Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Canadians can buy property in Arizona without restrictions, making it an excellent choice for a vacation home, investment, or permanent residence.

2. HomeAbroad offers tailored mortgage options for Canadian buyers, even without a US credit history.

3. The Canada-US Tax Treaty helps prevent double taxation, making it easier for Canadian investors to manage their tax obligations.

Arizona has been a favorite destination for Canadians looking to buy property in the US. The state offers excellent opportunities with its year-round sunshine, stunning desert landscapes, and relatively affordable homes.

In fact, 23% of all Canadian buyers who purchased US residential property between 2023 and 2024 chose Arizona, making it one of the most sought-after states for Canadians.

Understanding the process, from financing options to tax considerations, can help Canadian buyers make informed decisions and secure the right property easily. This guide breaks down everything you need to know for a smooth home-buying experience in Arizona.

Table of Contents

Can Canadians buy real estate property in Arizona?

Yes, Canadians can buy real estate in Arizona without any restrictions. The US has no laws preventing foreign nationals from purchasing property, making it easy for Canadians to invest in vacation homes, rental properties, or permanent residences in the state.

The best part is that you don’t need US citizenship, a green card, or even a visa to purchase property in Arizona. However, if you plan to stay for extended periods, you may need to consider US visa requirements for long-term visits.

With Arizona’s buyer-friendly real estate market and strong appeal among Canadian buyers, investing in the state can be a seamless and rewarding experience.

Mortgage Options for Canadians in Arizona

While Canadian buyers can purchase homes in cash, financing options are available for those who prefer to leverage their investment.

Mortgages with an Established US Credit History

If you’ve lived or worked in the US and have built a US credit score, you may qualify for standard mortgage options available to US residents.

Conventional Loans

A conventional loan is a standard mortgage offered by private lenders. typically requires a strong US credit history and a stable income. These loans offer competitive interest rates but are best suited for Canadians who have lived or worked in the US and have established credit.

Requirements:

- Credit Score Minimum: 620

- Down Payment: 3% to 20%

- Loan Terms: 8 to 30-year terms

- Mortgage Insurance Premiums: PMI (if less than 20% down)

FHA Loans (Federal Housing Administration)

The Federal Housing Administration (FHA) Loan is a government-backed mortgage that offers lower down payments and flexible credit requirements.

Requirements:

- Credit Score Minimum: 500

- Down Payment: 3.5% for credit scores of 580+; 10% for credit scores of 500-579

- Loan Terms: 15 or 30-year terms

- Mortgage Insurance Premiums: Upfront premium: 1.75% of loan amount; annual premium: 0.45% to 1.05%

Mortgages Without a US Credit History

For Canadians without a US credit score, several financing options exist through specialized foreign national loans that allow non-residents to qualify based on their financial standing in Canada.

Foreign National Loans

Foreign national mortgages are specifically designed for non-US residents looking to buy property in the US. These loans do not require a US credit history, making them one of the most accessible financing options for Canadians.

Requirements:

- A down payment of 20% or higher

- Canadian credit report or alternative financial documentation.

- Debt-to-Income ratio: 43% or lower

- Cash reserves: 12 Months

DSCR (Debt-Service Coverage Ratio) Loans

A DSCR loan is a mortgage option designed specifically for real estate investors. Instead of evaluating the buyer’s personal income, we qualify the loan based on the rental income generated by the property.

Requirements:

- DSCR Ratio: >= 1 for best terms, <1 eligible with higher down payment

- Down Payment: Minimum 25%

- Cash Reserves: 6 months

- Property appraisal and 1007 Rent Schedule

A DSCR loan is an excellent choice for Canadian investors who want to qualify based on cash flow potential rather than personal income. This makes it easier to invest in rental properties in Arizona without needing extensive financial documents.

I recently worked with a client from Canada who wanted to invest in US real estate but didn’t have a US credit history. I helped him find a high-demand rental property in Arizona, and our mortgage experts helped him secure a DSCR loan, allowing him to qualify based on the property’s rental income. The entire process was handled remotely, and now he’s earning consistent cash flow from his Arizona investment.

With years of experience helping international buyers, I’ve seen how Arizona offers incredible opportunities for Canadians, whether for vacation homes, rentals, or long-term investment. With the right mortgage solution, securing a home here is easier than many expect, even without a US credit history.

Steven Glick, Director of Mortgage Sales, HomeAbroad

Let’s walk through the step-by-step process of buying a home in Arizona as a Canadian.

Step-by-Step Guide: Buying a Home in Arizona as a Canadian

Buying a home in Arizona as a Canadian is a straightforward process, but it’s essential to understand each step to ensure a smooth transaction. Here’s a step-by-step guide:

1. Define Your Goals and Budget

Before starting your search, determine whether you’re buying for personal use, investment, or both. Set a budget, factoring in the purchase price, closing costs, and property taxes.

2. Find the Right Lender

Choosing the right lender is essential for Canadians buying property in Arizona, as not all lenders offer mortgage options for foreign buyers. Working with a lender who understands cross-border financing can make the process much smoother.

At HomeAbroad, we offer tailored mortgage solutions for Canadians, even if you don’t have a US credit history. With competitive rates and tailored financing options, HomeAbroad makes it easy for Canadian buyers to secure funding for Arizona real estate with confidence.

3. Get a Pre-Approval Letter

Getting pre-approved for a mortgage is a crucial step for Canadian buyers looking to finance a home in Arizona. A pre-approval letter from a lender shows sellers that you are a serious buyer and have the financial backing to complete the purchase.

Get pre-approved with HomeAbroad today and take the first step toward securing your dream home in Arizona!

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

4. Find the Right Property

Finding the right property in Arizona can be overwhelming, especially for Canadian buyers searching from abroad. HomeAbroad makes it easier by using its AI-powered property search engine platform to help Canadian buyers find properties that match their investment goals and budgets.

5. Make an Offer

Once you’ve found the perfect property, it’s time to make an offer. With Arizona’s competitive market, having the right support can make all the difference. HomeAbroad helps you submit a strong offer and negotiate the best deal, ensuring you secure the right property at the right price.

6. Get a Title Report and Conduct Inspection

Before closing on a property, it’s important to obtain a title report to verify ownership and check for any legal issues. Additionally, conducting a thorough home inspection ensures the property is in good condition and free of hidden problems. These steps help protect your investment and avoid unexpected complications.

7. Closing Process

The final step in buying a property is closing, where all paperwork is signed, and ownership is officially transferred. This includes finalizing your mortgage, paying closing costs, and ensuring all legal requirements are met. Once completed, you’ll receive the keys to your new property in Arizona.

By following these steps and working with trusted experts, you can seamlessly secure your ideal property in Arizona. With the right planning and support, buying a home as a Canadian can be a smooth and rewarding experience.

Tax Implications for Canadian Buyers

Canadian buyers investing in Arizona real estate should be aware of key tax implications to ensure compliance and maximize returns. The Canada-US Tax Treaty helps prevent double taxation, making it easier to manage rental income and capital gains.

When selling your property, you may be subject to capital gains tax under FIRPTA. To learn more about your tax responsibilities and potential deductions, check out our Comprehensive Tax Guide.

Benefits of buying a house in Arizona as a Canadian

Buying property in Arizona comes with several advantages for Canadian buyers, from favorable weather to strong investment potential. Here’s why Arizona is an excellent choice:

1. Year-Round Sunshine and Warm Climate

Arizona’s consistently warm weather makes it a great escape for Canadians looking to avoid long, harsh winters. The state enjoys sunshine most of the year, creating the perfect environment for outdoor activities and a strong demand for vacation and rental properties.

2. Strong Real Estate Investment Potential

Home prices in Arizona have appreciated 8.4% annually over the last five years, making it a strong market for investment. With a growing population and high rental demand, cities like Phoenix and Scottsdale offer excellent opportunities for long-term appreciation and steady rental income.

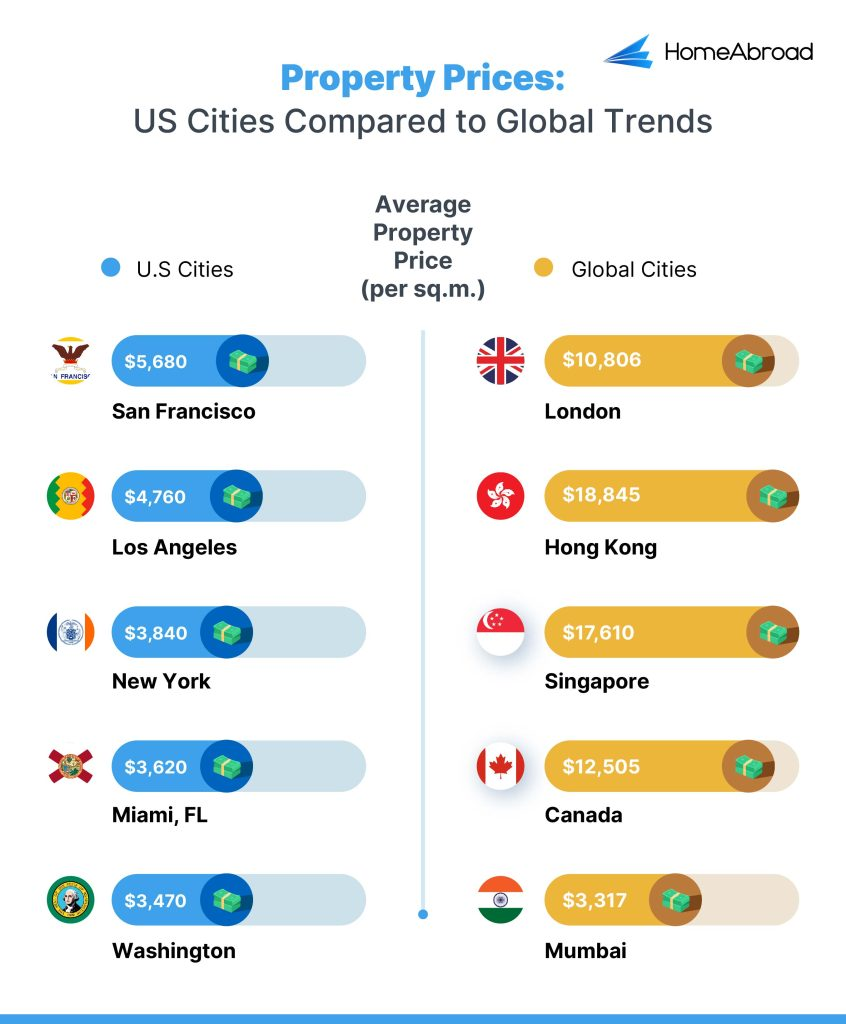

3. Lower Property Prices

Real estate in Arizona is often more affordable than in major Global cities. Lower property prices mean buyers can enter the market with a smaller upfront investment while still securing high-quality real estate.

Here’s a comparison of property prices compared to global cities:

4. High Demand for Rental Properties

With an average rental yield of 5.89%, Arizona offers strong income potential for property investors. The state’s thriving rental market is driven by tourists, students, and job seekers relocating to the area. Short-term rentals, particularly in high-demand cities like Scottsdale and Phoenix, offer excellent opportunities for Canadian investors to generate a steady cash flow.

5. Tax Benefits for Canadian Investors in the US

The Canada-US Tax Treaty helps prevent double taxation, making it easier for Canadians to manage their investment properties while ensuring compliance with tax laws in both countries. Additionally, Arizona’s relatively low property taxes further enhance the financial benefits of investing in real estate, allowing Canadian buyers to maximize their returns.

With these benefits, it’s easy to see why Arizona remains a top choice for Canadian buyers. Next, let’s explore the best locations in Arizona for Canadian real estate investment.

Best places for Canadians to buy property in Arizona

Arizona offers diverse real estate opportunities, from bustling cityscapes to peaceful desert getaways. Here are some of the top locations for Canadian buyers:

City | Avg. Home Value | Avg. Rental Yield |

|---|---|---|

Phoenix | $412,889 | 4.7% |

Scottsdale | $836,034 | 3.2% |

Tucson | $327,578 | 5.4% |

Mesa | $436,165 | 4.4% |

Glendale | $408,990 | 4.8% |

- Phoenix: As the state’s capital and largest city, Phoenix offers a strong job market, growing home values, and high rental demand, making it an excellent choice for investment properties. With a mix of urban living, family-friendly neighborhoods, and investment potential, Phoenix is a top choice for both rental properties and permanent relocation.

- Scottsdale: Known for its upscale communities, golf courses, and vibrant tourism industry, Scottsdale is ideal for those looking to invest in luxury vacation rentals or second homes.

- Tucson: Home to the University of Arizona, Tucson has a strong student rental market, an affordable cost of living, and a growing retiree population. The city’s lower home prices than Phoenix and Scottsdale allow for budget-friendly investments with solid returns.

- Mesa: With affordable housing and steady appreciation, Mesa is an excellent choice for those looking to invest or settle permanently. Its proximity to Phoenix and strong job market make it a desirable location for families and professionals.

- Glendale: A hotspot for entertainment, Glendale is home to major sports venues and a strong short-term rental market. Investors can capitalize on its tourism appeal while families benefit from its suburban feel and excellent amenities.

Whether you’re looking for a second home to escape the Canadian winters, an income-generating rental property, or a place to settle down permanently, Arizona offers excellent opportunities.

Conclusion

Buying real estate property in Arizona as a Canadian offers exciting opportunities, whether you’re looking for a rental property, a vacation home, or planning a permanent move. Arizona continues to attract Canadian buyers with its strong housing market, warm climate, and investor-friendly environment.

At HomeAbroad, we specialize in helping Canadian buyers successfully invest in US real estate. We offer tailored mortgage solutions and expert guidance to make the buying process seamless. Whether you’re looking for a rental property, vacation home, or a long-term investment, HomeAbroad is here to help you every step of the way.

Ready to invest in Arizona? Let HomeAbroad simplify the process and help you secure the perfect property with ease!

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

FAQs

Can Canadians buy property in Arizona?

Yes, Canadians can buy property in Arizona without any restrictions. The process is similar to that for US buyers. HomeAbroad simplifies the journey by offering tailored mortgage options and expert guidance, ensuring a smooth and hassle-free home-buying experience.

Do Canadians need a US credit history to get a mortgage in Arizona?

No, Canadians can qualify for a mortgage without a US credit history. At HomeAbroad, we offer tailored foreign-national mortgages that make it easier for Canadian buyers to secure financing and invest in Arizona real estate without the typical US credit requirements.

What documents do I need to buy property in Arizona?

To purchase property in Arizona, Canadians typically require a valid passport, proof of funds, and a US Individual Taxpayer Identification Number (ITIN) for tax purposes. If financing through a mortgage, additional documents such as bank statements, proof of income, and property details may be required. The exact documentation varies based on the loan program.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Housing Data – Zillow Research

![A Guide for Canadians Buying Property in Arizona [2026]](https://homeabroadinc.com/wp-content/uploads/2023/09/CanadiansbuyinginArizona-500x325.jpg)

![Can Canadians Buy Property in the USA? [2026]](https://homeabroadinc.com/wp-content/uploads/2021/08/CanCanadiansBuyPropertyInTheUSA-scaled.jpg)