Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Buying a big home on a $50K salary seems impossible in 2025—but in some U.S. cities, you can still find houses with 1,700-2,600 sq ft of living space.

A new HomeAbroad study analyzed 935 U.S. cities to identify where buyers can get the biggest homes for their budget—and how home sizes have changed since 2020. The results?

Only 4% of cities offers a big house with a $50K salary—down from 61% in 2020, marking a staggering 93% decline. The Midwest and South remain the best locations for finding big homes, while coastal and Western cities continue to offer smaller properties at much higher prices.

So, where can you still buy big on a budget? Here’s what we found.

Table of Contents

Highlights:

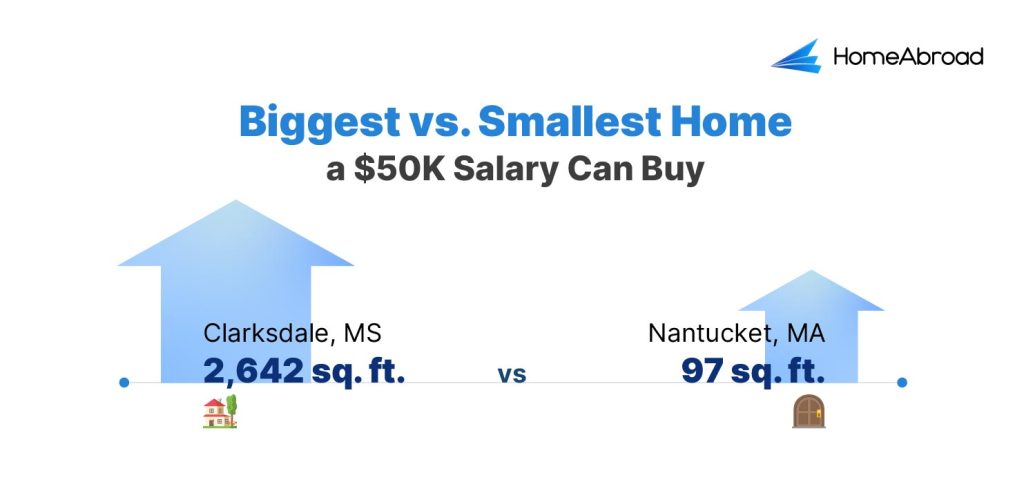

1. Clarksdale, MS (2,642 sq ft) offers the biggest home for a $50K salary, followed by Canton, IL (2,481 sq ft) and Forrest City, AR (2,374 sq ft), proving that buyers can still find large homes in select markets.

2. In 2020, 61% of cities (564 out of 925) offered 1,700+ sq ft homes for a $50K salary, but by 2025, only 4% (37 out of 935 cities) remain—highlighting the shrinking availability of large homes.

3. In 2020, a $50K salary allowed buyers to afford a home worth up to $239,935, but by 2025, this figure dropped to $163,806—a 31.7% decline. This sharp reduction is driven by skyrocketing mortgage rates, rising home insurance costs, and stagnant wage growth.

4. The 37 cities where buyers can still get a big space have a median home price of $136,509, significantly lower than the national median of $362,393, allowing for larger homes at the same budget.

5. The price per square foot in these 37 cities is 57.6% lower than the national average—$85.76 per sq ft vs. $202.34 per sq ft—enabling buyers to get more space for the same investment.

6. The average maximum home size in these cities is 1,940 sq ft, proving that there are still locations where buyers can maximize space on a modest income.

7. Nantucket, MA, offers the smallest home for a $50K salary. With a median home price of $4,345,000 and a price per square foot of $1,686, a buyer could only afford 97 sq ft—about the size of a small closet!

37 U.S. Cities Where a $50K Salary Buys the Biggest Home [2025]

Out of the 935 U.S. cities we analyzed, these 37 offer the most home for your money. With a $50,000 salary, the maximum affordable home price is estimated at $163,806—making these cities the best places to buy the biggest home.

Metro Area / City | Median Home Price ($) | Median List Price per Sq Ft ($/Sq Ft) | Max Home Size You Can Afford (Sq Ft) | Cost of Living Compared to US Average | Annual Job Growth (Occupations) |

|---|---|---|---|---|---|

1. Clarksdale, MS | $137,000 | $62 | 2,642 | 31.1% lower | 0.45% |

2. Canton, IL | $85,000 | $66 | 2,481 | 28.9% lower | 1.94% |

3. Forrest City, AR | $115,000 | $69 | 2,374 | 33.5% lower | −5.49% |

4. Macomb, IL | $98,975 | $69 | 2,374 | 31.4% lower | −1.81% |

5. Kennett, MO | $95,075 | $70 | 2,340 | 29.5% lower | −9.3% |

6. Greenville, MS | $128,750 | $72 | 2,275 | 30.2% lower | −6.78% |

7. Selma, AL | $113,675 | $74 | 2,214 | 29.9% lower | −3.7% |

8. Danville, IL | $115,125 | $75 | 2,184 | 29.4% lower | 0.25% |

9. Vernon, TX | $122,500 | $78 | 2,100 | 32.6% lower | −4.67% |

10. Pine Bluff, AR | $132,500 | $78 | 2,100 | 32.1% lower | 0.50% |

11. Lincoln, IL | $125,000 | $83 | 1,974 | 27.2% lower | −0.26% |

12. Johnstown, PA | $119,450 | $83 | 1,974 | 24.3% lower | 4.63% |

13. Jacksonville, IL | $139,900 | $83 | 1,974 | 27.1% lower | −2.29% |

14. Carbondale, IL | $124,250 | $85 | 1,927 | 21.6% lower | 2.83% |

15. Meridian, MS | $159,450 | $86 | 1,905 | 26.9% lower | −4.27% |

16. Greenwood, MS | $163,475 | $86 | 1,905 | 34.1% lower | 9.57% |

17. Galesburg, IL | $109,925 | $86 | 1,905 | 30.2% lower | −2.44% |

18. Decatur, IL | $160,325 | $88 | 1,861 | 27.1% lower | −0.54% |

19. Centralia, IL | $149,900 | $89 | 1,841 | 27.0% lower | 0.78% |

20. Taylorville, IL | $144,900 | $89 | 1,841 | 27.1% lower | 1.39% |

21. Camden, AR | $155,000 | $89 | 1,841 | 30.8% lower | −1.29% |

22. Indiana, PA | $148,825 | $90 | 1,820 | 20.6% lower | 0.04% |

23. Freeport, IL | $139,725 | $90 | 1,820 | 27.3% lower | −0.64% |

24. Sikeston, MO | $162,450 | $90 | 1,820 | 25.6% lower | 1.04% |

25. Arkansas City, KS | $154,450 | $92 | 1,781 | 29.7% lower | −1.16% |

26. Fort Madison, IA | $129,900 | $93 | 1,761 | 27.9% lower | 1.9% |

27. Clinton, IA | $141,000 | $93 | 1,761 | 22.2% lower | 0.51% |

28. Oil City, PA | $149,925 | $93 | 1,761 | 27.6% lower | −1.44% |

29. Sterling, IL | $155,725 | $94 | 1,743 | 25.7% lower | −1.9% |

30. Pottsville, PA | $149,925 | $94 | 1,743 | 22.2% lower | −2.23% |

31. Pampa, TX | $152,500 | $96 | 1,706 | 31.5% lower | −2.16% |

32. Marion, IN | $128,650 | $97 | 1,689 | 31.7% lower | −1.33% |

33. Sweetwater, TX | $155,755 | $98 | 1,672 | 30.2% lower | 2.91% |

34. Warren, PA | $149,750 | $98 | 1,672 | 26.4% lower | 2.19% |

35. Great Bend, KS | $159,700 | $98 | 1,672 | 30.0% lower | −1.27% |

36. Peoria, IL | $143,400 | $98 | 1,672 | 24.4% lower | 2.18% |

37. Altoona, PA | $134,000 | $99 | 1,655 | 22.8% lower | 3.96% |

Home Size Statistics for a $50K Salary [2025]

1. In 2025, only 37 out of 935 cities (4%) offer larger homes for a $50K salary, a sharp drop from 564 out of 925 cities (61%) in 2020—a 93% drop.

2. The maximum affordable home price for a $50K salary dropped from $239,935 in 2020 to just $163,806 in 2025, reducing purchasing power by 32%.

3. Clarksdale, MS, is the most affordable city in the U.S. for a $50K salary in 2025.

- Buyers in Clarksdale, MS, where the price per square foot is $62, can afford a 2,642 sq ft home, making it the best city for affordability.

- Surprisingly, Clarksdale also topped the list in 2020, when the same budget could buy 6,152 sq ft at just $39 per square foot—a stark reminder of how rising costs have drastically reduced home sizes in just five years.

4. The price per square foot in cities offering the biggest homes more than doubled, increasing 119.9% from $39 in 2020 to $85.76 in 2025.

5. The Midwest dominates home size availability, with 54% of the top 37 cities offering the largest homes for a $50K salary.

6. The South follows with 22% of the cities, particularly in Alabama, Arkansas, Mississippi, and Texas, where lower costs allow buyers to get more space.

7. The Northeast has limited availability, with just 16% of the cities where a $50K salary can still buy a larger home, mainly in Pennsylvania and upstate New York.

8. The Western U.S. is nearly absent, as rising home prices in California, Oregon, and Washington have significantly reduced home sizes for this budget.

9. A $50K salary buys just 97 sq ft in Nantucket, MA, making it the place where buyers get the least space for their budget.

10. Over 80% of cities with the smallest homes are in coastal regions, where high demand and limited supply drive up costs.

11. California, Hawaii, and Massachusetts dominate the list of places where buyers get the least space, with median home prices exceeding $1 million in most cases.

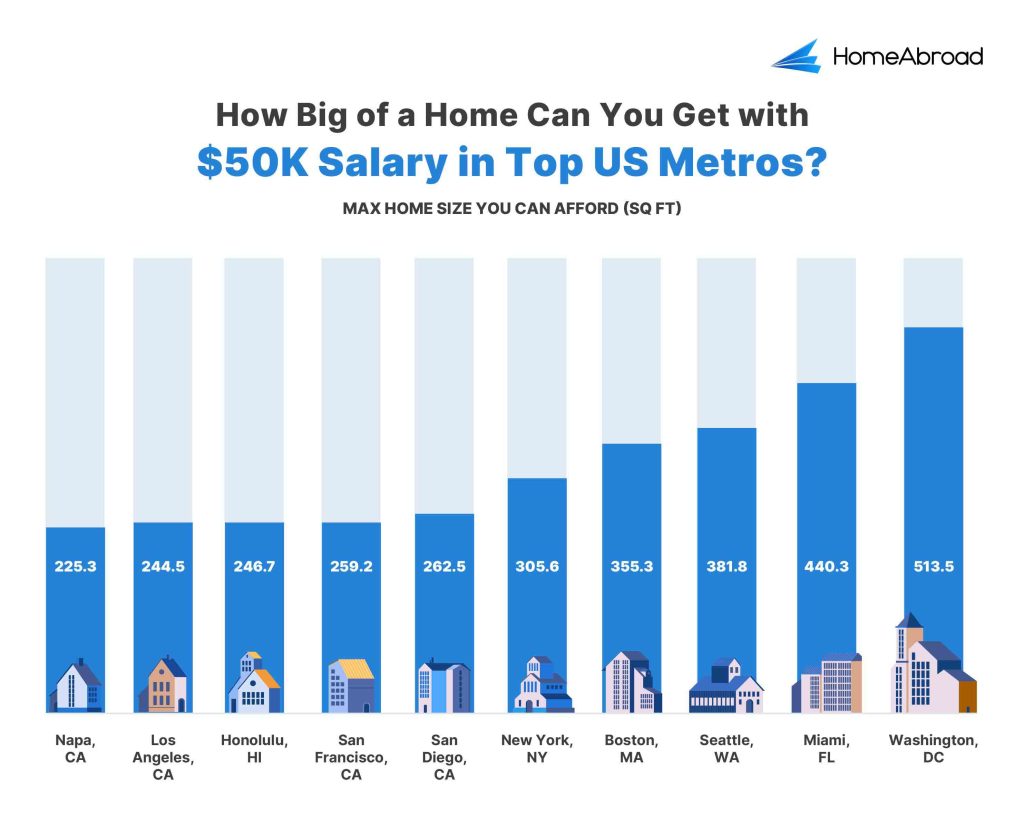

12. In high-cost cities like San Francisco, CA, and Key West, FL, a $50K salary only covers around 250 sq ft, showing the stark contrast in home sizes across the U.S.

13. Mortgage rates have more than doubled, surging from 3.11% in 2020 to 7% in 2025, drastically increasing monthly payments.

14. Home insurance costs skyrocketed by 72%, rising from $1,311 per year in 2020 to $2,258 per year in 2025, further straining affordability.

15. The price per square foot in affordable cities more than doubled, surging 119.9% from $39 in 2020 to $85.76 in 2025.

Home Size Over Time: 2025 vs. 2020

We analyzed home sizes in 2025 vs. 2020 and found a dramatic shift in how much space a $50K salary can buy.

2020: More Space for Your Money

A $50K salary could afford a home worth $239,935, thanks to:

✔ Lower mortgage rates (3.11%)

✔ Lower property taxes (1%)

✔ Affordable home insurance ($1,311 annually)

With these favorable conditions, buyers had options in 564 out of 925 cities.

2025: Shrinking Home Sizes

By 2025, rising property prices, mortgage rates (7%), higher insurance costs, and stagnant wages have dramatically reduced purchasing power. Now, only 37 out of 935 cities offer sizable homes for the same salary.

🔻 That’s a 93% drop in cities where a $50K salary can buy a big home!

Why This Matters

1. Homeownership is slipping further out of reach for middle-income Americans.

2. Mortgage rates have more than doubled, surging from 3.11% in 2020 to 7% in 2025, drastically increasing monthly payments.

3. Home insurance costs have jumped 72%, making affordability even worse.

4. If home prices and interest rates continue rising at this pace, owning a home on a $50K salary may become nearly impossible in the next decade.

Methodology

We wanted to answer a simple but pressing question:

How much home can a $50K salary buy today compared to five years ago?

Here’s how we did it:

Step 1: Calculating Maximum Affordable Home Budget

To determine how much home a $50K salary could realistically afford, we applied the 36% debt-to-income (DTI) rule, which accounts for mortgage payments, property taxes, and insurance when calculating affordability. The following key financial factors were used:

| Year | Mortgage Rate | Tenure | Down Payment (3.5% (FHA loan) of 200K) | Property Tax (Avg of Property Taxes across 50 States) | Home Insurance | Max Affordable Home Price |

| 2020 | 3.11% | 30 years | $7,253 | 1% | $1,311 per year | $239,935 |

| 2025 | 7% | 30 years | $7,253 | 1% | $2,258 per year | $163,806 |

📌 Cost of living insights: We sourced cost of living data from BestPlaces.net.

📌 Annual job growth insights: We sourced cost of living data from Data USA.

Step 2: Sourcing Housing Market Data

We sourced median home price and price per square foot data from Realtor.com for:

- January 2020 data for a historical comparison. (925 Cities)

- January 2025 data to reflect today’s market trends. (935 Cities)

Step 3: Calculating the Maximum Home Size Affordable

To determine how much space a $50K salary could buy, we used the formula:

= Maximum home purchase price ÷ Median price per square foot

This helped us pinpoint where a $50K salary could buy the most home in 2020 vs. 2025.

Step 4: Ranking Cities by Home Size

After calculating the maximum home size a buyer could afford in each city, we ranked all cities from largest to smallest home size to highlight the most affordable locations.

Step 5: Filtering for Cities Where Homeownership Is Realistic

We ensured a realistic view of affordability by filtering out cities where the median home price exceeded the maximum budget for each year:

- In 2020, 568 out of 925 cities were within reach for a $50K salary.

- By 2025, that number dropped to just 57 out of 935 cities, marking a 90% decline in affordability.

Next, we refined the list further by filtering for cities that offer approximately 1,700 sq ft or more. After applying this filter:

- In 2020, 564 cities met this criterion.

- By 2025, only 37 cities remained.

These final 37 cities represent the best locations where a $50K salary still buys a big home in 2025.

🔎 Want to explore the full data yourself?

![37 US Cities Where a $50K Salary Buys the Biggest Homes [2025]](https://homeabroadinc.com/wp-content/uploads/2025/02/50KSalaryBuysBiggestHome-500x325.jpg)