Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Indiana’s rental market is emerging as one of the most attractive in the Midwest, and DSCR loans from HomeAbroad make it possible for global real estate investors to qualify without US income, credit history, or permanent residency.

2. Since DSCR loans are evaluated based on a property’s rental performance, foreign national investors aren’t required to submit US tax returns, W-2s, pay stubs, or proof of employment.

3. Prime Indiana cities such as Indianapolis, Fort Wayne, and Evansville deliver solid rental returns, steady demand fueled by economic stability and job growth, and promising long-term appreciation potential.

4. HomeAbroad offers a streamlined, end-to-end service for international real estate investors, helping you discover high-performing properties through our AI-driven investment property search platform, secure financing, establish a US LLC, open a local bank account, and manage all closing documentation.

Table of Contents

Welcome to Indiana – the Hoosier State, where small-town charm meets a growing economy, manufacturing thrives, and the cost of living stays refreshingly low.

It’s not just locals enjoying the benefits; international real estate investors are increasingly drawn to Indiana for its affordable property prices, consistent rental demand, and landlord-friendly regulations.

From renovated duplexes in Indianapolis to student rentals near Purdue and Notre Dame, Indiana offers stable cash flow and long-term growth, especially for foreign national investors looking to grow their rental portfolios, taking advantage of HomeAbroad DSCR loans to bypass traditional income verification and US credit requirements.

What is a DSCR Loan for Foreign Nationals?

A HomeAbroad DSCR loan (Debt-Service Coverage Ratio loan) is a tailored foreign-national mortgage crafted for international real estate investors, qualifying you based solely on the property’s rental income, not your financial profile. It’s an ideal solution for overseas buyers, expats, business owners, and self-employed investors who may not have U.S. income or credit history.

Global investors can take advantage of HomeAbroad’s flexible DSCR loan features, including multiple simultaneous DSCR loans, cash-out refinancing, and rate term refinancing. These tools make it easier to scale a portfolio, unlock equity for new acquisitions or renovations, and optimize long-term returns.

With Indiana’s average gross rental yield at 11.3%, investors can enjoy both strong cash flow and growth potential in markets like Indianapolis, Fort Wayne, and South Bend, making it one of the most compelling destinations for foreign real estate investment in the U.S.

How to Calculate the DSCR Ratio?

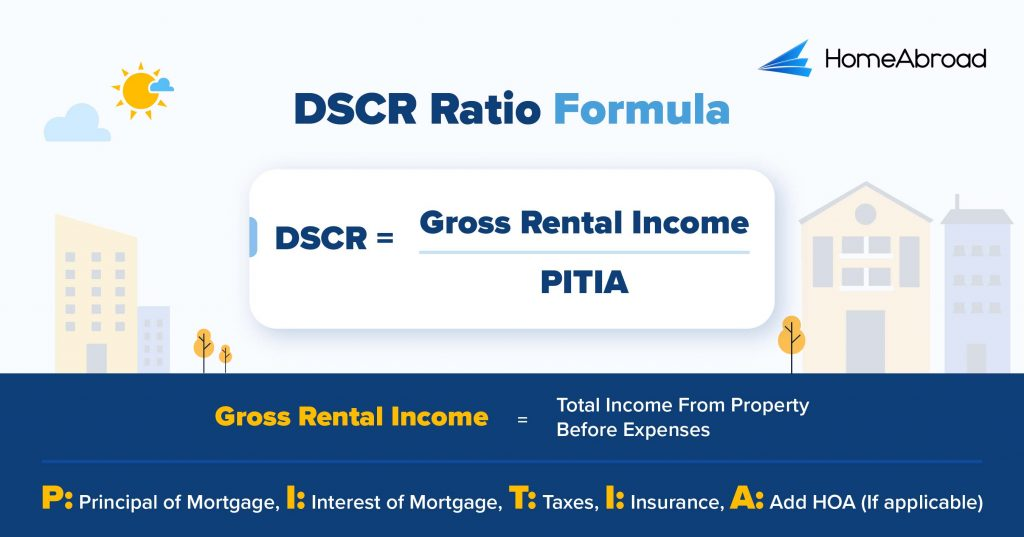

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key metric we use to assess loan eligibility from an investment perspective.

Here is the DSCR formula:

A DSCR of 1.37 indicates that the property generates 37% more income than the mortgage payment, signaling a substantial cash flow investment. If you do not want to do the math, you can use HomeAbroad’s DSCR ratio calculator.

Our DSCR loans are designed to qualify you based on a property’s income potential. A standard DSCR loan works by ensuring the monthly gross rent is equal to or greater than the mortgage payment (PITIA), which means your DSCR is 1.0 or higher. This is the ideal scenario that qualifies you for the best terms.

However, we understand that not every property's rental income will meet this threshold, which is why we also offer our No-Ratio DSCR Program, for properties with DSCR between 0 - 1. With the No-Ratio program, you can still secure financing, though it will require a slightly larger down payment (a 5% hit to LTV) and a higher interest rate. This option is perfect for investors with a strong long-term strategy who want to acquire properties that may not immediately cash-flow at a 1.0 ratio.

DSCR Loan Requirements in Indiana for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined foreign national mortgage DSCR loan process explicitly tailored for international real estate investors.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | For the best terms, we qualify based on rental income where DSCR ≥ 1. Our No-Ratio DSCR Program is available for properties with a lower DSCR, though it comes with a 5% hit to LTV and a slightly higher interest rate. | Typically, 1.2 and above, which means the property must generate at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on the rental income from your property. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30–35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as a foreign national investor.

- No Income Verification Required: We qualify you based solely on the projected rental income of the property.

- Flexible ownership structures: Purchase in your name or set up a US LLC, whichever suits your legal and tax strategy.

- Lower cash reserve requirements: We typically request 6 months of reserves, while others may require up to a year’s worth.

- Remote closing support: You can complete the entire process from anywhere in the world.

- US Bank Account Assistance: We also assist you in opening an account for rent collection and mortgage payments.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Indiana.

Where We Lend DSCR Loans in Indiana

HomeAbroad offers DSCR loans across Indiana, providing tailored support for global investors in top-performing markets, including Indianapolis, Fort Wayne, Muncie, South Bend, and more.

Here are a few cities where we lend DSCR Loans in Indiana:

- Indianapolis

- Fort Wayne

- South Bend

- Evansville

- Bloomington

- Lafayette

- Muncie

- Gary

- Mishawaka

- Anderson

- Kokomo

- Elkhart

- Terre Haute

- Fishers

- Carmel

- Westfield

- Columbus

- Noblesville

- New Albany

Let’s examine a case study of one of our past clients, a foreign national investor, to understand how profitable investing in the Indiana real estate market can be.

Case Study: Meet Priya Sharma, an Investor from India

Priya Sharma, a successful entrepreneur from Mumbai, wanted to diversify her portfolio by adding a long-term rental property in Indianapolis, Indiana. As a self-employed investor with no U.S. credit history, she quickly encountered roadblocks with traditional lenders, who demanded extensive personal income documentation and a domestic credit profile. After multiple setbacks, she finally discovered HomeAbroad’s DSCR loan program.

The Solution: HomeAbroad’s DSCR Loan

Priya was approved for financing by leveraging the property’s projected rental income instead of her personal financials. This gave her the ability to purchase a renovated duplex in a fast-growing Indianapolis neighborhood. With HomeAbroad’s tailored approach, she secured competitive terms and sidestepped the rigid requirements of conventional lenders.

- Loan Amount: $280,000

- Purpose: Purchase of an investment property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.5%

- Time to Close: 30 days

Why This Worked for Priya:

- No U.S. Credit History Needed: Approval was based solely on the property’s income potential, eliminating the need for a U.S. credit report.

- Flexible Underwriting: As a business owner, Priya was able to avoid providing personal tax returns or employment records, which traditional banks typically require.

- Portfolio Expansion: The DSCR loan allowed her to acquire a high-yield property in one of the Midwest’s most promising rental markets, boosting her long-term income stream.

Steven Glick,

Director of Mortgage Sales, HomeAbroad LoansPriya’s story demonstrates how DSCR loans make U.S. real estate more accessible to foreign national investors, empowering them to invest in profitable markets like Indianapolis while maintaining strong cash flow.

Top Places to Invest in Indiana with a DSCR Loan

Indiana is quietly becoming a powerhouse for real estate investment, offering a blend of affordability, strong rental yields, and a stable economy. With a cost of living well below the national average and a growing job market, the state attracts both tenants and investors alike. Cities like Indianapolis and Fort Wayne are experiencing steady demand from families, students, and professionals, making them reliable markets for long-term rentals.

For foreign nationals, Indiana offers an excellent opportunity to leverage DSCR loans, which are approved based on the property’s rental income rather than personal income or U.S. credit history. This opens the door for international investors to secure high-performing properties without the usual lending roadblocks.

Here are some of the top-performing cities in Indiana to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Indianapolis | Long-Term | 7.55% |

Fort Wayne | Long-Term | 9% |

Bloomington | Short-Term | 13.65% |

South Bend | Short-Term | 38.67% |

Lafayette | Short-Term | 12% |

Indianapolis: Steady Demand in the Heart of Indiana

Indianapolis boasts a diverse economy with strong healthcare, tech, and logistics sectors fueling rental demand year-round. The city’s affordable housing and growing professional base create a resilient long-term rental market with consistent cash flow potential. The rental yield stands at a solid 7.55%, reflecting steady income opportunities.

- Median Home Price: $242,667

- Average Rent: $1,526

What this means for investors: Indianapolis offers a balanced mix of value and stability. Low vacancy rates and steady rent growth support long-term rental income, making it an ideal market for DSCR loans and buy-and-hold strategies. Focus on neighborhoods near downtown and the north side for the best returns.

Investment Properties Listed Today on Sale in Indianapolis

Fort Wayne: Affordable, Stable, and Tenant-Friendly

Fort Wayne’s manufacturing roots, combined with the expansion of healthcare services, drive a steady demand for affordable rentals. This market appeals to families and working professionals, ensuring low turnover and reliable cash flow. The rental yield here is a strong 9%, highlighting its attractive cash flow potential.

- Median Home Price: $246,417

- Average Rent: $1,199

What this means for investors: With low entry costs and strong tenant demand, Fort Wayne is a prime candidate for long-term rental portfolios. The high rent-to-price ratio enhances cash-on-cash returns, and the market’s affordability makes it attractive for investors who leverage DSCR financing.

Investment Properties Listed Today on Sale in Fort Wayne

Bloomington: University-Driven STR Hotspot

Home to Indiana University, Bloomington’s short-term rental market thrives on consistent university visitors, parents, and event attendees. Strong seasonal demand and limited hotel capacity create lucrative opportunities for STR investors. Bloomington delivers a solid 13.65% rental yield, reflecting its premium STR returns.

- Median Home Price: $329,604

- Average Rent: $2,000

What this means for investors: Bloomington’s STR market offers premium nightly rates and high occupancy during academic and event seasons. Investors should target properties near campus or downtown to maximize bookings and revenue, making it a substantial addition to a diversified portfolio.

Investment Properties Listed Today on Sale in Bloomington

South Bend: Seasonal STR with Notre Dame Draw

South Bend’s rental market benefits from spikes tied to Notre Dame football games, conventions, and cultural festivals. These events create predictable high-demand windows, allowing STR owners to capitalize on peak pricing. The impressive 38.67% rental yield underscores its status as a high-return STR market.

- Median Home Price: $192,850

- Average Rent: $1,295

What this means for investors: Strategically positioned STRs near the university and downtown capture significant seasonal demand. Investors can expect strong cash flow during event periods, while off-season long-term rentals help maintain occupancy year-round.

Investment Properties Listed Today on Sale in South Bend

Lafayette: Purdue-Powered STR Growth

Lafayette experiences steady visitor traffic due to Purdue University’s events, conferences, and alumni gatherings. This drives consistent short-term rental demand, enabling investors to benefit from a diversified tenant profile. Lafayette’s rental yield of 12% offers solid income for STR investors.

- Median Home Price: $265,533

- Average Rent: $1,221

What this means for investors: Lafayette’s STR market combines steady university-related demand with affordability. Investors should focus on properties near campus and event venues to maximize occupancy and nightly rates, balancing seasonal peaks with strong mid-term rental potential.

Investment Properties Listed Today on Sale in Lafayette

Specific Considerations for Investing in Indiana for Foreign Nationals

Indiana offers one of the most accessible and profitable real estate landscapes in the Midwest for foreign investors. With affordable entry prices, strong rental yields, and landlord-friendly policies, it’s a market that strikes a balance between stability and growth potential. However, like any market, success here requires understanding the state’s unique regulations, risks, and opportunities.

– Agricultural Land Restrictions

Indiana consistently ranks among the most landlord-friendly states in the U.S. There is no statewide rent control, property taxes are relatively low, and eviction procedures are efficient and straightforward. These factors make it attractive for long-term rental strategies and high-occupancy investments.

– Favorable Foreign Ownership Rules

Foreign nationals are not subject to residency or citizenship requirements for property ownership in Indiana. However, they must comply with federal tax rules, such as the Foreign Investment in Real Property Tax Act (FIRPTA), which imposes withholding taxes on property sales by foreign owners.

– Diverse Investment Markets

While Indianapolis dominates the spotlight due to its strong rental demand, cities such as Fort Wayne, Bloomington, Lafayette, and South Bend are also growing in popularity. University towns and logistics hubs often produce stable year-round rental income.

Strategic & Future Considerations for Foreign Nationals Investing in Indiana

Indiana’s real estate market is entering a growth phase that combines affordability with long-term stability, making it an appealing target for international real estate investors using DSCR loans. While current conditions are favorable, understanding where the market is headed can help you position your portfolio for maximum gains.

1. Suburban Expansion and Population Growth: Suburbs like Fishers, Carmel, and Westfield are experiencing rapid growth, driven by families seeking high-quality schools, new infrastructure, and safer neighborhoods. These areas have been nationally recognized for their livability and are attracting both domestic and international buyers. For global investors, this means early entry into appreciating markets with strong rental demand from both professionals and relocating families.

2. Infrastructure and Logistics Development: Indiana’s location at the “Crossroads of America” is becoming even more valuable as the state invests in highway expansions, intermodal freight hubs, and airport upgrades. These improvements directly fuel demand for workforce housing near industrial parks and logistics centers, especially in Plainfield, Greenwood, and Lebanon. Properties in these zones tend to benefit from stable, long-term tenants employed in manufacturing and distribution.

3. University-Driven Rental Stability: Cities like Bloomington (Indiana University) and West Lafayette (Purdue University) continue to provide some of the most consistent occupancy rates in the state. Student housing demand creates predictable leasing cycles, and the growing trend of international student enrollment adds a layer of global demand, appealing to foreign investors looking for stable returns.

4. Mixed-Use and Lifestyle Developments: Large-scale projects such as Saxony in Fishers and Bottleworks District in Indianapolis are reshaping urban and suburban living with a blend of residential, retail, office, and entertainment spaces. These developments draw higher-income tenants and command premium rents, offering investors a way to diversify into higher-yield micro-markets within Indiana.

Get a HomeAbroad DSCR Loan in Indiana as a Foreign National

Financing your Indiana investment property is straightforward with HomeAbroad. Our DSCR loans are purpose-built for international real estate investors, offering competitive rates and adaptable terms to help you expand a profitable rental portfolio in one of the Midwest’s most consistent markets.

We make the entire investment journey seamless for you. Using our AI-powered investment property search platform, you can uncover prime rental opportunities in thriving cities such as Indianapolis, Fort Wayne, and Bloomington. Our network of local real estate agents provides hands-on support. At the same time, we assist with critical steps, such as setting up an LLC, opening a US bank account, and connecting you with reliable property management services.

For growth-minded foreign national investors, DSCR loans make it possible to finance multiple properties at once, ideal for diversifying across Indiana’s varied rental markets. Whether your focus is on university-town rentals, family homes in commuter suburbs, or multi-family properties in logistics hubs, approval is based entirely on projected rental income rather than your personal earnings or US credit history.

Get a DSCR loan with HomeAbroad today and start building your Indiana real estate portfolio with confidence and ease of mind.

FAQs

Can foreign nationals apply for DSCR loans in the state of Indiana?

Foreign nationals can apply for DSCR loans through HomeAbroad without needing a US credit score, making it a flexible financing option for global investors.

How long does it take to get a DSCR loan in Indiana?

At HomeAbroad, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

What are the interest rates for DSCR loans?

DSCR loan interest rates vary depending on market conditions, borrower profiles, and property types, but they are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that allow investors to leverage property cash flow for better returns.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loan Refinance: How to Qualify & Maximize Benefits [2025]](https://homeabroadinc.com/wp-content/uploads/2024/11/DSCRLoanRefinance.jpg)