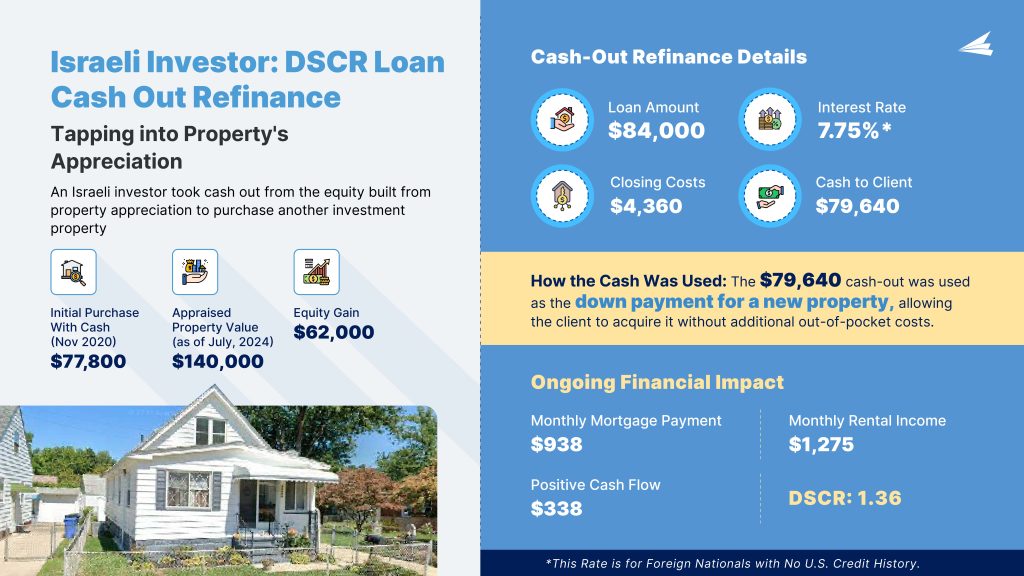

Loan Details

Program: DSCR Loan Refinance

Amount: $84,000

Cash to Client: $79,640

Interest Rate: 7.75% Fixed

Term: 30 year

Monthly Mortgage: $938

Property Details

Value: $77, 800

Appraised Value: $140,000

Monthly Rent: $1,275

Cash Flow: $338

Address: 14100, San Diego Ave, Cleveland, OH 44111

HomeAbroad Solutions:

– DSCR Loan Refinance

– LLC Setup Service

– Concierge Service

Meet the Hero of this Success Story

Meet Daniel, a non-resident investor from Israel who owned a property in Cleveland, OH.

Daniel had a vision for growth and made a strategic move to cash-out refinance his property, utilizing its untapped equity to invest in a new real estate investment property.

His journey is a testament to perseverance and smart financial planning.

His Goal

Daniel’s primary objective was to leverage the equity in his first US property to fund the purchase of another investment property—without tapping into his personal savings.

By refinancing his Cleveland home, Daniel aimed to secure the necessary funds for expansion while maintaining a stable and streamlined financial plan.

Challenges He Faced

Daniel’s journey was not without its hurdles. As a non-resident investor, he faced unique challenges that many foreign investors encounter:

- Low Loan Amount Options: Many lenders hesitate to provide loans under $100,000, limiting refinancing opportunities for properties like Daniel’s.

- Foreign National Investor Status: Daniel struggled to find lenders willing to offer him favorable terms or even consider his application due to his foreign status.

These obstacles made it seem nearly impossible to unlock his property’s equity and advance toward his goal of portfolio growth.

Finding a Partner in HomeAbroad

While researching US mortgage options for foreign investors, Daniel discovered HomeAbroad—a one-stop-shop for international buyers navigating the US real estate market.

HomeAbroad’s Comprehensive Support Includes:

- Tailored Mortgage Solutions: US Mortgage programs for foreign investors, including options for those with no US credit history.

- AI-Powered Property Search: Helping investors identify ideal properties based on their goals.

- Expert Real Estate Agents: Access to over 500 US real estate agents experienced in working with international clients.

- End-to-End Concierge Services: Assistance with LLC formation, US bank account setup, homeowner’s insurance, property management, and more.

With HomeAbroad’s expertise, Daniel found a trusted partner ready to help him overcome these challenges.

How We Helped Daniel

Daniel’s case received personalized attention from Steven Glick, our Director of Mortgage Sales, who guided him through the available options. After a thorough consultation, Steven helped Daniel secure a DSCR loan refinance tailored to his needs.

Why a DSCR Loan Worked for Daniel:

HomeAbroad’s DSCR loan focuses on the income generated by the property rather than personal income verification. As long as the property’s rental income covers the mortgage payment, the loan qualifies—a perfect fit for Daniel.

Refer to our DSCR loans hub to learn more about this loan program and different use cases.

Resuming the story, in just 29 days, we successfully closed Daniel’s DSCR refinance loan.

Here’s how it all came together:

If you’re looking to dig deeper into the DSCR calculation, here’s how it works:

DSCR = Gross Rental Income / PITIA

Gross Rental Income: $1,275

PITIA (Principal, Interest, Taxes, Insurance, HOA): $938

DSCR = 1,275 / 938 = 1.36

To qualify for a DSCR loan, you typically need a minimum DSCR of 0.75 or higher.

The Result

Daniel used the $79,640 cash-out as a down payment for a new investment property, enabling him to expand his portfolio without additional out-of-pocket costs.

Steven, who supported Daniel throughout this journey, said:

Daniel also shared his appreciation: “HomeAbroad was the perfect solution to my struggles with getting a cash-out refinance.

Their expertise in working with international buyers gave me peace of mind throughout the process. Steven’s guidance made the entire transaction smooth and efficient.”

HomeAbroad: One-Stop-Shop for Global Investors

Daniel’s story demonstrates how HomeAbroad empowers international investors to navigate and thrive in the US real estate market. From unlocking equity to growing portfolios, we provide the tools, expertise, and tailored solutions that investors need to succeed.

Are you ready to make your US real estate goals a reality? HomeAbroad is here to guide you every step of the way. Let’s unlock your potential and grow your investments together!