Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways

1. HomeAbroad DSCR loans in New York allow international real estate investors to qualify based on the property's rental income alone, so there is no need for US credit history, income documents, or residency.

2. With no personal tax returns, W-2s, or pay stubs required, DSCR loans offer a streamlined path to financing short-term rentals, long-term rentals, and multi-family properties.

3. Top New York markets like New York City, Buffalo, and Rochester offer strong rental demand, diverse tenant bases, and long-term appreciation potential, making them ideal for global investors.

4. HomeAbroad simplifies the investment journey for foreign nationals by offering an AI-driven investment property search, tailored mortgage solutions, LLC setup assistance, US bank account support, and full guidance through closing.

Table of Contents

Did you know New York is home to more millionaires than any other city in the world? It’s, therefore, no surprise that the Empire State is a magnet for real estate investment, especially when you can finance property here without jumping through the usual income-verification hoops.

How?

Using HomeAbroad DSCR (Debt Service Coverage Ratio) loan. Instead of relying on your personal income, this tailored foreign national mortgage solution lets you qualify based on the property’s rental income.

Whether you’re eyeing a Brooklyn brownstone, a short-term rental in the Catskills, or a multi-family in Buffalo, the numbers do the talking – not your personal income.

By focusing on cash-flowing properties, DSCR loans help you build a portfolio that pays for itself. And with strong rental demand across New York, many investors are not only covering their mortgages but also generating steady monthly income and long-term equity gains.

Get started with a HomeAbroad DSCR loan and kickstart your investment journey today!

What is a DSCR Loan for Foreign Nationals?

A DSCR (Debt Service Coverage Ratio) loan is an investment mortgage option tailored for international real estate investors, allowing them to qualify based on the property’s rental income instead of personal income. Unlike traditional loans that rely heavily on your personal income, HomeAbroad DSCR loans focus solely on the property’s ability to generate rental income.

With New York’s average rental yield at 8.47%, real estate investors can use DSCR loans to finance high-yield properties while maximizing returns in key markets like New York City, Buffalo, and Rochester.

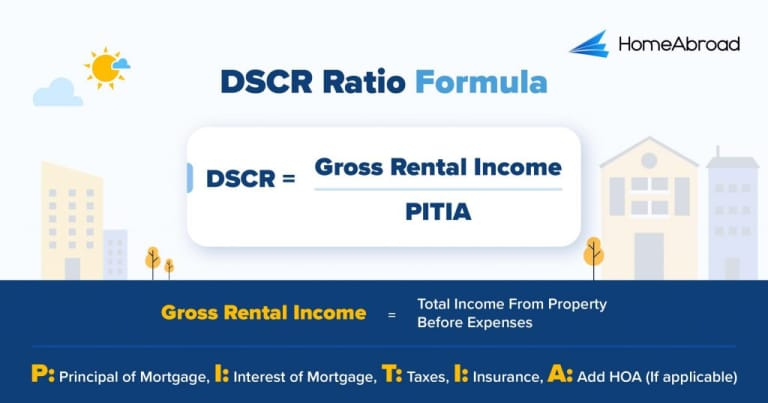

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio (DSCR) helps determine if a property’s rental income is sufficient to cover its mortgage payments. A higher DSCR indicates a lower risk for lenders, increasing the chances of loan approval.

Here is the DSCR Formula:

Example:

A DSCR of 1.38 indicates that the property generates more income than is needed to cover its debt obligations, ensuring a positive cash flow. At HomeAbroad, we typically require a DSCR of 1.0 or higher to qualify, meaning the property’s rental income should be sufficient to cover mortgage payments.

But what if your DSCR is below 1? I recently worked with an investor from Canada who found a promising rental property but got rejected by other lenders because his DSCR was only 0.89, slightly below the standard requirement. Instead of missing out on a great investment, I helped him secure financing through our No-Ratio DSCR loan, which allows qualification with a DSCR between 0 - 1.

Although this option requires a slightly larger down payment (a 5% hit to LTV) and carries higher interest rates, it offers valuable flexibility for investors with strong long-term plans.

Whether you’re scaling your portfolio or acquiring your first rental property, HomeAbroad offers tailored financing solutions to help you succeed even in cases where rental income is slightly lower than the mortgage payments.

DSCR Loan Requirements in New York for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined DSCR loan process tailored specifically for foreign nationals investing in New York real estate.

Our flexible terms, minimal documentation requirements, and remote closing support make buying in New York easier than ever. Here’s how our DSCR lending criteria for foreign nationals stack up against conventional lenders:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We provide DSCR Loans for foreign nationals at a DSCR ratio as low as 0.75, which means you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require you to have a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond DSCR ratio, down payment, and credit score, there are a few other requirements that foreign real estate investors should know about when investing in New York:

With deep expertise working with international real estate investors, the HomeAbroad team offers hands-on support throughout your investment journey. Our AI-driven investment property search platform helps you identify high-yield opportunities in New York, while our loan experts tailor the best DSCR financing solution to match your goals.

Where We Lend DSCR Loans in New York

HomeAbroad offers DSCR loans across New York, with tailored support for global investors in high-potential markets like New York City, Buffalo, Rochester, and beyond. Here are a few key cities where we provide DSCR loans for international real estate investors:

- New York City

- Buffalo

- Rochester

- Albany

- Yonkers

- Syracuse

- New Rochelle

- Schenectady

- Binghamton

- Mount Vernon

- Ithaca

- Poughkeepsie

Wondering how this all comes together in the real world? Here’s a real-life example of how one foreign national from Brazil used a DSCR loan to grow his investment portfolio in New York.

Case Study: Brazilian Investor Scales His Real Estate Portfolio in New York with a DSCR Loan

Rafael Costa, a real estate investor based in Sao Paulo, Brazil, wanted to diversify his portfolio by investing in stable, cash-flowing US properties. He identified upstate New York as a promising market, but without a US visa, credit history, or income, traditional lenders wouldn’t even consider his application.

The Solution: HomeAbroad Loans’ DSCR Loan

Rafael was able to secure HomeAbroad DSCR loan based entirely on the rental income of the property he wanted to purchase in Buffalo, NY. With no requirement for personal income verification, US tax documents, or a visa, he was able to qualify remotely.

One of HomeAbroad’s mortgage officers helped Rafael navigate the process, including LLC setup, US bank account assistance, and remote closing – all tailored for international real estate investors.

Loan Details:

- Loan Amount: $251,920

- Purpose: Purchase

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.2%

- Time to Close: 32 days

Why This Worked for Rafael:

- No Visa or Residency Required: HomeAbroad specializes in financing global real estate investors who live abroad and do not hold any US immigration status.

- Rental Income – Based Approval: Rafael qualified using the property’s projected income.

- End-to-End Support: Rafael received full assistance with setting up a US LLC, opening a US bank account for rent collection, and completing the entire process from Brazil.

Thanks to HomeAbroad’s tailored DSCR loan program, Rafael successfully financed a multi-family rental in Buffalo and took his first step into the US real estate market, without ever needing to set foot in the country.

Steven Glick

Director of Mortgage Sales,

HomeAbroad Loans

Top Places to Invest in New York with a DSCR Loan

New York offers diverse real estate investment opportunities, from high-demand urban rentals to stable suburban markets. With an average rental yield of 8.47%, the state provides strong potential for cash-flowing properties.

Whether you’re targeting short-term rentals in major metros or long-term income properties in upstate regions, a DSCR loan can help you secure financing without relying on personal income verification. Here are some top cities in New York for real estate investors:

City | Rental Type | Rental Yield |

|---|---|---|

Buffalo | Short Term | 14.1% |

Rochester | Long term | 8% |

New York City | Short term | 7.5% |

Albany | Long term | 6.5% |

Buffalo, NY: Affordable & High-Yield Cash‑Flow Market

Buffalo has become a go-to destination for investors seeking strong cash flow and low entry barriers. With its revitalizing downtown, growing student population, and steady tourism, the city supports both short-term and long-term rental strategies. Home prices remain relatively affordable, while demand continues to grow in key neighborhoods.

Median Home Price: $243,408

Average Rent: $1,400

What this means for investors:

Buffalo offers one of the most favorable environments for DSCR financing. The strong rental income relative to property cost makes it easier to meet DSCR qualification thresholds. Global investors can enter the market with less capital and still generate positive cash flow, making it ideal for both first-time and portfolio investors.

Investment Properties Listed Today on Sale in Buffalo

Rochester, NY: University Hub with Long-Term Stability

Rochester is anchored by major universities, medical centers, and a diversified economy, making it a stable and recession-resistant market. With consistent demand from students, healthcare workers, and young professionals, long-term rentals are especially strong here.

Median Home Price: $238,173

Average Rent: $1,450

What this means for investors:

Rochester offers dependable rental income and lower upfront investment costs. The strong rent-to-price ratio makes it easier to secure DSCR loans and maintain positive cash flow. It’s an excellent market for building a reliable income stream with long-term tenants and stable occupancy.

Investment Properties Listed Today on Sale in Rochester

New York City, NY: Premium Market with Global Appeal

New York City remains one of the most iconic and resilient real estate markets in the world. From Manhattan to Brooklyn and Queens, demand for rentals, especially furnished short-term units, continues to outpace supply. While property prices are higher, the rental market is dynamic and driven by a constantly renewing tenant base.

Median Home Price: $808,970

Average Rent: $3,800

What this means for investors:

Despite the higher cost of entry, NYC offers strong rental potential and long-term appreciation. Short-term rentals and furnished units can perform exceptionally well in the right neighborhoods. For DSCR financing, international real estate investors benefit from the city’s consistent rental income and premium rent levels, helping justify loan approvals even with steeper property prices.

Investment Properties Listed Today on Sale in New York

Albany, NY: Government-Fueled Stability with Room for Growth

As New York’s capital, Albany benefits from a stable employment base tied to government, education, and healthcare. The city has seen a recent influx of remote workers and urban spillover from nearby metros, strengthening its rental market.

Median Home Price: $322,882

Average Rent: $1,619

What this means for investors:

Albany offers steady income potential and low vacancy risk, making it a great fit for conservative, income-focused foreign national investors. While appreciation may be more gradual, the market’s reliability makes it ideal for DSCR loans that prioritize stable cash flow over speculative growth.

Investment Properties Listed Today on Sale in Albany

Specific Considerations for Investing in New York for Foreign Nationals

New York’s real estate market is among the most dynamic and diverse in the country, offering strong potential for long-term appreciation. However, its regulatory landscape and regional complexities require a well-informed approach, especially for international investors.

Here are the most critical factors to keep in mind:

– New York’s Property Tax and Insurance Landscape

Property taxes in New York vary significantly by county, with downstate areas like Long Island and Westchester carrying some of the highest rates. Insurance requirements are also stricter in multi-family and rent-regulated buildings. Older properties in New York City may demand higher premiums due to aging infrastructure or code upgrades.

– Regulatory and Zoning Complexity

Zoning in New York, particularly in New York City, is highly nuanced. From FAR (Floor Area Ratio) limits to historic district restrictions, what you can do with a property depends heavily on its zoning classification. Understanding zoning before purchase is crucial, especially for those considering multifamily or short-term rental strategies.

– Short-Term Rental Restrictions

New York City has some of the most stringent short-term rental laws in the country. Rentals of less than 30 days are largely prohibited unless the host is present and the property meets specific criteria. Outside NYC, regulations vary by municipality.

– Rent Stabilization and Landlord-Tenant Laws

New York has extensive tenant protections, particularly for rent-stabilized or rent-controlled units. Rent increases are regulated, and eviction processes are more tenant-friendly compared to other states. Landlords must adhere to strict rules around habitability, maintenance, and security deposit handling.

Strategic & Future Considerations for Foreign Nationals Investing in New York

New York continues to attract global investors with its dynamic economy, global status, and diversified real estate market. While Manhattan often takes the spotlight, shifting migration patterns, infrastructure upgrades, and evolving market dynamics are expanding the investment map for international real estate investors across the state.

Here are some forward-looking considerations for foreign nationals planning to invest in New York:

1. Open Access for Foreign Buyers: New York imposes no restrictions on foreign nationals purchasing real estate. This regulatory openness, coupled with strong property rights, makes the state a secure and stable environment for cross-border investments, from residential condos to commercial properties.

2. Urban-Core vs. Outer-Borough Investment Shifts: While Manhattan remains a global trophy market, investors are increasingly looking to the outer boroughs, such as Brooklyn, Queens, and parts of the Bronx, for better yields, redevelopment potential, and long-term appreciation. These areas are being transformed by new zoning, transit-oriented projects, and demographic shifts.

3. Luxury Real Estate and Foreign Buyer Trends: International demand for luxury real estate, especially in Manhattan and parts of Brooklyn, continues to shape pricing and competition. That said, foreign real estate investors are becoming more selective, prioritizing new-build properties with privacy, amenities, and tax-efficiency over legacy buildings with higher carrying costs.

4. Rising Importance of Transit and Development Corridors: Major public investments, such as the expansion of the Second Avenue Subway, Penn Station redevelopment, and Hudson Yards infrastructure, are creating new zones of interest for foreign investors. Access to these corridors often translates to better rental demand, long-term price appreciation, and business potential.

Get a HomeAbroad DSCR Loan in New York as a Foreign National

Investing in New York real estate is easier with HomeAbroad’s DSCR loans. Instead of relying on personal income or US credit history, our loans qualify you based on the property’s rental income, making it ideal for international real estate investors investing across the state.

With flexible terms, competitive rates, and full support for refinancing, HomeAbroad helps you maximize returns at every stage. Whether you’re looking to lower your interest rate, reduce monthly payments, or tap into your property’s built-up equity, our DSCR refinance options give you the flexibility to reinvest and grow.

Our AI-driven investment property search platform helps you identify high-yield investment properties, while our experienced team ensures fast approvals and a seamless closing process.

Start growing your real estate portfolio with a HomeAbroad DSCR loan today!

Frequently Asked Questions

Can a foreign national use a DSCR loan in New York for refinancing?

Yes, foreign nationals can qualify for HomeAbroad DSCR loans in New York. These loans are ideal because they don’t require a US credit history or personal income verification. Approval is based primarily on the property’s rental income, making them highly accessible to international real estate investors.

Do I need a US visa to apply for a DSCR loan in New York?

No, a US visa is not required to apply for a DSCR loan. As long as you have a valid passport and can provide basic documentation (such as proof of funds and identification), you can apply. HomeAbroad specializes in helping foreign nationals without a US visa secure financing.

Can I refinance my existing US property as a foreign national using HomeAbroad DSCR loan?

Yes, HomeAbroad DSCR loans can be used for refinancing. Foreign nationals can refinance to lower their interest rate, reduce monthly payments, or access equity from their existing investment property, even without US income or credit.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

AirDNA: https://www.airdna.co/vacation-rental-data/app/us/california

Zillow: Housing Data – Zillow Research