Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

The U.S. commercial real estate market remains a top choice for foreign investors, with total cross-border investments projected to reach $542 billion in 2025, a 39% annual increase. While foreign buyers purchased $42 billion worth of U.S. real estate in 2024, the commercial sector continues to attract high-net-worth individuals seeking stable returns and long-term value.

Given the high investment threshold in commercial real estate, many foreign investors explore residency opportunities through programs like the EB-5 Immigrant Investor Program, which recorded an all-time high of 6,089 approvals in 2024. Recognizing this demand, the U.S. government is also considering a new $5 million “Gold Card” visa, offering permanent residency to wealthy investors.

With the right financing solutions, foreign buyers can strategically invest in U.S. commercial properties while unlocking potential immigration benefits.

Key Takeaways:

1. Foreigners and non-US residents are eligible to buy commercial property or any other real estate in the US, irrespective of their citizenship, immigration, or residency status.

2. Foreign nationals don't require a green card for US real estate purchases.

3. Investing in US commercial real estate can result in long-term returns with higher property appreciation value and higher rental yields from renting the property.

Table of Contents

U.S. Commercial Real Estate: A Foreign Investor’s Paradise

The U.S. commercial real estate market remains a top choice for foreign investors. The investment volume is expected to reach $542 billion in 2025, a 39% increase from the previous year. With stable returns, a transparent legal framework, and substantial property fundamentals, international buyers capitalize on lucrative opportunities nationwide.

Key Foreign Investment Trends in 2024-2025

1. Surge in Investment Volume

- Foreign buyers contributed $42 billion in 2024, with capital from Canada, Europe, and Asia.

- A 16% growth in Q1 2024 signals a strong recovery in global real estate investments.

2. Top Investment Destinations

- Dallas, Miami, and Tampa are emerging as prime investment hotspots due to rapid job growth and business-friendly environments.

- Established markets like Los Angeles and New York continue attracting global capital but face competition from high-growth secondary cities.

3. Sector-Wise Investment Insights

- The industrial sector dominates, accounting for 34% of foreign investment, driven by logistics and e-commerce expansion.

- Multifamily properties (27%) remain a top choice for investors seeking steady rental income and long-term appreciation.

- Retail and office spaces are rebounding as businesses adapt to hybrid work and shifting consumer behaviors.

4. Commercial Investments & U.S. Residency Opportunities

- With high capital requirements, many foreign investors explore *U.S. residency through the EB-5 Immigrant Investor Program, which saw 6,089 approvals in 2024.

- The proposed $5 million “Gold Card” visa could provide a direct path to U.S. residency for ultra-high-net-worth investors.

5. Navigating the U.S. Market: What You Need to Know

- Legal & Tax Considerations: Understanding FIRPTA, capital gains taxes, and ownership structures is crucial for maximizing returns.

- Financing Options: Foreign buyers can access tailored mortgage solutions without a U.S. credit history, making investing easier.

- Market Trends: Strategic investments in high-growth regions and recession-resistant sectors can yield long-term success.

Now is the time to explore the U.S. commercial real estate market. Get pre-approved today and start your investment journey!

Eligibility and Legal Requirements for Foreign Buyers to Buy a US Commercial Property

There are specific key requirements for foreigners buying commercial real estate property in the US, which are as follows:

- Proof of Identification: Provide a valid passport, visa, SSN, ITIN, green card, or other official ID. Filing a tax return under FIRPTA is required.

- Address Proof: Submit documentation like a driver’s license or other official paperwork. Residency proof is needed if you plan to live on the property, along with proof of reserves, pay stubs, and international credit history.

- Income Proof: Demonstrate ability to make payments using wage slips, property tax returns, or financial records from your overseas bank.

- Affordability Proof: Share details of outstanding debts or loans to show mortgage feasibility.

HomeAbroad helps you properly prepare these documents to ensure a smoother property-purchase process. If you are a foreigner and want to buy an investment property in the United States, start with HomeAbroad today by learning about the steps involved in applying for foreign national mortgages.

How to Apply for a Commercial Property Mortgage Loan as a Foreign Buyer

Here is the step-by-step process for your commercial property mortgage application.

- Step 1 – Estimate your budget

- Step 2 – Obtain Mortgage Pre-approval for your foreign national mortgage

- Step 3 – Prepare your documents for a foreign national home loan

- Step 4 – Choose your property and make an offer

- Step 5 – Finalize your foreign national mortgage loan application

- Step 6 – Lock the interest rate on your mortgage loan

- Step 7 – Mortgage Loan Processing and Underwriting

- Step 8 – Conduct Property Appraisal

- Step 9 – Prepare for Closing

Now, let’s explore how to capitalize on the growing opportunities in US commercial real estate and unlock the potential of this thriving market.

How to Finance Your Commercial Property Purchase as a Foreigner

“Quick Facts: No US Credit? No Problem with HomeAbroad Loans!”

Foreign nationals can purchase US commercial property with HomeAbroad’s tailored financing options without a US credit history.

Foreign National Mortgages are designed to simplify property purchases for international buyers without a US credit history. At HomeAbroad, we provide tailored financing solutions and expert guidance, ensuring foreign investors can seamlessly secure commercial properties in the US.

Steven Glick, Mortgage Sales Director at HomeAbroad.

Now, let’s explore the different types of foreign national investment mortgages we offer and help you find the one that’s right for you.

1. DSCR Loan (Debt Service Coverage Ratio Loan)

Specifically designed for real estate investors, the DSCR Loan evaluates the income generated by the investment property instead of the borrower’s income. It’s a practical solution for expanding portfolios without personal financial constraints.

Requirements:

- DSCR ratio of 0.75+

- Minimum 25% down payment

- 6 months of PITIA cash reserves

- 12-month rental income history (for short-term rentals like Airbnb)

- Market rent appraisal or 12-month documented rental income

- Can close from the home country

2. Fix and Flip Loan

For investors looking to purchase, renovate, and resell properties, fix-and-flip loans provide short-term financing for both the purchase and renovation costs. They’re perfect for those seeking to capitalize on value-added projects and offer fast approval and closing timelines of less than seven days.

Requirements:

- 6-24 months loan term

- 25% – 30% down payment

- Up to 85% Loan-to-Cost (LTC) and 75% After Repair Value (ARV)

- Detailed renovation plan with cost estimates

- Proof of previous successful flip projects

3. Bridge Loan

This short-term financing solution helps real estate investors secure new properties while waiting to sell their current ones. It provides quick access to capital in less than 7 days without needing a US credit history.

Requirements:

- 6-24 months loan term

- 25% – 30% down payment

- Up to 75% LTV (Purchase)

- Up to 70% LTV (Rate term refinance)

- Up to 65% LTV (Cash-out refinance)

- Proof of existing property equity

- Exit strategy for loan repayment (e.g., property sale)

Property Types to Consider for Maximum ROI

Understanding the various kinds of commercial properties can assist you in making an informed decision about investing in commercial real estate. Commercial buildings could be classified as follows:

- Office buildings

- Retail buildings

- Multifamily apartments

- Malls or Arcades

- Office warehouses

- Shopping center

- Industrial building

- Mixed-use building

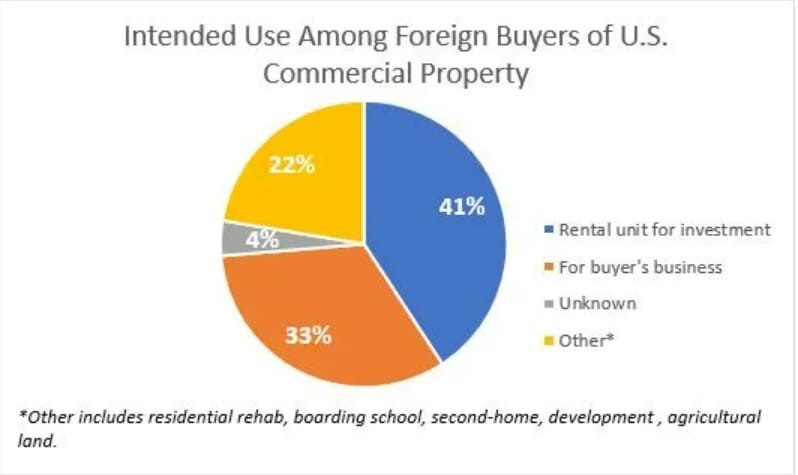

Source: National Association of Realtors

Now that you’re ready to invest in US commercial real estate, let’s discuss the profitable part of your investment journey: the benefits of investing in a commercial property.

Benefits of Investing in a Commercial Property

Commercial property investment offers numerous advantages, from higher rental yields to long-term appreciation. Let’s discuss the top benefits in detail:

Benefits | Key Reasons |

|---|---|

Higher Rental Income | Commercial properties offer 8–12% rental yields, far exceeding residential properties (1–2%). Prime locations can yield up to 15%, making them an excellent investment. The average U.S. commercial rental yield is currently 8% and rising. |

Long-Term Returns | Leases typically span 5–10 years, ensuring consistent revenue with minimal tenant turnover. Annual rent hikes provide stable returns regardless of market fluctuations. Commercial property sales rose 15.6% in 2024, reflecting strong investor confidence. |

Property Appreciation | Commercial properties appreciate faster, offering high long-term returns. Investment options like REITs and fractional ownership enhance accessibility and profit potential. The U.S. market outlook predicts substantial investment opportunities in 2024 and beyond. |

Cost Efficiency | Unlike residential properties, commercial leases shift maintenance costs to tenants, reducing owner expenses. Businesses often customize spaces, further increasing property value. Industrial sector rents averaged $8.30 per sq. ft. in Dec 2024, a 6.6% annual increase. |

Professional Tenants | Businesses leasing commercial spaces are financially stable and reliable, ensuring steady rental income and fewer management issues. Industrial properties remain in high demand, with vacancy rates below pre-pandemic levels. |

Economic Impact | Commercial properties boost job creation and local economies, attracting businesses, banks, and corporations that increase tenant demand. The U.S. economy is projected to grow at 1.7% in 2025, creating a stable environment for commercial investments. |

Own a US Commercial Property with HomeAbroad

Navigating the U.S. commercial real estate market as a foreign investor can be complex, but HomeAbroad makes it seamless.

With our tailored foreign national mortgage solutions, AI-powered property search, and expert network of 500+ real estate professionals, we provide everything you need to invest with confidence. Our concierge services ensure a hassle-free experience from LLC formation to property management.

Unlock exclusive investment opportunities in the U.S. commercial real estate market with HomeAbroad—your trusted partner for global real estate success. Get started today!

FAQs

Can I own a US commercial property without a green card?

All foreign nationals can own a US commercial property without a green card.

What type of commercial investment property is most profitable?

The highest-yielding property is usually rented at high rents. It may consist of RV parks, apartment complexes housing students, office spaces, or storage units.

What is a CCIM?

To become a commercial real estate investor, consider getting your CCIM designation. CCIM stands for Certified Commercial Investment Member, a well-respected designation in the industry. To get your CCIM designation, you’ll need to take a course and pass an exam.

![Can Foreigners Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)