Investment Highlights

| Property Details | Loan Details | HomeAbroad Solutions |

|---|---|---|

| Purchase Price: $210,000 | Program: DSCR Loan (30-year Fixed) | HomeAbroad DSCR Loan |

| Location: Memphis, Tennessee | Loan Amount: $157,500 | HomeAbroad Real Estate Agent |

| Monthly Rent: $1,800 | Down Payment: 25% ($52,500) | LLC Formation Service |

| Rental Yield: 10.28% | Interest Rate: 9.25% | Concierge Service |

In 2024, Indian citizens invested an impressive $4.1 billion in US real estate, according to the latest data from NAR.

Notably, 43% of those purchasers reside in India— demonstrating how Indian Citizens continue to tap into lucrative opportunities in the United States, while residing in India.

In fact, over the last 10 years, Indian citizens have purchased over $10 Billion of US Real Estate.

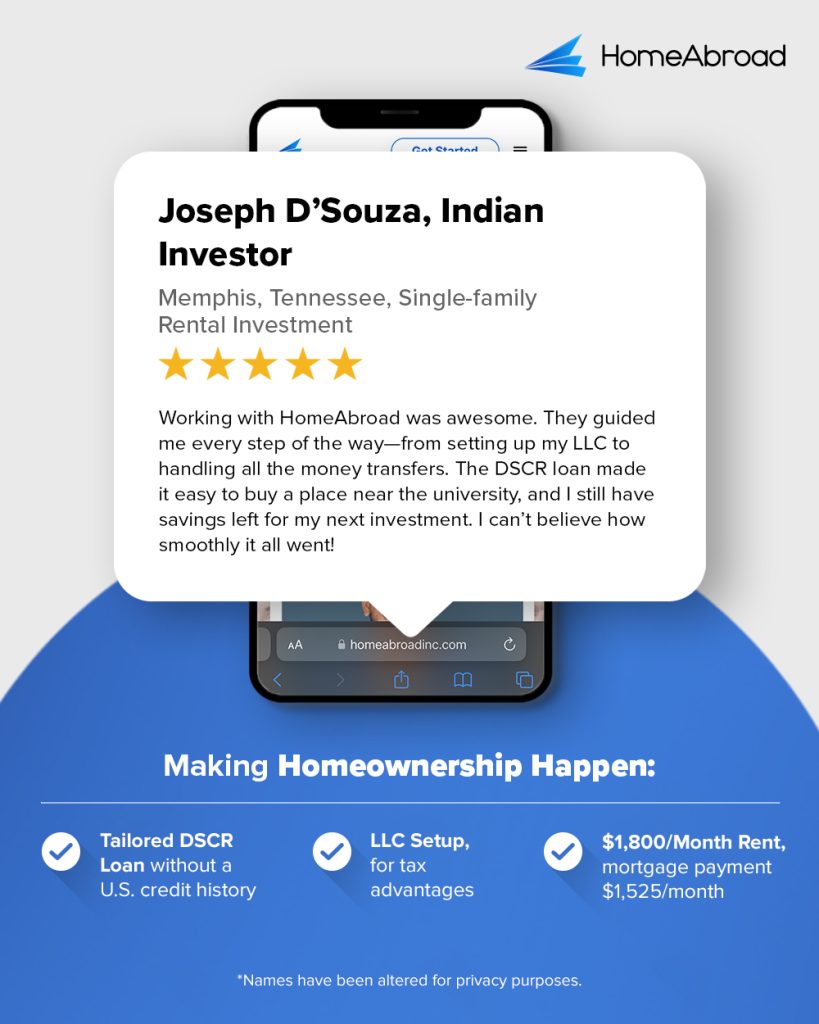

This case study spotlights one such investor, Joseph D’Souza, who used our Debt Service Coverage Ratio (DSCR) loan to secure a single-family property in Memphis, Tennessee, near a major medical university.

Meet the Hero of this Success Story

Meet Joseph D’Souza, an ambitious Indian investor with one clear goal: to acquire his first US investment property without depleting his personal assets. He wasn’t just looking for a property—he was after an opportunity to secure his future.

Bullish on the US real estate market’s growth and rental income potential, Joseph dreamed of owning a property that would not only cover its own mortgage but also generate steady cash flow, enabling him to build wealth with minimal financial strain.

His Goals

Joseph’s goal was to acquire a self-sustaining US investment property that would generate enough rental income to cover the mortgage. He sought an asset that would build wealth, provide steady cash flow, and secure his financial future—without depleting his personal assets.

He aimed to use his personal funds from India, combined with US-based gift money, for the down payment and closing costs, all while navigating currency exchange and regulatory hurdles.

Challenges He Faced

- As an global investor, Joseph’s biggest challenge was obtaining a mortgage without a US credit history.

- Finding a property with rental income higher than the mortgage

- Setting up an LLC

- Coordinating personal Indian funds + a US-based gift money without tripping up on currency exchange and regulatory hurdles.

How Joseph Found the Right Solutions with HomeAbroad

While researching options for Indian buyers investing in US real estate, Joseph discovered HomeAbroad, a leading PropTech and FinTech platform transforming the US real estate investment experience for international buyers.

Joseph initially reached out for a discovery call to discuss his challenges. Little did he know, we had tailored solutions for each of his concerns.

Here’s how we helped him:

HomeAbroad DSCR Loan

HomeAbroad’s DSCR Loan is ideal if you prefer not to use personal income for qualification and don’t have a US credit history. It features a straightforward and speedy approval process, focusing on your property’s cash flow positivity to qualify you.

HomeAbroad Real Estate Agent

HomeAbroad’s real estate agent helped Joseph overcome his second challenge by finding the perfect property with rental income higher than the mortgage payment. Joseph ultimately chose a property in Memphis, located near a major medical university.

LLC Setup Service

HomeAbroad educated Joseph on the benefits of LLC formation, including tax advantages and streamlined compliance for non-resident aliens. Our LLC setup service took care of everything, ensuring a smooth and efficient formation and registration in the US.

End-to-End Concierge Services

HomeAbroad offers end-to-end support throughout the entire process. Steven Glick, our Director of Mortgage Sales, guided Joseph every step of the way—from LLC setup to mortgage qualification and managing international money transfers, including the use of gift money.

Property Details:

The property was selected due to strong rental prospects and consistent tenant turnover from medical professionals, students, and university staff.

DSCR Calculation & Qualification

Joseph secured our DSCR loan of $157,500 with a 9.25% interest rate for a 30-year fixed mortgage. Here’s a breakdown of the calculation:

- Monthly Principal & Interest (P&I): $1,325

- Monthly Property Taxes & Insurance: $200

- Total Monthly Debt Service (PITIA): $1,325 (P&I) + $200 (Taxes & Insurance) = $1,525

Joseph also secured a signed lease for the property at $1,800 per month from a tenant affiliated with the nearby medical university, which generated $1,800 in monthly rental income.

DSCR = Monthly Rental Income / PITIA

= $1,800 / $1,525 ≈1.18

A DSCR of 1.18 confirmed the property’s cash flow sufficiently covered the monthly mortgage obligations, meeting the essential requirement for HomeAbroad’s DSCR loan approval, which qualifies you with a DSCR ratio of 1 or higher.

Explore our DSCR loan guide to learn how DSCR calculations work and how our loan program qualifies you without personal income verification.

Investment Analysis

For all the investment properties we finance, we conduct an investment analysis that helps us and our customers—Joseph, in this case—understand the income potential of the property.

In Joseph’s case, the property offers a 10% rental yield, which surpasses the average rental yield of many global metros (typically around 4%-5%), making this investment not only super profitable but also self-sustainable.

- Property Price: $210,000

- Monthly Rent: $1,800

- Annual Rental Income: $21,600

- Rental Yield: 10.29% (Annual Rental Income / Property Price)

HomeAbroad: Democratizing US Real Estate for Global Investors

Joseph’s journey from facing a bunch of challenges to finding success really shows how HomeAbroad helps international investors navigate the US real estate market. With our support—whether it was getting a DSCR loan without US credit history, setting up an LLC, or finding the perfect rental property—Joseph was able to secure a profitable property in Memphis.

On his successful purchase, Joseph shared:

Steven Glick, our Director of Mortgage Sales, also shared his thoughts:

Are you ready to start your own investment journey? Let HomeAbroad guide you every step of the way—contact us today to begin!