Why partner with

Get Referral Commission on Funded Loans

Earn a transparent referral commission on every funded loan you send our way.

List Your Rental Properties with Ziffy

Showcase your active investment rental listings to domestic and global investors.

Investor-Ready Loan Programs

Tailored U.S. mortgage options without U.S. credit history. DSCR and RTL (Fix & Flip, Bridge) so your clients can move fast.

Dedicated Loan Team for Your Clients

Clear next steps and a responsive point-of-contact from application to closing.

Seamless Referral Workflow

Refer via link or directly in our portal, and track lead status, milestones, and payouts in real time.

Full Visibility & Control

Automatic status updates at every step, no chasing.

Hear from our partner

Hear from our partner

What our partners say

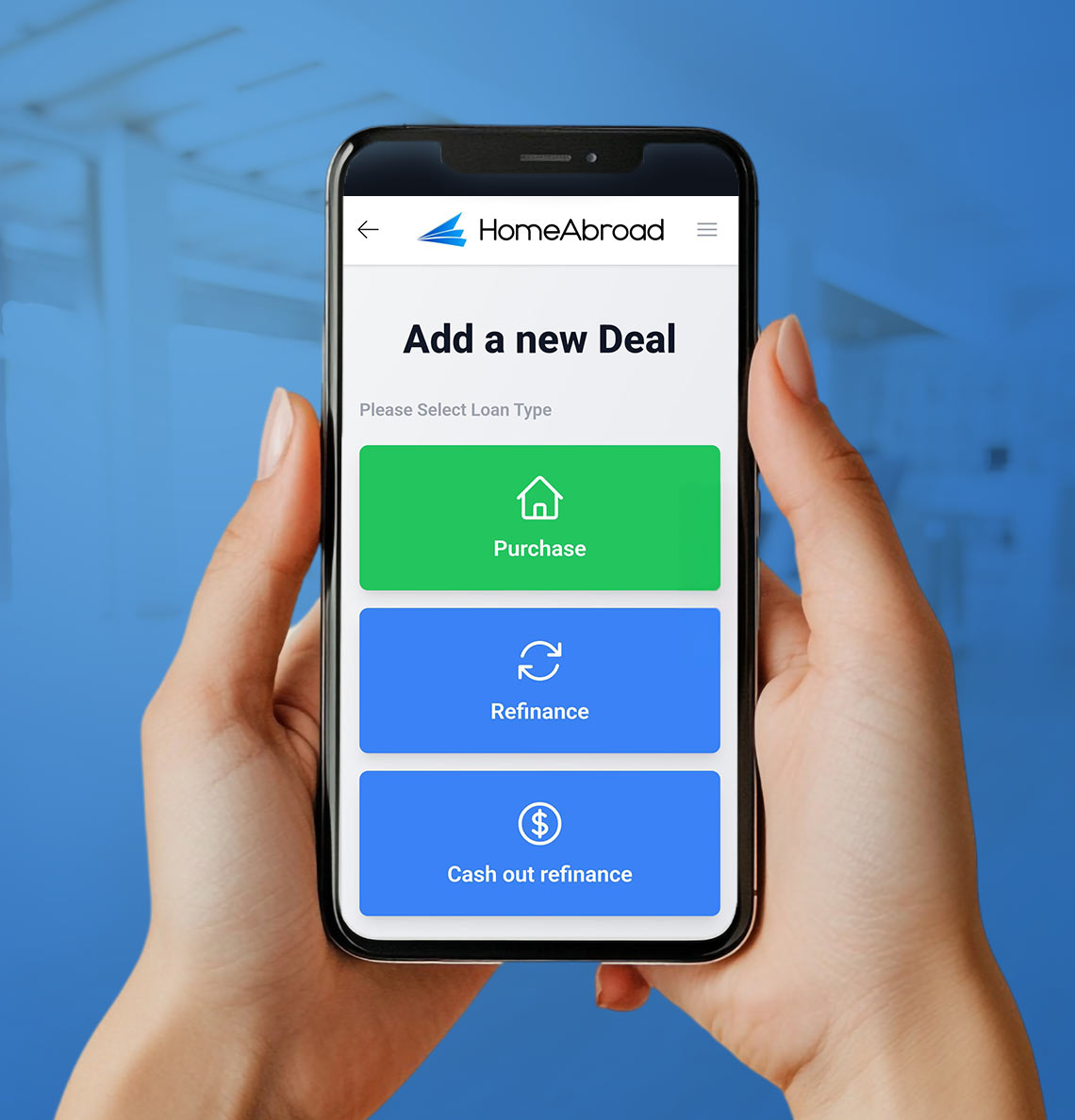

How it works

How it works

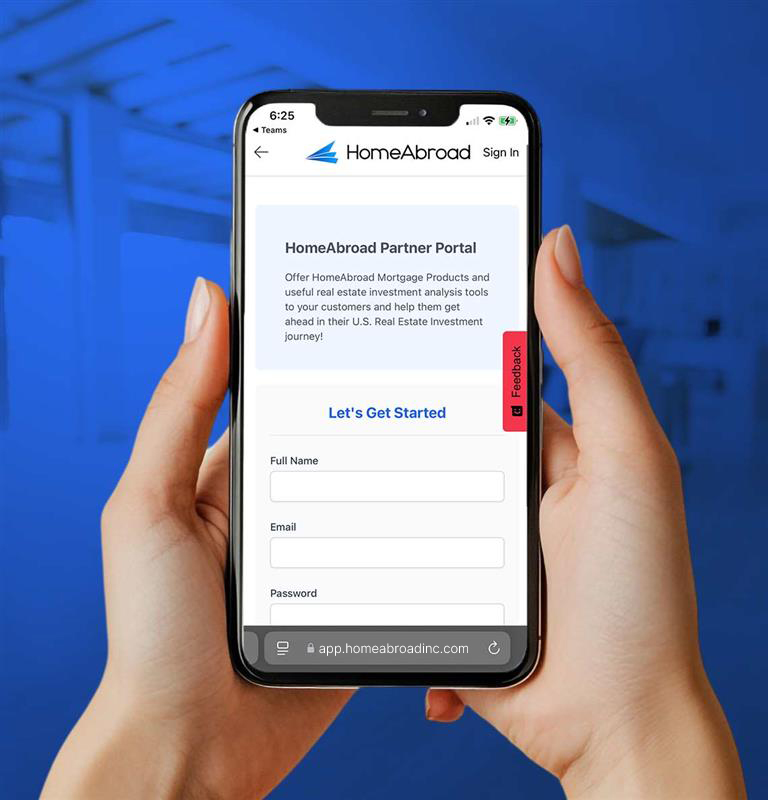

Apply & get portal access

Quick registration → secure partner account

Select the loan type

We offer multiple investor-friendly programs; our team route to DSCR or Hard Money loan as needed.

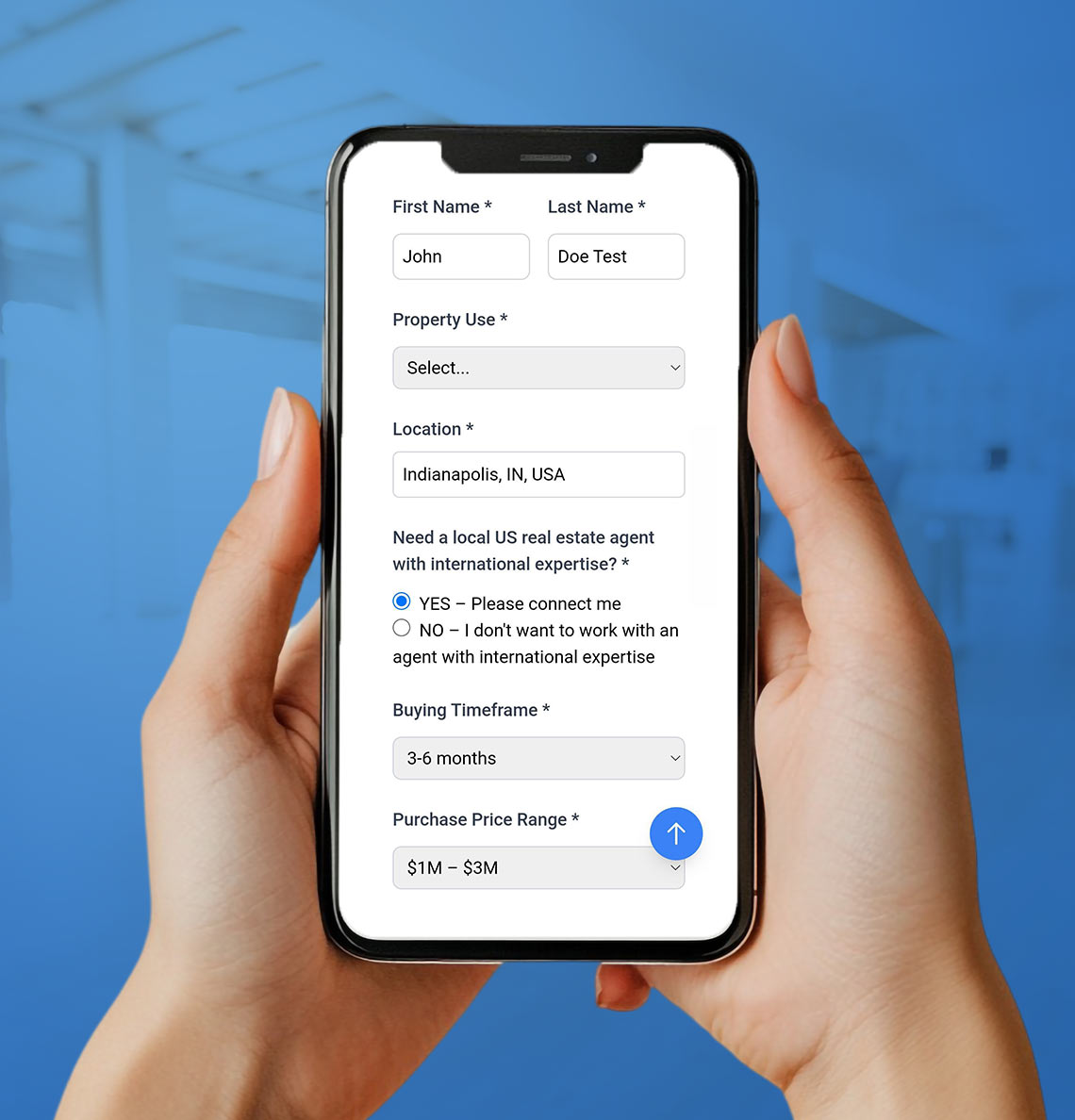

Submit leads in minutes

Add via portal or referral link; everything stays organized with status tracking.

Underwriting to closing

Dedicated team drives swift, reliable approvals and smooth closings, minimizing last-minute surprises.

Tailored Mortgage

Loan Programs To

Suit Your Investment Needs

DSCR Loan / Investor Cash Flow Loan

<1 eligible with higher down payment.

Full Documentation Loan

Bridge Loan

Fix & Flip Loans

What your clients get (you’ll love this too)

First AI Powered Vertically Integrated U.S. Real Estate Investment Platform

Investor-friendly loan programs and fast closings driven by a focused underwriting process

Discover. Analyze. Finance, All-in-one powerful ecosystem for your clients

A dedicated, responsive team from application to closing

Portal Video

FAQs

How does the referral program work?

You simply refer investor clients who need financing (DSCR or Hard Money). Our team handles the financing end-to-end, keeps you updated, and pays you a referral fee once the deal closes.

Who can participate in this program?

Licensed realtors, brokers, and real estate professionals are welcome.

Is this program compliant with real estate commission laws?

Yes. Referral fees are structured in compliance with RESPA and state-specific licensing requirements. We ensure all payments are made legally and transparently.

What is a DSCR loan?

A DSCR (Debt Service Coverage Ratio) loan is an investor-focused mortgage. Instead of using personal income or tax returns, lenders qualify the loan based on the property’s rental income. It’s ideal for real estate investors, including those with complex finances or multiple properties. You’ll get the best terms when rent covers the mortgage (DSCR ≥ 1.00), but we can still qualify your loan even if the rental income doesn’t fully cover it.

Can foreign nationals get financing through this program?

Yes. Foreign investors can qualify for DSCR and Hard Money loans even if they don’t have U.S. credit history, SSN, or residency. This makes it much easier to serve your international clients.

How much can I earn in referral fees?

Referral fees vary based on the loan amount and program terms. Typically, our partners earn an average of $15K per month on referral fees, but larger deals can pay more.

When do I get paid?

Referral fees are disbursed after the client’s loan has successfully closed and funded. Payments are usually processed within 15-20 days.

Do I have to do any loan paperwork or handle financing?

No. You focus on real estate, we handle all loan documentation, underwriting, and funding. You just make the referral.

Will I lose control of my client if I refer them?

Not at all. You stay the client’s primary agent. We handle financing only, and we’ll keep you in the loop throughout the process.

What types of clients should I refer?

Any investor clients seeking DSCR loans, hard money financing, or U.S. real estate investment loans. Both U.S. and global investors are eligible.

Do I need to sign a contract to join?

Yes, you’ll get a partner ID and agreement that clearly outlines terms, so your referrals and payouts are tracked accurately.

How do I track my referrals and earnings?

You’ll have access to our partner portal, where you can submit referrals, check deal statuses, and view upcoming payouts.

What if my client doesn’t close on a loan?

Referral fees are paid only on successful, funded deals. There’s no cost or penalty if your referral doesn’t close.

Can I refer clients outside my state?

Yes. Since this is financing, you can refer investor clients nationwide, even foreign investors buying in the U.S.

How do I get started?

Sign up through our partner portal. Once registered, you’ll receive a partner ID and can begin submitting referrals immediately.