Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Washington ranks among the most attractive rental markets in the U.S., and with HomeAbroad’s DSCR loans, international investors can secure financing without the usual hurdles, no U.S. income, credit history, or residency required.

2. DSCR loans focus solely on the property’s rental performance, freeing foreign buyers from the need to provide personal tax returns, pay stubs, or employment verification.

3. Top Washington cities like Seattle, Spokane, and Tacoma deliver impressive rental yields, strong tenant demand fueled by tech growth and steady population increases, and exceptional potential for long-term appreciation.

4. HomeAbroad offers an end-to-end solution for global real estate investors, helping you identify high-performing properties with our AI-powered investment search platform, secure competitive financing, establish a U.S.-based LLC, open a local bank account, and handle every detail through closing.

Table of Contents

Welcome to Washington – the Evergreen State, where a booming tech industry, thriving ports, and stunning natural scenery create one of the most dynamic economies in the U.S.

It’s not just residents enjoying the benefits; global real estate investors are turning to Washington for its high rental demand, strong job growth, and impressive long-term appreciation potential.

From sleek apartments in Seattle to multi-family properties in Spokane or vacation rentals near the Olympic Peninsula, Washington offers exceptional opportunities, especially for foreign nationals using DSCR loans from HomeAbroad to invest without the usual U.S. income or credit history requirements.

What is a DSCR Loan for Foreign Nationals?

A HomeAbroad DSCR loan (Debt-Service Coverage Ratio loan) is a foreign national mortgage designed for international real estate investors that qualifies you based on the property’s rental income, not your personal income.

I recently worked with an investor from the UK who wanted to purchase a multi-family property in Seattle. With no U.S. credit history and no local income documentation, traditional banks declined his application. Using our DSCR loan, we focused solely on the property’s substantial projected rental income and approved his financing without requiring personal tax returns or employment history. You’ll find the whole story later in the article.

From Seattle’s bustling urban market to Spokane’s growing rental demand, Washington presents global investors with opportunities for steady occupancy and long-term appreciation.

How to Calculate the DSCR Ratio?

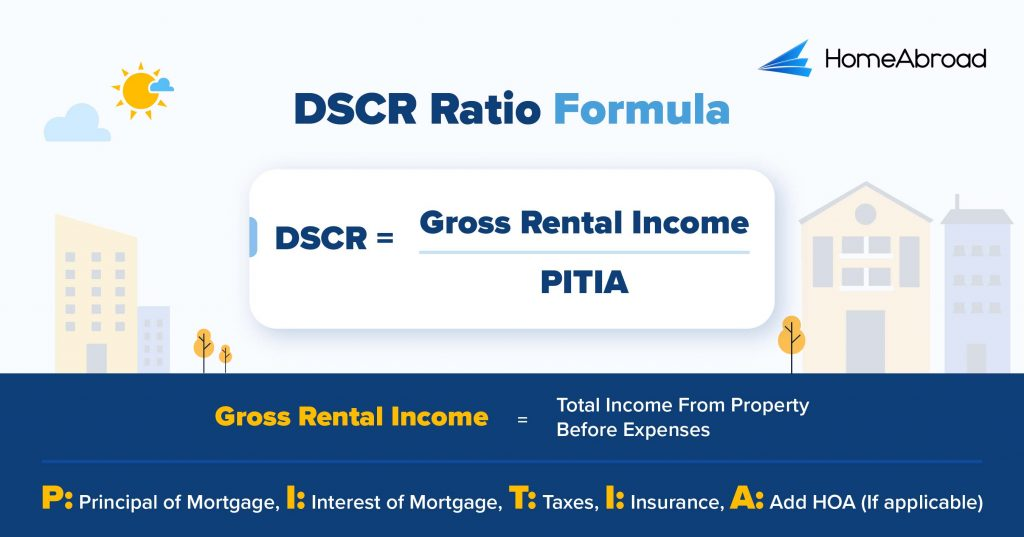

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income is sufficient to cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

A DSCR of 1.18 indicates that the property generates 18% more income than the mortgage payment, signaling strong cash flow. If you do not want to do the math, you can use HomeAbroad’s DSCR ratio calculator.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with strong long-term plans the opportunity to secure financing.

DSCR Loan Requirements in Washington for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined foreign national mortgage DSCR loan process explicitly tailored for international real estate investors.

Whether you’re investing from abroad or don’t have a US credit history, our flexible terms, lower barriers, and remote-closing support make Washington real estate more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, 1.2 and above, which means the property must generate at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as a global investor.

- No Income Verification Required: Unlike banks and other conventional lenders that require tax returns or job history, we qualify you solely based on projected rental income.

- Flexible ownership structures: Purchase in your name or set up a US LLC, whichever suits your legal and tax strategy.

- Lower cash reserve requirements: We typically ask for 6 months of reserves, while others may demand up to 12 months’ worth.

- Remote closing support: You can complete the entire process from anywhere in the world.

- US Bank Account Assistance: We also assist you in opening an account for rent collection and mortgage payments.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Washington.

Where We Lend DSCR Loans in Washington

HomeAbroad offers DSCR loans across Washington, providing tailored support for investors in top-performing cities, including Spokane, Tacoma, Vancouver, and more. Here are a few cities where we lend DSCR Loans in Washington.

- Seattle

- Spokane

- Tacoma

- Vancouver

- Bellingham

- Everett

- Olympia

- Bellevue

- Kent

- Renton

- Redmond

- Kirkland

- Federal Way

- Lynnwood

- Yakima

- Kennewick

- Richland

- Pasco

- Pullman

- Walla Walla

To see how a DSCR loan works in real life, let’s look at a case study of an international real estate investor who secured financing for a Washington rental property with the help of HomeAbroad.

Case Study: Meet James Carter, an Investor from the UK

James Carter, a seasoned property investor from London, wanted to purchase a multi-family building in Seattle, Washington. Without a U.S. credit history or verifiable local income, he encountered immediate roadblocks with traditional lenders, who required extensive personal financial documentation. After multiple rejections, he turned to HomeAbroad’s DSCR loan program.

The Solution: HomeAbroad Loans’ DSCR Loan

By evaluating the property’s projected rental income instead of James’s personal financials, HomeAbroad was able to approve financing for a well-located building in one of Seattle’s fastest-growing neighborhoods. This approach allowed James to secure a competitive loan and bypass the restrictive requirements of conventional lenders.

HomeAbroad’s mortgage officer successfully worked to reduce the DSCR interest rate to 7.5%, which improved the property’s Debt Service Coverage Ratio (DSCR) and enabled Sam to qualify for a $520,000 loan. This tailored approach ensured the property’s income could cover its debt payments, making the loan feasible.

- Loan Amount: $520,000

- Purpose: Purchase of an investment property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.5%

- Time to Close: 29 days

Why This Worked for James:

- No U.S. Credit History Required: Approval was based solely on the property’s income potential, eliminating the need for a domestic credit report.

- Flexible Underwriting: James avoided providing personal tax returns and employment history, which traditional banks would typically require.

- Strategic Portfolio Growth: The DSCR loan enabled him to acquire a property in a high-demand market with excellent appreciation prospects.

James’s success underscores how DSCR loans open doors for international investors, allowing them to secure profitable properties in competitive markets while keeping a strong cash flow.

Top Places to Invest in Washington with a DSCR Loan

Washington offers a unique mix of economic strength, natural beauty, and diverse rental markets, from the tech-driven growth of Seattle to the expanding opportunities in Spokane and Tacoma. The state’s strong job market, steady population growth, and limited housing supply contribute to consistent rental demand and long-term appreciation potential.

For international real estate investors, Washington’s real estate market pairs well with DSCR loans, which focus on the property’s income potential rather than the borrower’s personal financial history. This enables tapping into competitive, high-demand markets without the barriers of traditional lending requirements.

Here are some of the top-performing cities in Washington to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Seattle | Short-Term | 6% |

Spokane | Short-Term | 8.7% |

Vancouver | Long-Term | 5% |

Yakima | Long-Term | 5.12% |

Pullman | Long-Term | 4% |

Seattle: Premier Short-Term Rental Market Driven by Tech and Tourism

Seattle’s thriving tech industry, bustling tourism, and frequent conventions sustain a robust short-term rental market. High-demand neighborhoods such as Capitol Hill and Ballard deliver strong occupancy and premium nightly rates year-round. The market offers a healthy 6% rental yield, reflecting strong cash flow despite higher property prices.

- Median Home Price: $886,833

- Average Rent: $2,178/month

What this means for investors: Seattle’s STR market commands top-dollar rents, offsetting higher acquisition costs. Investors with DSCR financing can capitalize on a consistent influx of visitors and premium pricing to maximize cash flow, especially in downtown and key tourist areas.

Investment Properties Listed Today on Sale in Seattle

Spokane: Emerging STR Market with Growing Appeal

Spokane is gaining traction as a short-term rental destination due to its vibrant arts scene, outdoor recreation, and growing business travel. Lower home prices relative to Seattle offer attractive entry points for STR investors. Spokane delivers an impressive 8.7% rental yield, highlighting strong cash-on-cash returns.

- Median Home Price: $385,250

- Average Rent: $1,513/month

What this means for investors: Spokane’s affordability, combined with steady visitor demand, creates a promising STR play with solid cash-on-cash returns, target neighborhoods close to downtown and Riverfront Park to optimize occupancy and revenue.

Investment Properties Listed Today on Sale in Spokane

Vancouver: Stable Long-Term Rentals with Metro Proximity

Just across the river from Portland, Vancouver offers a strong long-term rental market fueled by commuters and families seeking affordability with urban access. Steady employment and community growth underpin rental demand. The market offers a reliable 4.9% rental yield, providing steady income with low vacancy rates.

- Median Home Price: $504,000

- Average Rent: $2,060/month

What this means for investors: Vancouver’s balanced appreciation and rental income profile support low vacancy and reliable cash flow. Investors benefit from long-term stability and strong DSCR qualification, especially in family-friendly neighborhoods.

Investment Properties Listed Today on Sale in Vancouver

Yakima: Affordable High-Yield Long-Term Rentals

Yakima’s agricultural economy and expanding healthcare sector drive consistent demand from tenants. The market offers some of the best rent-to-price ratios in Washington, making it an attractive option for investors seeking steady cash flow. With a 5.12% rental yield, Yakima stands out as a high-yield, affordable rental market.

- Median Sold Price: $363,333

- Average Rent: $1,550/month

What this means for investors: Yakima is ideal for investors seeking high-yield, low-competition LTR opportunities. Its affordability and tenant stability help meet DSCR criteria while delivering consistent monthly returns.

Investment Properties Listed Today on Sale in Yakima

Pullman: College Town Long-Term Rental Anchor

Pullman’s rental demand centers on Washington State University students, faculty, and staff. The market features consistent occupancy and predictable rental income driven by university-related housing needs. Pullman’s rental yield sits at 4%, reflecting stable but moderate income potential.

- Median Home Price: $445,650

- Average Rent: $1,400/month

What this means for investors: Pullman offers dependable cash flow with reduced vacancy risk, making it an excellent choice for DSCR-backed buy-and-hold strategies. Proximity to campus is key to maximizing tenant quality and occupancy rates.

Investment Properties Listed Today on Sale in Pullman

Specific Considerations for Investing in Washington for Foreign Nationals

Washington’s real estate market combines strong economic fundamentals with diverse property investment opportunities – from luxury urban condos in Seattle to high-demand rental homes in Spokane and Bellingham. For foreign national investors, the state’s stability, employment growth, and global appeal make it a sought-after destination. Still, navigating its unique rules and market dynamics is key to long-term success.

Here are the most critical factors to keep in mind:

– No Statewide Restrictions on Foreign Ownership

Washington does not impose ownership limitations based on citizenship or residency, allowing foreign nationals to buy residential, commercial, or multi-family properties freely. However, like all U.S. states, transactions must comply with federal laws such as FIRPTA for tax withholding on property sales by foreign owners.

– Property Tax and Housing Affordability Pressure

Washington has relatively higher property taxes compared to many Midwestern states, and the recent housing supply shortage has driven up median prices, especially in King County. Investors should factor in long-term affordability trends and potential property tax adjustments.

– Landlord-Tenant Regulations

Washington is more tenant-friendly than states like Indiana or Texas. Landlords must provide more extended notice periods for rent increases and follow detailed procedures for evictions. Rent control is not statewide, but cities like Seattle have implemented stricter rental rules and tenant protection

– Strong Demand from Tech and Trade Sectors

Seattle’s economy benefits from tech giants like Amazon and Microsoft, as well as the state’s major ports, driving trade with Asia. This creates steady demand for rental housing in job-growth regions such as Bellevue, Redmond, and Tacoma.

Strategic & Future Considerations for Foreign Nationals Investing in Washington

Global tech influence, international trade connections, and strong lifestyle appeal shape Washington’s property market. For foreign investors, these factors create a foundation for both steady cash flow and long-term capital growth. Looking ahead, several trends will influence where the best opportunities lie.

Here are some future considerations that international real estate investors need to pay heed to:

1. Tech-Driven Rental Hotspots: Cities like Redmond, Bellevue, and Kirkland continue to see strong rental demand from high-income tech employees, many of whom are international professionals on temporary visas. This creates stable occupancy and premium rent potential for well-located condos and single-family homes. As hybrid work becomes the norm, properties with home-office potential in these areas will command even greater appeal.

2. Port and Logistics Expansion: Washington’s ports in Seattle, Tacoma, and Everett are gateways for Pacific trade, particularly with Asia. Expansion projects and rising import/export volumes are creating a need for workforce housing in surrounding areas. Investors targeting mid-tier rental properties in these markets can benefit from consistent tenant demand tied to trade and manufacturing jobs.

3. Migration from High-Cost States: While Washington is not a low-cost state, it continues to attract residents from California due to no state income tax and relatively lower housing prices in secondary markets like Spokane, Vancouver, and Bellingham. This trend supports growing rental demand outside the Seattle metro, offering opportunities in more affordable, higher-yield locations.

4. Urban Redevelopment & Transit Projects: Infrastructure investments like Sound Transit’s Link Light Rail expansion are transforming commuting patterns and boosting property values along new transit corridors. Savvy investors can capture appreciation by purchasing rental units in areas slated for future stations before values peak.

Get a HomeAbroad DSCR Loan in Florida as a Foreign National

Washington offers a compelling mix of strong rental demand and long-term appreciation potential, and financing here is made simple with HomeAbroad’s DSCR loans. Specifically designed for international investors, our loans combine flexible structures with competitive rates, allowing you to strategically grow your portfolio across the state’s most in-demand markets.

From our AI-driven property search platform to tailored guidance from Washington-based agents, we ensure every stage of the investment process runs smoothly. You’ll have support with LLC formation, US banking setup, and access to trusted local property managers, helping you invest with confidence in Seattle, Bellevue, Spokane, and beyond.

For those already invested in Washington real estate, our cash-out refinancing program provides a smart way to unlock your property’s equity without needing US-based income or credit. This capital can be reinvested into additional properties, used for renovations to boost rental returns, or diversified into other promising US markets, all with an approval process centered on the property’s income potential.

Get a DSCR loan with HomeAbroad today and start building your Washington real estate portfolio with confidence.

Frequently Asked Questions

Can foreign nationals apply for DSCR loans in the state of Washington?

Yes, foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international real estate investors.

What are the interest rates for DSCR loans?

DSCR loan interest rates vary depending on market conditions, borrower profiles, and property types, but they are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that allow investors to leverage property cash flow for better returns.

What is the minimum DSCR required to qualify?

HomeAbroad typically requires a minimum DSCR of 0.75, but we also offer “No Ratio DSCR” loan options for some instances where the property’s income is below this ratio.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loan Refinance: How to Qualify & Maximize Benefits [2025]](https://homeabroadinc.com/wp-content/uploads/2024/11/DSCRLoanRefinance.jpg)