Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Smart investors don’t wait for the headlines. They act when the fundamentals quietly shift in their favor.

For Canadian investors, this shift couldn’t come at a better time. While housing prices at home remain high and cash flow opportunities are limited, the US is offering a rare mix of affordability, income potential, and long-term stability.

Even better, HomeAbroad offers exclusive 30-year fixed-rate mortgage financing solutions tailored specifically for Canadians. Our unique solutions require no US credit history and base qualifications on rental income rather than personal income.

This isn’t about chasing deals across the border. It’s about building long-term wealth where the numbers make sense.

Table of Contents

Is Investing in US Real Estate Still Worth It?

Absolutely, and especially for Canadians seeking affordability, income potential, and long-term value.

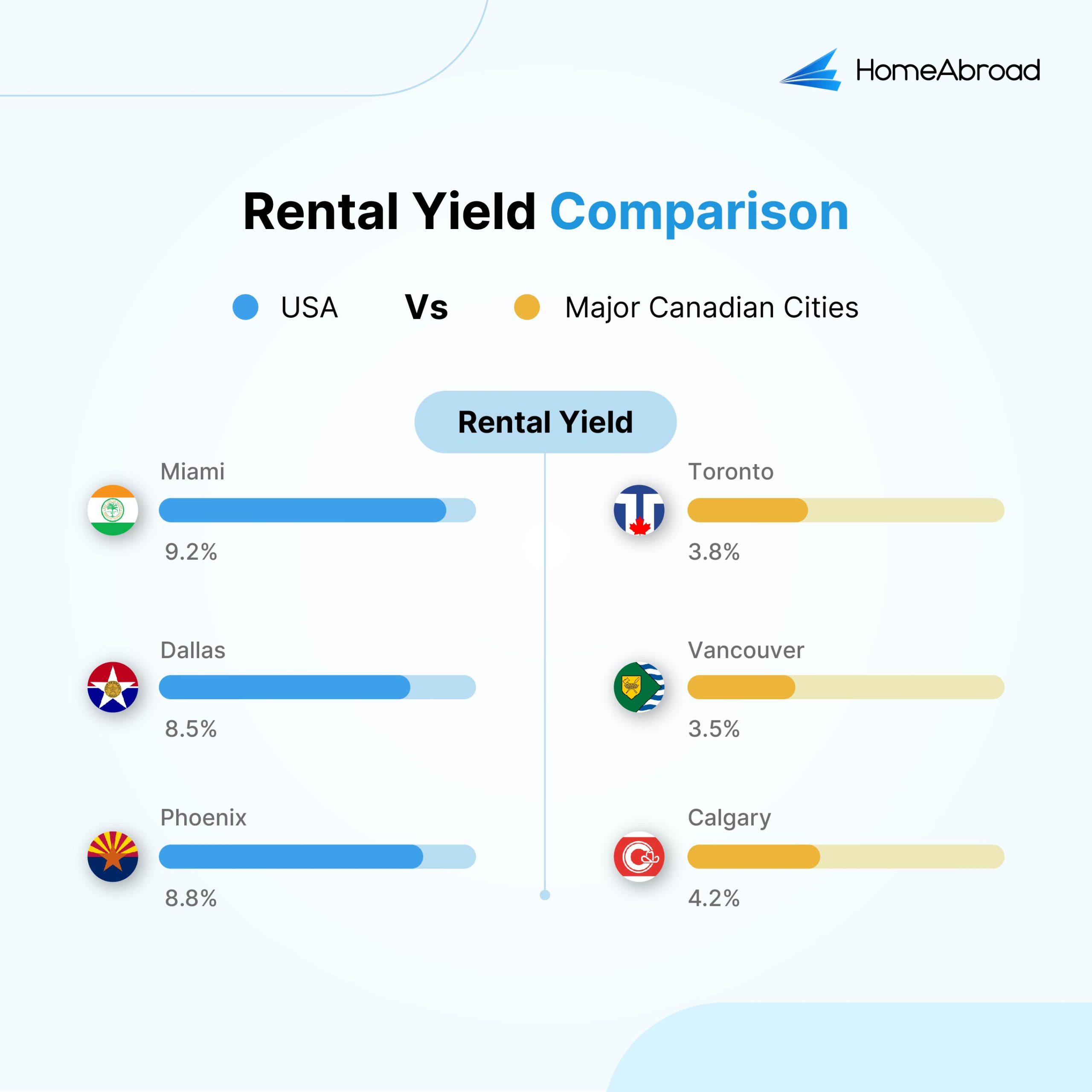

While Canadian real estate market remains difficult for investors to break into, the US continues to offer properties where the actual math works. Homes are priced more reasonably, rents are rising at a steady pace, and rental income can cover mortgage and generate monthly cash flow. That kind of opportunity is becoming incredibly rare in Canada.

According to RBC, as of late 2024, a typical household in Toronto needed 75.1 percent of its income to cover homeownership costs, and Vancouver hit an extreme 96.7 percent, meaning many families couldn’t realistically afford a home.

In contrast, the National Association of Realtors’ Housing Affordability Index remained above 100 in early 2025, which means a median-income household can qualify for a median-priced home.

Rental trends further reinforce the case.

Zillow’s May 2025 data shows US national median rents rose 3.2% year-over-year. More importantly, the rent-to-price ratio in many US markets remains favorable, allowing rental income to cover the mortgage and still generate monthly cash flow.

And this isn’t just happening in traditional hotspots. Cities across the Midwest and Southeast are benefiting from economic growth, job creation, and population shifts, keeping rental demand strong.

What this means for Canadian investors:

- Access to quality properties at lower cost

- Rent-to-price ratios that support strong cash flow

- Flexibility to build a portfolio without stretching finances too thin

With HomeAbroad’s mortgage solutions for Canadians and tools to help you find and analyze high-performing properties, it’s easier than ever to build a profitable US real estate portfolio.

Can You Expect Strong Returns from the US Real Estate Market?

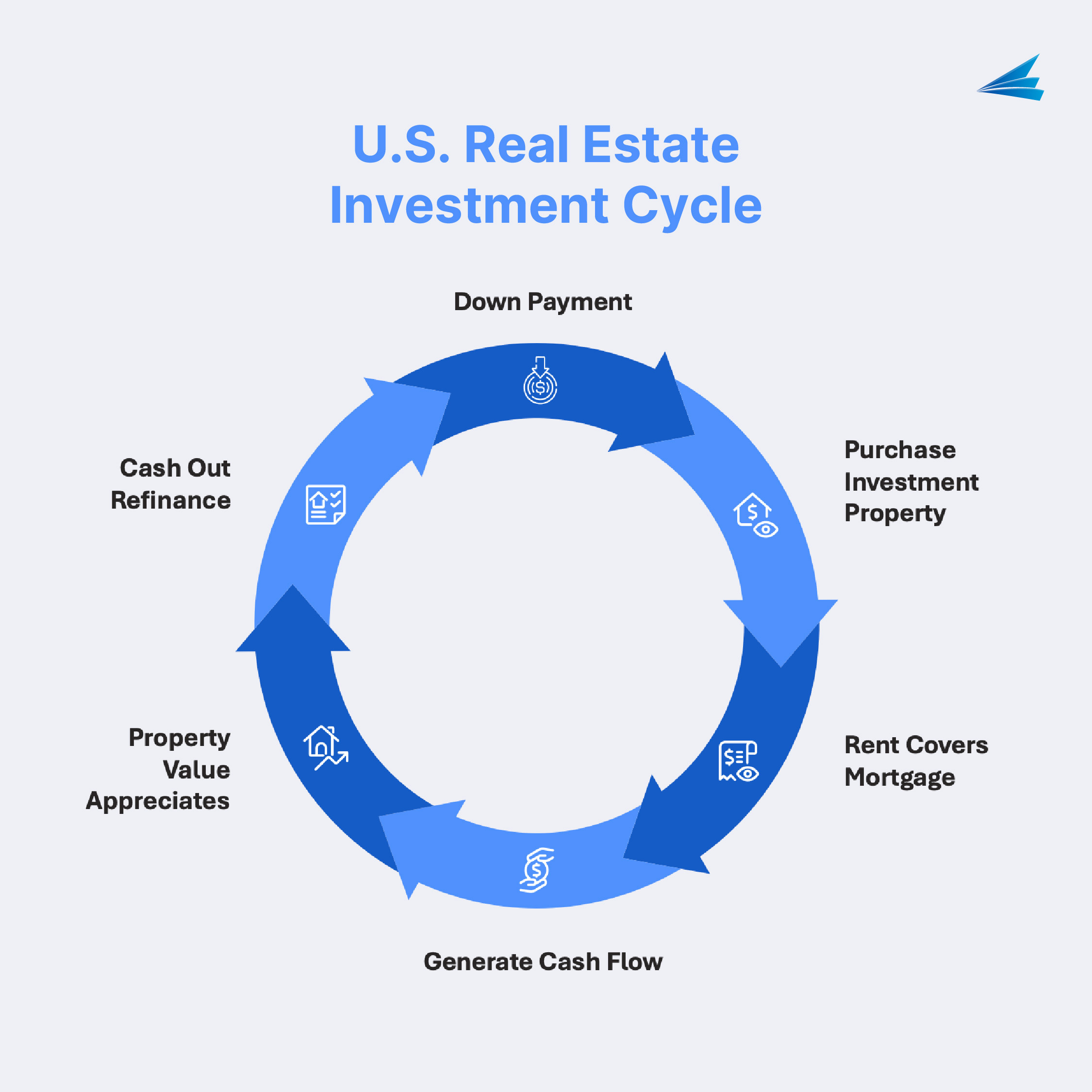

In many Canadian cities, property appreciation is the only real payoff. But in the US, returns start with positive cash flow.

Investments in mid-priced, high-demand US metros are delivering consistent income and long-term equity growth. This combination of monthly returns plus steady appreciation gives Canadian investors a more balanced path to wealth.

The ability to unlock equity via cash-out refinance really makes US real estate investing into a generational wealth-building tool.

For Canadians using HomeAbroad’s financing options and cashflow tools, this means being able to identify properties where rental income supports the mortgage, while still building equity over time. It’s a more measured approach to real estate investing, and it’s one that’s becoming harder to find at home.

Long-Term Real Estate Fundamentals That Outweigh Short-Term Noise

It’s understandable that some Canadian investors are feeling cautious. Cross-border headlines, policy changes, and economic uncertainty can make the US market feel unpredictable.

But when you take a closer look at the fundamentals, the long-term picture is steady and promising. Rental demand is strong. Affordability is improving. Inventory remains limited in high-growth regions, supporting future price appreciation.

Most importantly, Canadians still have full legal access to buy, finance, and own US property. Nothing has changed in terms of eligibility or access.

See how HomeAbroad’s Canadian clients, Liam & Emma bought a $1.5M Hawaii property using a HomeAbroad DSCR loan without US credit history. Read their full story here.

Canadian Mortgages vs. HomeAbroad US Mortgages: What Canadian Investors Should Know

The US real estate market is one of the few markets where you can generate cash-flow with financial leverage. Hence, figuring out financing is a critical piece of the puzzle. Here’s how traditional Canadian mortgages compare to the tailored US mortgage solutions offered by HomeAbroad for real estate investors:

| Feature | Mortgages offered by Canadian Banks | US Mortgages for Canadians by HomeAbroad |

|---|---|---|

| US Credit History | Requires strong financials in Canada | No US credit history or Canadian credit required |

| Qualification | Qualification based on Debt to Income Ratio | Qualification based on Property’s Rental Income. |

| Loan Term | Begins with an initial term of 3, 5, 7, or 10 years, with Adjustable Rate Mortgages. | Typically, 30 years or based on the specific loan product, with Fixed Rate Mortgage and zero restrictions. Adjustable Rate Mortgages are also available. |

| Interest Rates | Higher than the interest rates for Canadian domestic transactions | Competitive rates; interest rates can vary based on loan type and financial profile; only 0.5%-.75% higher than interest rates for US citizens. |

| Down Payment Requirement | 20% or higher | 25% |

| Documentation Required | Extensive documentation including proof of income, assets, and Canadian credit history | Streamlined process; we use property’s income. Personal income is not required. |

| Processing Time | Longer due to cross-border considerations | Quick approvals, often within 30 days |

With HomeAbroad, Canadian investors gain access to mortgage financing designed specifically for their unique cross-border needs, eliminating barriers and unlocking more flexible, long-term investment opportunities in the US market.

Why Choose HomeAbroad?

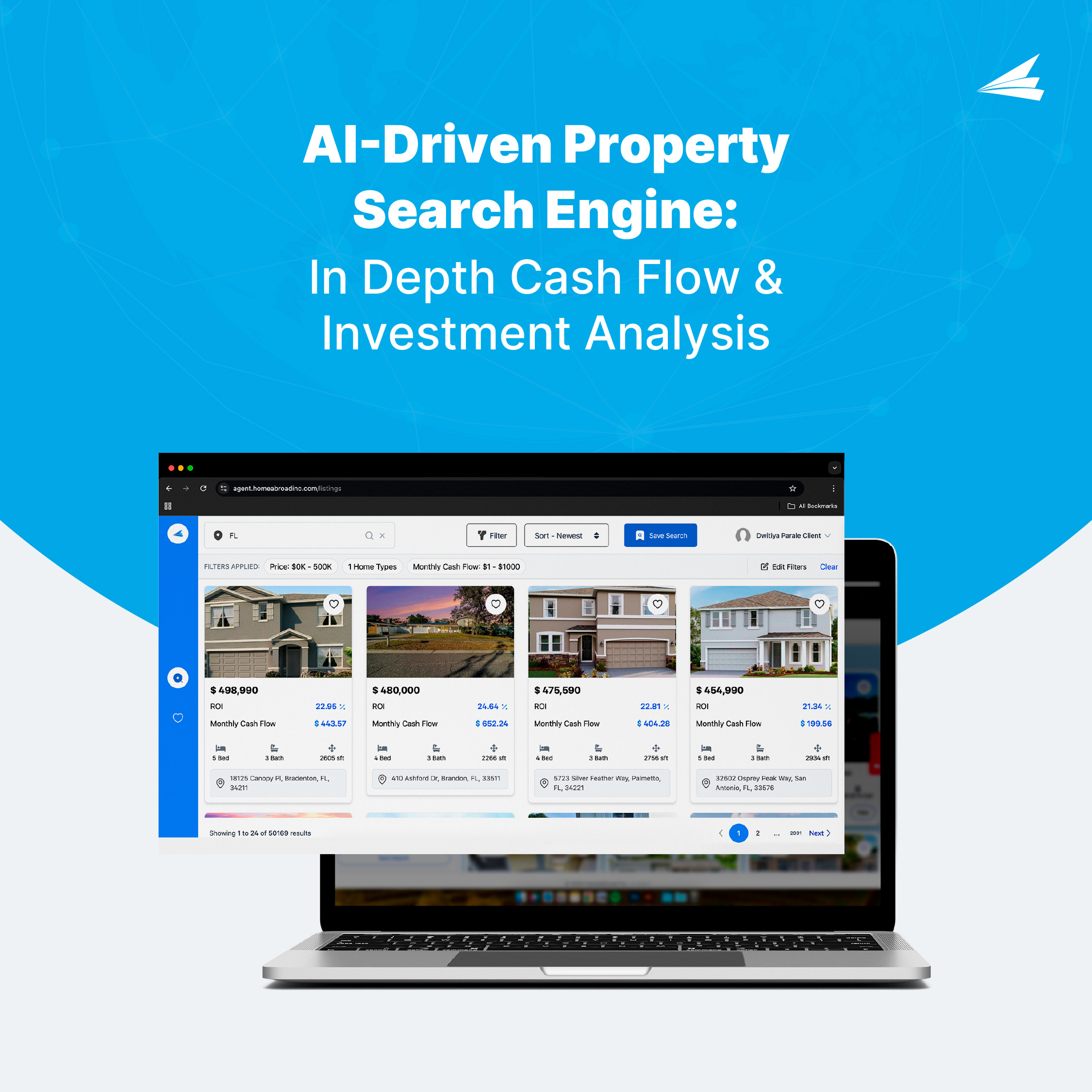

- One-Stop Solution: Find the perfect cashflow deal, running precise ROI analytics, and fund it – all on one powerful global investment platform.

- Exclusive Canadian Mortgage Programs: 75% financing and competitive rate tailored for Canadian investors without needing US credit history.

- AI-Driven Investment Property Platform: Discover top investment properties with curated listings, cash flow and profitability analysis and real-time market alerts.

- 500+ Real Estate Experts: Get personalized guidance from local investor-friendly agents with international expertise.

- Concierge Services: LLC setup, bank accounts, insurance, and property management.

Final Thoughts: Seize The Moment

For Canadian investors, the US market offers better affordability, strong rental income, and steady returns. HomeAbroad makes it easy to navigate financing without a US credit history and access tools built for cross-border success.

Now is the time to diversify and grow your portfolio with confidence.