Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Table of Contents

Estimate Your US Mortgage Payment As Foreign National

There are many things to consider while calculating a foreign mortgage, such as:

- If you have opted for several loans for your home, you will need to compare and analyze the monthly payment for each loan.

- You will need to determine how you will file interest for your loan. It can be every month, or you can choose to pay over the life of the loan.

- The amount you pay off after counting how much you put down against the total amount of borrowed money to calculate the extras you paid.

First, gather all the important information to calculate your accounts and understand other factors of the loan.

First, you must collect all the necessary information about your payments, interests, and other important loan details to calculate your mortgage.

The ( ) notation indicates where we’ll utilize these items in calculations.

- The (P) indicates the Principal, including the home purchase price and other payments and charges, excluding the down payment.

- The (R) indicates the Interest Rate on your loan. Remember that it does not denote the Annual Percentage Rate (APR) since the mortgage will be paid monthly and not annually, which eventually creates a difference between the interest rate and the APR.

- The (t) indicates the TERM, as in the years you will repay the loan.

- The (n) indicates the payments that will be paid per year (12 months)

- Type of loan: interest only, adjustable loan, fixed rate.

- The market value of your home

- Monthly income

How to Calculate your Monthly Mortgage Payments as a Foreigner

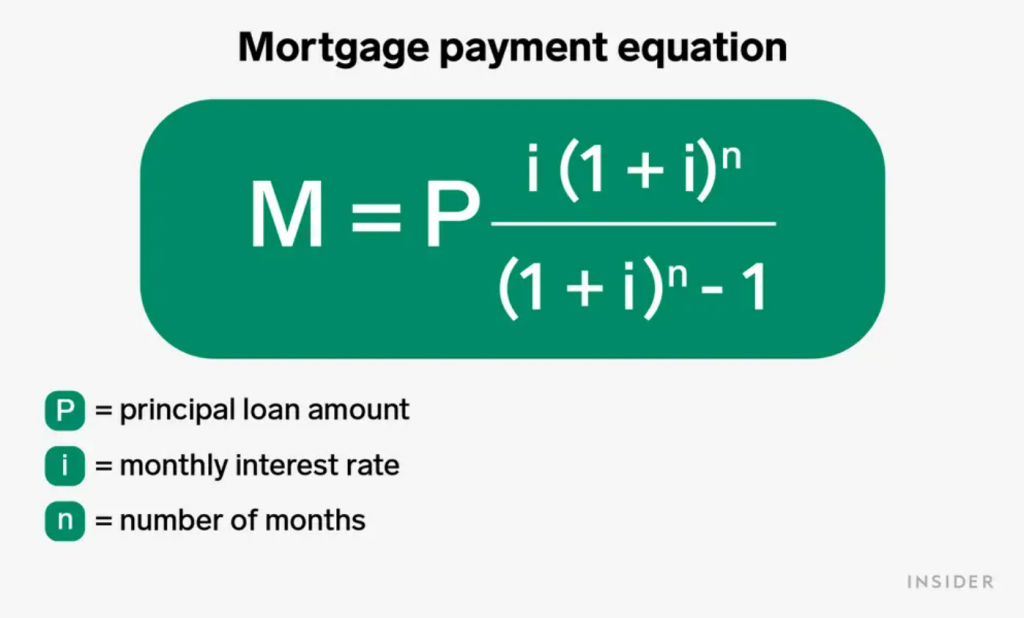

You can calculate your monthly mortgage payments with a formula which is:

M = P [ I ( 1 + I )^N ] / [ ( 1 + I )^N – 1 ]

To find the monthly payment amount “M,” you need to fill in the following three numbers from your loan:

- You need to determine “M” as in your monthly payment, and to do that, you will need to put these important numbers below:

As discussed above-

- P is the Principal Amount

- I is the Interest Rate

- N is the Monthly mortgage payments (number of periods)

It will help calculate your monthly mortgage payments if you know your principal amount, interest rate, and the number of periods. Not just that, but knowing these three details will also help you calculate the cost of your total loan.

Note that the formula only calculates the monthly Principal and interest expenses; you’ll need to add additional fees, such as taxes and insurance.

Coming Down to Calculations

Remember that most lender quotes provide rates and term information in annual terms. Since this formula aims to calculate your monthly payment amount as a foreigner, the interest rate denoted as “I” and the number of periods as “N” must be converted into a monthly format. This means that you must convert your variables through the following steps:

To calculate your monthly payment on your total loan cost, you will need to convert the variables from the formula (M = P [ I ( 1 + I )^N ] / [ ( 1 + I )^N – 1 ]).

Here are the steps:

- To find the “P,” which is the principal amount that is borrowed, you need to subtract the down payment amount from the home price.

- To find the “I,” which is the monthly interest rate. You need to divide the quoted annual interest rate by 12.

- To determine the total monthly payments you will make, multiply the years in your mortgage term by 12. “N” – You must be careful not to conflate this with the monthly payments, or “M,” which we’ll compute later.

EXAMPLE:

To illustrate, suppose you borrow $100,000 for 30 years with a rate of 6 percent.

{100,000 x (.06 / 12) x [1 + (.06 / 12)^12(30)]} / {[1 + (.06 / 12)^12(30)] – 1}

(100,000 x .005 x 6.022575) / 5.022575

3011.288 / 5.022575 = $599.55/Month

This calculation is only used to determine the monthly payment amount, although most lenders’ quotes give yearly terms and interest rates.

Important Factors to Consider to Calculate Foreign Mortgage Payment

It’s possible to compute your total monthly payment by hand using a basic equation, and it is also easier using an online mortgage calculator. However, if you choose to calculate your mortgage, you will need to keep the following things in mind:

Find out the mortgage principal.

A mortgage principal is the starting loan amount that you pay.

For instance, if you have $200,000 in cash, you can make a 20% down payment on a $600,000 property. You can get the rest of the $400,000 from a bank as a loan and get done with purchasing the house. So here, your mortgage principal is the amount that you borrowed from the back, which is $400,000.

If you choose a fixed-rate mortgage plan, you will pay the same principal amount every month. You’ll pay more of your money toward the Principal and less to the interest for each monthly mortgage payment.

Your monthly interest rate

An interest rate is simply a fee that a bank charges you when you borrow money which comes in percentage. In most cases, a foreign buyer is most likely to get a lower interest rate on the loan if they have a high credit report, a high down payment, and a low debt-to-income ratio.

This may happen because of the risk of loaning the money to a less financially stable buyer, which means fewer chances that the person will be able to cover all the payments.

The lenders or banks give an annual interest rate on the mortgages. If you wish to manually calculate the monthly mortgage payment, you’ll need the current month’s interest rate and then simply divide the yearly interest rate by 12 (the 12 will indicate the months). Here’s an example of how to do it:

If your annual interest rate is 3%, your monthly interest rate will be 0.25%. (3% divided by 12= 0.25%)

Calculation of the number of payments

The most frequent terms for a 30-year fixed-rate mortgage are 30 and 15 years.

Multiply the number of years on your mortgage to 12 (representing months) to find out the monthly payments that you can expect you will make.

For example, a 30-year mortgage would need 360 monthly payments, whereas a 15-year mortgage would necessitate 180 monthly installments. You will need these specific numbers only if you want to do the calculation manually.

Private mortgage insurance

If you go for a regular mortgage loan and can only put less than a 20% down payment for your total loan amount, you will require Private Mortgage Insurance (PMI).

The lender will likely include your PMI premium in your monthly mortgage payments.

The monthly PMI payment is a mortgage insurance premium that protects you against defaulting on your loan. It’s calculated based on your home’s equity and typically costs between 0.2% and 2% of your total mortgage principal.

PMI is frequently waived when the homeowner reaches 20% home equity. For example, you may pay a different sort of mortgage insurance if you have an FHA loan.

Costs of property tax

Property taxes are collected by the lender and then paid into a specific account, usually known as an escrow or impound account, at the end of each year and are often included in a monthly mortgage payment. On behalf of the homeowners, the taxes are paid to the government at the end of the year.

The amount you owe in property taxes is determined by local tax rates and the home’s value. Therefore, the lender’s estimate of how much a homeowner will have to pay may be greater or less than the actual amount owed, resulting in a credit or a bill at tax time.

Closing costs

It’s simple to factor in closing costs or fees once you’ve figured out the total Principal and interest charges on your mortgage because closing expenses are paid in full when you close.

There may be various other sorts of up-front charges, and the method for computing them is unchanged. These costs are added to the overall price of the mortgage loan. Remember that recurring payments, such as taxes or homeowner’s insurance, will be ignored.

Conclusion

Determining your mortgage payments as foreign nationals for an investment or a residential property can be daunting, but it doesn’t have to be. By following the tips we’ve outlined in this blog post, you should get a good idea of what you can expect each month in terms of payments. Remember that these are only estimations and that you will need to speak with a lender directly to get an exact figure.

HomeAbroad provides foreign national mortgage programs with no US credit history, and you can contact us for a quick quote and preapproval.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

FAQs

What is a fixed-rate mortgage?

A fixed-rate mortgage is one in which the interest rate remains constant till the loan is completely paid. However, the amount of Principal and interest paid each month varies, but the overall payment remains constant, making budgeting simple for homeowners.

Do foreign national loans have to pay a higher down payment?

Yes, a higher down payment can be needed for a loan if you are a foreign national, but the exact amount would also depend on the borrower’s financial situation. These loans will generally require a higher down payment than a traditional mortgage loan – typically around 20% – to offset the lender’s increased risk.

How much is a 150k mortgage per month?

If you’re looking at a $150,000 mortgage, your monthly payment will be about $725. This is based on a 3% interest rate and a 30-year term. Your monthly payment may be different depending on the interest rate, loan term, and other factors. You may go through this guide to know all the nitty-gritty details about mortgage payment calculation.