Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Foreign buyers purchased $56 billion worth of US real estate in 2025.

2. Florida, California, and Texas remained the top destinations, attracting over half of all foreign real estate transactions.

3. Vacation homes and primary residences were the top use cases, showing diverse investment motivations.

Table of Contents

Buying a home in the US isn’t just an American dream anymore. It’s a global investment trend.

Every year, foreign nationals, from recent immigrants to global investors, buy thousands of properties across the country. Some are looking for a stable place to live. Others want steady rental income or a long-term asset in a strong market.

In this article, we break down the latest foreign national activity in the US real estate market. Who’s buying, where they’re buying, and how foreign investment is shaping the US housing market today.

Highlights: Foreign Investment US Real Estate Statistics 2025

- Foreign buyers purchased $56 billion worth of existing homes between April 2024 and March 2025.

- 78,100 properties were sold to international buyers, marking a 44% increase from the previous year.

- 47% of all foreign buyers paid in cash, significantly higher than the 28% cash share among US domestic buyers.

- 56% of international buyers were recent immigrants or visa holders already living in the US.

- China, Canada, Mexico, India, and the United Kingdom were the top five countries of origin.

- Florida remained the most popular destination, followed by California, Texas, New York, and Arizona.

- Single-family homes and townhomes accounted for 77% of all purchases made by foreign nationals.

- Most purchases were for primary residences, but a large portion also targeted vacation homes or rental properties.

Which countries invest most in US real estate?

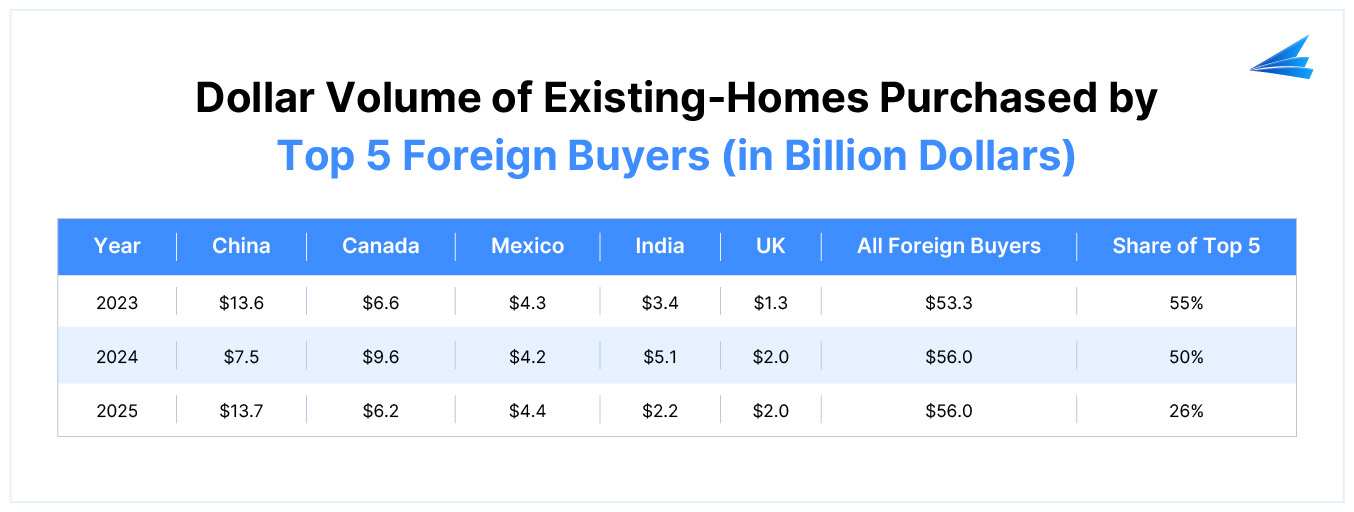

- Between April 2024 and March 2025, the majority of foreign buyers in US residential real estate originated from China, Canada, Mexico, India, and the United Kingdom. These five countries accounted for 47% of the $56 billion in foreign purchases.

- From April 2024 and March 2025, buyers from China, Canada, Mexico, India, and the United Kingdom made up 47% of the $56 billion spent by foreign nationals on US residential real estate.

- Chinese buyers topped the list, spending $13.7 billion and purchasing around 11,700 existing homes, the highest among all countries.

- Canadians remained active in the market, buying 10,900 homes with a total dollar volume of $6.2 billion.

- Buyers from Mexico secured approximately 6,200 homes, investing $4.4 billion across various states.

- Indian nationals purchased 4,700 properties, contributing $2.2 billion to the total volume.

- The UK ranked fifth, with $2 billion spent on 3,100 homes, continuing its steady investment in US real estate.

Foreign Real Estate Buyers Financing Statistics 2025

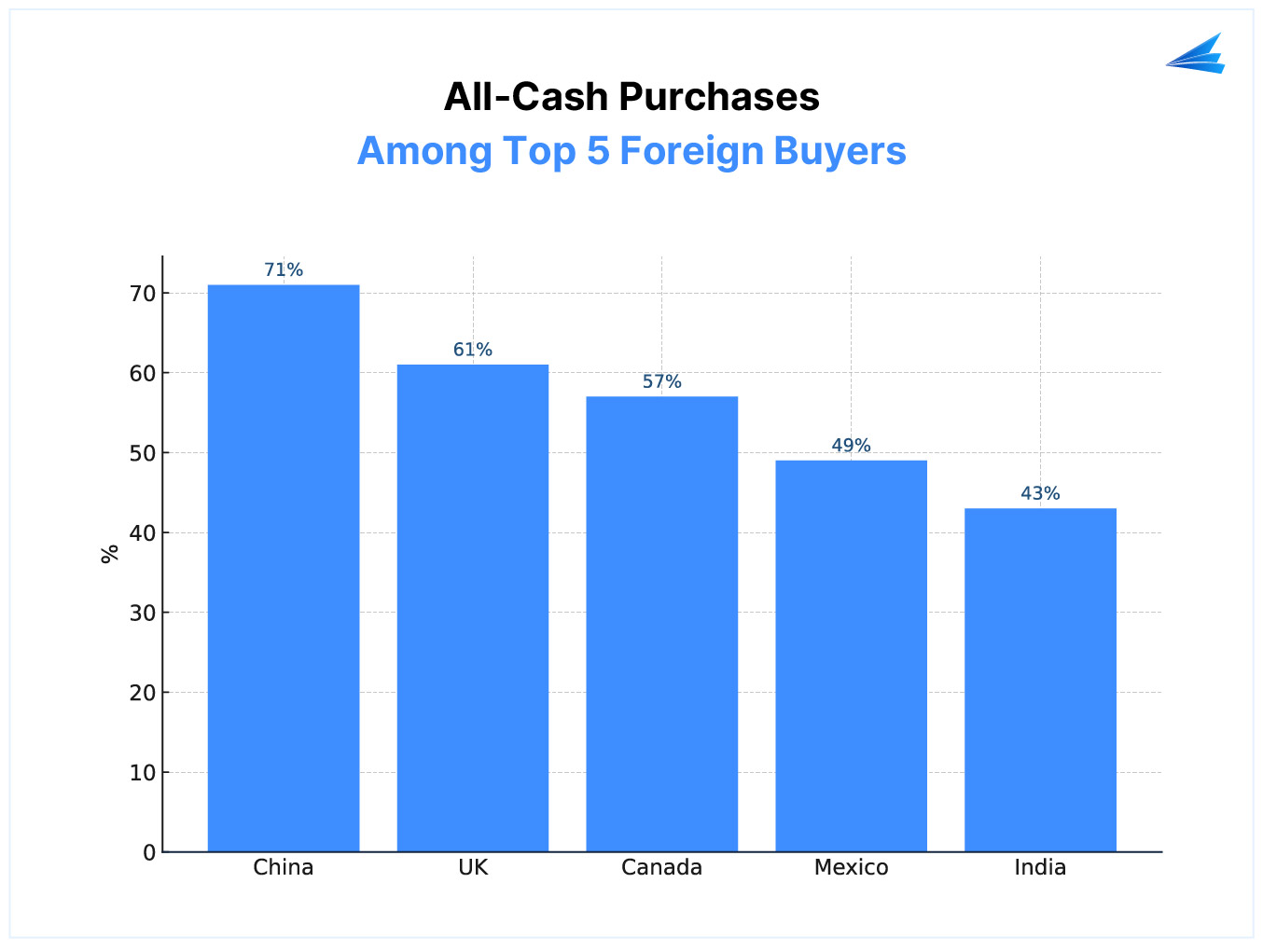

- 47% of foreign buyers paid all cash for US residential properties, compared to just 28% of all existing homebuyers.

- Foreign buyers who live abroad were more likely to purchase with all cash (56%) than those foreign buyers who are already living in the US (39%).

- Chinese buyers had the highest share of all-cash purchases at 71%, followed by UK buyers at 61%, and Canadians at 57%.

- Nearly half of Mexican buyers (49%) also paid in cash.

- Indian buyers had the lowest share of all-cash deals at 43%, as most reside in the US and typically use mortgage financing.

Why are Foreigners Buying Property in the USA?

- 47% of foreign buyers purchased property for use as a vacation home, rental, or both, slightly up from last year.

- Among foreign buyers who live abroad, this number jumps to 60%, showing strong interest in vacation homes or income-producing properties.

- Canadian buyers were most likely to purchase for vacation use (49%), while U.K. buyers followed at 27%.

- Indian buyers focused more on primary residences (66%), as did Mexican (53%) and Chinese (45%) buyers.

- Homes for student use were more common among buyers from the UK (18%) and China (16%).

Where are Foreigners Buying Homes in the USA?

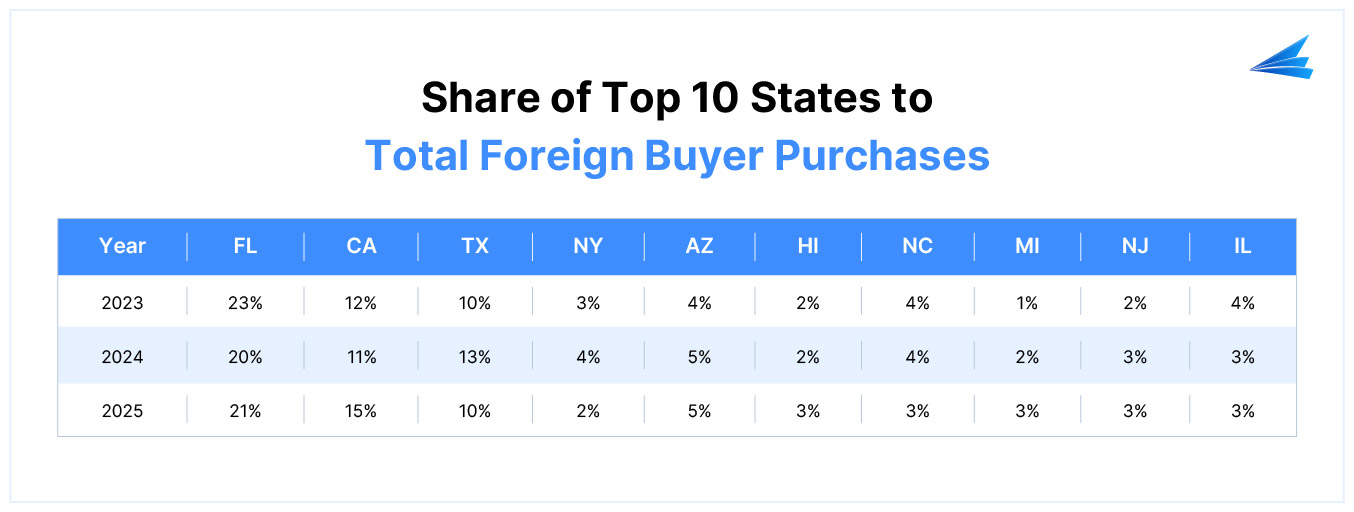

- Florida continues to dominate, with 21% of all foreign buyers choosing it, especially popular with Canadians and Latin American buyers (each making up 31% of Florida’s foreign demand).

- California climbed to second place at 15%, thanks to a surge in Chinese buyers. Over half of California’s foreign buyers were from Asia.

- Texas took 10% of foreign purchases, mainly from Mexico and India.

- New York attracted 7%, primarily from Asia and Latin America.

- Arizona held steady with 5%, with Canadian, Asian, and Latin American buyers evenly split.

- Other major destinations included Hawaii, North Carolina, Michigan, New Jersey, and Illinois, each capturing around 3% of foreign buyer purchases.

Type of Residential Property Purchased by International Buyers Statistics 2025

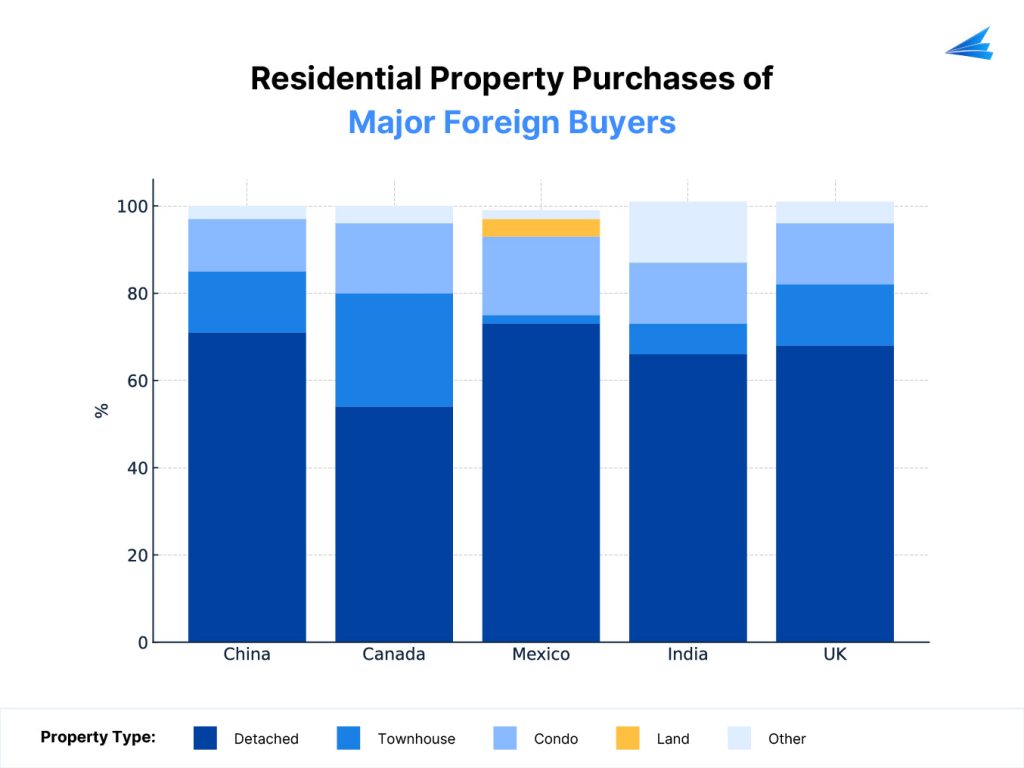

- 63% of foreign buyers purchased detached single-family homes, the most preferred property type overall.

- 18% of foreign buyers who live abroad chose condominiums, showing a stronger preference than US-based foreign buyers.

- Townhouses and condos were popular among Canadian buyers, often used as vacation or rental properties.

- Mexican buyers had the highest share of residential land purchases among all global buyers.

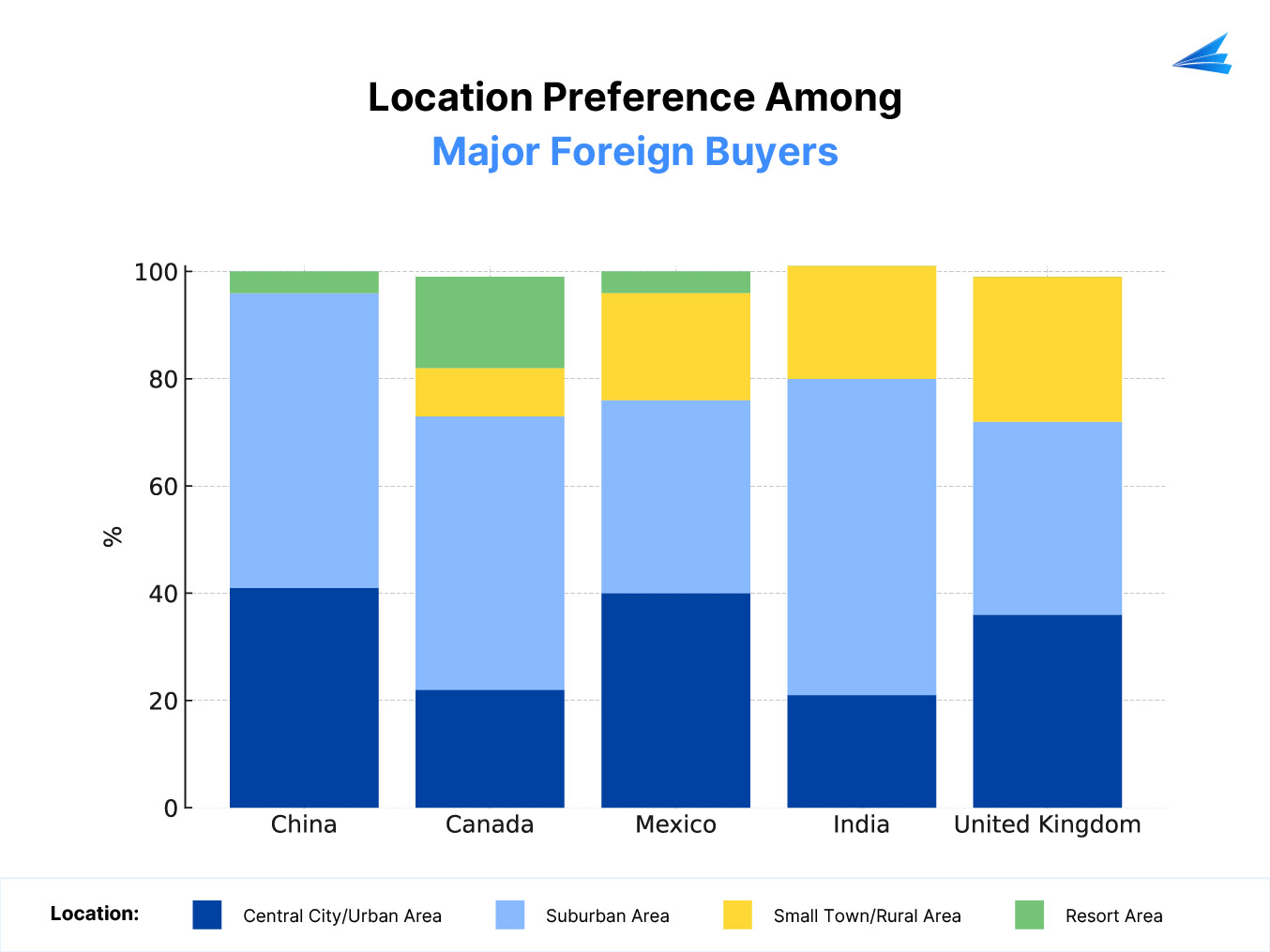

Types of Areas Where Foreigners Buy Property Statistics 2025

- Suburban areas were the top choice, attracting 44% of all foreign buyer purchases.

- 40% bought in central city or urban areas, a higher share than domestic buyers.

- Nearly 60% of Asian Indian buyers preferred suburbs, aligning with their focus on primary residences.

- Canadian buyers leaned toward resort areas, with nearly half purchasing vacation homes in such locations.

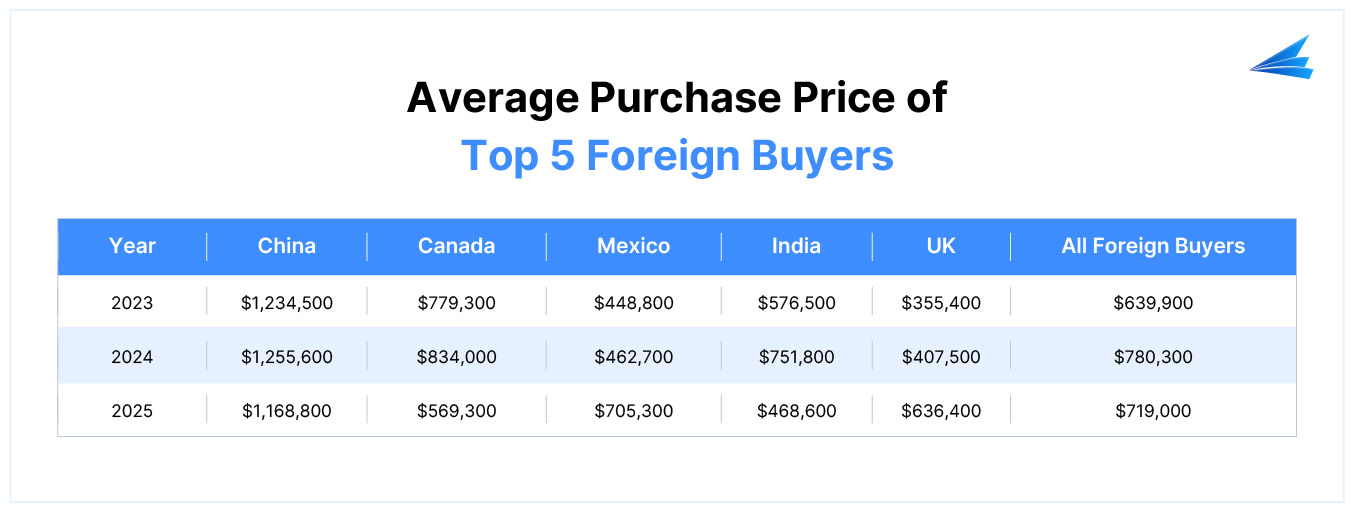

Most Expensive Property Purchased by Foreign Buyers in the USA 2025

- Chinese buyers had the highest average purchase price at $1.17 million in 2025. These buyers primarily focused on high-cost markets, with 36% purchasing in California and 9% in New York.

- Mexican buyers had the second-highest average purchase price among top international groups, coming in at $705,300. Notably, 16% of purchases by Mexican buyers exceeded $1 million, up from 8% the year before.

- Canadian buyers, while not at the very top, still spent significantly, with an average price of $569,300.

- Indian buyers averaged $468,600, and buyers from the UK came in with a $636,400 average.

- In total, the overall median purchase price among all foreign buyers rose to $494,400 in 2025, reflecting strong interest in US real estate from high-net-worth international investors.

Conclusion

Foreign investment in US real estate remains strong in 2025, driven by the country’s strong property values, stable legal system, and attractive rental returns. Whether for investment, relocation, or vacation purposes, international buyers are actively purchasing across diverse markets.

HomeAbroad simplifies the entire investment process for global buyers from property search to financing, ensuring a smooth and profitable real estate journey.

Why choose HomeAbroad?

- AI-driven investment property search platform

- Tailored foreign national mortgages

- No US credit history required

- LLC and US bank account setup

- Expert guidance from start to end

- Remote closing option

Start your investment journey with HomeAbroad today!

FAQs

What are the tax implications of foreign investment in US real estate?

Foreign buyers generally pay the same taxes as US residents on rental income and capital gains. However, they may face FIRPTA withholding when selling. Check out our detailed guide on US taxes for foreign nationals.

Can I get a US mortgage as a non-US resident?

Yes. HomeAbroad specializes in foreign national mortgages that don’t require US credit history or residency. Check out our guide on how to get foreign national mortgages with no US credit history.

How long does the buying process take for foreign nationals?

At HomeAbroad, foreign buyers can close deals in as little as 30 days. We streamline the entire process with expert support, ensuring a smooth international real estate transaction.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.