How to Qualify for a Mortgage on a J1, O1, F1 Visa / OPT, and EAD?

Product information

Are you craving for a home while on a J1, O1, F1 Visa / OPT, or EAD? Look no further! This article unveils the secrets to qualifying for a mortgage on these non-immigrant visas. Learn the essential criteria, overcome potential obstacles, and gain valuable insights to make your homeownership dreams a reality. Join us on this journey to discover how you can lay down roots in the land of opportunities, even as a visa holder. Let’s find out How to Qualify for a Mortgage on a J1, O1, F1 Visa / OPT, and EAD!

Table of Contents

Overview of J1, O1, F1 Visa / OPT, and EAD Statuses

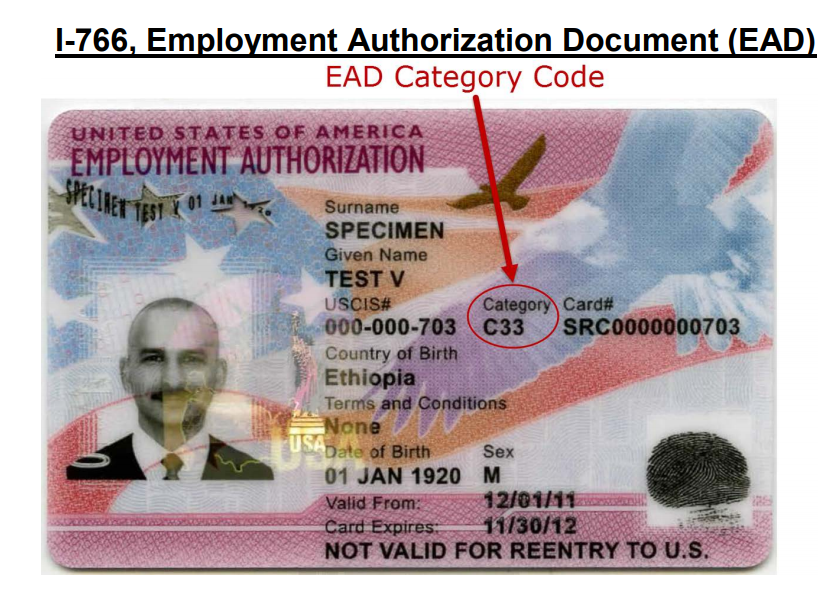

J1, O and F1 are all types of visas that allow foreign nationals to enter the United States for a specific purpose. An EAD is an Employment Authorization Document. It is a card issued by United States Citizenship and Immigration Services (USCIS). An EAD allows the holder to work in the United States for a specific period of time. The card also has the holder’s photo, name, date of birth, sex, expiration date, and other information.

J1 Visa

- J1 Visa:

- The J1 visa is a non-immigrant visa issued to exchange visitors participating in approved educational and cultural exchange programs in the US.

- Holders of J1 visas typically engage in activities such as research, teaching, training, or participating in cultural exchange programs.

Skip to How to Get a Mortgage on J1 Visa.

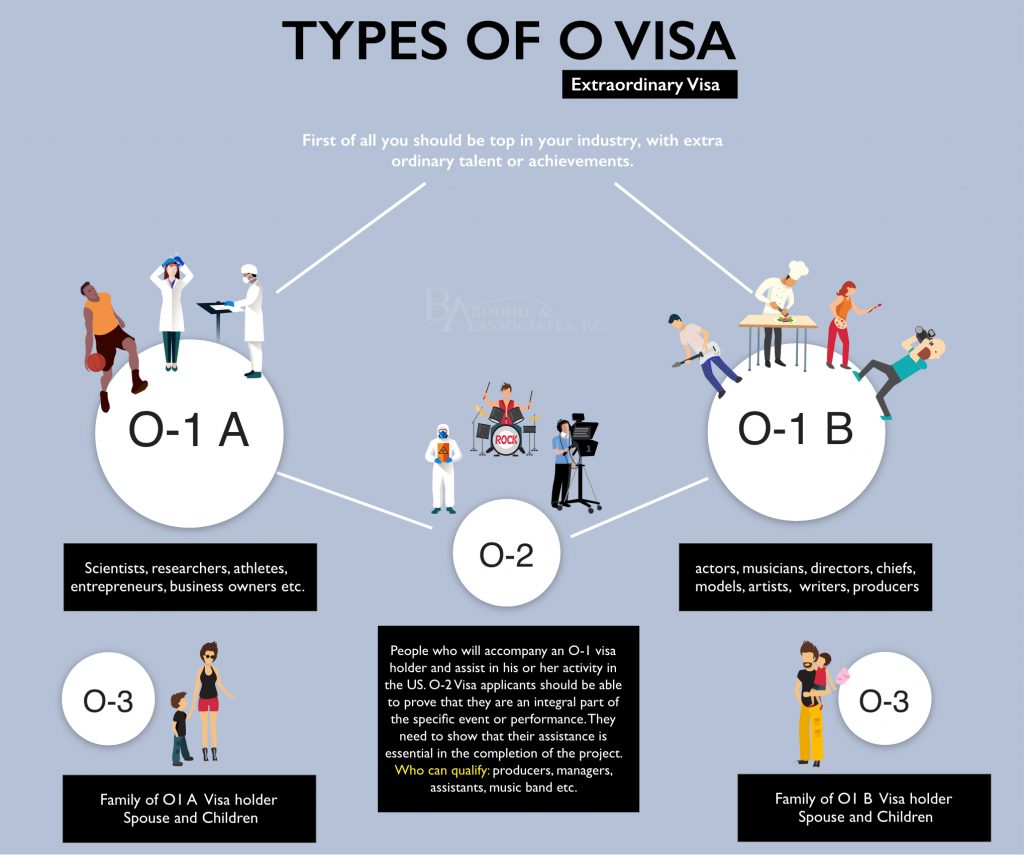

O 1 Visa

- O1 Visa:

- The O1 visa is for individuals with extraordinary abilities in various fields, including arts, sciences, education, business, or athletics.

- O1 visa holders are recognized for their exceptional talents and achievements, allowing them to work in their specialized fields in the US.

F1 Visa

- F1 Visa / OPT:

- The F1 visa is designed for international students pursuing academic programs at US universities and colleges.

- Optional Practical Training (OPT) is when F1 visa holders can work in their field of study after completing their academic program.

Skip to how to apply for a mortgage on an F1 visa

EAD (Employment Authorization Document)

- The EAD is not a visa but a document issued by the United States Citizenship and Immigration Services (USCIS) that grants temporary work authorization to certain visa holders or eligible foreign nationals in the US.

- EAD holders can work for any employer in the US for the duration specified on their EAD card.

Mortgage Application Process for J1, O1, F1 Visa / OPT, and EAD

Any lender would want to review a comprehensive summary of your financial stability and immigration status.

1. Pre-Qualification

The first step involves contacting lenders to determine how much you may be eligible to borrow based on your financial situation, income, and credit score.

2. Mortgage Application

Submit a formal mortgage application to the chosen lender, providing detailed information about your finances, employment history, assets, debts, and the property you intend to purchase.

3. Documentation and Verification

Gather and submit the necessary documents, such as pay stubs, bank statements, tax returns, and proof of identification, for the lender to verify your financial status.

4. Mortgage Underwriting

The lender evaluates your application, reviews the documentation, and assesses your creditworthiness to determine your lending risk.

5. Approval

If your application is deemed eligible, the lender provides a conditional approval indicating the loan amount and terms, subject to certain conditions.

6. Home Appraisal

The lender arranges a professional property appraisal to ensure its value aligns with the loan amount.

7. Title Search and Insurance

A title search is conducted to confirm that the property has clear ownership and title insurance is acquired to protect against any potential title issues.

8. Final Approval and Loan Offer

After satisfying all conditions, the lender issues a final approval and presents the formal loan offer, including the interest rate, terms, and monthly payment.

9. Loan Closing

A closing date is set, and you meet with the lender, seller, and other parties involved to sign the necessary documents and finalize the transaction.

10. Funding and Possession

The lender funds the mortgage, and you gain legal possession of the property, becoming a homeowner.

Throughout the process, it’s essential to communicate effectively with the lender, promptly respond to requests for information, and be prepared for potential delays or additional requirements.

Key Factors Lenders Consider for Non-Immigrant Mortgage

When evaluating mortgage applications from visa holders, lenders typically consider the following key factors:

- Visa Type and Validity: Lenders will assess the applicant’s visa type and expiration date to determine the length of time the borrower can legally remain in the US.

- Income Stability: Lenders look for a stable and reliable source of income that demonstrates the borrower’s ability to repay the mortgage. Visa holders should provide evidence of steady employment or other verifiable income sources.

- Employment Authorization: For certain visa holders, like F1 Visa / OPT and EAD holders, lenders will check for valid work authorization documents (EAD card) to ensure the applicant is legally allowed to work in the US.

- Credit History: A positive credit history is crucial for mortgage approval. To assess creditworthiness, lenders review the applicant’s credit score, credit history, and payment behavior.

- Debt-to-Income (DTI) Ratio: Lenders analyze the borrower’s debt-to-income ratio, which compares the monthly debt payments to their gross monthly income. A lower DTI ratio improves the chances of mortgage approval.

- Down Payment: The amount of the applicant’s down payment can impact mortgage approval. A larger down payment may increase the likelihood of obtaining a loan.

- Residency Status: Some lenders may consider the applicant’s residency status and the likelihood of their visa being renewed when determining loan terms.

- Employment Contract or Offer Letter: For visa holders with a limited duration of stay, providing an employment contract or offer letter can strengthen their mortgage application.

- Cash Reserves: Having sufficient cash reserves (savings) can be advantageous, as it shows the borrower’s ability to handle unexpected expenses or temporary disruptions in income.

- Payment History: Demonstrating a consistent payment history on rent and utilities can be beneficial, especially for F1 Visa / OPT and EAD holders without an extensive credit history.

Income Requirements and Limitations for Mortgage on J1, O1, F1 Visa/OPT, and EAD

To qualify for a mortgage on any Work or Student Visa in the US, one must provide the following documents:

- Proof of income, residency, financial assets, and a down payment of at least 20%.

- Minimum 2 years’ worth of US credit history (Thin or no US credit mortgages are also available)

- Minimum 2 years of prior employment in the United States. However, your foreign employment history may be considered if you have worked for the same company in another nation outside of the United States.

- You must have a green card or valid visa.

- You must also provide tax returns, W2 forms, and bank statements from the past two years. (For Government backed loan)

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN).

- US Citizenship and Immigration Services Employment Authorization Document (USCIS EAD)

Specific visa types, such as J1, O, F1 visa, and those with an EAD, will need to provide further documentation to prove their status to get a mortgage from any of the following lenders. You are expected to demonstrate your reliability as a borrower – this remains essential for each lender.

Qualifications Required for J1, O1, F1 Visa/OPT, and EAD Mortgage

J1 Visa Mortgage Requirements

You’ll need to provide a letter from your sponsor outlining the terms of your program and evidence that you have been in the US for two years or more. To qualify for a mortgage on a J1 Visa, the following would be needed:

- J1 Exchange Visitor Skills List

- 2 years of credit history from your home country

- W2 forms or 1099s for the past 2 years

- Bank statements from the past 3 months

O Visa Mortgage Requirements

You’ll need to provide a letter from your employers outlining the terms of your employment and evidence that you have been in the US for three years or more. To qualify for a mortgage on an O Visa, the following would be needed:

- Valid passport

- I-94 Arrival/departure card

- Employment letter from your sponsor in the US

- Proof of no criminal history

- 2 years of credit history (Get a mortgage with No US credit)

- W2 forms or 1099s for the past 2 years

- Bank statements from the past 3 months

F1 Visa Mortgage Requirements

You’ll need to provide a letter from your school outlining the terms of your program and evidence that you have been in the US for five years or more. To qualify for a mortgage on an F1 Visa, the following would be needed:

- Valid passport

- I-20 form from your school

- Employment letter from your sponsor in the US

- Proof of no criminal history

- 2 years of credit history (No US credit mortgages available)

- W2 forms or 1099s for the past 2 years

- Bank statements from the past 3 months

EAD Mortgage Requirements

You’ll need to provide a copy of your EAD and evidence that you have been in the US for two years or more. To qualify for a mortgage on an EAD, the following would be needed:

- Valid passport

- Employment Authorization Document (EAD)

- Proof of no criminal history

- 2 years of credit history (Get a mortgage with No US credit)

- W2 forms or 1099s for the past 2 years

- Bank statements from the past 3 months

For all other visa types, you’ll need to provide a letter from your employer outlining the terms of your employment and evidence that you have been in the US for at least two years.

Loan Options For J1, O1, F1 Visa/OPT, and EAD Holders

With No/Thin US Credit History

These types of loans are classified as Non-QM loans. These loans typically skirt the strict guidelines set by the Government for traditional loans, thus making them easily accessible and quick to procure.

1. Foreign National Loan

Foreign national loans open doors to homeownership for non-U.S. citizens. With no US credit history needed, these loans require essential documents like visa and residency status proofs, along with an international credit report. A downpayment of 20% or more and cash reserves, if necessary, pave the way. Students can boost their chances by utilizing parental income or having a co-signer.

Must read: Guide to Foreign National Mortgage Loans with No US Credit

2. DSCR Loan

Debt Service Coverage Ratio (DSCR) loan is a type of commercial mortgage that evaluates the property’s cash flow and borrower’s income to determine repayment ability. Lenders typically require a DSCR of 1 or higher for loan approval.

Connect with the Best DSCR Lenders

Get quotes from multiple lenders to compare and pick the best one!

Loan Options With Established Credit History

These loan types fall under Qualified Mortgage (QM) loans that follow guidelines set by the CFPB. They have stringent rules, limited fees, and a maximum 43% debt-to-income ratio.

1. FHA Loans

The Federal Housing Administration (FHA) supports the growth of the American housing market. They assist clients in receiving mortgage approvals that they would not typically receive from conventional lenders. Only 3.5 percent down is needed for an FHA loan.

FHA loans are only available to those who are legally permitted to work in the United States. So long as you have a valid visa and EAD, you are qualified for an FHA loan. For FHA loans, citizens and those with visas based on employment are automatically qualified.

2. Conventional Loan

Conventional loans that meet Fannie Mae’s or Freddie Mac’s underwriting guidelines are known as “conforming loans.” These guidelines include criteria related to borrower credit scores, loan-to-value ratios, debt-to-income ratios, and property types.

A conventional loan is a mortgage option for primary residences and investment properties. It requires a 2-year employment history, pay slips, and tax returns. To qualify, a minimum credit score of 620 is needed, and a down payment of 10-20% is typically required. The debt-to-income (DTI) ratio should be less than 45%. The maximum amount you can borrow with a conventional loan is $726,200.

Find the best real estate agent and mortgage lender with international expertise.

Connect with a local international real estate agent and mortgage lender

What are the Benefits of Getting a Mortgage on a J1, O, F1 Visa, and EAD?

There are a few benefits of getting a mortgage on a J1, O, F1 visa, and EAD. There are various compelling reasons to buy a property in the United States.

- Your mortgage payment will likely be less than your monthly rental income. House prices in the United States are much lower when compared to other major real estate markets such as Canada, the United Kingdom, China, and others. On the other hand, rental yields are high, and rent payments may be higher than mortgage payments.

- Additionally, it can help you to build equity in your home. Equity is the portion of your home that you own outright. It’s the difference between what your home is worth and what you still owe on your mortgage. As you make payments on your mortgage, your equity will increase.

- If you itemize your deductions, your mortgage interest and property taxes may be deductible when you file your US federal income tax return. Your tax savings may be enough to cover some of the cost of ownership. However, it would help if you contacted a tax professional to determine your eligibility for this deduction.

- If you have established solid US credit, you can obtain a mortgage loan to purchase your home and an asset that you will appreciate. However, if you are a newcomer or don’t have a good US credit score, you can still get a US mortgage; you need to find the right lender to get your mortgage approved.

Embark on the journey of homeownership by finding the best lenders through Homeabroad.

Find the best real estate agent and mortgage lender with international expertise.

Connect with a local international real estate agent and mortgage lender

What are the Challenges of Getting a Mortgage on a J1, O, F1, and EAD visa?

Various challenges come along with getting a mortgage on a J1, O, F1 visa, and EAD. Even for US citizens, mortgages might be tough to obtain. You may have an even more difficult time applying for a loan as a J1, O, or F1 Visa holder and those who possess EAD. Because you are not a permanent resident of the United States, lenders consider you to be a higher risk.

However, there are a few things that you can do to improve your chances of getting approved. Establishing credit and understanding the home-buying process in the United States are key to obtaining a mortgage loan. You may also need a larger down payment, a co-signer, or a higher credit score to qualify for a loan.

The following are the major difficulties that you might face in obtaining a mortgage:

- First, establishing credit in the United States can be difficult if you have only recently arrived. This can make it challenging to obtain a mortgage loan. However, you can do a few things to increase your chances of approval, such as obtaining an international credit history check or utilizing a co-signer with good credit. Alternatively, you can use HomeAbroad’s assistance to connect with a lender who offers mortgages with no US credit history.

- Another issue is that you may need to familiarize yourself with the home-buying procedure in the United States. HomeAbroad can help connect you with a CIPS-certified real estate agent who will guide you through the process with their expertise and understanding of both the US housing market and the needs of foreign buyers.

- If you have yet to gain experience in owning a property in the United States, you may face difficulties obtaining homeowners insurance. This is due to insurers viewing you as a high-risk customer. However, certain insurers specialize in insuring foreign nationals, so coverage can still be obtained.

- Finally, you may also be subject to different interest rates and fees than US citizens. This is because lenders often consider visa holders to be higher-risk borrowers.

We can connect you with lenders who offer loans to J1, O1 , F1 visa holders, and those on EAD and can assist you in obtaining a mortgage quickly, even if you are a newcomer with no US credit history.

Find the Best US Lender for J1, O, F1 Visa Holders and EAD

Get pre-qualified for a US Mortgage. No US credit needed for US Newcomers

Frequently Asked Questions

1. What is the interest rate for mortgages on J1, O, F1 visas, and EAD?

Interest rates for mortgages on J1, O, F1 visas, and EAD are typically higher than for US citizens. This is because visa holders are often considered to be higher-risk borrowers by lenders. Rates may vary from lender to lender, and it’s advised to connect with a lender to know the exact interest rate for your case.

2. Can I get a mortgage if I have no US credit history?

It is possible to get a mortgage with no US credit. There are mortgage lenders in the USA that provide mortgage options to foreign national borrowers with no US credit history at competitive rates – this is applicable for both U.S. newcomers on visas and Non-resident buyers of U.S. real estate. For additional information, explore our Guide to Foreign National Mortgage Loans with No US Credit.

3. How long does it take to get approved for a mortgage on a J1, O, F1 visa, and EAD?

The mortgage approval process can vary in length depending on the type of visa you have. For example, the J1 visa is a two-year program, so most lenders will require that you have at least one year left on your visa before they will approve you for a loan. The O visa is a three-year program, so most lenders will require that you have at least two years left on your visa. The F1 visa is a four-year program, so most lenders will require that you have at least three years left on your visa. And the EAD is typically valid for two years, so most lenders will require that you have at least one year left on your visa.

4. How much down payment do you need to pay for a mortgage on a J1, O, F1 visa, and EAD?

You will typically need a larger down payment for a mortgage on a J1, O, F1, visa, and EAD. There is a general requirement in the U.S. for a 20% down payment. There are certain circumstances in which you can pay less, but the general requirement is a 20% payment of the total value of the home before you can get the mortgage approved. So, for a mortgage downpayment for the following visas, the mortgage rate could be:

J1 Visas – 20-25% down

O Visas – 20-25% down

F1 Visas – 20-25% down

EAD – 20-25% down

5. How long is the F1 Visa valid?

The F1 Visa is valid for one academic year. If a student needs to extend their visa, they must submit a request to their school’s international student office.

6. Can I work on an F1 Visa?

Yes, you can work on an F1 Visa. There are certain restrictions, however, that you should be aware of before beginning your search for employment. For instance, you may only work on-campus for 20 hours per week during the academic year and full-time during vacation periods.

7. Is it easy to get an F1 Visa?

Yes, it is easy to get an F1 Visa. The process is relatively simple and straightforward, and as long as you meet the basic requirements, you should have no problem getting your visa approved.

One of the main requirements is that you have a valid passport from your country of citizenship. You will also need to show proof of financial support, which can be in the form of a bank statement or a letter from a sponsor. In addition, you will need to provide evidence of your ties to your home country, such as a copy of your birth certificate or a letter from your employer. Finally, you will need to schedule an interview with a consular officer at the U.S. embassy or consulate in your home country.

8. Is O1 Visa hard to get?

The O1 visa process can be complex and time-consuming, but it is possible to obtain an O1 visa if you meet the eligibility requirements.

To qualify for an O1 visa, an individual must demonstrate a level of achievement that is significantly above the average level of achievement in their field. In addition, they must be coming to the United States to participate in activities that are beneficial to the national interest.

9. How long is the O1 Visa valid?

The O1 Visa is valid for a maximum of three years. However, it can be renewed unlimited times as long as the visa holder continues to meet the eligibility requirements.

10. How long can I stay in the U.S. on an O2 work visa?

The O2 visa is valid for up to three years, and holders may apply for an extension of stay.

11. Can I change employers on an O-2 work visa?

As an O2 work visa holder, you have the right to change employer. However, in this case, the new employer must submit a new application. At the same time, you need to apply for an O2 extension of stay at USCIS.

Learn

Helpful Resources