Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Georgia, also known as the Peach State, is where the first Coca-Cola was poured and where one of the fastest-growing film industries outside Hollywood continues to thrive, bringing in billions to the state’s economy and supporting tens of thousands of jobs each year.

These job opportunities, along with a steady influx of tourists drawn to Georgia’s vibrant cities and scenic getaways, have fueled strong demand in the housing market, making the state an increasingly attractive destination for international real estate investors.

Whether you’re considering a short-term rental near Atlanta’s business hubs, a multifamily in Augusta, or a quiet suburban home in Savannah, Georgia, offers solid investment opportunities, especially for foreign nationals using DSCR loans from HomeAbroad.

Table of Contents

Key Takeaways:

1. Georgia offers a strong and stable rental market, and DSCR loans from HomeAbroad let foreign investors qualify without US income, credit history, or residency.

2. DSCR loans rely on the property's rental income, not your personal finances, so there’s no need for tax returns, pay stubs, or employment documents.

3. Cities like Atlanta, Augusta, and Savannah offer attractive rental yields, demand from tourism and universities, and solid appreciation potential.

4. HomeAbroad simplifies US real estate investing for global buyers by helping you find high-yield properties, secure financing, set up a US LLC, and complete your closing paperwork, all in one place.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt-Service Coverage Ratio loan) from HomeAbroad is a foreign national mortgage option for international real estate investors. Instead of requiring personal income documents like tax returns or W-2s, DSCR loans qualify you based on the rental income generated by the property itself. If the income can cover the mortgage payments, you’re in a strong position to qualify.

With average rental yields of 7.12% in Georgia cities such as Atlanta, Savannah, and Athens, the state offers plenty of potential for investors looking to grow a cash-flowing portfolio with minimal roadblocks.

How to Calculate Your DSCR Ratio

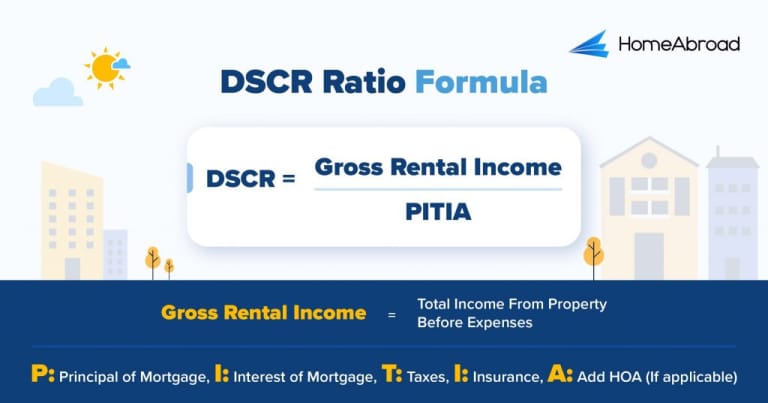

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here’s the formula to calculate your DSCR:

Example

Calculating the DSCR Ratio for a Georgia Property:

A DSCR of 1.0 is generally required, meaning the property’s rental income fully covers the mortgage payment. But at HomeAbroad, we know that some high-potential properties fall just below that mark and still make great investments.

One of my clients from the UAE wanted to purchase a long-term rental just outside Atlanta. The property had high potential, but his DSCR came in slightly short, around 0.86. Instead of turning him away, I helped him get approved through our No-Ratio DSCR Program, which offers more flexibility for deals that fall below the standard DSCR requirement

It’s a practical solution for foreign nationals who see strong long-term potential in a property but fall just short of the standard DSCR requirement. However, this option requires a larger down payment (a 5% hit to LTV) and comes with higher interest rates to mitigate the additional risk.

DSCR Loan Requirements in Georgia for Foreign Nationals

Unlike traditional lenders, HomeAbroad offers a streamlined DSCR loan process built specifically for foreign nationals investing in Georgia real estate.

Whether you’re investing from overseas or don’t have a US credit history, our flexible lending terms, remote closing, and foreign national-friendly process make Georgia real estate more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We provide DSCR Loans for foreign nationals at a DSCR ratio as low as 0.75, which means you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require you to have a minimum credit score of 620. Many lenders also do not consider foreign credit reports |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements for Foreign Nationals

Besides the DSCR ratio, down payment, and credit score, here are a few more things to know when applying for a DSCR loan in Georgia as an international real estate investor.

With years of experience working with international buyers, HomeAbroad offers expert guidance at every step. Our AI-driven investment property search platform helps you discover high-yield properties across Georgia, while our team finds the right DSCR loan solution to match your investment goals.

Areas We Lend in Georgia

From Atlanta to Savannah, HomeAbroad makes DSCR loans available across Georgia. Below are a few cities where you can secure financing with us.

- Atlanta

- Alpharetta

- Athens

- Savannah

- Augusta

- Columbus

- Macon

- Sandy Springs

- Roswell

- Marietta

- Jasper

- Blairsville

Let’s examine a case study of one of our past clients to understand how profitable investing in the Georgia real estate market can be.

Case Study: Li Wei, a Chinese Investor, Buys His First US Rental Property in Georgia

Li Wei, a business owner from Shenzhen, China, wanted to diversify his portfolio by entering the US rental market. After researching multiple cities, he identified Augusta, Georgia, as a promising location due to its stable rental demand and lower entry prices.

Despite having strong rental projections for the property, he struggled to secure financing through traditional lenders due to limited US credit history.

After being turned down by several banks, Li connected with HomeAbroad to explore alternatives.

The Solution: HomeAbroad Loans’ DSCR Loan

HomeAbroad helped Li secure a DSCR loan based solely on the projected rental income of the property. The monthly rent from the single-family home in Augusta was estimated at $2,150, while the monthly PITIA (principal, interest, taxes, insurance, and HOA) came to $1,700, giving the property a DSCR of 1.26.

With a 30-year fixed rate of 7.45%, Li was approved for a $392,000 loan. The deal closed in just under four weeks.

- Loan Amount: $392,000

- Purpose: Investment Purchase

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.45%

- DSCR: 1.26

- Time to Close: 26 days

Why This Worked for Li:

- No US Credit Score Needed: The loan was based on the strength of the property, not his personal credit profile.

- Rental Income Covered the Loan: A DSCR of 1.26 showed the property generated more than enough income to support the mortgage.

- Seamless Remote Process: Li was able to close from China with HomeAbroad’s remote support and on-ground coordination.

With HomeAbroad’s guidance, Li now owns a solid rental asset in the US and is already exploring his next purchase.

Top Places to Invest in Georgia with a DSCR Loan

Georgia is emerging as a smart pick for real estate investors, thanks to strong rental demand, affordable property prices, and consistent population growth. Cities like Atlanta, Augusta, and Savannah offer great opportunities for both long-term and short-term rentals.

For foreign nationals, DSCR loans make Georgia even more accessible. Since these loans focus on a property’s rental income, not the borrower’s income, they’re ideal for tapping into Georgia’s high-yield markets without traditional financing roadblocks.

Here are some top investment cities in Georgia:

City | Rental Type | Rental Yield |

|---|---|---|

Augusta | Long-Term | 9.2% |

Macon | Long-Term | 8.75% |

Atlanta | Short-Term | 8.09% |

Savannah | Long-Term | 6.58% |

Athens | Long-Term | 6% |

Augusta: Affordable Entry with Consistent Demand

Best known for the Masters Tournament, Augusta also benefits from a strong medical and military presence that fuels year-round rental demand.

- Median Home Price: $173,815

- Average Rent: $1,342/month

What this means for investors: Low purchase prices paired with strong rental income make Augusta an ideal market for hitting DSCR benchmarks quickly.

Investment Properties Listed Today on Sale in Augusta

Macon: Underrated, Affordable, and Consistently Profitable

Macon flies under the radar, but for investors chasing returns, it’s a solid pick. With reliable demand from college students, healthcare workers, and a growing logistics sector, Macon’s rental market holds up well even during economic shifts.

- Median Home Price: $169,737

- Average Rent: $1,239/month

What this means for investors: With yields close to 9%, Macon offers dependable long-term income and easy DSCR loan qualification, even without a US credit score or tax history.

Investment Properties Listed Today on Sale in Macon

Atlanta: The Economic Engine of the Southeast

Atlanta is a magnet for business, tech, and entertainment, which translates to high and steady rental demand. It’s pricier than other Georgia cities, but with rental rates to match, many neighborhoods in Atlanta still make the DSCR math work.

- Median Home Price: $402,035

- Average Rent: $2,713/month

What this means for investors: High occupancy and premium nightly rates make Atlanta ideal for short-term DSCR investments. It’s a market where strong cash flow can offset higher property prices, even for out-of-state or foreign investors.

Investment Properties Listed Today on Sale in Atlanta

Savannah: Historic Charm with Growing Rental Returns

Savannah’s mix of tourism, port activity, and steady population growth makes it a dependable rental market. Its downtown district and surrounding areas offer long-term rental stability, especially for those catering to families and young professionals.

- Median Home Price: $334,858

- Average Rent: $1,837/month

What this means for investors: Savannah gives a balance of short-term appreciation and long-term rental income. It’s ideal for DSCR loans focused on consistent occupancy over flashy yields.

Investment Properties Listed Today on Sale in Savannah

Athens: Reliable Income in a University Town

Home to the University of Georgia, Athens offers a built-in rental base that resets every academic year. Healthcare and small business growth add to its stability, making it a smart pick for conservative investors.

- Median Home Price: $338,221

- Average Rent: $1,692/month

What this means for investors: Reliable occupancy and affordable entry costs make Athens a solid choice for long-term DSCR rental investments, especially for those seeking lower-risk, steady returns.

Investment Properties Listed Today on Sale in Athens

Specific Considerations for Investing in Georgia for Foreign Nationals

Georgia offers a promising mix of affordability, rental income potential, and investor-friendly policies. But like any state, it comes with its own set of rules, risks, and local dynamics. From landlord laws to market volatility in different cities, foreign investors should approach with clarity and preparation.

Here are the most critical factors to keep in mind:

1. Property Taxes and Local Assessments

Georgia has relatively low property taxes, which can boost your ROI compared to other states. However, some counties reassess property values more frequently, and city-level taxes or special assessments (especially in areas like Atlanta or Savannah) can impact your annual outlay. Always verify county-specific millage rates before closing.

2. No State Rent Control

There are no rent control laws in Georgia, which gives landlords more flexibility to adjust rents in line with market conditions. However, fair housing laws still apply, and sharp rent hikes in gentrifying areas can trigger tenant pushback or media attention.

3. LLC Formation for Foreign Owners

Many non-US investors purchase through a US-based LLC. Georgia recognizes these structures, and forming one can protect your personal assets, simplify inheritance, and offer potential tax advantages.

4. US Tax Compliance and Withholding Rules

Foreign nationals pay the same taxes as US residents, which include property taxes and capital gains tax. Rental income is subject to both federal and Georgia state tax, and FIRPTA withholding may apply when you sell. Understanding these obligations is essential to staying compliant and protecting your returns.

Strategic & Future Considerations for Foreign Nationals Investing in Georgia

Georgia’s real estate market is gaining momentum among global investors, not just for affordability, but for long-term potential tied to infrastructure growth, population trends, and a business-friendly environment.

Here are some future considerations that international real estate investors need to pay attention to:

Business-Friendly Environment

Georgia consistently ranks among the top states for business, thanks to low taxes and pro-development policies. This economic climate fuels job growth and housing demand, especially in metro areas like Atlanta and Savannah.

Airport Connectivity and Logistics Growth

With Hartsfield-Jackson Atlanta International Airport being the world’s busiest, and Savannah’s port expanding, both cities are seeing steady commercial and residential growth driven by logistics and trade.

Student Housing Demand

Cities like Athens (home to the University of Georgia) offer reliable income potential through student rentals, with relatively low vacancy rates and consistent demand.

Shift Toward Build-to-Rent Communities

Build-to-rent housing is growing fast in Georgia’s suburbs. This trend can benefit foreign investors looking for newer, professionally managed properties that attract stable tenants.

Get a DSCR Loan in Georgia with HomeAbroad

HomeAbroad simplifies real estate investing with tailored DSCR loans specifically for global real estate investors. We offer flexible terms and competitive rates to help you grow a high-performing real estate portfolio.

Beyond financing, we provide an AI-powered investment property search platform and expert guidance through a network of 500+ real estate agents. Additionally, we offer concierge services for LLC formation, opening US bank accounts, homeowners’ insurance, property management, and ongoing investment support.

Invest in Georgia’s cash-flowing properties with confidence. Apply for a DSCR loan today!

Frequently Asked Questions

Are DSCR loans suitable for short-term rental properties, such as Airbnb, in Georgia?

DSCR loans can be suitable for short-term rentals in Georgia, as they assess the property’s income potential rather than the borrower’s. However, lender requirements on rental income and property type may vary.

Is cash-out refinancing available for DSCR loans in Georgia?

HomeAbroad Loans offers cash-out refinancing options for DSCR loans, allowing investors to tap into the equity in their properties for further investments or renovations.

Can self-employed borrowers apply for a DSCR loan in Georgia?

Yes, DSCR loans are ideal for self-employed borrowers who may not have consistent personal income or tax returns, as the loan qualification is based on the property’s income rather than the borrower’s personal financial history.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices