Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Oregon's rental market, especially in cities like Portland, Eugene, and Bend, is growing steadily, and DSCR loans from HomeAbroad allow international real estate investors to qualify without needing US income, credit history, or residency.

2. DSCR loans rely on the property's rental income to qualify so that foreign national investors can skip personal tax returns, employment records, or pay stubs entirely.

3. Oregon's cities offer a blend of stable long-term tenants, high occupancy rates, and consistent appreciation driven by limited housing supply, lifestyle migration, and strong renter demand.

4. HomeAbroad makes the process seamless for global investors, helping you find cash-flowing properties via our AI-driven investment property search platform, secure a DSCR mortgage, form a US LLC, open local bank accounts, and complete all necessary closing documentation.

Table of Contents

Welcome to Oregon – the Beaver State, where rugged coastlines, lush forests, and craft coffee culture thrive. It’s also the birthplace of Nike, launched by a University of Oregon track coach and his student.

However, it’s not just nature lovers and entrepreneurs who are heading here; international real estate investors are also turning to Oregon for its high rental demand, progressive housing laws, and thriving cities, such as Portland, Eugene, and Bend.

Whether you’re considering a vacation rental in Bend, a student property in Eugene, or a multifamily property in Portland, Oregon, the state offers stable returns and strong occupancy, especially for foreign nationals using the HomeAbroad DSCR loan.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt-Service Coverage Ratio loan) from HomeAbroad is a foreign national mortgage solution designed for international real estate investors. Instead of qualifying based on your personal income, we assess eligibility using the property’s rental income, with no requirement for tax returns, pay stubs, W-2s, or employment records.

This makes it ideal for self-employed investors, business owners, and global investors with limited or no US credit history. If the property’s rental income covers the mortgage payments, you can qualify even without US residency or credit history.

Oregon’s rental markets offer strong occupancy and steady demand, particularly in cities such as Portland, Eugene, and Bend. Foreign national investors can use DSCR loans to build portfolios in high-potential areas and generate reliable cash flow with fewer financing barriers.

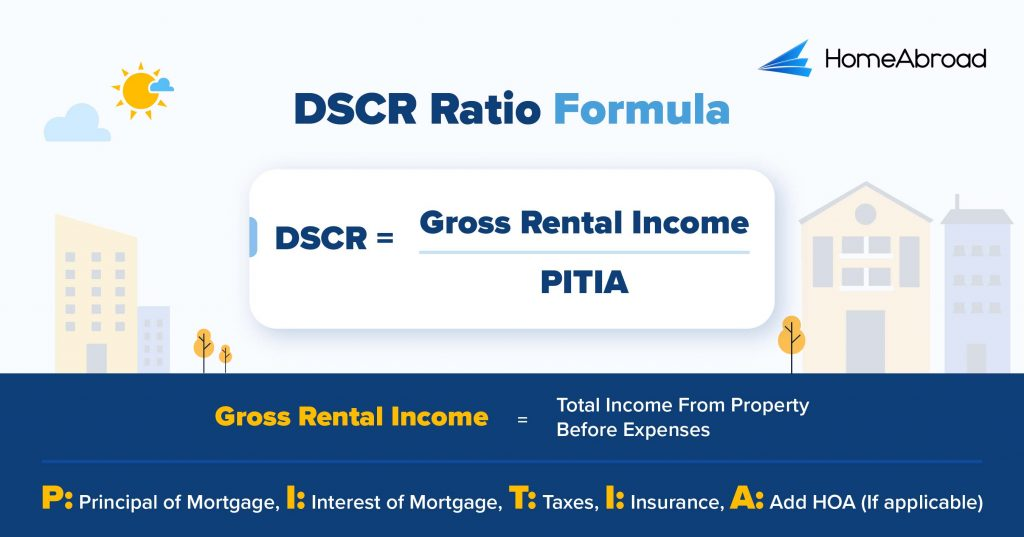

How to Calculate Your DSCR Ratio

If you’re a real estate investor in Oregon, understanding the Debt Service Coverage Ratio (DSCR) is crucial for securing favorable loan terms. The DSCR helps lenders determine if their rental property generates enough income to cover its mortgage payments.

The formula for DSCR is:

Let’s apply the DSCR formula using a real-world example of a rental property in Portland, Oregon.

Example

Calculating the DSCR Ratio for an Oregon Property:

Since the investor’s DSCR meets the lender’s 1.25 requirement, the property qualifies for financing under standard loan terms. You can now easily calculate your rental property’s DSCR ratio using HomeAbroad’s DSCR ratio calculator, eliminating the need for complex math.

Our DSCR loans are designed to qualify you based on a property's income potential in relation to its mortgage payments. A standard DSCR loan works by ensuring the monthly gross rent is equal to or greater than the mortgage payment (PITIA), which means your DSCR is 1.0 or higher. This is the ideal scenario that qualifies you for the best terms.

However, we understand that not every property's rental income will meet this threshold, which is why we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. With the No-Ratio program, you can still secure financing, although it will require a slightly larger down payment, 5% reduction in Loan-to-Value (LTV), and a higher interest rate. This option is ideal for investors with a strong long-term strategy who want to acquire properties that may not immediately generate a 1.0 cash flow ratio.

DSCR Loan Requirements in Oregon for Foreign Nationals

Traditional lenders often make it difficult for international real estate buyers to invest in US real estate, but HomeAbroad changes that.

Our DSCR loan program in Oregon is specifically designed for foreign national investors, utilizing the property’s rental income instead of personal income or an established US credit history. With flexible qualification requirements, remote closing options, and no need for a Social Security number, buying property in Oregon, from Portland to Bend, is now more straightforward and accessible.

Here’s how our foreign national mortgage DSCR loan requirements in Oregon compare to those of conventional lenders.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

In addition to the DSCR ratio, down payment, and credit score, several other factors can impact your eligibility for a DSCR loan as an international real estate investor in Oregon:

With extensive experience working with international real estate investors, the HomeAbroad team provides personalized support tailored to your specific goals. Our AI-powered investment property search platform helps you find high-performing properties in Oregon, and our lending experts structure DSCR loan solutions to match your needs.

Areas We Lend in Oregon

HomeAbroad offers DSCR loans across Oregon, providing personalized support to real estate investors in top-performing cities such as Portland, Eugene, and Salem. Whether you’re investing in urban rentals or high-demand suburban markets, our DSCR loan solutions are designed to help you qualify based on rental income, not personal income.

Here are a few cities where we lend DSCR Loans in Oregon:

- Lincoln City

- Seaside

- Rockaway Beach

- Pacific City

- Sunriver

- Bend

- Eugene

- Corvallis

- Springfield

- Portland

- Albany

- Klamath Falls

To see how a DSCR loan works in real life, let’s look at a case study of an investor who secured financing for an Oregon rental property with the help of HomeAbroad.

Case Study: Michael Reynolds Leverages a DSCR Loan to Expand His Rental Portfolio in Oregon

Investor Profile:

Michael Reynolds, a seasoned real estate investor from Washington state, aimed to grow his portfolio by acquiring a rental property in Portland, Oregon. He sought financing based solely on the property’s performance, independent of his personal income, and on a streamlined, scalable strategy.

The Challenge:

Traditional mortgages typically require income verification and a thorough credit review. Michael preferred to avoid this approach, focusing instead on a financing model driven by rental income.

The Solution: HomeAbroad DSCR Loan

At HomeAbroad, we guided Michael through a Debt Service Coverage Ratio (DSCR) loan structured entirely around the property’s rental cash flow. This allowed approval based on income projections without requiring personal tax returns or pay stubs.

Property Details:

- Location: Portland, Oregon

- Purchase Price: $550,000

- Estimated Monthly Rent: $4,600

Loan Details:

- Loan Amount: $440,000 (75% LTV)

- Down Payment: 25%

- Monthly PITIA: $3,792

- Interest Rate: Approximately 7.5% (30-year fixed)

- Time to Close: Approximately 27 days

DSCR Calculation:

- DSCR = $4,600 ÷ $3,792 = 1.21

- The property generates 21% more income than required to cover debt obligations, resulting in a monthly positive cash flow of about $808.

Why This Worked for Michael:

- Income-Based Qualification: Approved based solely on rental income; no personal income verification required.

- Reliable Cash Flow: A DSCR of 1.21 provided strong financial performance and lowered risk.

- Swift Closing: HomeAbroad’s streamlined process closed the loan in under 30 days, empowering Michael to secure the deal quickly.

- Investor-First Approach: With guidance from Michele Lawrie, a CIPS-certified real estate consultant at HomeAbroad, the financing was tailored to Michael’s goals and scale ambitions.

Michael Reynolds’ investment in Portland demonstrates how HomeAbroad’s DSCR loan program enables savvy real estate investors to pursue strategic growth. By underwriting based on property income rather than borrower income, Michael secured a profitable, scalable investment, supported by expert guidance and adequate financing.

Top Places to Invest in Oregon with a DSCR Loan

Oregon is steadily emerging as a prime destination for real estate investment, and it’s easy to see why. With its diverse landscapes, strong job market, and high quality of life, the state continues to attract residents and visitors year-round. Whether you’re eyeing long-term rentals or short-term vacation properties, Oregon offers promising opportunities for investors.

For global investors looking to invest in the US, Oregon’s rental market presents a favorable environment for DSCR (Debt Service Coverage Ratio) loans. These loans enable investors to qualify based on the property’s income-generating potential, rather than their personal income, a significant advantage for foreign nationals.

Here are some of the top-performing cities in Oregon to consider for your next DSCR loan-backed investment:

City | Rental Type | Rental Yield |

|---|---|---|

Lincoln City | Short-Term | 13.1% |

Seaside | Short-Term | 12.2% |

Rockaway Beach | Short-Term | 10.85% |

Albany | Long-Term | 5% |

Klamath Falls | Long-Term | 5.1% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in Oregon or anywhere in the US!

Lincoln City: Coastal Charm with Year-Round Short-Term Potential

Perched along Oregon’s central coast, Lincoln City blends small-town charm with serious short-term rental potential. With a steady influx of tourists drawn to its beaches, casino, and outlet mall, this coastal gem is gaining traction among investors targeting vacation rentals, which consistently achieve high occupancy rates.

- Median Home Price: $493,333

- Average Rent: $2,400/month

What this means for investors: Despite higher home prices, Lincoln City’s STR market remains attractive thanks to year-round demand and lenient permitting in key zones. Investors are seeing consistent bookings from Portland weekenders and West Coast travelers. Oceanview properties and homes near the historic Taft district command premium nightly rates.

Investment Properties Listed Today on Sale in Lincoln City

Seaside: Oregon’s Premier Beachfront Investment Hub

Seaside is one of Oregon’s most established coastal vacation destinations, and it’s still growing. With iconic boardwalks, family attractions, and steady seasonal traffic, it has built-in demand that fuels one of the state’s most reliable short-term rental markets.

- Median Home Price: $549,300

- Average Rent: $2,095/month

What this means for investors: Seaside’s home prices are on the higher side, but STR performance more than makes up for it. Rent-to-price ratios aren’t ideal for long-term buy-and-hold investments, but for nightly rentals, investors are achieving gross yields of 10–12%. To maximize returns, target properties located west of the highway with beach access and strong walkability.

Investment Properties Listed Today on Sale in Seaside

Rockaway Beach: Underrated STR Gem with Growing Appeal

Less crowded than Seaside but equally scenic, Rockaway Beach is becoming a sleeper pick for Oregon coast investors. With fewer STR restrictions and growing visitor interest, it’s a prime spot for early movers eyeing coastal returns without the high coastal prices.

- Median Home Price: $579,833

- Average Rent: $2,500/month

What this means for investors: Rockaway Beach strikes a sweet spot between affordability and potential. Properties within walking distance to the beach or Lake Lytle perform well on Airbnb, especially during the summer and fall. While not as high-volume as Seaside, Rockaway Beach has lower entry prices and fewer regulatory hurdles, giving it room to shine.

Investment Properties Listed Today on Sale in Rockaway Beach

Albany: Underrated I-5 Corridor Market with Steady Cash Flow

Albany is quietly emerging as a solid long-term rental play in Oregon. Located between Salem and Eugene, it benefits from steady population growth, a strong employment base in healthcare and manufacturing, and relatively affordable home prices. For investors seeking stable returns without the volatility of major metros, Albany checks the boxes.

- Median Home Price: $428,000

- Average Rent: $1,650/month

What this means for investors: Albany offers a rare mix of affordability and stability. While it’s not a high-yield market on paper, it’s an excellent fit for DSCR strategies focused on low vacancy, consistent leases, and minimal turnover. Investors are finding success with single-family homes and small multi-family near downtown, the hospital district, and Linn-Benton Community College. It’s a reliable market for long-term holds, and an excellent BRRRR candidate for those looking to build equity without heavy competition.

Investment Properties Listed Today on Sale in Albany

Klamath Falls: High-Yield, Low-Competition Market in Southern Oregon

Klamath Falls offers one of Oregon’s best combinations of low entry prices and high rental returns. With a stable tenant base fueled by healthcare, education, and regional industries, this southern Oregon city has quietly become a high-yield hotspot for long-term investors priced out of larger metropolitan areas.

- Median Home Price: $312,833

- Average Rent: $1,306/month

What this means for investors: Klamath Falls continues to outperform most major Oregon cities in rental yields. It’s ideal for buy-and-hold or BRRRR strategies that aim to meet DSCR targets while keeping acquisition costs low. The renter base includes hospital staff, students from Oregon Tech, and stable blue-collar tenants. Small multi-family homes, particularly those located near downtown or the hospital area, tend to rent quickly and deliver substantial monthly income.

Investment Properties Listed Today on Sale in Klamath Falls

Specific Considerations for Investing in Oregon for Foreign Nationals

Oregon’s real estate market combines strong environmental appeal with complex regulatory frameworks. From progressive land-use laws to tax nuances and evolving climate challenges, the state requires a tailored approach from foreign investors seeking long-term value.

Here are the most critical factors to keep in mind:

1. Urban Growth Boundaries and Land Use Regulation

Oregon’s strict land use laws limit urban sprawl through Urban Growth Boundaries (UGBs), particularly around cities such as Portland and Eugene. These boundaries constrain supply, often driving up property values within UGBs over time. For real estate investors, this means location is paramount; properties inside UGBs typically appreciate more but can carry higher entry costs due to development limits.

2. Rent Control and Tenant-Friendly Regulations

Oregon was the first US state to enact statewide rent control in 2019. Annual rent increases are capped (typically CPI + 7%, with exceptions), and eviction rules favor tenants. For foreign national investors seeking long-term rental income, professional property management is highly recommended, and accurate financial modeling is essential to account for capped rent growth and tenant protections.

3. Climate Risks and Wildfire Exposure

While Oregon avoids hurricanes, wildfire risk is increasing, particularly in rural and forest-adjacent areas such as Jackson County and parts of Central Oregon. Insurance costs have risen in high-risk zones, and future regulations may restrict development in vulnerable areas. Investors should prioritize properties with fire-resilient features and avoid areas identified as high wildfire hazard zones on maps.

Strategic & Future Considerations for Foreign Nationals Investing in Oregon

Oregon’s mix of progressive policies, natural beauty, and diversified economy appeals to international buyers with long-term outlooks. With rising tech sector growth and climate-conscious urban planning, Oregon offers unique advantages if approached with local insight.

Here are some future-oriented points foreign national investors should track:

1. No Restrictions on Foreign Ownership, but Limited Short-Term Rental Viability

Oregon has no ownership restrictions for foreign nationals, but short-term rentals are tightly regulated, especially in Portland. Many municipalities enforce permit quotas, primary residence requirements, or outright bans. This limits vacation rental returns, steering most foreign buyers toward mid- to long-term leasing strategies.

2. Emerging Markets Outside Portland: Bend, Salem, and Eugene

While Portland remains the economic hub, affordability and lifestyle trends are driving growth in mid-sized cities like Bend, Salem, and Eugene. These areas benefit from in-migration, university economies, and healthcare infrastructure, offering foreign investors lower entry points and strong appreciation potential without the regulatory intensity of Portland proper.

3. Environmental Building Codes Shaping New Development Value

Oregon’s building codes increasingly favor green construction, including requirements for energy efficiency and low-carbon materials. Newer, code-compliant properties often command premium valuations and appeal to eco-conscious buyers and tenants. Foreign investors should target LEED-certified or energy-efficient developments to future-proof their portfolios.

Get a HomeAbroad DSCR Loan in Oregon as a Foreign National

Financing your Oregon real estate investment is straightforward with HomeAbroad. Our DSCR (Debt Service Coverage Ratio) loans are built for international real estate investors, offering flexible qualification criteria, competitive rates, and a streamlined process, so you can focus on creating a profitable property portfolio in one of the Pacific Northwest’s most dynamic markets.

With HomeAbroad, you get more than just a loan. Our AI-powered investment property search platform helps you identify high-potential rental properties in Oregon cities like Portland, Eugene, and Bend. Our experienced local agents, who understand regional zoning laws, rental regulations, and market trends, ensure you make informed decisions at every step.

Already own investment property in Oregon? Tap into its equity with our rental-income-based cash-out refinancing. There’s no need for US credit history or income verification, just your property’s performance. Use the funds to expand your portfolio, upgrade for better returns, or diversify across Oregon’s emerging secondary markets.

HomeAbroad makes it easier for foreign nationals to invest in Oregon real estate, from LLC formation and US bank setup to property management support. Get started with a DSCR loan today and take advantage of Oregon’s growth-ready housing market.

FAQs

Can self-employed borrowers apply for a DSCR loan in Oregon?

Yes, DSCR loans are ideal for self-employed borrowers with inconsistent personal income or tax returns. The loan qualification is based on the property’s income rather than the borrower’s financial history.

How long does it take to get a DSCR loan in Oregon?

At HomeAbroad Loans, we streamline the application process to ensure a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

What are the interest rates for DSCR loans in Oregon?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loan Interest Rates Today [October, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCRLoanInterestRates.jpg)