Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Ohio’s rental property market, particularly in cities like Columbus, Cleveland, and Cincinnati, offers high rental yields, affordable home prices, and growing tenant demand. With DSCR loans from HomeAbroad, international real estate investors can now qualify without US income, credit history, or residency status.

2. DSCR loans are approved based on the rental income of the property, not the borrower's personal income or financial documents. That means international real estate investors don’t need to submit US tax returns, pay stubs, or employment verification to qualify for this loan.

3. Ohio’s economy is backed by thriving industries like healthcare, logistics, and education, supporting long-term rental demand across major cities. Combined with low property acquisition costs, this makes Ohio a strong choice for international buyers seeking steady cash flow and appreciation.

4. HomeAbroad simplifies the real estate investment process end-to-end for global investors. From discovering high-performing properties through our AI-driven investment property search platform to getting DSCR loan financing, forming a US LLC, and opening a US bank account, we handle the complexity so you can focus on growing your real estate portfolio.

Table of Contents

Welcome to Ohio—the Buckeye State, where aviation was born, college football is a way of life, and you’ll find both small-town charm and big-city opportunities, ticking all the boxes for your next real estate investment.

But lately, it’s not just students or sports fans calling Ohio home; international real estate investors are taking notice, too. With affordable property prices, strong rental demand, and a steady economy, this Midwest state is becoming a top pick for foreign national investors, and now you can finance investment properties all across Ohio using DSCR loans from HomeAbroad.

Whether you’re considering a rental in Columbus, a duplex in Cleveland, or a triplex in Cincinnati, Ohio offers it all: stable cash flow and long-term potential, all without the usual financing roadblocks, all with HomeAbroad’s flexible DSCR loan.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt Service Coverage Ratio loan) is a mortgage solution designed specifically for international real estate investors, including foreign nationals, that qualifies you based on the property’s rental income rather than your personal income, tax returns, or employment history. Instead of focusing on personal financial documents, DSCR loans evaluate whether the property’s rental income can cover the mortgage payments.

We recently worked with a South African investor who secured a rental property in Ohio, a state with an average rental yield of 6.8%, using a DSCR loan. Despite having no US credit history or verifiable income, she was approved based solely on the property’s strong cash flow. We’ll explore her full story in the case study section later in this article.

With DSCR loans from HomeAbroad, global investors can overcome traditional lending barriers and tap into high-performing markets throughout Ohio and beyond, whether for long-term leases or short-term rentals.

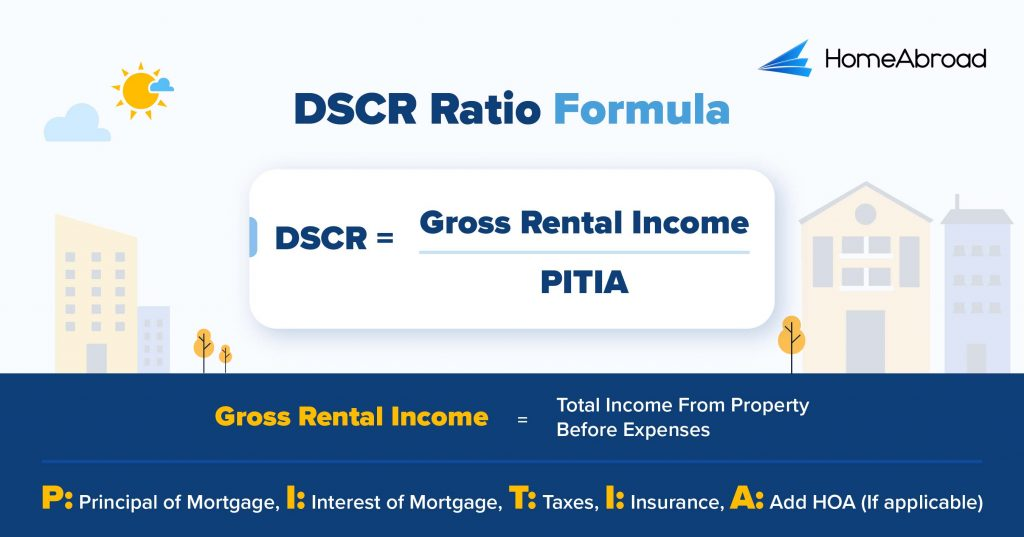

How to Calculate the DSCR Ratio?

The Debt Service Coverage Ratio (DSCR) is a key metric lenders use to determine if a rental property’s income is sufficient to cover its mortgage payments.

It’s calculated using this formula:

Example

A DSCR of 1.25 indicates that the property’s rental income is 25% higher than its monthly mortgage payment, signifying strong cash flow and financial stability.

Our DSCR loans are designed to qualify you based on a property's income potential. A standard DSCR loan works by ensuring the monthly gross rent is equal to or greater than the mortgage payment (PITIA), which means your DSCR is 1.0 or higher. This is the ideal scenario that qualifies you for the best terms.

However, we understand that not every property's rental income will meet this threshold, which is why we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. With the No-Ratio program, you can still secure financing, although it will require a slightly larger down payment (a 5% reduction in LTV) and a higher interest rate. This option is ideal for investors with a strong long-term strategy who want to acquire properties that may not immediately generate a 1.0 cash flow ratio.

You can check current DSCR loan interest rates and explore additional options through our dedicated DSCR loan hub at HomeAbroad, making it easier to secure financing that aligns with your investment strategy.

DSCR Loan Requirements in Ohio for Foreign Nationals

Compared to traditional lenders, HomeAbroad simplifies the DSCR loan process with a mortgage solution designed specifically for foreign national investors.

If you’re purchasing US real estate from overseas or don’t have a US credit score or income history, our flexible guidelines, remote-friendly process, and minimal documentation requirements make it significantly easier to invest, especially in thriving markets like Ohio.

Here’s a side-by-side comparison of how our foreign national mortgage DSCR loan criteria compare to conventional lending options.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

Beyond just the DSCR ratio, down payment, and credit score, several additional factors can influence your ability to qualify for a DSCR loan as a foreign investor in Ohio. We put our best foot forward in addressing these factors, providing extra flexibility.

At HomeAbroad, we’ve helped countless international real estate investors successfully invest in the Ohio real estate market. From identifying the right properties through our AI-driven investment property search platform to customizing the most suitable DSCR loan structure, our expert team is here to guide you through every step of the process.

Where We Lend DSCR Loans in Ohio

HomeAbroad offers DSCR loans across Ohio, providing tailored support for global investors in top-performing cities, including Columbus, Cleveland, Cincinnati, Toledo, and more. Here are a few cities in Ohio where we offer DSCR Loans.

- Columbus

- Cleveland

- Cincinnati

- Toledo

- Dayton

- Akron

- Youngstown

- Parma

- Dublin

- Middletown

- Mentor

- Lakewood

- Canton

- Lorain

- Avon

- Hilliard

To see how a DSCR loan works for global investors, let’s evaluate a real-life case study of our recent client, a South African Investor who successfully secured a DSCR Loan in Ohio with HomeAbroad.

Case Study: How a South African Investor Secured a DSCR Loan in Ohio

Sarah Williams, an investor from South Africa, sought to diversify her real estate portfolio by investing in a high-return rental property in Lorain, Ohio. However, as a foreign national with no US credit history and limited familiarity with the local market, she faced multiple challenges securing financing through conventional lenders.

The Solution: HomeAbroad’s DSCR Loan Program

Instead of going through the traditional income-verification route, Sarah chose a DSCR loan from HomeAbroad, which allowed her to qualify based solely on the property’s rental income, thereby completely bypassing the need for US tax returns or employment history.

Working closely with Steven Glick, Director of Mortgage Sales at HomeAbroad, Sarah was offered a DSCR loan tailored to her investment profile, resulting in quick and smooth approval.

Loan & Property Details:

- Property Location: 1863 E 30th St, Lorain, OH 44055

- Property Value: $140,000

- Monthly Rent: $2,656

- Rental Yield: 22.77%

Mortgage Details:

- Loan Amount: $105,000

- Down Payment: $35,000

- Interest Rate: 7.25%

- Loan Term: 30-Year Fixed

- Monthly Mortgage (PITIA): $914

DSCR Breakdown:

DSCR = Gross Monthly Rent ÷ PITIA

DSCR = $2,656 ÷ $914 = 2.9

With a DSCR of 2.9, Sarah’s property comfortably exceeded the typical qualifying threshold, ensuring strong cash flow and lender confidence.

Why This Worked for Sarah:

- No US Credit History Required: Qualification was based entirely on rental income, not personal financials.

- Strong Cash Flow Property: The high DSCR made loan approval straightforward and fast.

- End-to-End Investor Support: HomeAbroad assisted with setting up a US LLC, opening a US bank account, and managing the entire process remotely.

- AI-driven Property Investment Search Platform: Using HomeAbroad’s AI-driven investment property search platform, Sarah quickly identified a property that matched her cash flow goals.

This case highlights HomeAbroad’s commitment to helping international real estate investors enter the US real estate market, offering flexible loan structures and comprehensive support to overcome the typical challenges of credit, income, and geographic location.

You can learn more about this case study here.

Top Places to Invest in Ohio with a DSCR Loan

Ohio offers substantial potential for international real estate investors looking to maximize cash flow and enter the US market at a lower cost. With affordable property prices, steady rental demand, and a diverse economic foundation, the state provides an ideal environment for income-focused investment strategies.

For foreign nationals and global investors, DSCR loans make investing in Ohio even more accessible. Since qualification is based on the property’s rental income rather than the borrower’s income or credit history, it’s easier to secure financing even without a US financial footprint.

Whether you’re interested in long-term residential rentals or short-term leasing opportunities, Ohio’s market fundamentals align well with DSCR loan financing, offering both stability and room for growth.

Here are some of the top-performing cities in Ohio to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Cleveland | Short-Term | 27.9% |

Toledo | Short-Term | 18.66% |

Youngstown | Long-Term | 14.97% |

Akron | Long-Term | 10.3% |

Dayton | Long-Term | 6.9% |

Need help finding the right investment property? Our AI-powered investment property search platform can help you discover high-performing rentals in Ohio or anywhere in the US!

Cleveland: Rust Belt Revival Meets Rental Opportunity

Cleveland’s transformation is quietly gaining momentum. From a revitalized downtown to booming sectors in healthcare and biotech, the city is attracting renters and remote workers alike. Its affordability, paired with strong short-term rental returns, makes it a rising favorite for cash flow investors.

- Median Home Price: $108,333

- Average Rent: $1,200/month

What this means for investors: Low acquisition costs and a rent-to-price ratio over 13% make Cleveland a prime target for short-term rentals and DSCR strategies. With the Cleveland Clinic and University Circle driving demand, landlords are seeing high occupancy and above-average nightly rates, especially in downtown, Tremont, and Ohio City.

Investment Properties Listed Today on Sale in Cleveland

Toledo: America’s Underrated High-Growth Market

Toledo has quietly become one of the hottest real estate markets in the Midwest. A rebounding manufacturing base, high rental yields, and surging buyer interest, especially from out-of-state investors, have earned it top rankings for 2025 housing performance.

- Median Home Price: $123,667

- Average Rent: $950/month

What this means for investors: With median home prices still under $140K and rapid appreciation, Toledo offers some of the best cash-on-cash returns in the country. Investor activity is increasing rapidly, but rents remain affordable, enabling the meeting of DSCR metrics with room to spare. Consider areas such as the Old West End and Downtown for a balanced risk-to-return ratio.

Investment Properties Listed Today on Sale in Toledo

Youngstown: Ultra-Affordable Market with Long-Term Promise

Youngstown is one of the most affordable housing markets in the US, and that’s precisely why investors are paying attention. While not a flash-in-the-pan short-term play, it’s gaining traction as a stable, long-term rental market with growing local infrastructure and state-backed redevelopment.

- Median Home Price: $76,133

- Average Rent: $950/month

What this means for investors: For those focused on long-term holds and steady income, Youngstown checks all the boxes. High rent-to-price ratios and limited competition mean investors can secure deals below market value. Ideal for DSCR strategies that favor stable monthly income over short-term speculation.

Investment Properties Listed Today on Sale in Youngstown

Akron: College Town Stability Meets Blue-Collar Resilience

Akron blends university-town consistency with industrial market fundamentals. The presence of the University of Akron and major employers, such as Summa Health, supports consistent rental demand. Investors benefit from a tenant base comprising students, hospital staff, and working professionals.

- Median Home Price: $120,833

- Average Rent: $1,037/month

What this means for investors: Akron’s combination of stable rents and low property prices creates a reliable path to DSCR qualification. Long-term leases tend to dominate the market, and vacancy rates remain low near institutions and major hospitals. It is a clever investment option for those seeking dependable, low-maintenance rental income.

Investment Properties Listed Today on Sale in Akron

Dayton: Aerospace Engine Driving Steady Returns

Dayton, the birthplace of aviation, is also soaring as a real estate investment hub. With Wright-Patterson Air Force Base, defense contractors, and a robust healthcare sector, it’s a city built for economic resilience. The market is gaining attention for its affordability and high rent-to-value ratios.

- Median Home Price: $169,483

- Average Rent: $975/month

What this means for investors: Dayton offers strong rental returns in a city with low purchase prices and rising demand. Investors are finding it easy to hit DSCR targets, especially in areas close to base operations or downtown. The city’s steady job growth and low vacancy rates support long-term rental income and appreciation.

Investment Properties Listed Today on Sale in Dayton

Specific Considerations for Investing in Ohio for Foreign Nationals

Ohio has become a strategic destination for international real estate investors looking to build long-term rental portfolios in the US. Its affordable home prices, steady tenant demand, and flexibility with DSCR loans make it a compelling market. However, there are several unique local considerations investors should be aware of when purchasing income-generating property in the state.

1. Landlord-Tenant Laws and Eviction Process

Ohio is generally landlord-friendly, with no statewide rent control and a relatively streamlined eviction process. However, each county has its specific notice periods and legal procedures. A missed step, such as incorrect delivery of notice or court filing errors, can delay removals and affect income continuity. Professional property management is advisable, especially for international investors who manage their properties remotely.

2. High and Variable Property Taxes

Ohio’s property taxes are among the highest in the country, with significant differences depending on the county. The state’s average effective property tax rate stands at approximately 1.31%. However, in urban areas like Cuyahoga and Franklin Counties, reassessments in 2024 resulted in many property tax bills increasing by 30-40%. For DSCR loan borrowers, this increase can reduce the property’s net income and affect loan eligibility.

3. City-Specific Short-Term Rental Laws

While the state doesn’t impose uniform rules on short-term rentals, cities like Columbus and Cleveland have their licensing, tax collection, and zoning requirements. In Columbus, hosts are required to register, undergo background checks, and collect hotel/motel taxes. Cleveland mandates property inspections and occupancy restrictions. These factors impact the projected rental income used in DSCR calculations, especially for short-term or vacation rentals.

4. Seasonal Weather Risks and Insurance Costs

Ohio’s winters can bring heavy snow, freezing temperatures, and flooding, which pose operational risks for property owners. Damage from frozen pipes, ice buildup, and water backups can result in costly repairs and temporary loss of rental income. Comprehensive landlord insurance, especially policies with “loss of rent” protection, is strongly recommended and may be a lender requirement for DSCR loan approval.

Strategic & Future Considerations for Foreign Nationals Investing in Ohio

Ohio continues to attract international real estate investors due to its affordability, strong rental yields, and the accessibility of financing tools, such as DSCR loans. However, 2025 brings some notable legal and market shifts that investors must understand before entering the Ohio property landscape:

1. Potential Ownership Restrictions

Ohio lawmakers have introduced House Bill 1 and Senate Bill 88, which aim to limit foreign ownership of farmland and properties within 25 miles of military or critical infrastructure. These proposals have not yet been passed, but they indicate growing scrutiny that may influence access to foreign investment in the near future.

2. Investor Activity in Value Cities

Foreign buyers are fueling price growth in mid-sized cities such as Toledo, Akron, and Cleveland, where investor purchases now account for a significant share of transactions. In Toledo, nearly 30% of homes are being bought by investors, including international capital, as prices remain well below national averages.

3. Visa-Linked Investment Demand

Ohio continues to attract buyers on E-2, EB-5, and L-1 visas who use real estate acquisitions to align with US business or residency goals. Affordable pricing and lower market saturation compared to coastal states make Ohio cities attractive for visa-linked property strategies. Check out our recent article on Statistics on Foreign Investment in the US Real Estate 2025 to know more about such investment-friendly insights.

4. Secondary Markets Offering Strong Returns

Markets such as Dayton, Youngstown, and smaller suburbs near Cleveland are drawing attention for their 6–10% cap rates and consistent tenant demand. These cities present opportunities for foreign national investors seeking lower entry points and fewer regulatory constraints.

5. Zoning Reform and Density-Friendly Development

Many Ohio cities are updating outdated zoning codes to allow higher-density housing and accessory dwelling units. This is creating new inventory pipelines and redevelopment potential in urban and semi-urban areas. Check out the Columbus Zoning Update to learn more about these zoning reforms and regulations.

Get a HomeAbroad DSCR Loan in Ohio as a Foreign National

HomeAbroad’s DSCR loans are specifically designed for international real estate investors, offering flexible terms, competitive interest rates, and a simplified approval process based entirely on the property’s rental income, rather than your personal income or US credit history.

At HomeAbroad, we streamline the entire investment process. With our AI-powered investment property search platform, you can discover high-yield rental properties throughout Ohio. Our expert agents provide personalized, local guidance, and we support every step from LLC formation and US bank account setup to property management assistance.

One of the key advantages of DSCR loans through HomeAbroad is the ability to finance multiple properties simultaneously. Whether you’re a foreign national, L1 visa holder, E2 investor, expat, or non-resident buyer, you can expand your real estate holdings without being limited by conventional loan restrictions.

Take complete control of your Ohio investment strategy, leverage the cash flow of each property to scale your portfolio, access exclusive tools and support, and start earning with confidence. Get started with a HomeAbroad DSCR loan today and grow your Ohio real estate portfolio with ease and flexibility.

FAQs

Are DSCR loans in Ohio available for Airbnb or rental properties?

Yes, HomeAbroad offers DSCR loans in Ohio for both Airbnb short-term rental properties and traditional long-term rental properties. Our loans help you qualify based on the property’s rental income, making them ideal for investors in short-term rental markets, such as those utilizing rental platforms like Airbnb.

What happens if my property’s rental income in Ohio doesn’t meet the required DSCR?

If your property’s income doesn’t meet the typical DSCR requirements, HomeAbroad offers “No Ratio DSCR loans“. However, this option requires a larger down payment to mitigate the additional risk.

Is cash-out refinancing available for DSCR loans in Ohio?

Yes, HomeAbroad offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)