Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways

1. Instead of paying rent, buying a home allows H1B visa holders to build equity and gain long-term stability.

2. H1B visa holders can benefit from tax deductions on mortgage interest, property taxes, and potential capital gains exemptions.

3. Even if an H1B visa holder has to leave the US, they can rent out, sell, or keep the property for future use.

Table of Contents

Buying a house in the US while on an H1B visa is a major decision, and many visa holders wonder if it’s the right move. The good news is that H1B visa holders are eligible to buy property in the US, and with the right approach, homeownership can be a smart financial decision.

Owning a home means building equity instead of paying rent, enjoying stability, and potentially benefiting from long-term appreciation. Plus, with mortgage options available even for those without a US credit history, buying a home is more accessible than you might think.

In this guide, explore the benefits of buying a home on an H1B visa, what to consider before making a purchase, and how to secure financing, even if you’re new to the US real estate market.

Benefits of Buying a House on an H1B Visa

Many H1B visa holders struggle with the decision of whether to keep renting or buy a home in the US. While renting offers flexibility, homeownership provides long-term financial benefits that make it a smarter choice. Below are the key benefits of buying a house while on an H1B visa:

1. Build Equity Instead of Paying Rent

Renting means paying monthly expenses without getting any financial return. When you buy a house, your mortgage payments help you build equity, which is the difference between your home’s market value and the remaining mortgage balance.

Over time, as you pay down your loan and your property appreciates, your equity grows. Essentially, instead of paying rent to a landlord, you’re investing in an asset that can generate wealth in the long run.

2. Owning Can Be More Affordable Than Renting

Renting in major US cities can be expensive, with monthly costs rising yearly due to market demand. In many cases, the mortgage payment can be lower than rent for a comparable home, especially with a fixed-rate mortgage that keeps payments stable.

Unlike rent, which is purely an expense, mortgage payments contribute toward homeownership and equity. Plus, homeowners avoid the uncertainties of lease renewal and unexpected rent hikes, offering greater long-term financial stability.

3. Enjoy Stability and Personal Freedom

Owning a home isn’t just about finances; it’s about creating a stable and comfortable living environment. When you buy a house, you don’t have to worry about landlords raising rent, ending leases, or restricting how you use the space.

Homeownership provides more space and privacy. You can modify and decorate your home as you like, enjoy outdoor space, and create a stable environment without the hassle of frequent relocations.

4. Affordable Home Prices in the US

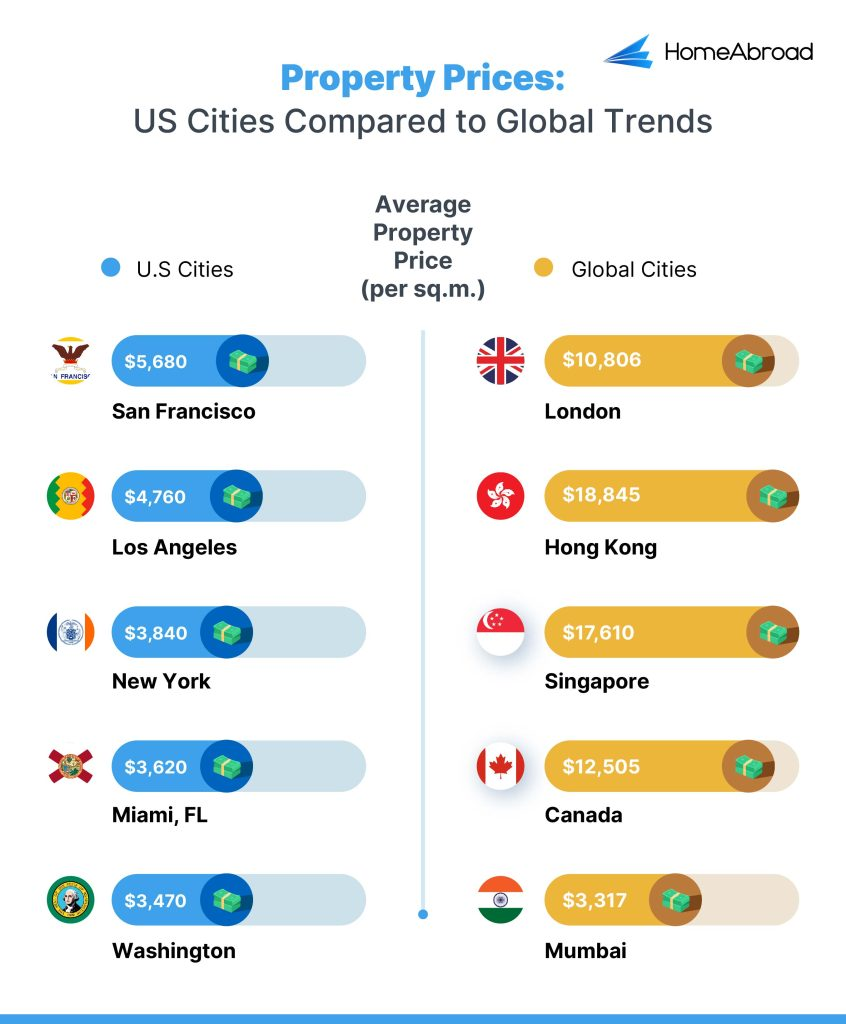

As of 2025, the average US home value is around $355,328, making homeownership a realistic goal for many H1B visa holders. Compared to many other countries, the US offers relatively affordable housing options, especially in suburban areas and growing cities.

With a wide range of properties available, you can find a home that fits your budget while still offering excellent investment potential. Plus, with mortgage options available even to H-1 B visa holders, buying a home can be a financially wise decision rather than continuing to pay rent.

5. Mortgage Options Available (Even Without a US Credit History)

If you have a strong US credit history, you may qualify for a mortgage with a lower interest rate, making homeownership even more affordable. Lenders assess your credit score to determine your financial reliability, and a higher credit score can lead to better loan terms.

However, with HomeAbroad, you can secure a mortgage on an H1B visa even without a US credit history. Our deep understanding of the challenges foreign nationals face in securing mortgages enables us to provide tailored mortgage solutions for your unique situation, making it easier for H-1 B visa holders to achieve homeownership in the US.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

6. Tax Benefits of Homeownership

Owning a home on an H1B visa comes with valuable tax benefits that can save you thousands of dollars compared to renting. Some of the key tax advantages include:

- Mortgage Interest Deduction – You can deduct mortgage interest, reducing your taxable income.

- Property Tax Deduction – A portion of the property taxes you pay can also be deducted.

- Capital Gains Tax Exemptions – If you sell your home after living in it for at least two years, you may qualify for tax exemptions on a portion of your profits.

These tax benefits make homeownership a financially savvy choice for H1B visa holders looking to build long-term wealth. For more details, check out our Comprehensive Tax guide.

7. Appreciation and Wealth Building

US home values have increased by an average of 7.5% annually over the past five years (source: Zillow), highlighting the long-term wealth-building potential of real estate. For H1B visa holders, buying a home today can be a strategic financial move, allowing you to benefit from rising property values and growing equity.

If you sell your home in the future, you could benefit from capital appreciation and secure a solid return on investment. Additionally, as your home’s value rises, you can leverage your equity for future investments or refinancing opportunities.

Potential Risks of Buying a Home on an H1B Visa

Buying a home on an H-1 B visa offers significant advantages, but homeownership while on a work visa also carries risks. The good news is that with careful planning and the right financial strategies, you can reduce these risks and make homeownership a wise long-term investment.

1. Job Security and Mortgage Responsibility

Since your H-1 B visa is tied to your employment, losing your job could affect your ability to remain in the US. If this happens, you may have a limited time to find a new employer willing to sponsor your visa.

To mitigate this risk, consider building an emergency fund to cover several months of mortgage payments. Additionally, you can talk to your lender about increasing your loan tenure, which will lower your monthly payments and make them more manageable in case of financial uncertainty.

2. Relocation Due to Job Changes

Your visa status is linked to your employer, meaning if your company transfers you to another location, then you may have to relocate unexpectedly. This could make homeownership seem risky, as selling a property quickly may not always be ideal.

However, you can rent your home, which can cover your mortgage payments and even generate additional income. This way, your investment remains beneficial even if you need to move elsewhere.

What Happens to Your Home If You Have to Return to Your Home Country?

One of the biggest concerns for H-1 B visa holders is the uncertainty about their stay in the US. Since the H1B visa depends on employment sponsorship, job changes, visa renewals, or green card delays can create challenges.

However, even if you have to leave the US, owning a home remains a valuable asset. Here’s what you can do:

1. Rent Out Your Property

If you return to your home country, you don’t have to sell your house immediately. Instead, you can convert it into a rental property and generate rental income. Many H-1 B visa holders successfully rent out their homes, ensuring their investments continue to grow.

Pro Tip: Consider hiring a property management company to handle tenants, maintenance, and rent collection while you’re abroad.

2. Sell Your Home

If your home is appreciated, selling it could be a profitable option. Over the last five years, US home values have increased by 7.5%, meaning you could walk away with a solid return on investment.

3. Allowing friends and family to use the property

If you don’t want to sell or rent out your home, you can allow trusted friends or family members to stay in the property. This ensures the home is maintained and occupied while you’re away.

Owning a home on an H1B visa comes with flexibility, and regardless of your visa status, you have multiple options to make the most of your investment.

Case Study: How an H1B Visa Holder Successfully Bought a Home in the US

Markus, a software engineer from Germany, had been renting an apartment in Orlando, Florida, for $2,200 per month. With rising rents, he began considering buying a home. However, he wasn’t sure how he would qualify for a mortgage without a US credit history.

That’s when he connected with HomeAbroad, where our expert loan manager, Rachel Spaccarotelli, helped Markus find his dream home in a growing Orlando neighborhood and secure a tailored Mortgage for his unique needs.

With expert guidance, he qualified for a loan without a US credit history, turning his homeownership goal into reality.

Property Details:

Location: Orlando, FL

Property Value: $350,000

Mortgage Details:

Loan Amount: $280,000

Down Payment: 20% ($70,000)

Interest Rate: 7.1% (Fixed)

Loan Term: 30 Years

Monthly Mortgage Payment: $1,880

Before buying, Markus was paying $2,200 per month on rent, which offered no financial return. Now, with a $1,880 mortgage payment, a portion of his monthly payments goes toward home equity, turning his housing costs into an investment rather than an expense.

With a proven track record of helping foreign nationals achieve homeownership, HomeAbroad simplifies the mortgage process for H1B visa holders. By offering tailored mortgage solutions and expert guidance, we ensure that visa holders can confidently secure a mortgage, find high-potential properties, and make informed real estate decisions.

Conclusion

Buying a home on an H1B visa may seem challenging, but with the proper guidance and mortgage solutions, it’s entirely possible. Instead of spending years paying rent with no financial return, investing in a home allows you to build equity, gain long-term stability, and take advantage of home value appreciation.

At HomeAbroad, we specialize in helping H1B visa holders secure mortgages and find the right home, even without a US credit history. With our expertise and seamless process, foreign nationals can confidently move forward in their homeownership journey.

Start your journey to homeownership with HomeAbroad and make your dream home a reality!

FAQs

Is buying a house in the USA worth it?

Yes, buying a house in the USA can be worth it, especially if you plan to stay long-term. It allows you to build equity, gain tax benefits, and avoid rising rent costs. Additionally, property appreciation can make it a wise financial investment over time.

Is buying a home cheaper than renting for H1B visa holders?

In many cases, buying a home can be cheaper than renting for H-1 B visa holders, especially in cities where rents are high. With a fixed-rate mortgage, monthly payments remain stable, while rent can increase over time.

What are the mortgage options for H1B visa holders?

H1B visa holders with a good US credit score can qualify for conventional loans. In contrast, those without a US credit history may be eligible for HomeAbroad’s tailored H-1B visa mortgage programs.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Housing Data – Zillow Research