Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Colorado’s rental market, particularly in Denver, Colorado Springs, and mountain resort towns, offers strong long-term appreciation and rental income potential, making it an ideal choice for qualifying through DSCR loans.

2. Colorado DSCR loans from HomeAbroad allow international real estate investors to qualify without US income, credit history, or residency status, as approval is based solely on the property’s rental income.

3. Global investors all across Colorado can qualify using HomeAbroad’s flexible “No-Ratio” option, making it easier to finance high-potential properties with minimal income documentation.

4. Colorado real estate investing is now simplified with HomeAbroad’s all-in-one stop shop, helping foreign nationals find properties through our AI-driven investment property search platform, get financing, form a US-based LLC, open a bank account, and handle closing paperwork.

Table of Contents

Welcome to Colorado – the Centennial State, known for its breathtaking Rocky Mountains, booming tech hubs, and vibrant real estate market spanning Denver, Boulder, and Colorado Springs. With strong rental demand driven by job growth, tourism, and immigration, Colorado continues to attract savvy property investors.

According to the Colorado Association of Realtors, the state has seen consistent home value appreciation while maintaining relatively low property taxes (avg. 0.47%) and landlord-friendly laws. It’s no surprise that Colorado has become a top choice for international real estate investors in recent years.

HomeAbroad DSCR Loans are a perfect fit for this market, allowing foreign national investors to qualify based on the cash flow of their rental property, rather than their personal income. Whether you’re targeting a vacation rental in Breckenridge or a multifamily unit in Aurora, this state offers strong rental yields and reliable occupancy, making it a top target for global investors.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt‑Service Coverage Ratio loan) from HomeAbroad is a foreign national mortgage option for international real estate investors that qualifies you based on the property’s rental income, not your personal income. Personal Debt-to-Income (DTI) ratios don’t impact eligibility, as approval focuses entirely on how well the property can cover its own expenses.

With Colorado’s average rental yield ranging between 5% and 8% (Zillow) and strong tenant demand in cities like Denver, Colorado Springs, and Boulder, international real estate investors can use DSCR loans to tap into high-performing rental markets without the hassle of traditional income documentation. Whether you’re targeting long-term rentals or short-term vacation stays in mountain towns, HomeAbroad’s DSCR loan makes it simple to qualify with no US credit required and minimal paperwork.

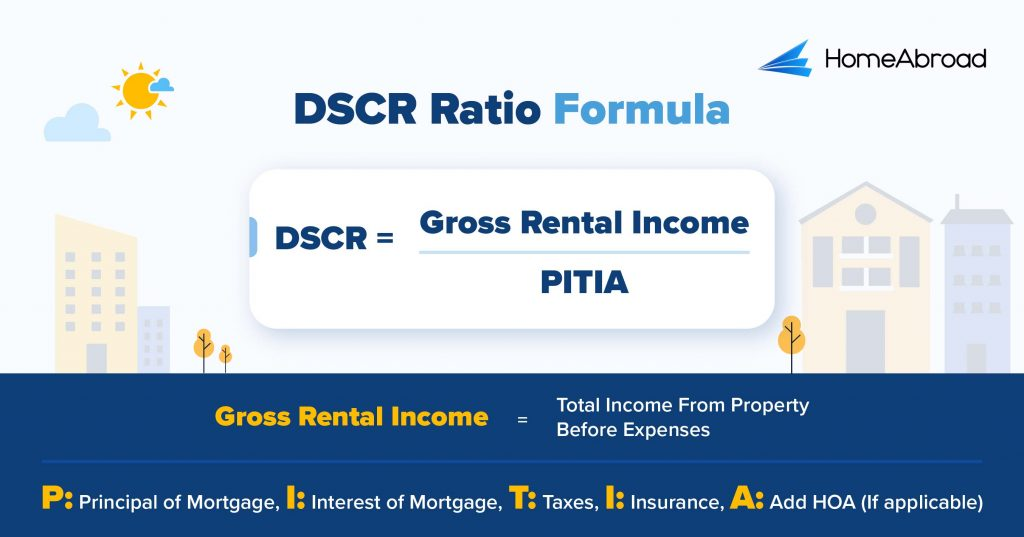

How to Calculate the DSCR Ratio

The Debt Service Coverage Ratio (DSCR) is a key metric that lenders use to determine whether a rental property generates enough income to cover its mortgage payments.

If you’re a real estate investor in Colorado, understanding and calculating your DSCR ratio can help you quickly secure the best loan terms and expand your investment portfolio.

The formula for calculating DSCR is:

I recently worked with a foreign national investor looking to invest in a rental property in Denver, Colorado. He wanted to secure financing but was unsure if the property’s cash flow would meet the requirements for a DSCR loan. I helped him analyze the numbers, calculate the Debt Service Coverage Ratio (DSCR), and navigate the loan process.

Example

Calculating the DSCR Ratio for a Colorado Property:

With a DSCR of 1.16, the property generated more income than its loan obligations, making it a solid investment. This number helped my investor secure financing, knowing the property had a positive monthly cash flow of $350. After working through the numbers together, he successfully closed on the property and is now generating steady rental income.

It’s that seamless and easy. Still, if you don’t want to do the math, you can use HomeAbroad’s DSCR ratio calculator.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with strong long-term plans the opportunity to secure financing.

DSCR Loan Requirements in Colorado for Foreign Nationals

Compared to conventional banks, HomeAbroad simplifies the foreign national mortgage DSCR loan process with solutions specifically designed for international investors eyeing Colorado’s real estate market.

Whether you’re overseas or lack a US credit footprint, our borrower-friendly terms, streamlined requirements, and full remote-closing capabilities make investing in Colorado properties more attainable.

Here’s how our foreign national DSCR loan criteria stack up against traditional lenders:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

Beyond standard metrics such as the DSCR ratio, credit history, and down payment size, several other factors also play a significant role in qualifying for a DSCR loan as an international real estate investor.

At HomeAbroad, we bring years of experience helping international real estate investors break into the US market. Our AI-powered property search tool pinpoints top-performing Colorado investment opportunities, and our mortgage specialists tailor DSCR loan solutions to align with your financial goals.

Where We Lend DSCR Loans in Colorado

HomeAbroad provides DSCR loans throughout Colorado, offering personalized support to international real estate investors targeting high-potential markets such as Denver, Colorado Springs, Aurora, Fort Collins, and more.

We understand that each city presents unique investment opportunities, and our loan process is designed to support your strategy, whether you’re investing in an urban short-term rental or a suburban long-term property. Here are a few cities in Colorado where we offer DSCR Loans.

- Denver

- Colorado Springs

- Aurora

- Fort Collins

- Boulder

- Thornton

- Arvada

- Westminster

- Woodland Park

- Jefferson

- Hartsel

- Guffey

- Florissant

- Lake George

- Breckenridge

- Estes Park

Let’s walk through a real-world example of a foreign national investor who successfully financed a Colorado rental property using a DSCR loan from HomeAbroad.

Case Study: David Expands His Rental Portfolio in Colorado

Investor Profile:

David Thompson, an experienced real estate investor from California, wanted to expand his rental portfolio with a single-family property in Denver. His goal was to acquire a high-performing asset while keeping his personal income and finances separate from the investment.

The Challenge:

David sought financing that wouldn’t require traditional income verification, allowing him to qualify based solely on the property’s performance. He also wanted a solution that supported long-term cash flow and minimized personal financial entanglements.

The Solution: HomeAbroad’s DSCR Loan

David partnered with our team at HomeAbroad to explore a financing route centered on the property’s rental income. We helped him structure a DSCR loan that required no US income or credit history, focusing solely on the property’s ability to generate positive rental cash flow.

By leveraging a DSCR of 1.24, the property’s income exceeded its monthly debt obligations by 24%, resulting in a strong monthly cash flow of $825. The approved DSCR loan interest rate of 7.25% helped ensure affordability and long-term return on investment.

Loan & Property Details:

- Location: Denver, Colorado

- Property Price: $500,000

- Monthly Rent: $4,200

- Loan Amount: $400,000

- Down Payment: 25%

- Loan Type: DSCR Loan, 30-year fixed-rate

- Interest Rate: 7.25%

- Monthly PITIA: Approx. $3,375

- Time to Close: 28 days

Why This Worked for David:

- No Traditional Income Verification: David qualified based solely on rental income, keeping his personal income out of the process.

- Positive Cash Flow: With a DSCR of 1.24 and a monthly surplus of $825, the property became an immediate cash-flowing asset.

- Quick Closing: The loan closed within 28 days, allowing David to act quickly in Denver’s competitive market.

- Strategic Portfolio Growth: This DSCR loan helped David scale his rental holdings without financial roadblocks.

This case study highlights the strength of DSCR loans in helping investors efficiently grow their real estate portfolios. With expert support and rental-income-based approval, David secured a profitable property in one of Colorado’s top markets without relying on US income or an established credit history.

Top Places to Invest in Colorado with a DSCR Loan

Colorado stands out as a prime destination for real estate investors thanks to its booming population, strong job market, and unbeatable natural appeal. From ski towns to tech hubs, the state offers a diverse mix of long-term rental demand and short-term vacation rental potential.

For foreign national investors, Colorado’s rental markets pair well with DSCR loans, as the focus remains on the property’s rental performance rather than your personal income or an established US credit history.

Here are some of the top-performing cities in Colorado to consider for your DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Colorado Springs | Short-Term | 10.12% |

Woodland Park | Short-Term | 10.2% |

Thornton | Long-Term | 6.17% |

Estes Park | Short-Term | 11.4% |

Aurora | Long-Term | 6% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in Colorado or anywhere in the US!

Colorado Springs: Affordable Entry into a Dual Market

Colorado Springs stands out for its unique blend of military presence, tourism, and robust residential growth. It’s one of the few cities in the US where both long-term and short-term rentals perform well. But its proximity to attractions like Garden of the Gods, Pikes Peak, and Olympic City USA makes it especially STR-friendly.

- Median Home Price: $457,483

- Average Rent: $1,989/month

What this means for investors: High occupancy and solid ADR (Average Daily Rate) make it ideal for STR-based DSCR qualification. International real estate investors benefit from substantial returns and ease of property management, thanks to the city’s size and robust tourism infrastructure.

Investment Properties Listed Today on Sale in Colorado Springs

Woodland Park: Hidden STR Gem in the Mountains

Tucked away just west of Colorado Springs, Woodland Park is a small mountain town that’s quietly booming in the short-term rental market. It offers nature, trails, and cabin-style living —everything vacation renters look for in Colorado.

- Median Home Price: $570,450

- Average Rent: $2,400/month

What this means for investors: It’s perfect for short-term rental investors using DSCR loans to capitalize on high seasonal income and limited local hotel competition. Strong returns, scenic views, and vacation demand make this a top-tier niche play for global investors.

Investment Properties Listed Today on Sale in Woodland Park

Thornton: Metro Suburb with Reliable Returns

Located just outside Denver, Thornton is a commuter-friendly suburb that’s growing fast. With its newer developments, good schools, and easy highway access, it appeals to renters who want space and proximity to employment opportunities.

- Median Home Price: $520,000

- Average Rent: $2,675/month

What this means for investors: Thornton gives DSCR investors long-term stability. Its solid rent-to-price ratio supports sustainable cash flow, especially for international buyers without local credit or tax documents. It is an excellent pick for those seeking steady appreciation and rental income.

Investment Properties Listed Today on Sale in Thornton

Estes Park: Gateway to the Rockies with STR Powerhouse Potential

Estes Park isn’t just a postcard-perfect mountain town; it’s the front door to Rocky Mountain National Park, one of the most visited national parks in the country. With strict STR regulations that limit supply and year-round tourist demand, the market is tailored for high-performing short-term rentals and premium nightly rates.

- Median Home Price: $719,500

- Average Rent: $2,844/month

What this means for investors: Estes Park delivers impressive STR returns thanks to a powerful combo: limited rental inventory, high tourism volume, and top-tier nightly rates. Properties near downtown and park entrances consistently attract steady bookings year-round, especially during summer and fall. For DSCR-focused international real estate investors targeting vacation markets, Estes Park offers strong revenue fundamentals and long-term demand in a tightly regulated, high-visibility destination.

Investment Properties Listed Today on Sale in Estes Park

Aurora: Quiet Performer in Denver’s Backyard

Aurora is one of Denver’s largest suburbs, but it flies under the radar. With the growth of the healthcare, education, and aerospace sectors, Aurora experiences strong population growth and steady rental demand from professionals and families.

- Median Home Price: $464,583

- Average Rent: $2,300/month

Aurora is ideal for long-term DSCR investors looking for affordability near Denver. Its diverse tenant base and rising rents make it a quiet yet solid choice for sustained income, particularly for those building a US rental portfolio remotely.

Investment Properties Listed Today on Sale in Aurora

Specific Considerations for Investing in Colorado for Foreign Nationals

Below are the most critical investor-specific factors to understand before entering the Colorado rental market.

Colorado’s real estate market offers foreign national investors a compelling mix of rental demand, economic stability, and geographic diversity. But its unique environmental, legal, and regulatory characteristics require careful consideration, especially when qualifying for a DSCR loan based solely on rental income.

1. Wildfire and Hail Risk Drive Insurance Costs and Location Strategy

Colorado is among the top US states for both wildfire exposure and hailstorm frequency, particularly in the foothills, mountain regions, and suburban areas along the Front Range. These climate risks result in higher insurance premiums, potential coverage limitations, and property eligibility issues with certain insurers.

For DSCR investors, high insurance costs can lower net operating income (NOI) and affect debt coverage ratios. Select locations with a strong fire mitigation rating and avoid properties in FEMA-designated high-risk zones, unless you have budgeted for adequate coverage.

2. Property Maintenance Costs Are Elevated Due to Altitude and Weather Extremes

At elevations over 5,000 feet, homes in Colorado endure freeze-thaw cycles, heavy snow loads, and intense sun exposure, which accelerate wear on roofs, foundations, HVAC systems, and exterior finishes. Investors should favor newer construction or older properties with recent renovations meeting high-altitude performance standards.

These maintenance realities impact your expense forecasts and DSCR calculations, especially if you’re investing remotely without local oversight.

3. Short-Term Rental (STR) Laws Are Fragmented and Often Investor-Restrictive

STR laws in Colorado are locally controlled and frequently restrict non-owner-occupied rentals. For instance, Denver allows STRs only in primary residences. Popular tourist towns like Breckenridge, Vail, and Aspen have strict STR caps or moratoriums, and some HOAs entirely prohibit short-term leases.

Foreign national investors must align their strategy with municipal licensing rules, HOA bylaws, and tax collection requirements before targeting vacation or Airbnb-style properties.

4. Seasonal Demand Patterns Create Uneven Cash Flow in Key Markets

Unlike year-round rental markets, many Colorado towns, especially ski resort areas, experience highly seasonal rental income. Peak demand runs from November to April, while the off-season can result in extended vacancies or sharply reduced rental rates.

DSCR investors must factor in seasonality when projecting cash flow and may need to qualify based on long-term lease projections rather than relying on inflated short-term rental returns.

5. Zoning, Water Rights, and HOA Rules Can Restrict Rental Use

Many Colorado municipalities enforce strict zoning codes, particularly in mountain communities, which limit multi-family use or short-term stays. Some rural properties also come with shared water rights or well permits, which can affect tenancy and property modification options.

Investors using DSCR loans should avoid surprises by requesting a zoning certificate, reviewing the HOA bylaws, and verifying that there are no water access restrictions before closing.

Strategic & Future Considerations for Foreign Nationals Investing in Colorado

Colorado offers strong fundamentals for international real estate investors utilizing DSCR loans, including landlord-friendly laws, diverse markets, and consistent population growth. However, long-term success requires navigating shifting regulations, market patterns, and regional development. Here’s what global investors must consider when evaluating future-oriented opportunities across the state.

1. No Legal Barriers to Foreign Ownership

Colorado currently imposes no restrictions on foreign nationals purchasing residential or investment property. Buyers may buy under their name or through a US LLC, with no state-imposed residency or visa requirements. However, like other states, Colorado has seen growing political interest in regulating foreign ownership of land, particularly farmland and water-access properties.

Foreign national investors, especially those buying rural land, should stay aware of potential future regulatory shifts and always consult a real estate attorney familiar with international transactions.

2. Secondary Markets Outperform for Rental Income and Long-Term Value

While Denver draws attention, many investors are targeting secondary cities with lower price points and strong rental demand, such as Colorado Springs, Fort Collins, Greeley, and Loveland. These cities benefit from local universities, stable job bases (such as military, tech, and healthcare sectors), and less restrictive short-term rental regulations.

Properties in these metros often produce better DSCR ratios due to lower taxes and insurance costs, making them more attractive for foreign investors seeking stable cash flow and long-term appreciation.

3. Front Range Transit Growth and TODs Create New Investment Zones

The Front Range Urban Corridor (stretching from Pueblo to Fort Collins) is seeing significant infrastructure investment, including proposed passenger rail, highway upgrades, and urban transit-oriented developments (TODs). These projects enhance property accessibility and appeal to tenants who prioritize ease of commuting and walkability.

Foreign national investors can gain a long-term edge by buying near upcoming rail stations or transit corridors, particularly in Aurora, Thornton, and Northglenn, where pricing is still reasonable but poised for growth.

4. Green Building and Energy Codes Are Reshaping Property Values

Colorado is emerging as a national leader in energy-efficient housing, with cities such as Denver, Boulder, and Aspen implementing stringent building performance standards. Future resale value and tenant demand will increasingly depend on energy performance ratings, solar-readiness, and efficient HVAC systems.

For foreign DSCR investors, targeting properties that already meet or exceed energy codes helps control long-term costs and improves financing eligibility, especially as lenders and tenants prioritize sustainability.

5. Colorado’s Demographics Support Long-Term Rental Demand

Colorado’s population continues to grow, particularly among millennials, remote workers, and retirees, who are drawn to the state by its quality of life, access to nature, and economic opportunities. The result is strong long-term rental demand, especially for mid-sized single-family homes, multifamily properties, and townhomes in lifestyle-rich communities.

Cities with high in-migration, such as Castle Rock, Parker, and Longmont, are excellent long-term investments for foreign investors focused on steady DSCR loan performance.

Get a HomeAbroad DSCR Loan in Colorado as a Foreign National

Securing financing for your investment property in Colorado is simple with HomeAbroad. Our DSCR loans are designed specifically for international real estate investors, offering flexible terms and competitive rates to help you build a substantial property portfolio in key Colorado markets.

HomeAbroad simplifies the investment process from start to finish. Use our AI-powered investment property search to explore high-yield opportunities across Colorado. Our experienced local agents provide hands-on support, assisting with LLC setup, opening a US bank account, and ongoing property management.

Already own a rental property in Colorado? With HomeAbroad’s cash-out refinancing, you can tap into your property’s equity without US income or credit history. Reinvest the funds into new properties, renovations, or strategic diversification, all with a rental-income-based approval process.

Get started with a DSCR loan from HomeAbroad today and grow your Colorado real estate portfolio with confidence.

FAQs

Can foreign nationals apply for DSCR loans in the state of Colorado?

Foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international investors.

How long does it take to get a DSCR loan in Colorado?

At HomeAbroad Loans, we streamline the application process to ensure a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

What are the interest rates for DSCR loans in Colorado?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loan Interest Rates Today [December, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates.png)

![DSCR Loan Refinance: How to Qualify & Maximize Benefits [2025]](https://homeabroadinc.com/wp-content/uploads/2024/11/DSCRLoanRefinance.jpg)