Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Hot chicken, country music, and the smoky mountain air, Tennessee blends cultural charm with strong real estate opportunities. From the bustling streets of Nashville to the scenic beauty of Knoxville and the historic appeal of Memphis, the state offers a mix of thriving rental markets and steady appreciation potential.

Investors are drawn to Tennessee for its no-state income tax policy, growing population, and steady influx of tourists and job seekers. Whether it’s short-term rentals in Nashville’s entertainment districts or long-term properties near expanding business hubs, Tennessee’s market caters to diverse investment strategies.

With HomeAbroad’s DSCR loans, international investors can finance Tennessee properties based solely on rental income, no US credit history, income, or residency required. It’s a simple, flexible way to enter a market known for both cultural vibrancy and consistent returns.

Table of Contents

Key Takeaways:

1. Tennessee’s rental market benefits from no state income tax, steady population growth, and affordable property prices, giving foreign nationals strong potential for both cash flow and appreciation.

2. HomeAbroad’s DSCR loans are approved based on property rental income alone, so investors don’t need US credit history, US income, or residency status to qualify.

3. Cities like Memphis, Nashville, and Gatlinburg offer high rental yields, supported by strong tourism, local job markets, and diverse tenant demand.

4. HomeAbroad provides end-to-end support for foreign nationals, from property search using our AI-driven platform to DSCR loan financing, US LLC formation, local bank account setup, and closing paperwork, making remote investing in Tennessee seamless.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt-Service Coverage Ratio loan) from HomeAbroad is a tailored mortgage solution for foreign nationals investing in US real estate. Instead of requiring personal income proof or a US credit score, it qualifies you based on the property’s rental income potential.

Unlike traditional loans that demand tax returns, pay stubs, or employment verification, HomeAbroad’s DSCR loans streamline the process by evaluating the property’s income-to-expense ratio. This makes it ideal for global investors looking to scale their portfolios without getting stuck in lengthy documentation checks.

With an average rental yield of 6.43%, Tennessee offers solid cash flow potential for real estate investors. DSCR loans make it easier to purchase high-performing rental properties in cities like Nashville, Memphis, and Knoxville without traditional income verification requirements.

How to Calculate the DSCR Ratio?

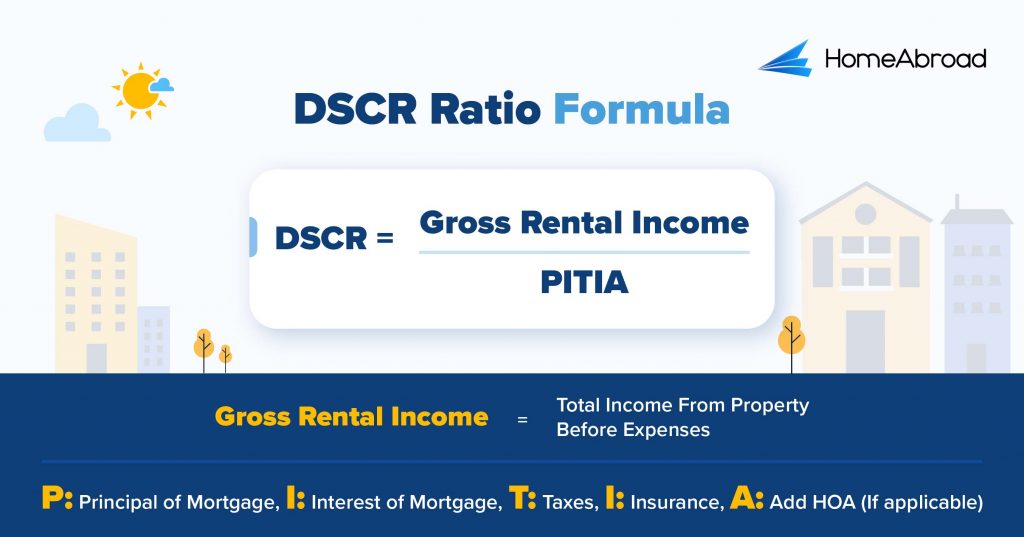

The Debt-Service Coverage Ratio (DSCR) measures a property’s ability to generate enough rental income to cover its mortgage payments.

DSCR Formula:

A DSCR of 1.0 is generally required, meaning the property’s rental income fully covers the mortgage payment. But at HomeAbroad, we know that some high-potential properties fall just below that mark and still make excellent investments.

One of my clients from Canada was eager to buy a short-term rental in Gatlinburg, right near the Great Smoky Mountains. The location had huge tourism potential, but the property’s DSCR came in at 0.89, just under the standard threshold. Instead of turning him away, I guided him through our No-Ratio DSCR Program, which gives more flexibility for deals that don’t quite meet the 1.0 mark.

It’s an ideal option for foreign nationals who recognize the long-term upside in a property but don’t quite meet the standard ratio. However, this option requires a larger down payment (a 5% hit to LTV) and comes with higher interest rates to mitigate the additional risk.

DSCR Loan Requirements in Tennessee for Foreign Nationals

Unlike traditional lenders, HomeAbroad offers a streamlined DSCR loan process built specifically for foreign nationals investing in Tennessee real estate.

Whether you’re investing from overseas or don’t have a US credit history, our flexible lending terms, remote closing, and foreign national-friendly process make Tennessee real estate more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | For the best terms, we qualify based on rental income where DSCR ≥ 1. Our No-Ratio DSCR Program is available for properties with a lower DSCR, though it comes with a 5% LTV hit and a slightly higher interest rate. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25% gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements for Foreign Nationals

Besides the DSCR ratio, down payment, and credit score, here are a few more things to know when applying for a DSCR loan in Tennessee as an international real estate investor.

With years of experience helping international investors, HomeAbroad offers expert guidance at every stage. Our AI-powered investment property search makes it easy to find high-yield opportunities across Tennessee, while our mortgage specialists secure the right DSCR loan to match your goals.

Areas We Lend in Tennessee

Whether you’re eyeing short-term rentals in Gatlinburg or multifamily units in Nashville, HomeAbroad offers DSCR loans across Tennessee. Here are a few cities in Tennessee where we lend DSCR loans.

- Nashville

- Chattanooga

- Knoxville

- Murfreesboro

- Memphis

- Clarksville

- Johnson City

- Brentwood

- Maryville

- Germantown

- Collierville

- Gatlinburg

- Hendersonville

- Franklin

Case Study: Alejandro García, a Mexican Investor, Expands Into the Tennessee Rental Market

Alejandro García, an entrepreneur from Monterrey, Mexico, wanted to expand his investment portfolio into the US real estate market. After exploring several states, he focused on Knoxville, Tennessee, for its strong university-driven rental demand, growing population, and affordable property prices.

Although Alejandro had ample capital and a clear investment plan, traditional lenders turned him down because he lacked a US credit history and domestic income documentation.

The Solution: HomeAbroad’s DSCR Loan

HomeAbroad helped Alejandro secure financing based entirely on the property’s rental income potential. The single-family home he purchased in Knoxville was projected to generate $2,630 in monthly rent, while his PITIA (principal, interest, taxes, insurance, and HOA) totaled $2,170, yielding a DSCR of 1.21.

With a 30-year fixed rate of 7.35%, Alejandro was approved for a $315,000 loan and closed the deal in just 24 days.

- Loan Amount: $315,000

- Purpose: Investment Purchase

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.35%

- DSCR: 1.21

- Time to Close: 24 days

Why This Worked for Alejandro:

- No US Credit Score Needed: Approval was based on the property’s income, not his personal credit profile.

- Strong Cash Flow: The DSCR of 1.30 showed the property’s income easily covered the mortgage.

- Smooth Remote Process: Alejandro completed the entire purchase from Mexico through HomeAbroad’s remote closing and local agent support.

Top Places to Invest in Tennessee with a DSCR Loan

Tennessee offers a potent mix of affordability, steady population growth, and a diverse economy, making it appealing for real estate investors. The state’s lack of a personal income tax and its relatively low cost of living attract both residents and businesses, fueling consistent housing demand.

Popular cities like Nashville, Memphis, and Knoxville have healthy rental markets supported by tourism, universities, and job opportunities, providing solid ground for both long- and short-term rental investments with a DSCR loan.

Here are some of the best cities in Tennessee for real estate investors using a DSCR loan:

City | Rental Type | Rental Yield |

|---|---|---|

Nashville | Short-Term | 16.2% |

Memphis | Long-Term | 11% |

Gatlinburg | Long-Term | 8.9% |

Knoxville | Long-Term | 5.8% |

Chattanooga | Long-Term | 5.5% |

Nashville: Tourism and Economic Powerhouse

Nashville’s booming music, healthcare, and tourism industries keep rental demand high. Short-term rentals thrive here because it is a top travel destination.

- Median Home Price: $445,803

- Average Rent: $1,884

What this means for investors: High rental income potential offsets the higher entry price, enabling strong DSCR returns with the right property strategy.

Investment Properties Listed Today on Sale in Nashville

Memphis: High Cash Flow Potential

Memphis offers strong rental demand driven by its diverse economy, including healthcare, transportation, and education sectors. Its affordability makes it a hotspot for investors seeking solid cash flow.

- Median Home Price: $145,735

- Average Rent: $1,338

What this means for investors: Low property costs and steady rental demand create an attractive environment for generating positive cash flow and meeting DSCR requirements.

Investment Properties Listed Today on Sale in Memphis

Gatlinburg: Gateway to the Smokies

Tourism dominates in Gatlinburg, drawing millions annually to the Great Smoky Mountains. This steady flow of visitors supports year-round rental demand.

- Median Home Price: $416,935

- Average Rent: $3,125

What this means for investors: Strong tourist-driven income potential makes Gatlinburg ideal for maximizing returns, especially in the short-term rental segment.

Investment Properties Listed Today on Sale in Gatlinburg

Knoxville: Steady Growth and Stability

Knoxville’s mix of university-driven demand and a growing job market creates consistent rental opportunities. Its balance of affordability and tenant stability appeals to both new and seasoned investors.

- Median Home Price: $368,879

- Average Rent: $1,809

What this means for investors: The city’s stable rent-to-price ratio supports sustainable returns and long-term DSCR performance.

Investment Properties Listed Today on Sale in Knoxville

Chattanooga: Emerging Investment Hub

With a revitalized downtown, tech growth, and access to outdoor recreation, Chattanooga is attracting both residents and businesses. This growth translates into a competitive rental market.

- Median Home Price: $327,326

- Average Rent: $1,506

What this means for investors: Ongoing economic expansion and tenant demand offer room for both cash flow and appreciation.

Investment Properties Listed Today on Sale in Chattanooga

Specific Considerations for Investing in Tennessee for Foreign Nationals

Tennessee offers a potent combination of affordability, steady rental income potential, and a landlord-friendly legal environment. But like any market, it has its own rules, tax structure, and local dynamics that foreign investors should understand before committing capital.

Here are the most critical factors to keep in mind:

- Property Taxes and County Variations

Tennessee has no state property tax, and overall rates are lower than the national average. However, property taxes are set at the county level and can vary significantly. Popular investment areas like Nashville and Memphis may have higher assessments, so verify local rates before making an offer.

- Landlord-Friendly Laws

The state has no rent control and generally favors landlords in lease enforcement and eviction processes. Still, investor protections vary slightly by city, and short-term rental laws can be stricter in some tourist-heavy regions, such as Nashville or Gatlinburg.

- LLC Formation for Foreign Owners

Forming a Tennessee or other US-based LLC is common for foreign nationals buying investment property. It can shield personal assets, simplify estate planning, and offer certain tax benefits. The process is straightforward and recognized statewide.

- US Tax Compliance and FIRPTA

Foreign nationals owe the same property taxes and capital gains taxes as US residents. Rental income is taxable at both the federal and state levels (though Tennessee doesn’t tax wage income, it does tax certain investment income). When selling, FIRPTA withholding may apply, so proper tax planning is key.

Strategic & Future Considerations for Foreign Nationals Investing in Tennessee

Tennessee’s real estate market is attracting increased attention from international investors thanks to its affordability, strong rental demand, and favorable tax environment. Long-term potential is tied to population growth, infrastructure expansion, and the state’s appeal as both a business and lifestyle destination.

Here are some future considerations that international real estate investors need to pay attention to:

1. Business-Friendly Policies:

Tennessee has no state income tax on wages and maintains relatively low property taxes, creating a stable and attractive environment for both residents and investors. This helps drive steady demand in key metro areas like Nashville, Knoxville, and Memphis.

2. Transportation and Infrastructure Growth

Projects like Nashville’s mass transit expansion and Chattanooga’s riverfront redevelopment are enhancing connectivity and livability, which can increase property values in surrounding neighborhoods.

3. Tourism-Driven Short-Term Rental Demand

Tourist hubs such as Gatlinburg and Nashville see consistent demand for vacation rentals year-round. While this offers strong income potential, investors should stay up to date on evolving local STR regulations.

4. University and Healthcare Markets

Cities with major universities and healthcare institutions, such as Knoxville (University of Tennessee) and Memphis (major hospital networks), provide steady demand for both short- and long-term rentals.

Get a DSCR Loan in Tennessee with HomeAbroad

Securing financing for your investment property in Tennessee is seamless with HomeAbroad. Our DSCR loans are built for international real estate investors, offering flexible terms and competitive rates to help you make a strong, cash-flowing rental portfolio.

HomeAbroad makes investing in Tennessee effortless for foreign nationals. Our AI-driven Investment property search platform connects you to profitable rental properties across markets like Memphis, Nashville, and Gatlinburg.

We handle everything —LLC formation, US bank account setup, complete paperwork, and expert guidance —so you can build and grow your portfolio without being in the US.

Get a DSCR loan with HomeAbroad today and start growing your Tennessee real estate portfolio!

FAQs

Can foreign nationals get a DSCR loan in Tennessee?

Yes. HomeAbroad helps international investors secure DSCR loans in Tennessee without a US credit history, income proof, or residency requirements.

Can I refinance my existing Tennessee property with a DSCR loan?

Absolutely. HomeAbroad offers DSCR cash-out refinance options, allowing you to leverage rental income and built-up equity to reinvest or scale your portfolio.

How long does it take to close a DSCR loan in Tennessee?

With HomeAbroad, foreign investors can close in as little as 30 days, thanks to streamlined processes, remote closing options, and dedicated support.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices