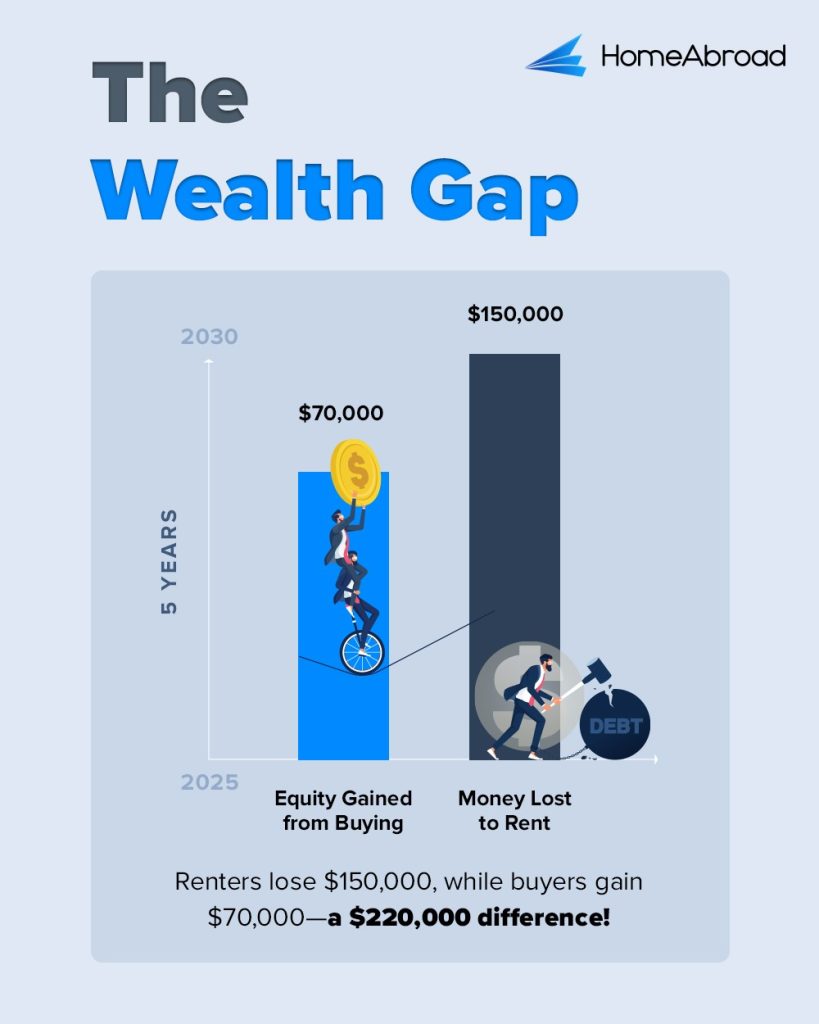

The Wealth Gap: Renting vs. Buying

This brings us to one of the most significant considerations for anyone deciding between renting and buying: the wealth gap.

Over five years:

🛅 Renters: Lose $150,000 or more on rent with no financial returns.

💲 Buyers: Build an estimated $70,000+ in equity, benefiting from both paying down the mortgage and rising home values.

The result is a financial gap of nearly $220,000 between renters and buyers. This gap underscores why owning a home isn’t just about having a place to live—it’s a long-term strategy for building wealth.

Why “Time in the Market” Matters

At this point, you might wonder if it’s better to wait for home prices to drop or interest rates to stabilize.

However, the key takeaway from Fannie Mae’s research is clear: “time in the market” beats timing the market.

The longer you own a home, the more equity you can build. Even with fluctuating market conditions, real estate remains one of the most reliable vehicles for long-term financial growth.

Take Action: Build Your Wealth Through Homeownership

The data is clear—homeownership offers an unparalleled opportunity to grow your wealth. With home prices projected to rise steadily, the best time to buy a home is now.

If you’re ready to take the leap, start by exploring your financing options. Whether you’re a US citizen or an international buyer, HomeAbroad Loans and Ziffy Mortgages offer tailored solutions to help you achieve your homeownership dreams.

FAQs

1. How does homeownership help build wealth?

Homeownership builds wealth by allowing you to build equity as you pay down your mortgage and as the property appreciates in value over time.

2. Is it a good time to buy a home in 2024?

Yes, Fannie Mae’s projections indicate steady home price growth over the next five years, making 2024 an excellent time to lock in prices and start building equity.

3. What if I wait for the housing market to stabilize?

Waiting can cost you more in missed equity gains. Real estate rewards “time in the market” rather than trying to perfectly time the market.

4. Can I buy a home without a US credit history?

Yes! HomeAbroad Loans specialize in providing mortgage solutions for international buyers without requiring US credit history.